Acko

Founded Year

2016Stage

Growth Equity | AliveTotal Raised

$428MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-54 points in the past 30 days

About Acko

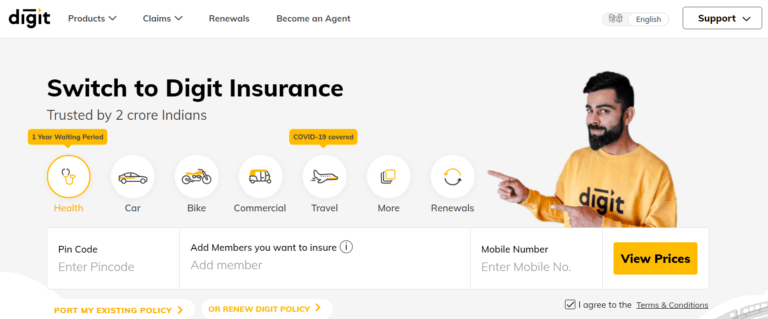

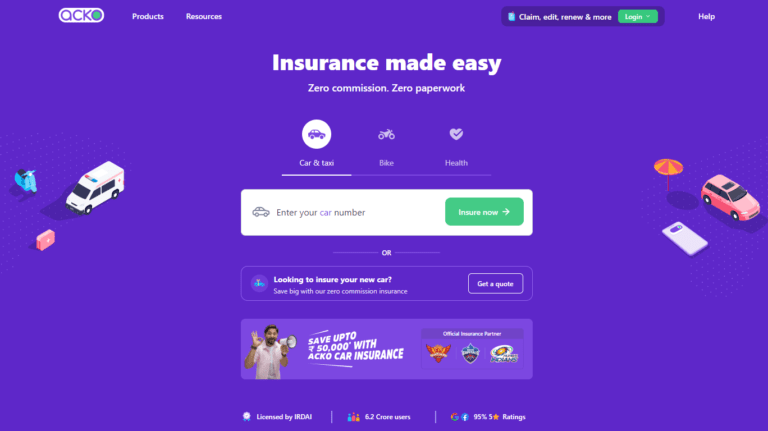

Acko is a tech-driven company specializing in insurance products across various sectors such as auto, health, and life insurance. The company offers a range of insurance policies designed to provide financial protection and peace of mind, including vehicle coverage, health plans, life insurance, and travel protection. Acko's innovative approach includes features like zero commission, instant policy renewal, and same-day claim settlements, catering to the digitally savvy consumer. It was founded in 2016 and is based in Bengaluru, India.

Loading...

ESPs containing Acko

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Acko named as Leader among 12 other companies, including Oscar, Clover Health, and Digit Insurance.

Acko's Products & Differentiators

Auto insurance

ACKO offers customized motor insurance products that can be easily accessed online and with quotes and all the relevant information pertaining to motor insurance available on the website. ACKO uses data and analytics to underwrite the customer, which in turn helps improve premium pricing accuracy. After the purchase is made, the policy is directly sent into the buyer’s inbox in less than two minutes. Claim assessment time is drastically reduced and a settlement is provided within 48 - 72 business hours.

Loading...

Research containing Acko

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Acko in 5 CB Insights research briefs, most recently on Aug 16, 2022.

Mar 8, 2022 report

The 12 Industries Amazon Could Disrupt NextExpert Collections containing Acko

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Acko is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,263 items

