Amazon

Founded Year

1994Stage

PIPE - II | IPOTotal Raised

$8.98MMarket Cap

1956.69BStock Price

186.43Revenue

$0000About Amazon

Amazon (NASDAQ: AMZN) operates as a multinational technology company. It focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. The company provides an e-commerce platform to sell a wide variety of products and services, including electronics, home goods, apparel, food, and more. It also offers cloud computing services through Amazon Web Services (AWS). It was formerly known as Cadabra. It was founded in 1994 and is based in Seattle, Washington.

Loading...

ESPs containing Amazon

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The on-demand grocery delivery market caters to the busy lifestyles of modern consumers looking to purchase groceries without leaving their home. Platforms in this market offer convenience and prompt services, delivering everything customers need within a short timeframe. They bring local sellers online, provide a larger choice of products at competitive prices, and can offer discounts that are ex…

Amazon named as Leader among 15 other companies, including Instacart, DoorDash, and Deliveroo.

Loading...

Research containing Amazon

Get data-driven expert analysis from the CB Insights Intelligence Unit.

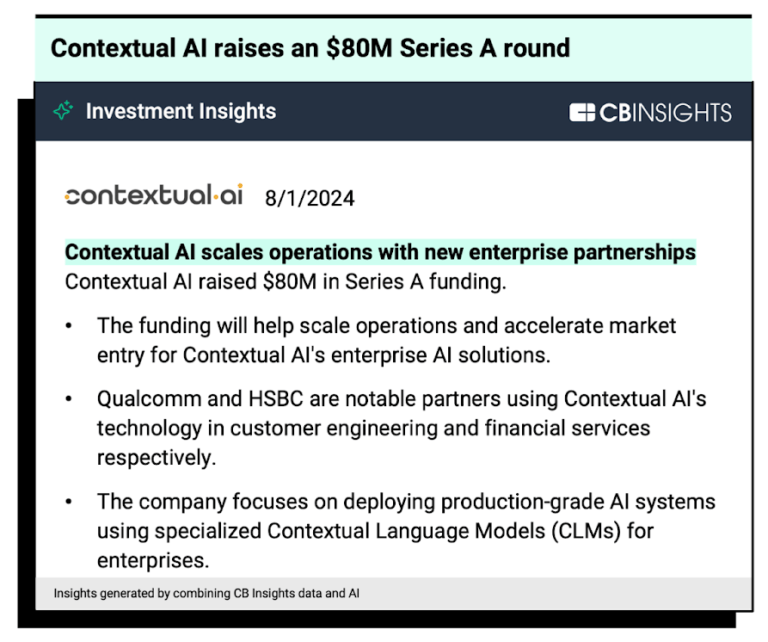

CB Insights Intelligence Analysts have mentioned Amazon in 49 CB Insights research briefs, most recently on Sep 16, 2024.

Expert Collections containing Amazon

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amazon is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,054 items

Food & Beverage

123 items

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

New Retail Formats

11 items

Companies offering automated checkout solutions for retailers or operating cashless, cashier-free retail stores.

