Creditas

Founded Year

2012Stage

Series F - II | AliveTotal Raised

$917.44MValuation

$0000Last Raised

$50M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-108 points in the past 30 days

About Creditas

Creditas is a digital platform specializing in financial solutions within the lending sector. The company offers loans using vehicles and real estate as collateral, payroll-deducted personal loans, and vehicle financing services. Creditas primarily serves individuals seeking personal finance solutions and companies looking for corporate benefits and insurance services. Creditas was formerly known as BankFacil. It was founded in 2012 and is based in Sao Paulo, Brazil.

Loading...

Creditas's Products & Differentiators

Auto Equity Loans

Personal loans with the customer car as a collateral

Loading...

Research containing Creditas

Get data-driven expert analysis from the CB Insights Intelligence Unit.

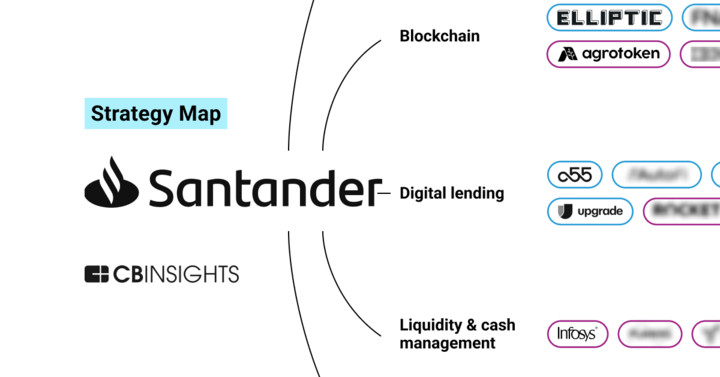

CB Insights Intelligence Analysts have mentioned Creditas in 6 CB Insights research briefs, most recently on Mar 28, 2023.

Expert Collections containing Creditas

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Creditas is included in 7 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,486 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,573 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Auto Commerce

700 items

Companies involved in the rental, selling, trading, or purchasing of cars, RVs, trucks, and fleets, including auto financing companies, vehicle auction services, online classified advertising companies with a focus on auto, and dealership software platforms.

Fintech

13,396 items

Excludes US-based companies

Latest Creditas News

May 17, 2024

VEF: Creditas financial results 1Q24 May 17, 2024 at 02:11 am EDT Share Creditas, VEF's largest portfolio holding, has announced its financial results for 1Q24. Key comments from Creditas' release: "Following the operational breakeven milestone achieved at the end of 2023, we are glad to announce our first profitable quarter in the history of the company. In Q1-24, we posted revenues of R$486mn, with record R$206.2mn gross profit, net income at R$1.4mn and positive cash flow generation." "Over the last 2 years we have been adapting our business to a new environment with a more disciplined approach to growth. We have achieved remarkable results in margin expansion and business efficiency which now positions the company to open a new chapter combining growth and profitability." "With gross profit margins now at 42.5% in Q1-24 (within the 40-45% steady-state range that we anticipated 2 years ago) we can move the company to a target annual growth rate of 25%+, while remaining profitable. In this new phase we will prioritize our technology investments in user experience as a mechanism to grow efficiently and deliver a best-in-class onboarding process for our customers." "Our vision of building a company that provides consumers with an easy, affordable, and fully digital solution to access liquidity and protect their most important assets is more relevant than ever. The market potential is massive and the geographies where we operate are significantly underpenetrated in high quality credit, insurance, and investment products. This provides Creditas with unlimited growth potential in a journey that is just getting started." The full release is available on Creditas' investor relations webpage and can be accessed at the following link: https://ir.creditas.com/ir/financial-information For further information please contact: Cathal Carroll, Investor relations: +46 (0) 8-545 015 50 About Us VEF AB (publ) is an investment company whose Common Shares are listed in Sweden. We invest in growth stage private fintech companies, take minority stakes and are active investors with board representation in our portfolio companies, always looking to back the best entrepreneurs in each market. We focus on scale emerging markets and invest across all areas of financial services inclusive of payments, credit, mobile money and wealth advisors. VEF trades in Sweden on Nasdaq Stockholm's Main Market under the ticker VEFAB. For more information on VEF, please visithttp://www.vef.vc. Attachments:

Creditas Frequently Asked Questions (FAQ)

When was Creditas founded?

Creditas was founded in 2012.

Where is Creditas's headquarters?

Creditas's headquarters is located at Engenheiro Luís Carlos Berrini Avenue, 105, Sao Paulo.

What is Creditas's latest funding round?

Creditas's latest funding round is Series F - II.

How much did Creditas raise?

Creditas raised a total of $917.44M.

Who are the investors of Creditas?

Investors of Creditas include Andbank, Kaszek Ventures, VEF, QED Investors, SoftBank Latin America Fund and 23 more.

Who are Creditas's competitors?

Competitors of Creditas include Neon, Addi, YoFio, Uala, Albo and 7 more.

What products does Creditas offer?

Creditas's products include Auto Equity Loans and 4 more.

Loading...

Compare Creditas to Competitors

Klar is a financial services company offering credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Albo is an electronic funds institution that offers financial services for personal and business needs. The company provides personal and business debit accounts, loans, payroll services, and facilitates cryptocurrency transactions, all managed through a single app. Albo primarily serves individuals and small to medium-sized businesses with their financial management and growth. It was founded in 2016 and is based in Mexico City, Mexico.

Neon operates as a financial technology payment platform. It offers services such as loans, investments, digital wallets, and digital account services. It facilitates banking services, savings products like personal financial management tools, and credit cards & loans to individuals and small businesses. Neon was formerly known as ControlY. The company was founded in 2016 and is based in Sao Paulo, Brazil.

Ualá operates in the financial technology sector, focusing on providing digital financial services. The company offers a prepaid Mastercard and an application that allows users to manage their money, make purchases, access loans, invest, and pay bills. Ualá primarily serves the financial services industry. It was founded in 2017 and is based in Buenos Aires, Argentina.

Banco Agibank is a financial institution that operates in the banking sector. The company offers a range of financial services including personal loans, consigned loans, and investment services, all designed to facilitate the financial lives of its customers. It primarily serves individuals, offering solutions for various financial needs. It was founded in 1999 and is based in Campinas, Brazil.

Digio is a digital platform focused on financial services. The company offers a range of products and services including a digital account, credit card management through an application, personal loans, and a rewards club. These services are designed to simplify people's relationship with their money. It was founded in 2013 and is based in Barueri, Brazil.

Loading...