Biofourmis

Founded Year

2015Stage

Series D - II | AliveTotal Raised

$461.85MLast Raised

$20M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-28 points in the past 30 days

About Biofourmis

Biofourmis discovers, develops, and delivers clinically-validated, software-based therapeutics. The company produces Biovital, a personalized, artificial intelligence (AI) powered health analytics platform to predict clinical exacerbation. It was founded in 2015 and is based in Boston, Massachusetts.

Loading...

ESPs containing Biofourmis

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The home care platforms market involves digital platforms or software solutions designed to facilitate and manage various aspects of home-based healthcare services. These platforms aim to improve the delivery of care, enhance communication between caregivers and patients, and streamline administrative tasks related to home healthcare. The home care platforms market is part of the broader trend tow…

Biofourmis named as Leader among 14 other companies, including DispatchHealth, Signify Health, and CareCentrix.

Biofourmis's Products & Differentiators

Biovitals RPM

Remote patient monitoring platform

Loading...

Research containing Biofourmis

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Biofourmis in 12 CB Insights research briefs, most recently on Dec 22, 2023.

Aug 15, 2023

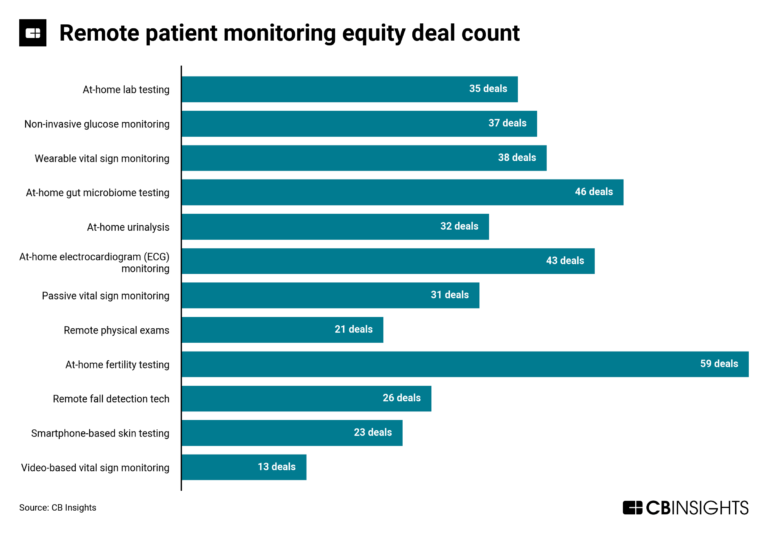

The remote patient monitoring market map

Expert Collections containing Biofourmis

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Biofourmis is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Value-Based Care & Population Health

1,067 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Digital Health

11,072 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,918 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Latest Biofourmis News

