Augury

Founded Year

2011Stage

Series E | AliveTotal Raised

$294MValuation

$0000Last Raised

$180M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-40 points in the past 30 days

About Augury

Augury provides predictive and prescriptive artificial intelligence (AI) solutions. The company offers AI-enabled insights into machines, processes, and operations to help businesses improve outcomes, maintain workforce, and achieve sustainable production. It primarily serves sectors such as food and beverage, consumer packaged goods, forest products, pulp and paper, glass, metals and mining, chemicals, building materials and cement, pharmaceutical, steel, plastics, commercial services, and energy. It was founded in 2011 and is based in New York, New York.

Loading...

Augury's Product Videos

ESPs containing Augury

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The predictive maintenance market offers software solutions leveraging AI and IoT technologies to provide real-time machine insights. This enables manufacturers to move from reactive to proactive maintenance programs and, as a result, prevent process-driven production losses, reduce over maintenance, extend asset lifetime, and optimize manufacturing equipment controls. It also helps them eliminate…

Augury named as Outperformer among 15 other companies, including IBM, Siemens, and SAP.

Augury's Products & Differentiators

Machine Health

An industrial AI solution, Machine Health uses the Internet of Things (IoT) and purpose-built Artificial Intelligence (AI) to help people manage industrial assets and optimize their performance. Augury’s full-stack Machine Health Solutions use sensors that capture vibration, temperature and magnetic data from machines, then leverages advanced AI diagnostics and human reliability expertise to deliver real-time visibility and actionable insights into the full range of rotating equipment. With insights aggregated into a centralized platform and additional interoperability capabilities, manufacturing companies can eliminate data silos and work collaboratively to reduce inefficiencies generated by malfunctioning equipment.

Loading...

Research containing Augury

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Augury in 13 CB Insights research briefs, most recently on Feb 29, 2024.

