Artificial Labs

Founded Year

2013Stage

Series A - II | AliveTotal Raised

$27.46MLast Raised

$10.05M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Artificial Labs

Artificial Labs facilitates automated, algorithmic underwriting to determine insurance risk. It offers data ingestion, instant risk triaging, a digital contract builder, and an underwriting workbench. It also provides integration for data retrieval from internal and external sources via an application programming interface (API). It was founded in 2013 and is based in London, United Kingdom.

Loading...

Artificial Labs's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

ESPs containing Artificial Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The submission pre-fill market refers to the use of technology solutions that automate and streamline the process of filling out forms and submitting them. This can be particularly useful in industries such as insurance, where there are many complex forms that need to be completed accurately and efficiently. By using pre-filled data from sources such as government databases or previous submissions…

Artificial Labs named as Leader among 10 other companies, including Percayso Inform, Convr, and Fenris Digital.

Artificial Labs's Products & Differentiators

Algorithmic Underwriting Platform

The platform performs automatic data ingestion, via API, broker portal, or extraction via OCR. The risk data is assessed using our proprietary algorithm, against underwriting appetite, to generate an accept, refer or decline decision which can then be priced and placed, all within the platform. Risk data can then be sent via API to our client's target systems. The platform allows underwriters to define their appetite and automatically build towards a target portfolio of risks.

Loading...

Research containing Artificial Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Artificial Labs in 3 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024Expert Collections containing Artificial Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

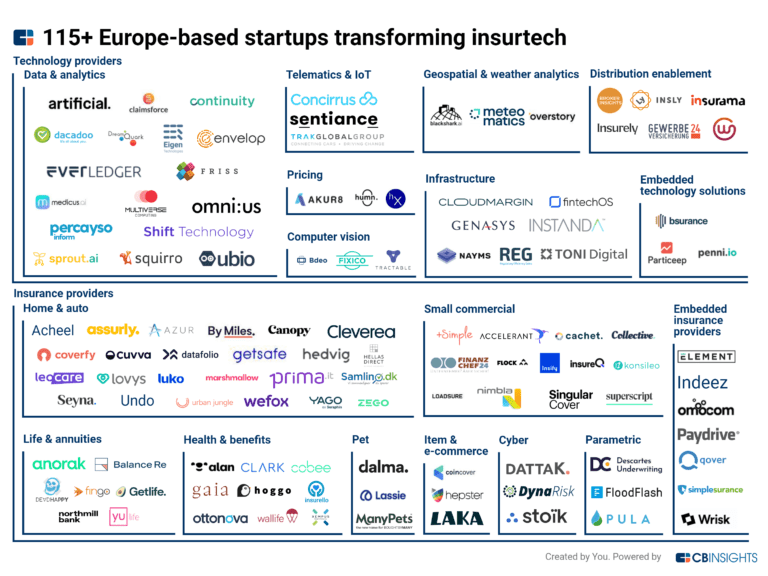

Artificial Labs is included in 5 Expert Collections, including Insurtech.

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,396 items

Excludes US-based companies

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

ITC Vegas 2024 - Exhibitors and Sponsors

627 items

As of 9/9/24. Company list source: ITC Vegas. Check ITC Vegas' website for any updates: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest Artificial Labs News

Aug 6, 2024

2024 insurtech funding still going strong 💪 💪Lot's of investments to report on this week... some from the big names in insurtech & some from the just getting started - love to see it! 👏 👏 👏Always great to see our The Leadership In Insurance Podcast guests in the news too - shout out Artificial Labs , Kin Insurance & Shepherd 🎙🎙🎙Congratulations all - great stuff 🚀 🚀 🚀 Shepherd , an insurance startup focused on the construction space, has raised $13.5 million in Series A funding led by Costanoa Ventures , with participation from Intact Ventures , Era Ventures , Greenlight Re and Spark Capital . Artificial Labs , a London-based company offering an underwriting software, announced the completion of an £8 million Series A+ funding round led by Augmentum Fintech , with participation from existing investors MS&AD Ventures and FOMCAP IV. David King Candor Technology Inc. has closed a Series B equity round led by Rice Park Capital Management , with participation from Arthur Ventures , Assurant Ventures , and others.Home insurance scale up Kin Insurance announced the closing of $15 million in financing from new investor Activate Capital . Sean Harper Employee benefits startup Benepass has raised $20 million in funding led by Portage and Clocktower Technology Ventures, with participation from Workday Ventures , Threshold Ventures and Gradient Ventures . Drodat , who are pioneering a new era in property data and insurance received their preseed investment round. Noah Plitt Jacob O. Hydronos Labs LLC , who build applied hydrology and Climate Data software and services announced their seed investment round.Specialty insurer Core Specialty Insurance Holdings, Inc. , along with its subsidiaries, has signed a purchase agreement to make a minority investment in Gramercy Risk Management , which provides property and casualty insurance programs for specialty classes of business, including New York Contractors.