Sep 4, 2024

September 4, 2024 The 2024 Medtech Big 100 ranks the world’s largest medical device companies by revenue. [Illustration by Matthew Claney/Medical Design & Outsourcing] Medtronic remains at the top, but Johnson & Johnson MedTech is now a close second in the Medtech Big 100 list of largest medical device companies. Could we see a new No. 1 company in next year’s Medtech Big 100 report ? Time will tell. But in the meantime, this year’s edition of Medical Design & Outsourcing and MassDevice‘s Medtech Big 100 is chock-full of insights about the 100 largest medical device companies in the world. Managing Editor Jim Hammerand and Senior Editor Danielle Kirsh’s analysis found that a wave of mergers and acquisitions made the world’s largest medical device companies even larger. Even amid some layoffs and belt-tightening, M&A grew overall sales to a record-high $474.8 billion year-over-year among the 100 largest companies. ( Read the full story on MDO. ) The Medtech Big 100 includes annual revenue, R&D spending, headcount, CEOs and key leaders, headquarters locations and descriptions of each company. We collect data from regulatory disclosures filed with the SEC and annual reports from foreign and privately held firms. For many companies, we include data they share with us. Read the full Medtech Big 100 report to find out more about the 100 largest medical device companies. Here are the 10 largest medtech companies by revenue: Company “Our top priority is restoring our earnings power — full stop,” Medtronic Chair and CEO Geoff Martha said to start 2024. Over the following months, the world’s largest medtech company continued significant portfolio management moves, including the shuttering of its ventilators business . There was more discipline on headcount and expenses — including worldwide layoffs — and increased use of automation and digitization. Some high-ranking officials have left the company, too — including CFO Karen Parkhill, who resigned to take over as CFO at HP. At the same time, company leaders stressed that Medtronic is making strategic investments in research and development to boost future growth. They said in May that the company had achieved 130 product approvals in the last 12 months in key geographies. Recent wins include: And the launch of the next-gen Micra AV2 and Micra VR2 leadless pacemakers, which were approved in 2023. Medtronic is also seeking coverage and payments for its FDA-approved Simplicity Spyral renal denervation technology to treat hypertension. In August, it secured a CMS New Technology Add-on Payment (NTAP) win for the technology. Now under the leadership of Johnson & Johnson veteran Tim Schmid after Ashley McEvoy’s announcement in October 2023 that she was resigning, Johnson & Johnson MedTech continues to grow. With its $13 billion acquisition of Shockwave Medical and its intravascular lithotripsy (IVL) technology completed in May, J&J’s medical device business could give Medtronic a run for the top spot in next year’s Medtech Big 100. On top of the Shockwave acquisition, recent developments at J&J MedTech include the unveiling of Polyphonic , its open and secure digital surgical ecosystem. Think data-source-agnostic software applications to deliver surgical insights. The first release included apps for surgical video, telepresence and planning. Watch for more artificial intelligence applications created through a partnership with Nvidia that the companies announced in March. Other recent J&J MedTech news includes: Siemens Healthineers reported good progress in its third quarter despite ongoing order delays in China. The German medtech giant now expects 4.5–6.5% sales growth for fiscal 2024. “Varian and Diagnostics especially contributed to the strong operating performance,” CEO Bernd Montag said in late July. Recent innovations at the company include the FDA-cleared Syngo Virtual Cockpit, a platform that enables real-time collaboration between healthcare professionals across different locations. The FDA also cleared the Magnetom Cima.X 3 Tesla (3T) magnetic resonance imaging whole-body scanner. The company said that scanner has the strongest gradients ever for a whole-body scanner, which improve the visibility of smaller structures and accelerates image captures. Additionally, Siemens Healthineers announced in March that its self-driving Ciartic Move mobile C-arm received an FDA clearance . Ciartic Move automates and accelerates imaging workflows in surgical environments. Meanwhile, Varian in March announced clearance of its TrueBeam and Edge radiotherapy systems with HyperSight imaging. Medline revenue grew 9% in 2023. The privately-held medical supply manufacturer, distributor and services provider now operates in over 100 countries and territories, offering more than 335,000 medical products. Medline recently grew even more through its $950 million acquisition of Ecolab’s surgical solutions business . The deal gave Medline access to operating room equipment, Ecolab’s line of Microtek sterile operating room drapes and Ecolab’s fluid temperature management system. “With this acquisition, we are eager to collaborate with healthcare providers and cutting-edge medical device companies to bring innovative solutions to the surgical suite,” Medline President and Chief Operating Officer Jim Pigott said. Medline recently spent $27 million to triple the size of its product testing and development lab in Mundelein, Illinois, to 74,000 ft². Still riding the success of its Mako robotic orthopedic surgery systems and digital surgery systems, Stryker has gone on offense with M&A. Recent tuck-in acquisitions for the orthopedic and surgical tech giant include Artelon and its soft tissue fixation products for foot and ankle and sports medicine procedures, and Molli Surgical , which develops wire-free soft tissue localization technology for breast-conserving surgery. Stryker Chair and CEO Kevin Lobo recently indicated that the company has a very active deal pipeline for even more M&A. He said a soft-tissue surgical robotics play is a possibility, as well something in the neuromodulation space down the road. Notable updates include the myMako app for Apple Vision Pro, which enhances surgeons’ ability to visualize and plan surgeries. Stryker also introduced the Triathlon Hinge within its knee surgery offerings, aiming to simplify revision procedures. Analysts expect Stryker to enjoy even more growth on shoulder and spine applications for Mako that are slated for later this year. The fallout from Philips’ massive, yearslong recall of CPAPs and other respiratory devices reached a critical point in 2024. In April, the Dutch medtech giant finalized a consent decree with the U.S. Department of Justice and FDA that provided a roadmap for resolving the Philips Respironics recall. Dr. Jeff Shuren, who was director of the FDA’s Center for Devices and Radiological Health (CDRH) at the time, said the agreement “marks the first time a device company is providing a remediation payment option for a recalled device under a consent decree.” Philips soon settled personal injury claims in the U.S. for $1.1 billion and is also paying at least $613 million to settle personal injury claims. By June, Philips announced the closure of its Respironics business’ Pittsburgh headquarters and elimination of hundreds of manufacturing jobs in the region. Exclude the impact of the Respironics recall, however, and Philips is still projecting 3–5% comparable sales growth in 2024. Said CEO Roy Jakobs: “We continue to focus on enhancing execution, improving end-to-end supply chain resilience and increasing agility and productivity through simplifying our operating model. Patient safety and quality remains our number one priority.” GE HealthCare is facing headwinds in the market in China, which caused it in July to reduce its organic revenue growth projection to 1–2%, versus the previous projection of 4%. CEO Peter Arduini highlighted year-over-year sales growth and margin expansion in the second quarter: “We are pleased with our continued progress in advancing our margin goals, while continuing our investments for future growth.” GE HealthCare continues with new partnerships, products and tuck-in acquisitions, especially when it comes to medtech innovations enabled by artificial intelligence. Recent AI-related moves include: A joint development agreement with Volta Medical over AI-driven electrophysiology tech; Acquiring Intelligent Ultrasound Group’s clinical AI software business; The launch of the AI-enhanced Voluson Signature 20 and 18 ultrasound systems for women’s health imaging applications; A partnership with Biofourmis to use its FDA-cleared, AI-guided algorithms to help deliver personalized healthcare and health monitoring in people’s homes. In addition, GE HealthCare in May announced the launch of its “new era” of AI-enhanced oncology solutions, known as Revolution RT. Abbott medical device segment sales were up more than 12% during the first half of 2024. Diabetes treatment tech — especially the Abbott FreeStyle Libre continuous glucose monitor (CGM) — played an important role fueling the growth. FreeStyle Libre sales totaled $1.6 billion in the second quarter alone , marking 18.4% growth year-over-year. A new partnership to combine FreeStyle Libre CGM technology with Medtronic’s automated insulin delivery systems could boost sales even more in the years ahead. In June, Abbott announced that it secured FDA clearance for two over-the-counter CGM systems , Lingo and Libre Rio. Electrophysiology is also an exciting space for Abbott. The company in June announced CE mark approval for its Aveir DR dual-chamber leadless pacemaker system , nearly a year after Aveir won FDA approval. The company has seen recent launches and new indications for its Amplatzer Amulet, Navitor, and TriClip. When it comes to pulsed field ablation, Abbott continues to develop its Volt system, which has a balloon-in-basket design meant to enable efficient deployment of energy into the tissue during cardiac ablation to treat AFib. During Cardinal Health’s third-quarter earnings call on May 2, CEO Jason Hollar reported that the company’s Global Medical Products and Distribution (GMPD) business is seeing strong topline and bottom line performance, with growth accelerating as a turnaround plan accelerates. “GMPD’s quarter was overall consistent with our expectations and the team is already working hard on the continued ramp-up in Q4,” Hollar said. Cardinal Health said its U.S. Medical Products and Distribution Business won recognition from the HIRC Resiliency Badge program for its supply chain resiliency. Baxter continues to move forward with a separation of its Kidney Care business, which will be called Vantive . In mid-August it announced that it would sell Vantive to global investment firm Carlyle for $3.8 billion. The companies expect the transaction to close in late 2024 or early 2025, subject to customary approvals and closing conditions. “As a result of this proposed transaction, Baxter will emerge a more focused and more efficient company, better positioned to redefine healthcare delivery and advance innovation that benefits patients, customers and shareholders,” Baxter Chair and CEO José Almeida said. Meanwhile, the Baxter Medical Products & Therapies business has benefitted from positive pricing and demand. The second quarter also saw the first U.S. sales of the Novum IQ large-volume infusion pump with Dose IQ safety software .