Sep 28, 2023

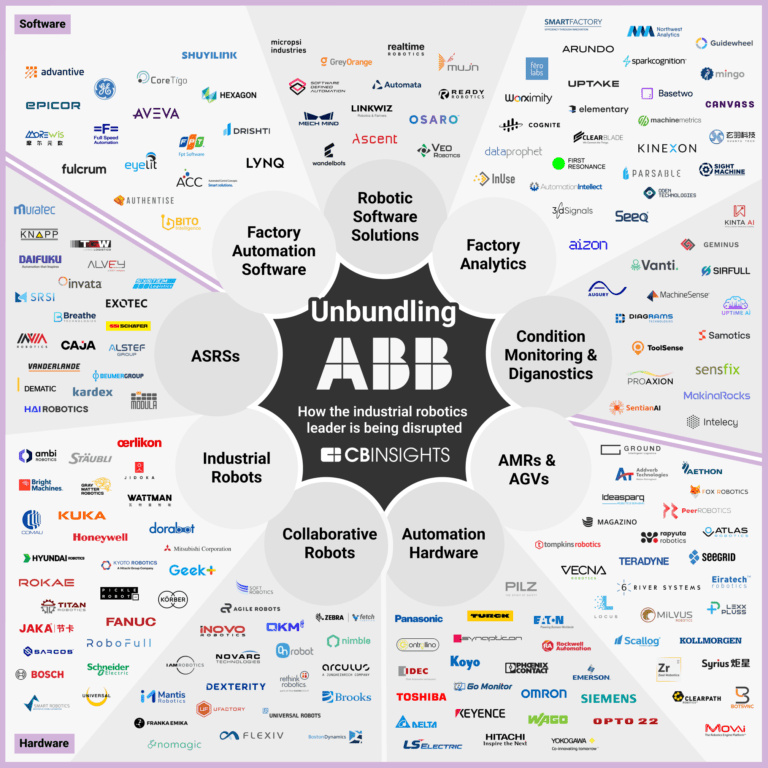

The automation in advanced manufacturing market map

Aug 16, 2023

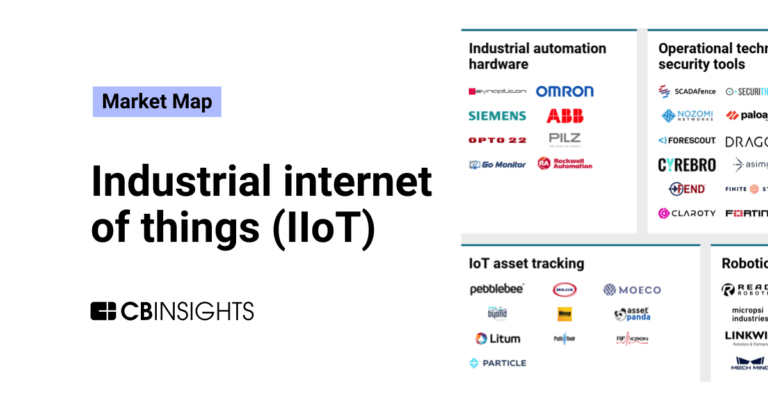

The industrial internet of things (IIoT) market map

Expert Collections containing Augury

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Augury is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Oil & Gas Tech

4,980 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,653 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Advanced Manufacturing

6,340 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Future of the Factory (2024)

436 items

This collection contains companies in the key markets highlighted in the Future of the Factory 2024 report. Companies are not exclusive to the categories listed.

Augury Patents

Augury has filed 16 patents.

The 3 most popular patent topics include:

- maintenance

- acoustics

- artificial intelligence

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/4/2023 | 5/7/2024 | Semiconductor device fabrication, Acoustics, Nondestructive testing, Thin film deposition, Plasma processing | Grant |

Application Date | 5/4/2023 |

|---|---|

Grant Date | 5/7/2024 |

Title | |

Related Topics | Semiconductor device fabrication, Acoustics, Nondestructive testing, Thin film deposition, Plasma processing |

