Allstate

Founded Year

1931Stage

PIPE | IPOMarket Cap

50.35BStock Price

191.00Revenue

$0000About Allstate

Allstate provides insurance products and services. Its products include property and casualty insurance, vehicle insurance, life insurance, business insurance, and registered securities. The company also provides protection plans against theft, lightning, fire, sprinkler leakage, explosions, and more. It was founded in 1931 and is based in Northbrook, Illinois.

Loading...

Loading...

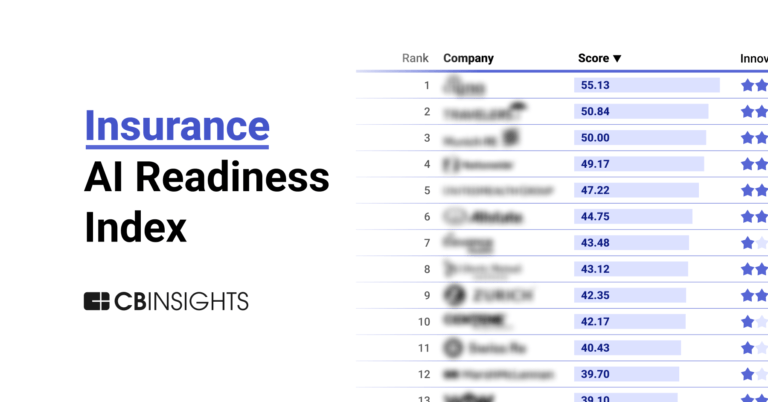

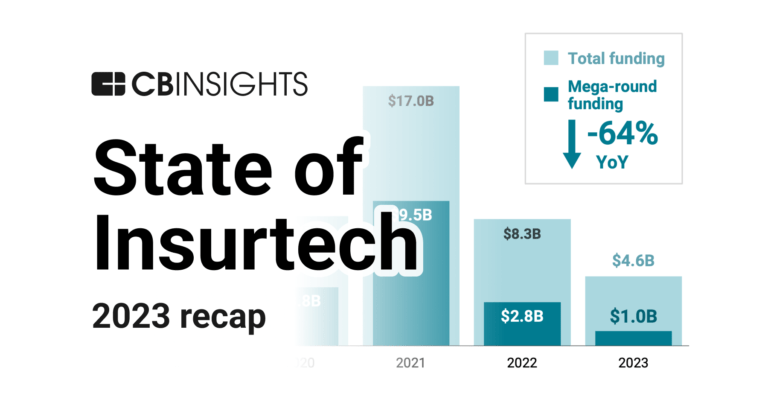

Research containing Allstate

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Allstate in 5 CB Insights research briefs, most recently on Feb 29, 2024.

Expert Collections containing Allstate

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Allstate is included in 2 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Allstate Patents

Allstate has filed 1225 patents.

The 3 most popular patent topics include:

- data management

- wireless networking

- sensors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/2/2022 | 9/17/2024 | Numerical climate and weather models, Mathematical optimization, Sustainable transport, Halifax-class frigates, Transport culture | Grant |

Application Date | 8/2/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Numerical climate and weather models, Mathematical optimization, Sustainable transport, Halifax-class frigates, Transport culture |

