Agora Financial Technologies

Founded Year

2018Stage

Seed - II | AliveTotal Raised

$13.2MLast Raised

$1.04M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-254 points in the past 30 days

About Agora Financial Technologies

Agora Financial Technologies, the FinTech enabler for banks, helps banks to ramp up their digital experience without replacing their core banking system. Agora provides and co-creates tech tools for banks so that they can accelerate their digital journey and implement Fintech products. It was founded in 2018 and is based in New York, New York.

Loading...

Agora Financial Technologies's Product Videos

Agora Financial Technologies's Products & Differentiators

Teenz Power

Teen Banking White label solution for community banks and credit unions

Loading...

Research containing Agora Financial Technologies

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Agora Financial Technologies in 1 CB Insights research brief, most recently on Jan 4, 2024.

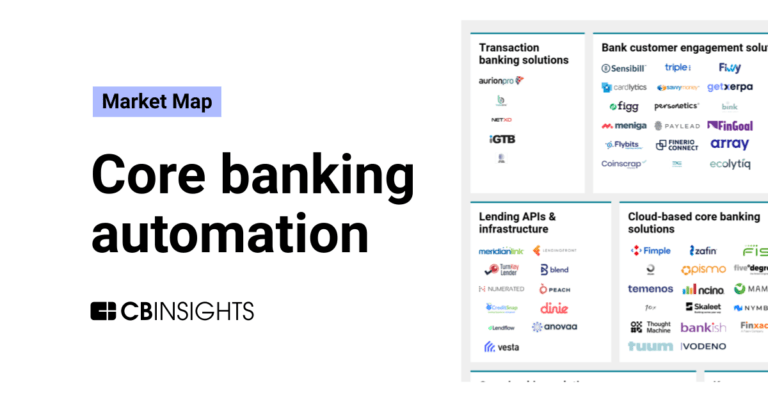

Jan 4, 2024

The core banking automation market mapExpert Collections containing Agora Financial Technologies

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Agora Financial Technologies is included in 1 Expert Collection, including Fintech.

Fintech

9,294 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Agora Financial Technologies News

Jun 21, 2023

ATLANTA--(BUSINESS WIRE)-- #baas--Agora Services, the next generation of bank as a service / embedded fintech provider announced today its inclusion in the 2023 AIFinTech100 list.– a select global listing reflecting "the world's most innovative solution providers" who are "using artificial intelligence (AI) to transform financial services." The standout companies were chosen by a panel of industry experts and analysts who reviewed a study of over 2,000 fintech companies undertaken by FinTech Global, a

Agora Financial Technologies Frequently Asked Questions (FAQ)

When was Agora Financial Technologies founded?

Agora Financial Technologies was founded in 2018.

Where is Agora Financial Technologies's headquarters?

Agora Financial Technologies's headquarters is located at 112 W 34th St, New York.

What is Agora Financial Technologies's latest funding round?

Agora Financial Technologies's latest funding round is Seed - II.

How much did Agora Financial Technologies raise?

Agora Financial Technologies raised a total of $13.2M.

Who are the investors of Agora Financial Technologies?

Investors of Agora Financial Technologies include ThinkTECH and MasterCard Start Path.

Who are Agora Financial Technologies's competitors?

Competitors of Agora Financial Technologies include Nymbus and 8 more.

What products does Agora Financial Technologies offer?

Agora Financial Technologies's products include Teenz Power and 2 more.

Loading...

Compare Agora Financial Technologies to Competitors

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms, focusing on digital financial and transactional services. The company offers a suite of bank-grade solutions including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems to enhance financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize their services. It was founded in 2007 and is based in Miami, Florida.

Unit develops financial infrastructure for banking and lending solutions. The company offers a platform that enables technology companies to build banking and lending products, including features such as bank accounts, physical and virtual cards, payments, and lending services. Its dashboard and suite of application programming interface (API), software development kit (SDK), and white-labeled user interface (UI) enable developers to build financial features into their products. It was founded in 2019 and is based in New York, New York.

Productfy is a platform specializing in the embedding of financial products within various business sectors. The company offers a suite of services including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

Synctera provides partnerships between community banks and fintech companies through a two-sided marketplace. It offers business-to-business (B2B) transactions, business-to-consumer (B2C) transactions, wealth management, and investing, services for nonprofits, cannabis banking, and more. It serves individuals, enterprises, and banks. It was founded in 2020 and is based in Palo Alto, California.

Lithic is a financial technology company specializing in card issuing services for developers within the payment processing industry. The company offers a platform for issuing virtual, physical, and tokenized cards, along with features such as authorization stream access, automated reconciliation, and risk management tools. Lithic's solutions cater to various sectors including digital banking, expense management, and rewards & incentives programs. Lithic was formerly known as Pay with Privacy. It was founded in 2014 and is based in New York, New York.

Loading...