Status | Grant |

Latest Augury News

Sep 10, 2024

Summary The first industrial revolution marked the shift from manual labor to mechanization. The second introduced mass production, and the third was driven by computers and Programmable Logic Controllers (PLCs) to control machines. The fourth, defining the early 21st century, has been the era of connectivity, advanced analytics, and automation. We at Insight now see a new revolution underway led by humans and augmented by increased sophistication in AI/ML, automation, and IoT — ushering in a new era of industrial productivity. While other industries have rapidly digitized over the past decade, the industrial and manufacturing sector has seen slower technological adoption. There’s long been cultural resistance toward adopting new tools and software due to the fact that production needs to remain uninterrupted, leaving little room for the downtime required to implement large-scale upgrades. But now, facing existential labor shortages, lingering supply chain disruptions, and increasing pressure from ESG regulations, the industry is increasingly embracing technological innovation to meet these challenges, thereby creating a big opportunity. At Insight Partners, we’re excited by the opportunities of software digitizing, optimizing, and accelerating efficiency across the industrials and manufacturing landscape and look forward to adding to our growing roster of investments in the sector. The industry Technological innovations — like AI, ML, IoT, digital twins, and automation — have clear use cases within the industrial context. IoT devices and sensors increase the volume and granularity of data collection, centralizing it for better analysis and application through AI and ML. Automation and robotics, building on the progress of Programmable Logic Controllers (PLCs), make machines easier to control while increasing efficiency and safety. But automation isn’t about replacing people — it’s about empowering them. The goal is to use technology to help these workers do more with less. This is all the more important today because the industry is facing a critical labor shortage. The manufacturing sector currently has more than half a million job openings, and an estimated 3.8M additional employees will be needed in manufacturing between 2024 and 2033 as current workers retire or change careers. But up to 1.9M of these positions could remain unfilled if manufacturers aren’t able to address the skills and applicant gaps, threatening U.S. manufacturing growth and competitiveness. The sector’s aging workforce compounds this problem. Over 51% of U.S. manufacturing jobs are held by employees aged 45 and up, with a quarter of that workforce over the age of 55. As baby boomers retire, finding workers with similar experience and expertise to fill the skills gaps will be challenging, particularly as fewer students are enrolling in vocational programs. Many industries rely on industrial experience and specialized knowledge, which is disappearing as the workforce retires. But with the demand for such highly skilled employees outweighing supply, the ability to implement and maintain the very technologies that would improve productivity rates may be hindered. It demands technology that can formalize operating procedures and industrial know-how — improving the productivity of the existing workforce and upskilling new entrants. The investment landscape Two major and recent pieces of legislation — the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act and the Inflation Reduction Act (IRA) — have generated a sizable tailwind for the sector. Together, they prioritize rebuilding infrastructure, advancing clean energy initiatives, and building out the domestic semiconductor industry while also fostering job growth and workforce development. *Source: deloitte.com/en/insights/research-centers/center-energy-industrials.html The CHIPS and Science Act authorizes roughly $280B in new funding to boost domestic research and manufacturing of semiconductors in the U.S. Since the Act’s passage in August 2022, over $210B in private investments for semiconductor projects have been announced across 20 states. The IRA, primarily focused on clean energy and climate change initiatives, also has significant implications for manufacturing and industrials. It provides around $370B to bolster sustainability efforts, increase energy security, and lower energy costs. Since the IRA’s passage, close to 200 new clean technology manufacturing facilities have been announced , representing $88B in investment and the potential creation of over 75,000 new jobs. As a result, the manufacturing industry is experiencing record spending and private sector investment. Between Q1 2020 and Q3 2023, the industry received $1.47T in investment from U.S. investors, 71% of which was invested in domestic manufacturing companies. Investments in new technologies have nearly doubled compared to 2021 and are almost 20 times the amount allocated in 2019. And, as of July 2023, annual construction spending in manufacturing reached $201B , a 70% YoY increase, setting the stage for further growth in 2024. This stimulus and spending means many more new, mid-market industrial companies will emerge. These companies will have more youthful DNA and be ready to adopt technology from the start to streamline their operations alongside legacy incumbents that are forced to reinvent themselves with new-age technology. For example, according to a study conducted by Forbes , “70% of manufacturers say they’ve implemented some form of AI into their operations and that 82% have plans to increase their AI budgets in 2024.” The opportunities This combination of industry-specific challenges coupled with technological tailwinds means that the need and opportunity to leverage digital technologies within and around the factory are only growing. Workforce and asset optimization Given the labor shortage and skills gap , software that upskills workers is mission-critical to increase productivity and reduce operational redundancies. Given most of these processes are largely manual and paper-based, the opportunity to digitize creates high value and meaningful ROI for customers. Data analytics and consolidation In the past decade, the ability to collect, store, and analyze data on an industrial scale has matured. The sector generates vast amounts of data, but industrial floors are fragmented and often plagued by data silos. This presents a high-value opportunity to aggregate data and provide meaningful insights to operators. At the same time, new regulatory frameworks, like the EU’s Digital Product Passport , which requires detailed information about a product’s lifecycle, are also pushing manufacturers toward better data collection and reporting. ESG and safety With increasing pressure and regulations around decarbonization, there is a significant opportunity to use software to make industrial processes greener, safer, and more efficient. Strategies around energy optimization, ESG management and reporting provide meaningful value-add across the board. Cybersecurity As the sector further automates and adopts more digital technology, it also introduces new risks and vulnerabilities — and cybersecurity solutions will become increasingly critical in ensuring the safe and efficient operation of manufacturing processes. Cyber threats have played a part in the cultural reluctance to adopt technology — in a recent study, more than half of surveyed manufacturing companies said they were targeted by ransomware . To mitigate the risks, the sector should prioritize cybersecurity as much as the digital transformation projects themselves. The innovators Workforce and asset optimization UpKeep * provides asset operations management solutions, including CMMS and enterprise asset management (EAM) software. Their platform supports maintenance and reliability teams in streamlining operations, managing work orders, scheduling preventive maintenance, tracking inventory, and monitoring asset health using real-time data and IoT integrations. Through mobile-first technology and analytics, it helps improve efficiency, reduce downtime, and extend asset lifecycles through mobile-first technology and robust analytics. XOi is a data integration platform that unifies siloed data to equip technicians with relevant