Amount

Founded Year

2014Stage

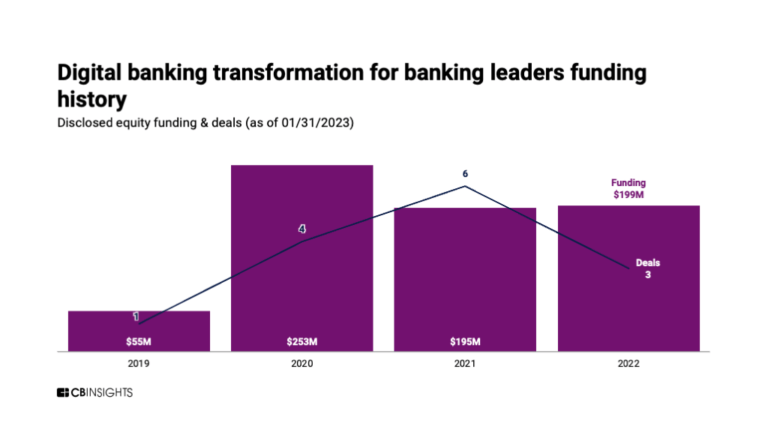

Series E | AliveTotal Raised

$253.2MLast Raised

$30M | 1 mo agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+34 points in the past 30 days

About Amount

Amount develops digital banking and financial technology solutions. The company offers a suite of products and services that enable financial institutions to provide mobile banking experiences, including swift loan approval, automated account origination, and flexible payment solutions. Its primary customers are financial institutions and their merchant partners. It was founded in 2014 and is based in Chicago, Illinois.

Loading...

ESPs containing Amount

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Amount named as Challenger among 15 other companies, including PayPal, Affirm, and Klarna.

Amount's Products & Differentiators

Retail Banking

Amount empowers financial institutions to rapidly and securely create high-value digital solutions so customers can bank when, where and how they want. Amount’s fully integrated and flexible platform is underpinned by enterprise bank-grade infrastructure and compliance, ensuring safe and reliable banking experiences across e-commerce and brick-and-mortar channels. Amount technology delivers: Ø White-label application to tailor and optimize cross-channel consumer experiences. Ø API toolkit that enables seamless integrations to originate and manage loans. Ø Proprietary decisioning engine and fraud prevention framework that delivers instant customer approvals and greater conversions without increasing overall risk. Ø Flexible reporting and analytics tools Ø Solutions that work and thrive with existing infrastructure

Loading...

Research containing Amount

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amount in 6 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Mar 30, 2022

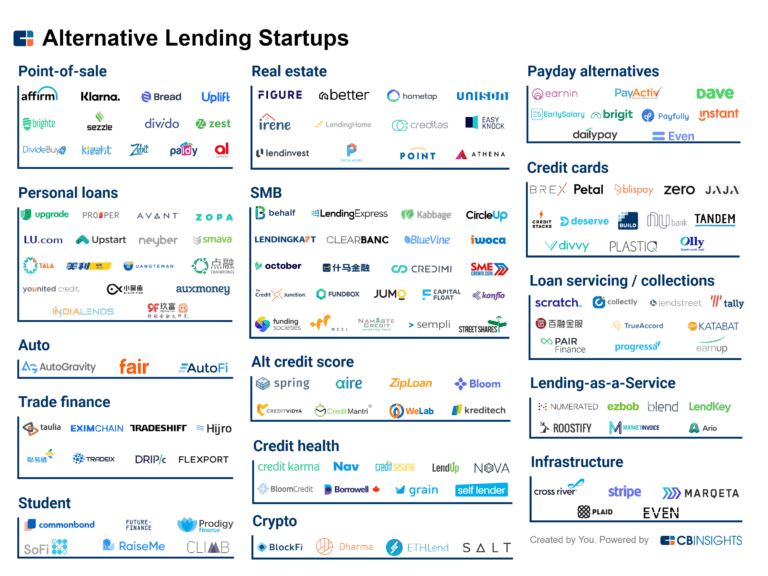

140+ startups shaping the digital lending spaceExpert Collections containing Amount

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amount is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Digital Lending

2,667 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

979 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Amount Patents

Amount has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/14/2015 | 9/13/2016 | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers | Grant |

Application Date | 10/14/2015 |

|---|---|

Grant Date | 9/13/2016 |

Title | |

Related Topics | GPS navigation devices, Videotelephony, Mobile computers, Windows administration, Personal computers |