Artificial Labs Frequently Asked Questions (FAQ)

When was Artificial Labs founded?

Artificial Labs was founded in 2013.

Where is Artificial Labs's headquarters?

Artificial Labs's headquarters is located at 10 Bow Lane, London.

What is Artificial Labs's latest funding round?

Artificial Labs's latest funding round is Series A - II.

How much did Artificial Labs raise?

Artificial Labs raised a total of $27.46M.

Who are the investors of Artificial Labs?

Investors of Artificial Labs include Force Over Mass Capital, MS&AD Ventures, Augmentum Fintech, Mundi Ventures, No. 9 Investments and 6 more.

Who are Artificial Labs's competitors?

Competitors of Artificial Labs include InsurX and 5 more.

What products does Artificial Labs offer?

Artificial Labs's products include Algorithmic Underwriting Platform and 1 more.

Who are Artificial Labs's customers?

Customers of Artificial Labs include Chaucer, Marsh, Convex and Ed Broking.

Loading...

Compare Artificial Labs to Competitors

Allphins is a data analytics and technology platform operating in the insurance industry. The company provides services that enhance property and casualty (P&C) reinsurance capabilities by transforming unstructured data into risk insights, thereby enabling insurance professionals to make better and faster underwriting decisions. Allphins primarily serves the reinsurance sector. It was founded in 2018 and is based in Paris, France.

Concirrus is a company that focuses on digital insurance platforms within the insurance industry. The company offers products that provide actionable insights and risk assessment capabilities, which are used to drive informed decisions in the insurance market. These digital solutions are primarily used by commercial insurance organizations to optimize various aspects of the insurance value chain, such as submissions, broking, underwriting, risk management, reserving, and claims. It was founded in 2012 and is based in London, England.

IntellectAI is a company that focuses on artificial intelligence and data insights, operating primarily in the financial services industry. The company offers a range of AI-powered products designed to streamline underwriting processes, provide risk analysis, and automate invoice processing in the insurance sector. IntellectAI primarily serves the insurance industry, with a particular focus on commercial and specialty insurance providers. It is based in Piscataway, New Jersey.

Convr specializes in AI-driven underwriting analysis for the commercial property and casualty (P&C) insurance sector. The company offers a modular end-to-end underwriting management platform that processes commercial insurance data, automates risk assessment, and supports underwriting decisions with a patented AI decisioning engine. Convr's platform is designed to enhance underwriting productivity, improve risk classification accuracy, and streamline the submission intake process. It was founded in 2015 and is based in Schaumburg, Illinois.

Unqork is a company focused on providing a codeless application development platform for the enterprise sector. Their main offerings include a visual designer for creating complex, mission-critical enterprise applications without the need for traditional coding. The company primarily serves sectors such as financial services, insurance, government, and healthcare. It was founded in 2017 and is based in New York, New York.

Intellect SEEC is a company that focuses on providing artificial intelligence products and data insights for the financial services industry. The company offers AI-powered solutions for underwriting in commercial, specialty, and E&S lines, including automatic submission ingestion, data enrichment, and quote and bind processes. These solutions are designed to increase underwriting effectiveness and drive portfolio profitability, primarily for carriers, MGAs, and wholesalers in the insurance industry. It is based in Mumbai, India.

Loading...