Aviva Singlife

Stage

Corporate Majority | AcquiredValuation

$0000About Aviva Singlife

Aviva (LON: AV) is a multinational insurance company that offers general, life, and pension insurance. The company operates in Europe, Ireland, Canada, and Asia. On September 20th, 2020, Singapore Life acquired a majority stake in Aviva Singlife for $2385M.

Loading...

Loading...

Research containing Aviva Singlife

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Aviva Singlife in 1 CB Insights research brief, most recently on Feb 9, 2024.

Feb 9, 2024 report

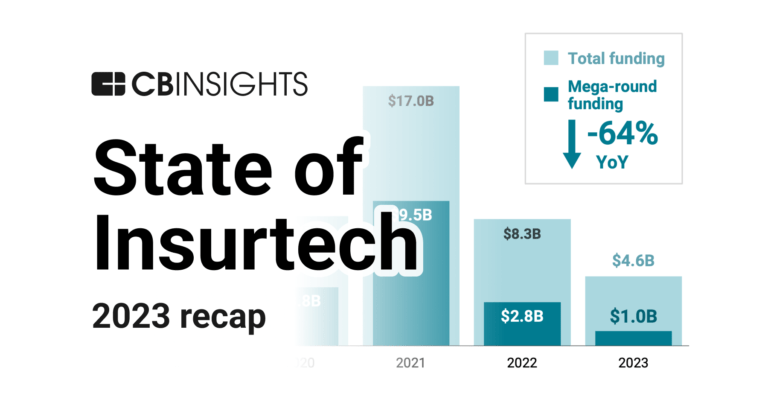

State of Insurtech 2023 ReportLatest Aviva Singlife News

Jun 20, 2024

" Singaporean financial services company, Singlife, has transformed from a promising startup into a major player, bolstered by Sumitomo Life's 2019 investment and its 2020 merger with Aviva Singapore. Now, Group CEO Pearlyn Phau sets her sights on regional dominance, leveraging talent, technology, and strategic partnerships to fuel Singlife's Southeast Asian expansion. In this exclusive interview, Pearlyn shares insights on regional insurance trends, Singlife's future growth prospects, and how the company will leverage next-generation technology to drive innovation. Here are the edited excerpts. Now under Sumitomo Life's umbrella, how will Singlife utilise its backing to expand its reach in Southeast Asia and beyond? Are there specific markets targeted for prioritised growth? Singlife's journey since Sumitomo Life's initial investment in 2019 has been one of remarkable growth. We've evolved from a promising insurtech startup to a key player in Singapore's insurance market, culminating in our 2020 merger with Aviva Singapore. Sumitomo Life's continuous support, evidenced by their ongoing investments, reflects their long-term commitment to Singlife's success. While expanding our reach in Southeast Asia (SEA) is one of our priorities, we remain laser-focused on solidifying our position within Singapore's insurance landscape. This strategically positions Singlife as a regional hub, aligning perfectly with Sumitomo Life's own expansion plans for the SEA market. Our mission – to empower customers and communities across Asia through technology-driven financial services – remains unchanged. Our Singlife House strategy, built on five pillars – Customer Centricity, Next-Gen Products and Services, Digital Enablement, Sustainability, and Future-Ready Talent – continues to guide our growth. We’re actively exploring growth opportunities in SEA, where we've already established a presence in the Philippines and are scaling up our direct-to-consumer operations. The region boasts a significant population with low insurance penetration (under 5%), increasing mobile phone usage, and a growing wealth pool – presenting a vast untapped market. Looking ahead, we plan to expand our offshore sales across SEA, focusing on high-value segments. This includes offering investment-type products like investment-linked policies (ILPs) and single-premium endowments, legacy and family planning solutions, and high-coverage protection plans. By leveraging existing partnerships with private banks and financial adviser networks across the region, we can establish a targeted presence in these markets. Our vision goes beyond mere geographical expansion. We aim to make a meaningful and strategic impact by becoming a key player in the SEA insurance landscape. What are the biggest trends shaping Southeast Asia's insurance industry today? How is Singlife positioned to capitalise on these trends for a competitive edge? The insurance landscape in Southeast Asia is dynamic and rapidly evolving. Healthcare costs are a growing concern, especially after the pandemic. A rising demand for personalised insurance products also presents insurers with an opportunity to offer tailored solutions. Singlife is well-positioned to capitalise on several key trends shaping Southeast Asia's insurance market, including: Ecosystem Partnerships: Our collaboration with IHH Healthcare Singapore allows our customers seamless access to over 600 clinics and specialists, streamlining administrative processes and ensuring affordable healthcare solutions. Championing ESG: Our 2023 ESG Survey revealed a growing demand for sustainable financial products among consumers, particularly in investment-linked policies (ILPs). We are integrating sustainable funds into offerings like ILPs and developing green economy insurance products such as EV motors. Embracing Digitalisation: Singlife adopts a digital-forward approach, offering streamlined digital-only application processes for products. We also actively leverage artificial intelligence and machine learning in our daily operations to streamline processes for tasks like underwriting and claims settlement. Recognising the Human Touch: Despite digital advancements, customers value personal relationships with financial advisers. Singlife acknowledges this by nurturing "phygital" relationships, blending digital tools with personal guidance. What are the most exciting opportunities you see for Singlife's future, both regionally and globally? With Singlife's integration into the Sumitomo Life family, a myriad of opportunities arises for collaboration and leveraging their extensive network and expertise. Regionally, Sumitomo Life's presence in Vietnam, Indonesia and China, offers avenues for knowledge exchange and best practice sharing. This may encompass talent sourcing, exchange programmes, mentorship initiatives, or joint projects focusing on innovation and product development. On a global scale, the potential for collaboration extends to Symetra Financial Corporation, a U.S.