Conference Exhibitors

5,302 items

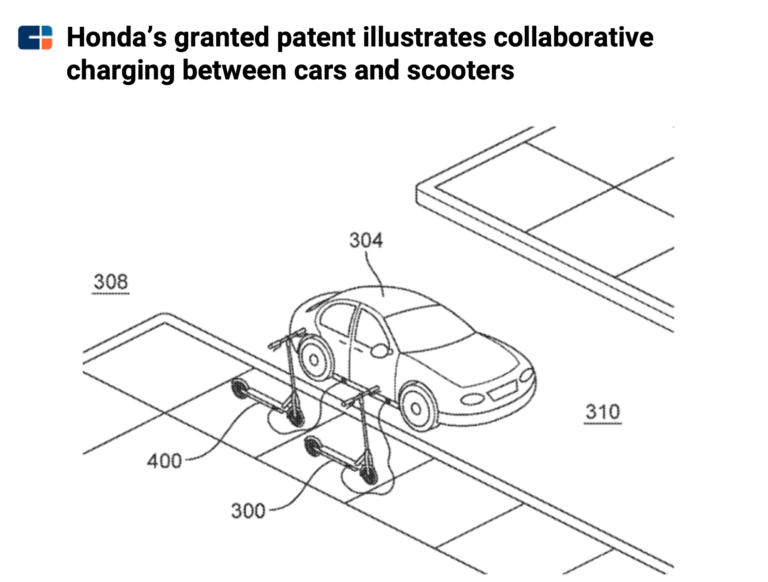

Amazon Patents

Amazon has filed 10000 patents.

The 3 most popular patent topics include:

- data management

- network protocols

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/22/2017 | 9/17/2024 | Home appliance brands, Manufacturing, Production and manufacturing, Mobile phone manufacturers, Consumer electronics brands | Grant |

Application Date | 3/22/2017 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Home appliance brands, Manufacturing, Production and manufacturing, Mobile phone manufacturers, Consumer electronics brands |

