Investments

1728Portfolio Exits

238Funds

73Partners & Customers

3Service Providers

3About Andreessen Horowitz

Andreessen Horowitz (a16z) is a venture capital firm with $4.2 billion under management. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

Expert Collections containing Andreessen Horowitz

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Andreessen Horowitz in 18 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

AR/VR

33 items

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Agriculture Technology (Agtech)

28 items

Companies that are using technology to make farms more efficient

Vitamin & Supplement Startups

237 items

Research containing Andreessen Horowitz

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Andreessen Horowitz in 27 CB Insights research briefs, most recently on Aug 23, 2024.

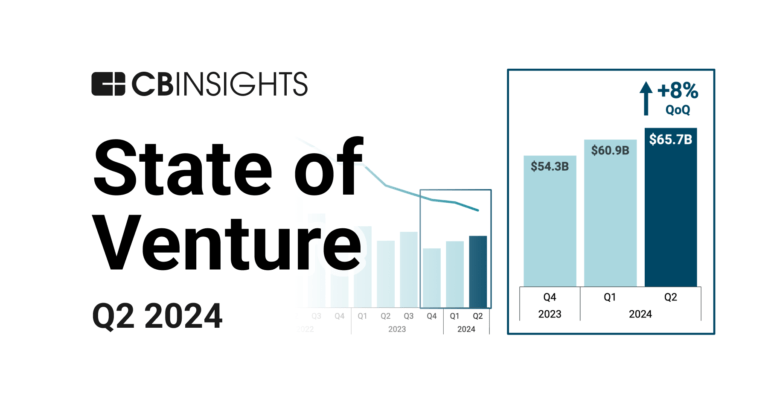

Jul 3, 2024 report

State of Venture Q2’24 Report

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Mar 5, 2024 report

The top 20 venture investors in North America

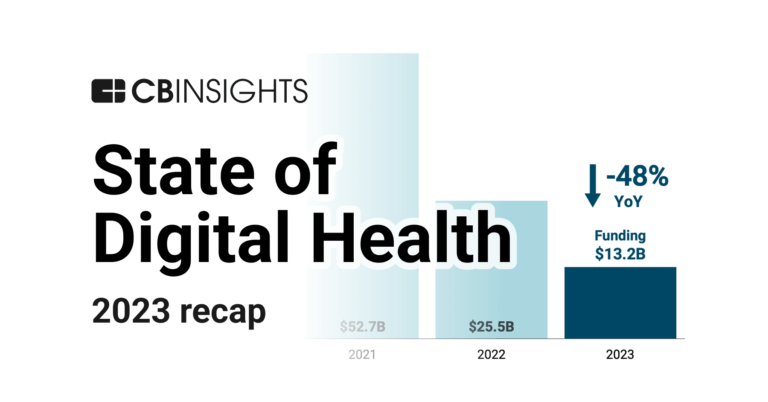

Jan 25, 2024 report

State of Digital Health 2023 Report

Jul 26, 2023 report

State of Digital Health Q2’23 ReportLatest Andreessen Horowitz News

Sep 2, 2024

Image Credits: a16z Andreessen Horowitz’s partner Joshua Lu knows that, in the video game industry, you can never get too comfortable. When he was head of product at Zynga, he experienced the height of mobile games, working on hits like Words with Friends; then as a vice president at Blizzard Entertainment, he helped produce tentpole hits like Diablo Immortal. And then, as a director of product management at Meta, he learned to see games in new dimensions while working on the VR game, Horizon Worlds. “I had to forget what I thought were universal truths and learn a whole new set of ways to do things,” Lu told TechCrunch. Now Lu wants a front row seat to where video games are heading. After joining the firm as an investor in 2022, Lu helped launch the firm’s Speedrun accelerator, which invests $750,000 apiece into about 40 gaming startups twice a year. Now on the firm’s third cohort — with the applications for the fourth cohort now open — Lu said he’s seen how AI and new distribution platforms are changing the industry. Half of the accelerator’s current batch are AI companies, doing everything from creating AI-crafted stories to using AI for 3D avatars. “The last game that I worked on at Blizzard took six years and a $250 million budget to ship,” he said, referring to Diablo Immortal. “But wouldn’t it be so great if that kind of quality of game could be done with a 10th of the budget and a 10th of the people?” We might quibble with how great it is for AI to kill high-paying developer jobs at the largest game companies. But if AI also helps more startups form and be qualitatively competitive, that’s a compelling thought. Lu says he’s seen firsthand how companies are getting creative, citing Clementine , a startup that went through Speedrun. The company “released a demo where you had to solve a mystery by talking to AI and making sure that they didn’t find out that you were a human,” he said. That may be a terrifying premise, or a tongue-in-cheek one, depending on how existential a threat you think AI could become. Lu also mentioned Echo Chunk, a company that raised $1.4 million in a round led by Speedrun. Echo Chunk went viral for its game Echo Chess that uses AI to instantly generate an endless number of levels. “These are all fairly early explorations,” he said. “But we’re excited in general about novel types of game design interactions and game dynamics that can be unlocked because of AI.” Lu is also advocating for startups to build games atop Discord. Earlier this year, Discord made it so developers can create apps for people to use within the chatting platform. Lu said that, over the course of his career, he’s seen the places for people to discover games dwindle; for example, no one finds games through social media feeds anymore, like many did with Farmville. “Where can we find the next platform where truly social games can be created and distributed?” Lu said. Several companies entered the accelerator building within Discord. Lu said several more pivoted to building in Discord over the course of the 12-weeks. “There are more games being made than ever, and it’s hard for developers to stand out,” he said. He hopes building on Discord will help “people to find pieces of content that they would really like playing.” More TechCrunch

Andreessen Horowitz Investments

1,728 Investments

Andreessen Horowitz has made 1,728 investments. Their latest investment was in Hello Wonder as part of their Seed VC on August 30, 2024.

