AgentSync

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$161.1MLast Raised

$50M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+207 points in the past 30 days

About AgentSync

AgentSync specializes in insurance compliance software within the insurance industry. Its main offerings include automating producer management, ensuring compliance, and optimizing distribution management through modern application programming interface (API) integrations and data solutions. It primarily serves insurance carriers, agencies, and managing general agents (MGAs ) with compliance and producer management needs. AgentSync was founded in 2018 and is based in Denver, Colorado.

Loading...

ESPs containing AgentSync

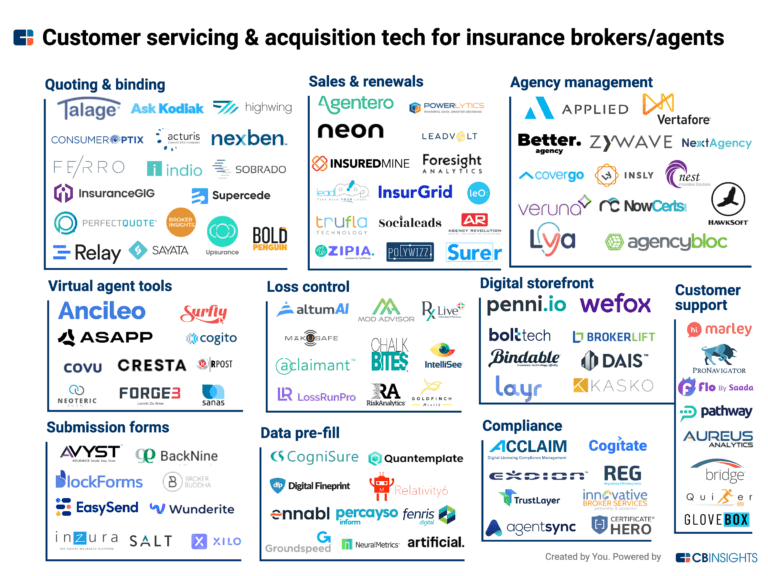

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance lead management market refers to the software solutions that help insurance companies manage their leads and sales processes. These solutions typically include lead tracking, customer relationship management (CRM), marketing automation, and analytics tools. The market is driven by the need for insurers to streamline their sales processes, improve customer engagement, and increase rev…

AgentSync named as Leader among 9 other companies, including Better Agency, Applied, and Bridge.

AgentSync's Products & Differentiators

AgentSync Manage

Our core solution, AgentSync Manage, is a powerful platform that effortlessly enforces state producer licensing and appointment regulatory requirements through an integration with the National Insurance Producer Registry (NIPR). Manage minimizes compliance costs and prevents regulatory violations before they occur by automating the administrative paper chase required to verify that agents have the necessary appointments and state licenses to sell. By simplifying the complexity of selling insurance, you can drastically reduce costs and compliance risks associated with manually managing these tasks via spreadsheets and disparate legacy systems.

Loading...

Research containing AgentSync

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AgentSync in 1 CB Insights research brief, most recently on Sep 30, 2022.

Expert Collections containing AgentSync

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AgentSync is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Insurtech

3,178 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

ITC Vegas 2024 - Exhibitors and Sponsors

627 items

As of 9/9/24. Company list source: ITC Vegas. Check ITC Vegas' website for any updates: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest AgentSync News