Status | Grant |

Latest Allstate News

Sep 17, 2024

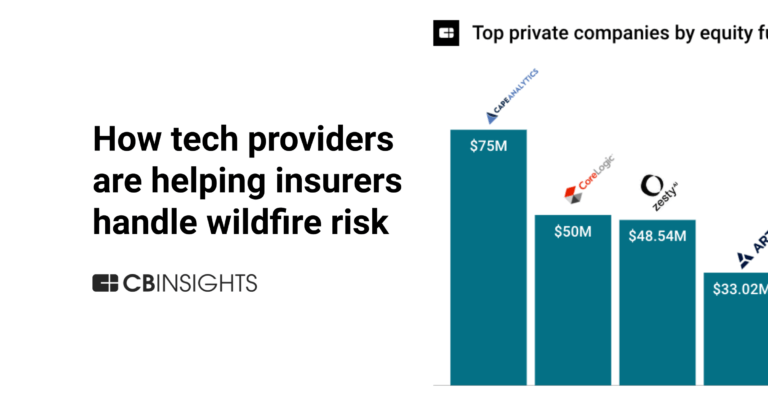

Whole life, universal life, and term policies to be offered Foresters Financial has been selected as a US life insurance provider by Allstate Financial Services. Under the agreement , Allstate’s exclusive agents and Personal Financial Representatives will now offer a range of Foresters life insurance products, including three fully underwritten and four non-medical options. These products include whole life, guaranteed rate universal life, and term life policies. Mark Rush, vice president and chief distribution officer at Foresters Financial US, said the company is pleased to work with Allstate to bring its life insurance solutions to a broader audience. “We’re excited to combine Foresters’ holistic approach to life and well-being with Allstate’s robust distribution capabilities and expertise to meet growing demand and help more families attain the protection they need,” Rush said. Foresters offers a variety of member benefits, which the company describes as enhancing traditional life insurance by providing added financial security and wellness opportunities. These benefits include scholarships, orphan benefits, community volunteer grants, legal services such as wills, lifelong learning resources, and member discounts. These features are provided at no additional cost to policyholders. Scott Delaney (pictured above), vice president at Allstate Financial Services, LLC, said that the collaboration with Foresters allows Allstate to deliver modern life insurance solutions to its customers. “We’re thrilled to enhance our offerings and empower our exclusive agents and Personal Financial representatives with the best tools to help customers achieve their financial and life goals,” Delaney said. Foresters’ life insurance coverage is available in all states except New York. The timing of this collaboration also comes as Allstate faces a significant shift in its home insurance business in California. In November , Allstate will raise home insurance premiums in the state by an average of 34.1%, marking the most substantial rate increase by a major insurer in California over the past three years. The premium hike, approved by state regulators, will affect approximately 350,000 policyholders across the state, Bloomberg reported. According to documents filed by Allstate, some customers could see increases as high as 650%, while others may experience decreases of up to 57%. What are your thoughts on this story? Please feel free to share your comments below. Related Stories

Allstate Frequently Asked Questions (FAQ)

When was Allstate founded?

Allstate was founded in 1931.

Where is Allstate's headquarters?

Allstate's headquarters is located at 3100 Sanders Road, Northbrook.

What is Allstate's latest funding round?

Allstate's latest funding round is PIPE.

Who are the investors of Allstate?

Investors of Allstate include Trian Partners.

Who are Allstate's competitors?

Competitors of Allstate include New York Life Insurance Company, INSURICA, AmTrust Financial Services, Solera Holdings, Travelers Canada and 7 more.

Loading...

Compare Allstate to Competitors

State Farm Insurance specializes in providing a wide range of insurance and financial services. The company offers insurance coverage for vehicles, properties, life, and health, as well as banking, investment, and retirement planning solutions. State Farm Insurance primarily serves individual consumers and businesses seeking insurance and financial products. It was founded in 1922 and is based in Bloomington, Illinois.

Liberty Mutual Insurance specializes in property and casualty insurance, providing a wide range of personal and commercial insurance products. The company offers insurance coverage for vehicles, homes, businesses, and lives, as well as protection against identity theft and for pets. Liberty Mutual Insurance primarily serves individual consumers and businesses across various industries with their insurance needs. Liberty Mutual Insurance was formerly known as Massachusetts Employees Insurance Association. It was founded in 1912 and is based in Boston, Massachusetts.

Nationwide Mutual Insurance Company operates as a diversified insurance and financial services organization. The company offers a range of insurance products including vehicle, property, personal, and business insurance, as well as financial services such as retirement plans, annuities, and mutual funds. Nationwide primarily serves individuals and businesses seeking insurance and financial planning solutions. Nationwide Mutual Insurance Company was formerly known as Farm Bureau Mutual Automobile Insurance Company. It was founded in 1926 and is based in Columbus, Ohio.

Frontline Insurance focuses on providing insurance services, specifically in the home and commercial property insurance sector. The company offers a range of insurance policies to cover home, liability, and property needs, providing protection for homeowners and commercial properties. It primarily serves the insurance industry, with a focus on coastal homeowners. It was founded in 1998 and is based in Lake Mary, Florida.

Guardian Life Insurance Company of America focuses on providing insurance and benefits, operating within the insurance industry. The company offers a range of insurance products including life, disability, dental, vision, accident, and critical illness insurance, as well as investment services and workforce solutions such as group benefits and absence management. Guardian Life Insurance Company of America was formerly known as Germania Life Insurance. It was founded in 1860 and is based in New York, New York.

Chartis focuses on providing strategic, performance, and technology consulting to the healthcare sector. The company offers a broad range of services including strategy and performance improvement, clinical quality and patient safety, and digital and technology solutions to improve care delivery. Chartis serves a diverse clientele, including healthcare providers, payers, health service and technology companies, and investors. It was founded in 2001 and is based in Boston, Massachusetts.

Loading...