Status | Grant |

Latest Amount News

Sep 17, 2024

By PYMNTS | September 17, 2024 | The benefits of swapping analog, manual processes for digital ones are obvious. But that doesn’t mean they don’t bear repeating — especially against a backdrop of fierce demand for streamlined, efficient and customer-friendly financial processes. It’s these processes that have traditionally defined legacy banking systems, Moe added, stressing that adopting digital tools within the financial services space not only enhances operations and customer engagement, but also drives greater profitability. This shift is especially important as customer expectations increasingly favor speed, convenience and automation in financial services. “Modern money experiences typically engage younger generations of banking customers,” Moe said. Revolutionizing Digital Engagement in Lending Amount’s core offering lies in its loan origination and account opening software solutions. These tools help lenders, from community banks to nonbanking financial institutions, move away from creaking and outdated workflows that result in friction-filled experiences for their customers. “Part of our role is helping our clients with their own customers by looking at the overall effectiveness of their funnel, of their policies, of the ways that they’re mitigating fraud,” Moe said. “And each of our customers comes to us with some nuance as it relates to their own unique priorities and what’s important. Together, we help them in striking a balance between risks and outcomes.” This dual focus ensures that lenders can expand their reach and deepen customer relationships without compromising on security or compliance. “The time is always ripe for disruption, regardless of the segment,” Moe said. “Lenders that typically have relied on in-person relationships and the more traditional modes of application intake, verification and contract signing are also increasingly leaning into digital and automation.” One of the key insights Moe shared was the shift in digital engagement across different customer groups. While younger generations have long been early adopters of digital financial services, more traditional lenders that have historically relied on in-person relationships are also beginning to try automation and digital processes. The ability to adapt to customer preferences is a critical component of modern banking, and Amount provides the tools necessary to enable that adaptability. The Digital Transformation Imperative and Role of Data in Measuring Success As financial institutions move to embrace the adaptability offered by digital platforms, measuring success becomes both a qualitative and quantitative exercise. According to Moe, data plays a crucial role in showing firms where they can achieve the highest return on investment as they digitize. “Lenders can expand their reach, they can add new households, they can also deepen that wallet share within their existing base of customers, too,” she explained, noting that it’s important to think through “not just the tech, but also the organizational change management that needs to accompany that in order to best facilitate the move from manual to digital.” Moe pointed out that many lenders miss out on potential revenue because customers abandon online applications. Additionally, fraud losses and penalties from compliance infractions can deplete margins. The marketplace is full of digital solutions like Amount’s that address these pain points in a measurable way. For example, one of Amount’s clients launched a new consumer loan program and saw that 80% of applications were funded without human intervention. Another client reduced application-to-funding time from two weeks to just 15 minutes, underscoring the operational efficiency gains that digital technology can bring. In an industry that is rapidly evolving, financial institutions are under increasing pressure to modernize their operations. Looking ahead, Moe expressed excitement about the future of digital lending and Amount’s role in shaping it. The company is focused on continuing to develop innovative solutions, including around artificial intelligence, that drive customer engagement, enhance risk management and deliver superior performance outcomes — all combined with a deep understanding of client needs. “You’re able to incorporate new technology in a safe and responsible way that drives real efficiencies,” Moe said. Recommended

Amount Frequently Asked Questions (FAQ)

When was Amount founded?

Amount was founded in 2014.

Where is Amount's headquarters?

Amount's headquarters is located at 222 North LaSalle Street, Chicago.

What is Amount's latest funding round?

Amount's latest funding round is Series E.

How much did Amount raise?

Amount raised a total of $253.2M.

Who are the investors of Amount?

Investors of Amount include Hanaco Ventures, Goldman Sachs, WestCap, QED Investors, Curql and 11 more.

Who are Amount's competitors?

Competitors of Amount include Lendflow, VeendHQ, SplitIt, Figure Technologies, Avant and 7 more.

What products does Amount offer?

Amount's products include Retail Banking and 1 more.

Loading...

Compare Amount to Competitors

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

Best Egg operates as a consumer financial technology platform in the fintech sector. The company offers a digital financial platform that provides personal loans, credit cards, and financial health resources to help individuals manage their everyday finances. It primarily serves the personal finance management sector. Best Egg was formerly known as Marlette Holdings. It was founded in 2014 and is based in Wilmington, Delaware.

Achieve offers digital financial solutions. Its services include home equity loans, personal loans and debt resolution, and financial education. It caters to individuals and families. Achieve was formerly known as Freedom Financial Network. It was founded in 2002 and is based in Scottsdale, Arizona.

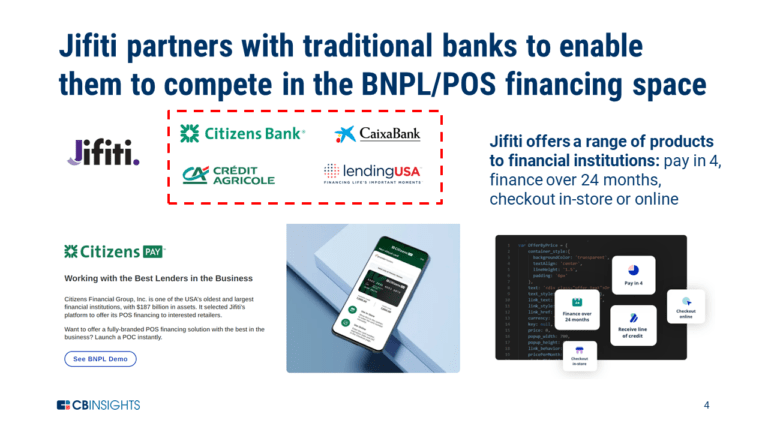

Jifiti is a fintech company that operates in the financial services industry. The company provides white-labeled embedded lending solutions for banks, lenders, and merchants, enabling them to deploy and scale consumer and business financing programs at any point of sale. These services primarily cater to the retail finance and consumer finance sectors. It was founded in 2011 and is based in Columbus, Ohio.

Ezbob is a company that focuses on embedded banking and finance technology in the financial services industry. The company offers digital finance solutions that enable financial institutions and payment companies to provide services such as term loans, account opening, line of credit, overdraft, asset finance, and credit cards. Ezbob primarily serves the banking and payment companies sector. It was founded in 2011 and is based in London, England.

Zirtue offers a relationship-based lending application that aims to drive financial inclusion. It provides funds through relationship-based loans. It offers peer lending and borrowing. The company was founded in 2018 and is based in Dallas, Texas.

Loading...