Status | Grant |

Latest Amazon News

Sep 19, 2024

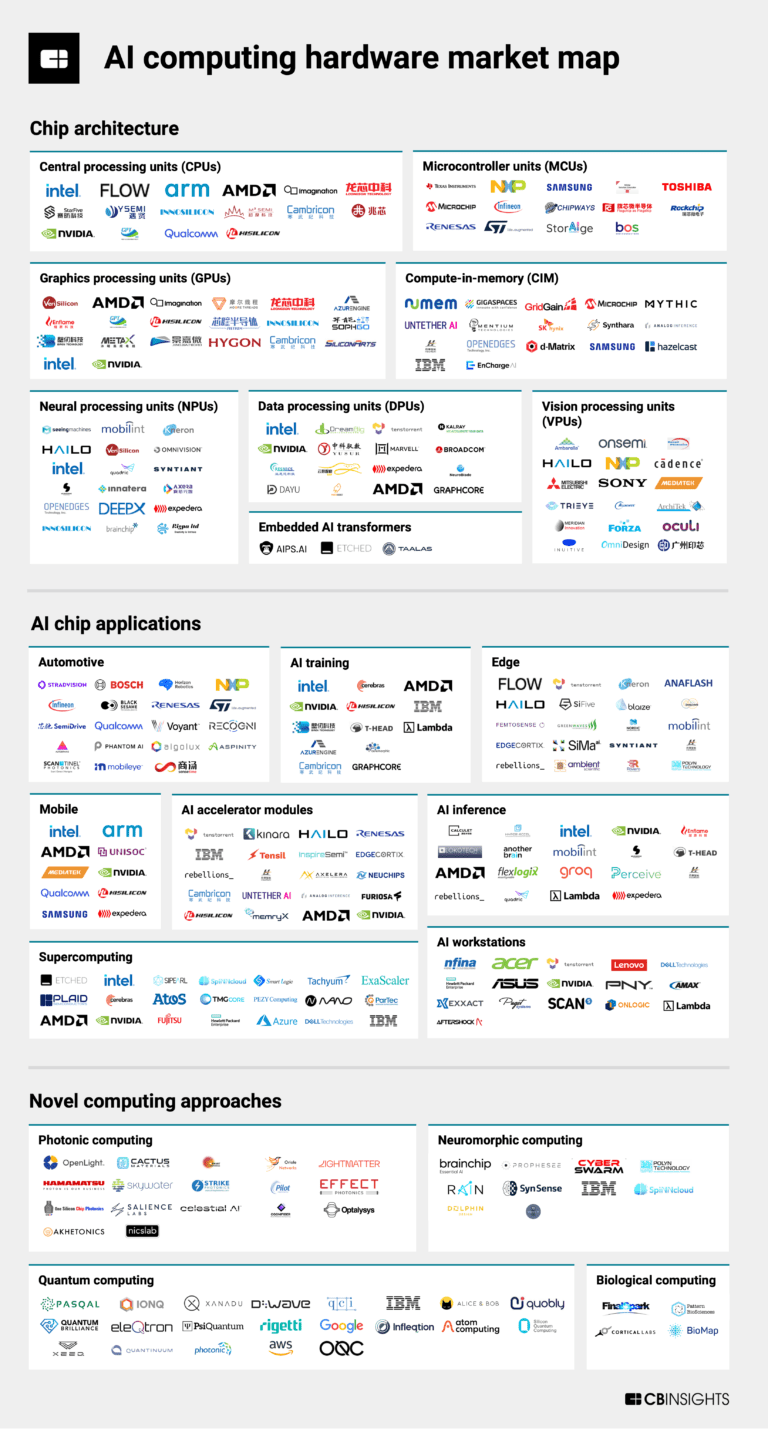

Shares of Nvidia have soared almost 800% over the last two years, but can the company keep its growth up? Posted by Image source: Getty Images You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More This article was originally published on Fool.com . All figures quoted in US dollars unless otherwise stated. Over the last two years, the prospects of artificial intelligence (AI) have become a bellwether for the technology industry. Among a long list of AI investment opportunities, semiconductor companies have emerged as some of the most lucrative. Since ChatGPT took the world by storm in November 2022, shares of Nvidia ( NASDAQ: NVDA ) have gained a jaw-dropping 760% as of this writing. In fact, the company's market cap briefly eclipsed $3 trillion. It really wasn't too long ago that Nvidia was seen as a niche opportunity among a broader sea of technology companies. And yet, today, Nvidia is the third-largest in the world as measured by market cap, making it more valuable than Amazon, Alphabet, Meta Platforms, Tesla, and Berkshire Hathaway. With AI looking like the next generational opportunity for investors, Nvidia may appear the most lucrative choice of all, given its influential role and seemingly unstoppable potential. However, a recent remark from Nvidia CEO Jensen Huang has me questioning just how much longer the stock can soar. What did Jensen Huang just say? Last week, investment bank Goldman Sachs hosted the Communacopia + Technology Conference, where analysts were granted rare access to Huang to ask questions related to Nvidia's product roadmap, customer use cases, and broader industry trends. Considering Nvidia has consistently blown out Wall Street's expectations over the last couple of years, you'd think most questions presented to Huang would focus on the prospects of more record growth. But one analyst actually took a different approach: The analyst asked Huang what he's worried about despite Nvidia's market-leading position and strong secular tailwinds fueling its business. Here was Huang's response: Well, our company works with every AI company in the world today. We're working with every single data center in the world today. I don't know one data center, one cloud service provider, one computer maker we're not working with. And so what comes with that is ... [an] enormous responsibility and we have a lot of people on our shoulders and everybody is counting on us and demand is so great that delivery of our components and our technology and our infrastructure and software is really emotional for people, because it directly affects their revenues, it directly affects their competitiveness. And so we probably have more emotional customers today than -- and deservedly so. And if we could fulfill everybody's needs, then the emotion would go away but it's very emotional. It's really tense. We've got a lot of responsibility on our shoulder and we're trying to do the best we can. I know that's a jam-packed, run-on sentence. And candidly, there are a lot of themes in there that suggest Nvidia is in a good spot. But the explanation above doesn't inspire the same sense of confidence in me that it might for other investors. Instead, it makes me a little nervous. Why does this make me nervous? Nvidia's roster of chipsets, called graphics processing units (GPUs), includes its highly touted A100, H100, and new Blackwell series. As it stands today, some industry research suggests Nvidia holds 88% of the AI chip market. Huang really wasn't exaggerating when he said, "Everybody is counting on us." Considering the release of the Blackwell chips was recently delayed due to a design flaw, Huang's remarks about customers being emotional make a lot of sense. It's these ideas that have me concerned. Nvidia is no longer just viewed as another semiconductor stock. Rather, the company itself is largely seen as a barometer for the health of the overall AI market. Given this change in perception and the pressure to deliver that comes with it, I'm beginning to think Nvidia's stock price action is increasingly vulnerable. Said another way, even if Nvidia delivers a strong quarter of growth, investor expectations are becoming so sky-high that good may not be good enough. When you layer on top just how much influence Nvidia has in the chip space, it's natural to think it's only a matter of time before even the slightest hiccup could take a material toll on the share price. I cannot say with any justifiable certainty whether Nvidia stock is headed higher or not. What I do believe with strong conviction is that shares of Nvidia are unlikely to rise by another 700%. Even in the long run, I think such a move is doubtful. There are already several reasons to be wary of Nvidia's long-term growth prospects. At the moment, nearly half of the company's revenue is concentrated in just four customers. Yet, many of these customers are spending significant sums to make their own chips and migrate away from Nvidia. The combination of rising competition, decelerating revenue and margin trends, and the immense (and unrealistic) expectations that Nvidia will continue to deliver top-tier products and business results in perpetuity brings me to the opinion that Nvidia stock may have peaked. While further gains are probably in store, I think these will be short-lived. Ultimately, I think Nvidia stock will normalize sooner than many are anticipating. For that reason, investors should consider all pieces of the puzzle before pouring into the semiconductor darling going forward. This article was originally published on Fool.com . All figures quoted in US dollars unless otherwise stated. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Nvidia, and Tesla. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has positions in and has recommended Alphabet, Amazon, Berkshire Hathaway, Goldman Sachs Group, Meta Platforms, Nvidia, and Tesla. The Motley Fool Australia has recommended Alphabet, Amazon, Berkshire Hathaway, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy . This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips. More on International Stock News