information, schematics, support, and ML-driven repair recommendations — thereby tapping into the industrial know-how lost through the aging workforce and labor shortages. The platform brings together data from OEMs, distributors, and back-office FSM tools into a single pane of glass that is seeing wide adoption and continuous use by front-line technicians. Management Controls’ myTrack platform is a workforce and safety solution for contingent labor data and spend management across complex and industrial industries. Owners typically rely on pen and paper for coordinating their workforce. myTrack digitizes the process by automating compliance with contract terms; reducing compliance risks and overbilling; and providing tools for labor, equipment, and material tracking. Arbor (Founded by former Insight Partners employees) is an AI-powered labor intelligence platform for the manufacturing industry. The company takes in HRIS and ATS data to help businesses uncover insights and value on their employees, ultimately driving improvements across hiring, retention, compensation, and engagement and mitigating risks posed by labor shortages. Data analytics and consolidation Augury * provides AI-driven predictive maintenance and process optimization solutions for manufacturing. Their technology predicts and prevents machine failures, optimizes production processes, and improves overall operational efficiency to enhance machine health, maximize yield, reduce waste, and achieve sustainable production goals. Cognite is an industrial DataOps platform aggregating siloed data to drive improvements across data exploration, digital operator rounds, production optimization, turnaround planning, and root-cause analysis. The solution is purpose-built for messy industrial data and uniquely addresses the needs of the sector across energy, process manufacturing and other industrials. KCF Technologies specializes in machine health optimization for complex industrials. Their SMARTdiagnostics platform integrates IoT, advanced analytics, and user-friendly software to reduce downtime, extend asset life, and enhance overall efficiency. Seeq * provides advanced analytics and visualization tools supplemented by machine learning and AI solutions for time series data in industrial operations. Seeq’s tools help oil and gas, pharmaceuticals, and manufacturing businesses enhance productivity, achieve sustainability goals, and empower engineers and data scientists with actionable insights. Technical Toolboxes provides advanced analysis tools for pipeline integrity, crossings, corrosion, and welding. By centralizing data and automating calculations, they help increase productivity, promote compliance, and reduce risk. ESG and safety Intenseye * leverages AI technology to enhance workplace safety by monitoring existing cameras to detect and notify safety hazards in real time. Intenseye’s platform offers tools for compliance management, audits, and reporting. In turn, the platform helps reduce incidents, increase operational efficiency, and promote regulatory adherence. Imubit * specializes in process optimization for the energy industry. Their closed-loop neural network (CLNN) technology helps refineries and petrochemical plants optimize their processes by continuously learning and adapting to changing conditions, integrating with existing systems to provide improved efficiency and reduced energy consumption. Gradyent focuses on optimizing district heating networks through digital twin technology. The platform creates a virtual model of the heating network, allowing for precise control and optimization of energy use — thus reducing energy waste and improving the overall efficiency of heating systems. Cybersecurity Tenable * provides comprehensive exposure management and vulnerability risk management solutions. Its platform enables real-time continuous assessment of an organization’s attack surface, providing risk-based insights on vulnerabilities and recommendations for prioritization and remediation. It also provides specific operational technology security to protect tech on the factory floor. Armis * provides comprehensive security across various types of assets and networks, offering asset management security, operational technology and IoT security, and vulnerability prioritization and remediation with a focus on both managed and unmanaged devices across manufacturing environments. The considerations Here are Insight’s key considerations for founders building a software business within the industrials and manufacturing space. Anticipate long sales cycles — but sticky customers Customers in this space are large and complex, which means lengthy and bureaucratic sales cycles. However, once landed customers are sticky with high annual contract values (ACVs) and high upsell potential — and the next customer will be much easier to land. While the initial contract value can start small, value can expand throughout their operations. A good approach is solving a smaller use case to build trust and using that as a wedge to scale. This requires a low-risk implementation strategy, incrementally deploying applications to address pressing challenges without having to rip and replace existing systems wholesale. Start by targeting one manufacturing plant with one use case, prove the ROI, and then expand the solution. Land a beachhead client Landing a beachhead customer is crucial because it establishes credibility and provides a real-world proof of concept. In such a close-knit industry, which is oftentimes reliant on word-of-mouth and references, having one promoter can spark a go-to-market flywheel. This not only accelerates growth but also rapidly lowers CaC and implementation time. Take a user-centric approach In an industry that can’t afford downtime, you can’t throw a tool at the workforce and expect them to figure it out. Take a user-centric approach that can be fit into existing workflows, working alongside the end-users and solving the problem together. You can have the best product in the world, but if you don’t know your end user and it’s not easy to adopt and use, you’ll stall. AI needs to focus on proprietary data The industrial sector holds a wealth of untouched data, so there’s a rich opportunity for AI optimization. However, there is first a need to clean and aggregate this data to earn the trust of customers. Focus on defensibility through the use of proprietary foundational data assets — critical data unique to a market, platform, or business outcome. As the intelligence layer becomes commoditized, leveraging unique data becomes essential for maintaining a competitive edge. The resources If you want to learn more, here are some resources our team and founders recommend. Aditya Raghupathy’s Substack, Breaking the Bottleneck : A weekly newsletter with perspectives and updates on manufacturing news, funding, startups, and building venture businesses. Momenta Partners, Insights : A blog from a leading industrial impact venture firm. Robin Dechant, The Future of Manufacturing : An interview series with founders and commercial leaders of manufacturing technology companies. David Rogers, Exponential Industry : A weekly look at manufacturing and supply chain technology adoption within Industry 4.0, and covers the breakthroughs in additive manufacturing, machine learning, robotics, IoT, and the industrial metaverse. *Note: Insight Partners has invested in Upkeep, Tulip, Keyfactor, SentinelOne, Augury, Seeq, Intenseye, Imubit, Tenable, and Armis footer-banner-logo *The portfolio companies and portfolio company executives presented are examples of portfolio companies that Insight has worked with to assist the company achieve business and capital raising goals and are not intended to be a representative sample of all portfolio companies. The statements by portfolio company executives are intended to highlight their experiences working with Insight as an investor in their companies. The experiences of other portfolio companies and portfolio company executives may differ from the experiences presented. Insight did not provide compensation to the portfolio company executives or portfolio companies in connection with the statements provided by such executives. There is no guarantee that Insight’s work with other portfolio companies will produce similar results to those presented.