Andreessen Horowitz Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/30/2024 | Seed VC | Hello Wonder | $2.1M | Yes | 2 | |

8/26/2024 | Series A | Viggle AI | $19M | Yes | 3 | |

8/21/2024 | Series B | Story Protocol | No | 7 | ||

8/20/2024 | Series A | |||||

8/14/2024 | Series A - III |

Date | 8/30/2024 | 8/26/2024 | 8/21/2024 | 8/20/2024 | 8/14/2024 |

|---|---|---|---|---|---|

Round | Seed VC | Series A | Series B | Series A | Series A - III |

Company | Hello Wonder | Viggle AI | Story Protocol | ||

Amount | $2.1M | $19M | |||

New? | Yes | Yes | No | ||

Co-Investors | |||||

Sources | 2 | 3 | 7 |

Andreessen Horowitz Portfolio Exits

238 Portfolio Exits

Andreessen Horowitz has 238 portfolio exits. Their latest portfolio exit was Singularity 6 on July 01, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

7/1/2024 | Acquired | 3 | |||

6/20/2024 | Acquired | 4 | |||

6/11/2024 | Acquired | 12 | |||

Date | 7/1/2024 | 6/20/2024 | 6/11/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 3 | 4 | 12 |

Andreessen Horowitz Fund History

73 Fund Histories

Andreessen Horowitz has 73 funds, including Crewcial AH 2024 Fund Multiplexer.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

6/21/2024 | Crewcial AH 2024 Fund Multiplexer | $64M | 1 | ||

4/16/2024 | Andreessen Horowitz Fund IX | $7,200M | 2 | ||

5/25/2022 | a16z Crypto Fund IV | $4,500M | 1 | ||

5/18/2022 | Games Fund One | ||||

1/7/2022 | Andreessen Horowitz Fund VIII |

Closing Date | 6/21/2024 | 4/16/2024 | 5/25/2022 | 5/18/2022 | 1/7/2022 |

|---|---|---|---|---|---|

Fund | Crewcial AH 2024 Fund Multiplexer | Andreessen Horowitz Fund IX | a16z Crypto Fund IV | Games Fund One | Andreessen Horowitz Fund VIII |

Fund Type | |||||

Status | |||||

Amount | $64M | $7,200M | $4,500M | ||

Sources | 1 | 2 | 1 |

Andreessen Horowitz Partners & Customers

3 Partners and customers

Andreessen Horowitz has 3 strategic partners and customers. Andreessen Horowitz recently partnered with Bassett Healthcare Network on November 11, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

11/7/2022 | Partner | United States | Through this partnership , Bassett Healthcare Network will have access to the companies Andreessen Horowitz has backed as well as the broader Andreessen Horowitz ecosystem , which comprises innovative companies in relevant fields including enterprise tech , fintech and consumer services . | 2 | |

12/19/2017 | Partner | ||||

Vendor |

Date | 11/7/2022 | 12/19/2017 | |

|---|---|---|---|

Type | Partner | Partner | Vendor |

Business Partner | |||

Country | United States | ||

News Snippet | Through this partnership , Bassett Healthcare Network will have access to the companies Andreessen Horowitz has backed as well as the broader Andreessen Horowitz ecosystem , which comprises innovative companies in relevant fields including enterprise tech , fintech and consumer services . | ||

Sources | 2 |

Andreessen Horowitz Service Providers

4 Service Providers

Andreessen Horowitz has 4 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | |||

|---|---|---|---|

Associated Rounds | |||

Provider Type | Counsel | ||

Service Type | General Counsel |

Partnership data by VentureSource

Andreessen Horowitz Team

40 Team Members

Andreessen Horowitz has 40 team members, including current Founder, General Partner, Marc Lowell Andreessen.

Name | Work History | Title | Status |

|---|---|---|---|

Marc Lowell Andreessen | Founder, General Partner | Current | |

Name | Marc Lowell Andreessen | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, General Partner | ||||

Status | Current |

Compare Andreessen Horowitz to Competitors

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Accel serves as a global venture capital firm operating in the financial sector. The company's main service is providing financial backing to exceptional teams at all stages of private company growth. Accel primarily sells to the tech industry, with investments in companies across various sectors such as social media, cloud computing, and ecommerce. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

New Enterprise Associates (NEA) provides venture capital to help entrepreneurs and business leaders build transformational, industry-leading companies. It mainly focuses on companies in the early stages of development, while a portion of its dollars is invested in venture growth equity opportunities. NEA also invests in foreign markets, including China and India, across sectors including information technology, healthcare, and energy technology. It was founded in 1977 and is based in Menlo, California.

Loading...