Sep 12, 2024

liance Solutions Mumbai, September 12, 2024: Successfully managing insurance compliance requires diligence, accuracy, and a strict adherence to timelines. Onboarding, licensing, appointments, and terminations can be extremely labor-intensive, error prone, and expensive without the right technology in place, which is why AgentSync developed a SaaS platform to help insurance companies streamline their end-to-end producer management processes. Mphasis Silverline is excited to announce that it has partnered with AgentSync to bring their producer and compliance management solution to our insurance clients. Built directly on the Salesforce Platform, AgentSync Manage gives organizations the power to use intelligent automation to simplify producer management and compliance, gaining valuable customer insights in the process. “We’ve had to custom-build these solutions or integrate into another system for a lot of insurance clients over the years,” said Danielle Laffey, Senior Director of Insurance of Mphasis Silverline. “AgentSync’s solution is native to the Salesforce Platform and can be easily configured to the particular needs of the insurance community.” Prior to AgentSync, insurance compliance vendors operated on infrastructure that looked similar to the legacy insurers they served: dated, complex, custom-coded, and difficult to use. Today, however, many of the largest insurance carriers and agencies are adopting modern technology and digitally transforming the way they manage compliance, improving operations and reducing financial, legal, and reputational risks. AgentSync is the only insurance compliance management solution that takes an agency or carrier’s processes from hours of manual data entry, including cross-referencing websites and spreadsheets, to a few minutes of activity in a single platform. “When we were evaluating compliance technology solutions, other products looked dated, bland, and didn’t seem to be customizable. They were hard to navigate around, and hard to read. AgentSync was the opposite. It felt modern, purpose-built, and innovative and the interface was appealing to look at,” said Matt Brockmeier, Business Development Specialist at Veterans United Insurance and an AgentSync customer. “AgentSync showed a level of insurance industry expertise that we didn’t see in other vendors we were looking at.” Using APIs and a cloud-native, low-code architecture, AgentSync’s robust integrations and unparalleled data accuracy break through the milieu of outdated legacy tech to modernize and simplify operations and compliance in the insurance branch of the financial services industry. “AgentSync knows compliance,” said Laffey. “They are experts, and their platform demonstrates that expertise. They understand the nuances and state-level requirements across the producer lifecycle – from licensing and appointing to continuing education and renewals – and make it really easy and efficient for organizations to achieve and maintain compliance and leverage producer data to drive reporting, analytics, and distribution strategies.” AgentSync is committed to building insurance infrastructure that is current, automatic, and integrated into an organization’s technology ecosystem. With a daily sync, the first-of-its-kind API to connect customers to the industry’s source of truth on producer licensing and state appointments, customers get a real-time view into their workforce’s compliance and can understand ready-to-sell status across all jurisdictions, without anyone having to perform manual checks or validation. The combination of AgentSync’s insurance compliance expertise with Mphasis Silverline’s deep Salesforce knowledge provides a significant opportunity for our clients to transform their compliance processes on the Salesforce Platform.

AgentSync Frequently Asked Questions (FAQ)

When was AgentSync founded?

AgentSync was founded in 2018.

Where is AgentSync's headquarters?

AgentSync's headquarters is located at 3601 Walnut Street, Denver.

What is AgentSync's latest funding round?

AgentSync's latest funding round is Series B - II.

How much did AgentSync raise?

AgentSync raised a total of $161.1M.

Who are the investors of AgentSync?

Investors of AgentSync include Craft Ventures, Valor Equity Partners, Tiger Global Management, Anthemis, Atreides Management and 9 more.

Who are AgentSync's competitors?

Competitors of AgentSync include RegEd and 5 more.

What products does AgentSync offer?

AgentSync's products include AgentSync Manage and 1 more.

Who are AgentSync's customers?

Customers of AgentSync include Senior Life and Online Medicare Distributor.

Loading...

Compare AgentSync to Competitors

RegEd operates as a market-leading provider of Regulatory Technology solutions within the financial services industry. The company offers a suite of enterprise solutions that include workflow-directed processes, regulatory intelligence, automated validations, and compliance dashboards to facilitate operational efficiency and regulatory compliance. RegEd primarily serves the financial services sector, with a focus on compliance and risk management for enterprise clients. It was founded in 2000 and is based in Morrisville, North Carolina.

Spyder specializes in data management, cyber compliance, and secure document storage for the financial services and insurance domains. The company offers a platform that helps in data management and compliance with cyber regulations and document storage needs, tailored specifically for insurance agents and financial service providers. Its solutions are designed to support licensed individuals and home office firms in managing licensing renewals, continuing education, and cyber security certifications. The company was founded in 2021 and is based in Fort Scott, Kansas.

Egnyte is a company that specializes in content governance and smart content collaboration, operating within the cloud computing and data governance sectors. The company offers a unified, artificial intelligence (AI) enabled platform designed to manage, secure, and govern digital content for businesses, facilitating collaboration in the cloud or on-premises. Egnyte's platform provides sensitive content classification, ransomware detection and recovery, and data access governance among other services. It was founded in 2007 and is based in Mountain View, California.

CaseWare specializes in cloud-enabled audit, financial reporting, and data analytics solutions for various sectors within the accounting industry. The company provides tools that automate and streamline financial reporting, tax engagements, practice management, and audit processes to enhance efficiency and insights. The company primarily serves accounting firms, corporations, and government entities with its suite of software products and services. It was founded in 1988 and is based in Toronto, Ontario.

EverCheck is a company that focuses on healthcare compliance, operating within the healthcare and software industries. The company offers automated compliance software that provides services such as license verification, sanction and exclusion management, and continuing education tracking for healthcare professionals. The primary sectors EverCheck caters to are the healthcare and human resources industries. It was founded in 2012 and is based in Jacksonville, Florida.

Propelus is a leader in workforce compliance management technology, focusing on professional career advancement and regulatory compliance within various sectors. The company offers a suite of solutions including continuing education tracking, compliance management, and employee health software to streamline professional development and ensure regulatory adherence. Propelus primarily serves professionals, employers, regulators, educators, and partners in the healthcare and education sectors. It was founded in 2003 and is based in Jacksonville Beach, Florida.

Loading...