Augury Frequently Asked Questions (FAQ)

When was Augury founded?

Augury was founded in 2011.

Where is Augury's headquarters?

Augury's headquarters is located at 469 Fashion Avenue, New York.

What is Augury's latest funding round?

Augury's latest funding round is Series E.

How much did Augury raise?

Augury raised a total of $294M.

Who are the investors of Augury?

Investors of Augury include Lerer Hippeau, Munich Re Ventures, Eclipse Ventures, Qualcomm Ventures, Insight Partners and 10 more.

Who are Augury's competitors?

Competitors of Augury include Everactive, Ndustrial, AssetWatch, Sensemore, Bosch and 7 more.

What products does Augury offer?

Augury's products include Machine Health and 1 more.

Who are Augury's customers?

Customers of Augury include Colgate-Palmolive Company, Osem-Nestlé and ICL .

Loading...

Compare Augury to Competitors

Predictronics is a company that focuses on providing AI-based predictive analytics solutions and services in the industrial sector. The company offers solutions that provide actionable data insights, which help businesses reduce downtime, optimize productivity, and improve product quality. Predictronics primarily serves sectors such as manufacturing, semiconductors, cargo and logistics, energy, transportation, and industrial equipment. It is based in Cincinnati, Ohio.

SparkCognition specializes in artificial intelligence (AI) solutions across various sectors including energy, manufacturing, government, education, and retail. The company offers products and services that enable predictive maintenance, fraud detection, and cybersecurity, with a focus on preventing zero-day attacks. SparkCognition's AI technology is designed to analyze and optimize data, augment human intelligence, and enhance operational efficiency. It was founded in 2013 and is based in Austin, Texas.

Samotics is a company focused on optimizing the performance and energy efficiency of AC motors and rotating equipment in the industrial sector. The company offers a platform that provides real-time actionable insights to monitor machine health and manage industrial energy, detecting potential failures in advance and identifying areas of energy waste. Samotics primarily serves various industries including water, wastewater, airports, steel, pulp & paper, chemical, oil & gas, and wind energy. Samotics was formerly known as Semiotic Labs. It was founded in 2015 and is based in Leiden, Netherlands.

Petasense is a company focused on asset reliability and optimization within the Industrial IoT sector. They offer a suite of wireless sensors, cloud software, and machine learning analytics designed to monitor and predict the health of industrial machinery. Their solutions cater to various sectors, including rotating machines, electric panels, valves, and steam traps. It was founded in 2014 and is based in Milpitas, California.

Uptake is a company specializing in industrial intelligence and predictive analytics within the software-as-a-service (SaaS) sector. The company offers solutions that translate data into actionable insights for predictive maintenance, asset failure prediction, and optimization of maintenance strategies. Uptake primarily serves sectors that require robust maintenance analytics, such as transportation and heavy industry. It was founded in 2014 and is based in Chicago, Illinois.

Smartia is a leading company in the field of Industrial AI and IOT technology. The company provides end-to-end data and machine learning-as-a-service platform, enabling industrial enterprises to rapidly realise operational insights at scale. It primarily serves sectors such as aerospace, defence, food & beverage, manufacturing, packaging, and utilities. It was founded in 2018 and is based in Bristol, England.

Loading...