Amazon Frequently Asked Questions (FAQ)

When was Amazon founded?

Amazon was founded in 1994.

Where is Amazon's headquarters?

Amazon's headquarters is located at 410 Terry Avenue North, Seattle.

What is Amazon's latest funding round?

Amazon's latest funding round is PIPE - II.

How much did Amazon raise?

Amazon raised a total of $8.98M.

Who are the investors of Amazon?

Investors of Amazon include Temasek, AOL, Kleiner Perkins, Eric Dillon, Nick Hanauer and 4 more.

Who are Amazon's competitors?

Competitors of Amazon include Digikala, Favo, Coppel, SoftBank, Shopify and 7 more.

Loading...

Compare Amazon to Competitors

EC Bay operates as a company focused on providing nicotine delivery systems within the vaping industry. Their main offerings include disposable vape products designed for ease of use and convenience, capable of delivering up to 1000 puffs in a variety of flavors. It is based in Richmond, Virginia.

HEB Grocery is a supermarket chain operating in the retail industry. The company offers a range of products including groceries, pharmacy services, and recipe suggestions. It primarily serves the retail and healthcare sectors. It was founded in 1905 and is based in San Antonio, Texas.

IKEA provides home furnishing solutions in the retail industry. The company offers a range of furniture and home accessories. It was founded in 1997 and is based in Delft, Netherlands.

Bunnings is a retailer of home improvement and outdoor living products in Australia and New Zealand and a major supplier to project builders, commercial tradespeople and the housing industry.

CJ Express is a retail company focused on providing a unique supermarket experience under the theme 'More Than a Supermarket.' The company offers a variety of consumer goods and services through its strong store brands, aiming to meet all consumer needs and stand out in the retail market. CJ Express primarily serves the retail industry, with a focus on expanding its own retail brand. It was founded in 2005 and is based in Bangkok, Thailand.

Huawei Technologies focuses on information and communications technology (ICT) infrastructure and smart devices. The company offers integrated solutions across four key domains such as telecommunication networks, information technology (IT), smart devices, and cloud services. Huawei primarily sells to the telecommunications industry, the IT sector, and the consumer electronics market. It was founded in 1987 and is based in Shenzhen, China.

Loading...