Bayer

Founded Year

1863Stage

PIPE - II | IPOMarket Cap

28.46BStock Price

28.66Revenue

$0000About Bayer

Bayer (FWB: BAYN) specializes in the fields of healthcare and agriculture. Its areas of business include pharmaceuticals; consumer healthcare products, agricultural chemicals, seeds, and biotechnology products. It provides healthcare solutions designed to help prevent, alleviate, and treat diseases; and agriculture solutions for farmers to help plant, grow, and protect their harvests using less land, water, and energy. The company was founded in 1863 and is based in Leverkusen, Germany.

Loading...

Loading...

Research containing Bayer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bayer in 7 CB Insights research briefs, most recently on Jan 8, 2024.

Jan 8, 2024

4 applications of generative AI in drug R&D

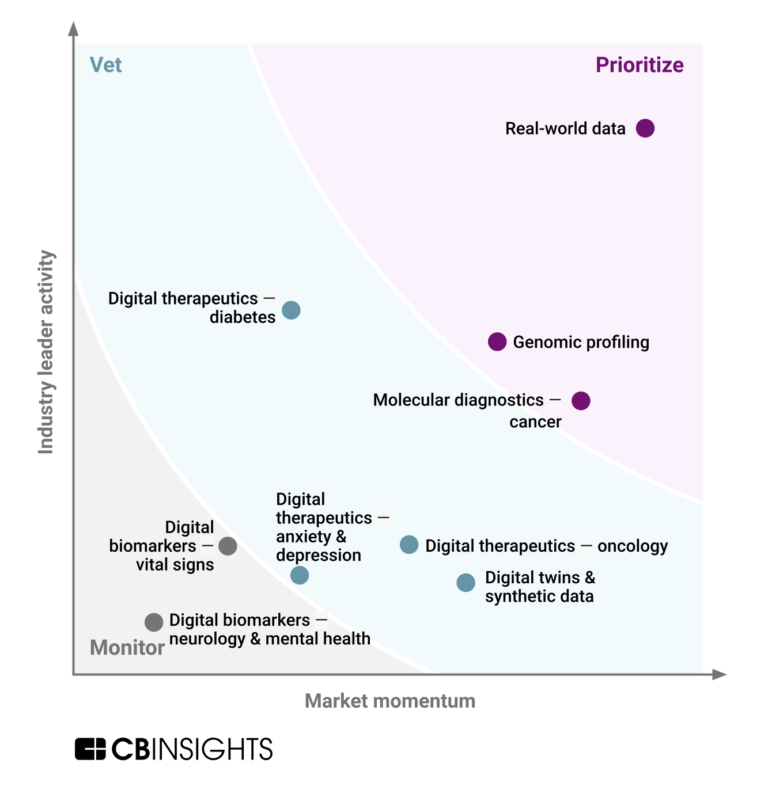

Aug 1, 2023

The state of healthcare AI in 5 charts

Expert Collections containing Bayer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bayer is included in 1 Expert Collection, including Synthetic Biology.

Synthetic Biology

382 items

Bayer Patents

Bayer has filed 5154 patents.

The 3 most popular patent topics include:

- acetylcholinesterase inhibitors

- herbicides

- insecticides

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/12/2019 | 9/17/2024 | Insecticides, Acetylcholinesterase inhibitors, Organophosphate insecticides, ATC codes, Nitriles | Grant |

Application Date | 4/12/2019 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Insecticides, Acetylcholinesterase inhibitors, Organophosphate insecticides, ATC codes, Nitriles |