-based insurer and another wholly-owned subsidiary of Sumitomo Life. Both companies are big on financial freedom and the technology-driven approach with common goals in various areas such as capital solutions and customer, partner, and employee experience. Potential areas that we can look at include digitalisation and distribution. We remain open to exploring avenues for collaboration within the Sumitomo Life family, capitalising on these synergies to advance our shared goals and drive continued growth. As part of Sumitomo Life, do you have any specific plan for tapping into the global talent pool within the group to bolster its capabilities in Southeast Asia? We pride ourselves on our diverse team of over 1,600 individuals. We prioritise skills and cultural fit over background and are proud to have fostered a collaborative environment with experts in customer experience, marketing, technology, and fintech. Becoming part of the Sumitomo Life group opens exciting possibilities for talent collaboration. While we haven't yet formalised a specific plan, we're actively exploring ways to leverage their global expertise. This could involve knowledge sharing through exchange programmes and cross-border collaboration on projects. Committed to building a future-ready workforce, we are excited to explore the potential of collaboration with Sumitomo Life's global talent pool to drive our growth ambitions in SEA. What's your perspective on disruptive technologies like blockchain impacting the insurance value chain? Is Singlife exploring any next-gen tech to enhance its offerings? We recognise the transformative potential of disruptive technologies such as blockchain and AI on the insurance value chain and are actively exploring their applications. However, our primary focus remains on utilising these technologies to improve the customer experience and streamline operations. We believe that technology should complement rather than replace human interaction. Our emphasis is on building long-term relationships with customers through personalised insurance and financial solutions. As a pioneer in insurtech, we have integrated cutting-edge technologies like machine learning, the Internet of Things, cloud computing, and data analytics to optimise our business processes and enhance efficiency. What are some of your biggest challenges for Singlife in 2024 and beyond, and how do you plan to navigate these challenges? What are your top priorities for Singlife this year? In 2024 and beyond, Singlife faces significant challenges within the competitive Singapore insurance market. With new entrants offering low premiums to gain market share, navigating these challenges requires strategic adaptation. Despite this competitive landscape, the industry has shown resilience, particularly in the growth of the life insurance sector. Recent data from the Life Insurance Association of Singapore (LIA) indicates positive trends, with nearly a 2% increase in total sum assured and coverage for integrated shield plans (IPs) among Singapore residents. Additionally, there has been substantial growth in both annual and single-premium products, showcasing the industry's ability to adapt to consumer needs despite economic volatility. To position ourselves for growth amidst these challenges, we are focusing on three key areas. We aim to strengthen our product and investment offerings, with smart bundling across integrated insurance and investment solutions. Exploring novel health partnership models in Singapore to foster stronger integration and cost optimisation between insurers and the healthcare ecosystem. Singapore boasts one of the world's largest concentrations of high-net-worth individuals. To keep pace with these changes, we are adapting our products and services to meet the growing demand for investment-linked and wealth offerings.

Aviva Singlife Frequently Asked Questions (FAQ)

Where is Aviva Singlife's headquarters?

Aviva Singlife's headquarters is located at St Helens, London.

What is Aviva Singlife's latest funding round?

Aviva Singlife's latest funding round is Corporate Majority.

Who are the investors of Aviva Singlife?

Investors of Aviva Singlife include Singlife.

Loading...

Loading...