Excludes US-based companies

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Acko News

Sep 10, 2024

Acko Tech, an insurtech unicorn, has launched the Acko flexi term life insurance plan, which provides policyholders with the ability to vary the amount of coverage when their financial responsibilities change. This comes after the company made its debut in the automotive industry. By launching this product, the company intends to become a one-stop shop for all of the protection needs that customers may have. A statement issued by the company stated that the plan offers customers comprehensive coverage, which provides them with financial safety throughout their entire lifetimes. In accordance with the firm, the plan offers the possibility of modifying the period of the policy to accommodate one's life goals, whether those goals are for short-term or long-term protection. Giving Options of Lump Sum, Monthly Instalments, or an Annuity By opting to Acko's service clients will have the opportunity to change payout methods at any point throughout the policy, which adds flexibility. Policyholders have the ability to adapt their payouts to match their changing financial circumstances, even while the claims procedure is in progress, by selecting from a lump sum, monthly instalments, or an annuity depending on their preference. As stated in a release, the creator of Acko, Varun Dua , expressed the company's desire for clients to view life insurance not as a method of investment but rather as a form of security that is solely for themselves and their families. As we move forward, the company will continue to place its primary emphasis on products that are related to pure protection, such as the term life product that we have just recently introduced. Acko is an insurance company that deals with travel, health, and automobile insurance. It was established in 2016 by Varun Dua and Ruchi Deepak. Among its investors are companies such as General Atlantic, Multiples Private Equity, Lightspeed, and Intact Ventures, among others. An insurance plan for the batteries of electric cars (EVs) was also introduced by the company in the previous year. For the purpose of constructing an all-encompassing healthcare ecosystem, Acko purchased the digital chronic care management startup OneCare many months ago. Acko’s Progress Card The organisation asserts that it has provided insurance plans to more than 78 million distinct consumers and has issued more than one billion policies through the present day. The entire amount of money that Acko has received from investors is about $450 million. These investors include Amazon , General Atlantic, and Multiples Private Equity. The company reported a net loss of INR 738.5 crore in FY23, which is an increase of 53% compared to the previous year. On the other hand, its operating revenue increased by 32% to INR 1,758.6 crore.

Acko Frequently Asked Questions (FAQ)

When was Acko founded?

Acko was founded in 2016.

Where is Acko's headquarters?

Acko's headquarters is located at Somasandrapalya, 27th Main Rd, Sector 2, HSR Layout, Bengaluru.

What is Acko's latest funding round?

Acko's latest funding round is Growth Equity.

How much did Acko raise?

Acko raised a total of $428M.

Who are the investors of Acko?

Investors of Acko include General Atlantic, Multiples Alternate Asset Management, Cpp Investment Board Private Holdings, Intact Ventures, Munich Re Ventures and 20 more.

Who are Acko's competitors?

Competitors of Acko include Digit Insurance, Buckle, Cachet, PolicyBazaar, Zego and 7 more.

What products does Acko offer?

Acko's products include Auto insurance and 2 more.

Loading...

Compare Acko to Competitors

Vooli is a mobile-based insurance platform in the financial services industry. The company offers a range of insurance products that can be purchased and managed directly through its mobile application, providing convenience and immediate digital insurance certificates. Vooli primarily serves individuals seeking personal insurance solutions. It was founded in 2019 and is based in Nairobi, Kenya.

Tata AIG is a joint venture company between Tata Group and American International Group (AIG), focusing on the general insurance industry. The company offers insurance products, including motor insurance for cars, bikes, and commercial vehicles, travel insurance for international and domestic travel, health insurance, and other general insurance products such as marine cargo insurance, fire insurance, and burglary insurance. It primarily serves individuals and businesses, offering protection covers for various sectors, including liability, marine cargo, personal accident, travel, rural agriculture, and extended warranty. Tata AIG was founded in 2001 and is based in Mumbai, India.

Buckle specializes in insurance fronting services within the insurance industry. The company offers a platform designed to connect Managing General Agents (MGAs) to reinsurance markets, providing cost-effective solutions and professional guidance to support their growth. Buckle aims to serve as an economic alternative to MGAs considering owning an insurance carrier by reducing fronting costs. It was founded in 2017 and is based in Jersey City, New Jersey.

Datafolio specializes in usage-based insurance solutions for mobility platforms within the insurance industry. The company offers comprehensive personal accident coverage and assistance services that can be embedded into mobility platforms, allowing users to opt-in for insurance on a per-trip basis. Datafolio's insurance products are designed to be transparent, fair, affordable, and profitable for platform operators by turning insurance costs into revenue opportunities. It was founded in 2020 and is based in Lille, France.

Probus Insurance is a prominent insurance broker that operates in the insurance industry. The company offers a wide range of insurance plans including life, health, motor, travel, property, and commercial insurance. It primarily serves retail clients across various sectors. It was founded in 2003 and is based in mumbai, Delaware.

Coverfox is an insurtech platform focused on providing online insurance products in various sectors such as motor, health, and life insurance. The company offers a comparison tool for customers to evaluate and purchase insurance policies from over 50 providers, ensuring a diverse range of options. Coverfox also provides claims assistance and prioritizes data security for its users. It was founded in 2013 and is based in Mumbai, India.

Loading...