Status | Grant |

Latest Bayer News

Sep 22, 2024

Cutbacks of up to 90% set to change chemical industry Today at 1:49 a.m. byMichael Hirtzer Bloomberg News (WPNS) Farmers shelling out $37 billion a year to drench fields in liquid weed killers are increasingly trying out a new model: use tech to use less. After almost a century of deploying a more-is-more approach to chemical herbicides, the global agricultural sector is rapidly rolling out advancements that promise to curb the use of weed-control sprays by as much as 90%. Using artificial-intelligence powered cameras, the new sprayers can identify and target invasive plants while avoiding the cash crops. If even a fraction of growers adopt the new tools, it could mean a big shift for crop-chemical majors like Bayer AG and BASF SE. "Though they don't widely acknowledge it, they realize selling millions of gallons of product is a blunt and fading model," Jason Miner, global head of agriculture at Bloomberg Intelligence, said of the herbicide industry. Crop protection is a big business, valued at about $79 billion in 2022, according to S&P Global, with herbicides comprising almost half of the overall market. In the U.S., weed killers are used on 96% of planted corn acres, compared with 19% of fields that are treated with fungicides and 14% with insecticides, according to a 2021 U.S. Department of Agriculture survey. About 28% of cropland gets sprayed via aerial applications, but the vast majority relies on ground sprayers. Using less weed killer through precision applications can help cut costs for growers whose overall incomes are expected to inch lower in 2024. There are also environmental reasons to consider pulling back. So-called drift from one field to another can damage crops and harm animals, prompting more targeted use. Drift can lead to expensive lawsuits, such as ones claiming dicamba made its way to neighboring acreage. Crop chemicals have also faced costly legal action related to human health. Bayer has already spent about $10 billion of the $16 billion it set aside to handle the mass U.S. litigation over Roundup, the blockbuster weed killer it acquired when it bought Monsanto that tens of thousands of plaintiffs insist caused their cancer. Bayer maintains that the product -- and its key ingredient, glyphosate -- is safe. Europe's drive to reduce chemical pesticides by half by 2030 has given further incentive to change tack. Machinery makers big and small are pushing out solutions. The world's top tractor maker, Deere & Co., is in the second year of selling its top-of-the-line crop sprayer that it says can cut chemical applications by as much as 77% using AI and machine learning. Israel-based Greeneye Technology just opened its first U.S. retail location to sell AI-powered spray booms that can be retrofitted onto any existing machine, with plans to expand to eight additional states next year. Brazil's Solinftec is building robot sprayers at an Indiana factory that it says let growers cut herbicide volumes by more than 90%. "The chemical companies cannot fight against the reduction of herbicides," said Guilherme Guine, Solinftec's chief sustainability officer. Such technology is a "threat for sure because they drastically reduce the amount of inputs." So far, the emerging tech is still small scale and doesn't appear to be having much impact on chemical makers' bottom lines. But that doesn't mean they are sitting idly by. Some companies are trying to get out ahead, including by working more closely with equipment manufacturers and adding new service models that provide farmers with agronomic advice. "They've tried to position themselves to sell 'better yield on your acre' by effectively offering consulting and prescriptions," Miner said. BASF, for instance, has a joint venture with technology provider Bosch called One Smart Spray that automatically applies product only where needed and integrates weed mapping that helps farmers track cost savings in real time on a mobile phone application. Bayer, which has been talking for years about shifting from "volume to value" when it comes to crop-protection solutions, has developed its own AI-backed tool to spray chemicals that farmers can use when they buy a subscription. Overall, Bayer said the new spraying advancements from the industry would be "neutral" overall as chemical companies shift along with farmers. "We are totally aligned with companies like Deere and others in the automation and equipment space that have this aspiration to help a farmer really be better in terms of precision use of the various inputs that they use," said Bob Reiter, global head of research and development for Bayer's crop science division. "We want to maximize the output the farmers can create but minimize the inputs that they're using." And while chemicals applied after weeds emerge are largely expected to decline with the new technology, some farmers may need to apply more product known as residual herbicides earlier in the process, said Matt Leininger, managing director for North America and Australia at the Bosch-BASF JV, helping to buffer the sector. "The easiest way to control a weed is not to let it up," Leininger said. Advertisement All rights reserved. This document may not be reprinted without the express written permission of Arkansas Democrat-Gazette, Inc. Material from the Associated Press is Copyright © 2024, Associated Press and may not be published, broadcast, rewritten, or redistributed. Associated Press text, photo, graphic, audio and/or video material shall not be published, broadcast, rewritten for broadcast or publication or redistributed directly or indirectly in any medium. Neither these AP materials nor any portion thereof may be stored in a computer except for personal and noncommercial use. The AP will not be held liable for any delays, inaccuracies, errors or omissions therefrom or in the transmission or delivery of all or any part thereof or for any damages arising from any of the foregoing. All rights reserved.

Bayer Frequently Asked Questions (FAQ)

When was Bayer founded?

Bayer was founded in 1863.

Where is Bayer's headquarters?

Bayer's headquarters is located at Kaiser-Wilhelm-Allee 1, Leverkusen.

What is Bayer's latest funding round?

Bayer's latest funding round is PIPE - II.

Who are the investors of Bayer?

Investors of Bayer include Elliott Management and Temasek.

Who are Bayer's competitors?

Competitors of Bayer include OCON Therapeutics, MorphoSys, Full-Life, Kenvue, Organon & Co and 7 more.

Loading...

Compare Bayer to Competitors

Sanofi (NYSE:SNY) is a healthcare company. It focuses on pharmaceuticals and vaccines. It offers a range of life-saving vaccines and therapeutic treatments for conditions in immunology, oncology, neurology, rare blood disorders, and rare diseases, as well as consumer healthcare products. Its products are designed to improve people's lives by addressing complex medical challenges and advancing health. It was founded in 1973 and is based in Gentilly, France.

Boehringer Ingelheim operates as a biopharmaceutical company. The company's main offerings include therapies in areas of high unmet medical need, spanning three business areas such as human pharma, animal health, and biopharmaceutical contract manufacturing. It primarily serves the pharmaceutical and healthcare industries. The company was founded in 1885 and is based in Ingelheim am Rhein, Germany.

Servier is a global pharmaceutical company focused on therapeutic progress to serve patient needs across various medical domains including cardiology and oncology. The company offers a range of targeted therapies and generic drugs aimed at treating cardiovascular diseases, cancers, and immuno-inflammatory and neuro-psychiatric conditions. Servier's research and development efforts prioritize innovative treatments in oncology, neuroscience, and immuno-inflammatory diseases, with a commitment to precision medicine and quality care for all. It was founded in 1954 and is based in Suresnes, France.

Sumitomo Pharma is a biopharmaceutical company focused on developing therapeutic and scientific breakthroughs. The company's main offerings include the development of novel cancer therapeutics and a robust pipeline of treatments aimed at addressing unmet clinical needs in oncology. Sumitomo Pharma was formerly known as Sumitomo Dainippon Pharma. It was founded in 1897 and is based in Osaka, Japan.

Daiichi Sankyo France operates as a global pharmaceutical company with a focus on providing therapeutic solutions in oncology and cardiology. The company offers treatments for various diseases including hypertension, dyslipidemia, diabetes, acute coronary syndrome, venous thromboembolism, breast cancer, metastatic melanoma, inflammatory diseases, and pain. Daiichi Sankyo France primarily serves the healthcare sector, providing innovative medications and supporting services to patients and medical professionals. It was founded in 2003 and is based in Rueil-Malmaison, France.

LifeArc operates as a self-financing medical research charity. The organization specializes in drug discovery, diagnostics development, antibody humanization, and intellectual property management, aiming to lab-based scientific discoveries into diagnostics, treatments, and cures. LifeArc collaborates with various sectors including the pharmaceutical industry, biotechnology sector, and academic institutions to develop and commercialize medical research. LifeArc was formerly known as MRC Technology. It was founded in 2000 and is based in London, United Kingdom.

Loading...