Biofourmis Frequently Asked Questions (FAQ)

When was Biofourmis founded?

Biofourmis was founded in 2015.

Where is Biofourmis's headquarters?

Biofourmis's headquarters is located at 33 Arch Street, Boston.

What is Biofourmis's latest funding round?

Biofourmis's latest funding round is Series D - II.

How much did Biofourmis raise?

Biofourmis raised a total of $461.85M.

Who are the investors of Biofourmis?

Investors of Biofourmis include Intel Capital, CVS Health, General Atlantic, Openspace Ventures, EDBI and 12 more.

Who are Biofourmis's competitors?

Competitors of Biofourmis include Datos Health, Huma, Myelin-H, Acorai, tenacio and 7 more.

What products does Biofourmis offer?

Biofourmis's products include Biovitals RPM and 3 more.

Loading...

Compare Biofourmis to Competitors

Crely focuses on healthcare technology, specifically in the domain of post-surgical care and monitoring. The company offers an artificial intelligence (AI)-based early warning system that utilizes a non-invasive, wearable medical device to predict and detect surgical site infections (SSIs) by monitoring patients' biomarkers remotely. Crely primarily serves the healthcare industry, including hospitals and care organizations. It was founded in 2017 and is based in Oxnard, California.

PhysIQ specializes in remote patient monitoring and data analytics within the healthcare and life sciences sectors. The company offers a platform that leverages artificial intelligence and wearable biosensors to continuously monitor patients and provide personalized medical insights, aiming to improve patient outcomes and assist in clinical trials. PhysIQ primarily serves healthcare providers and life sciences companies, offering solutions for virtual care, hospital-at-home models, and decentralized clinical research. PhysIQ was formerly known as VGBio. It was founded in 2005 and is based in Chicago, Illinois.

Health Recovery Solutions specializes in remote patient monitoring and telehealth solutions within the healthcare technology sector. The company offers a suite of services designed to improve care coordination, patient outcomes, and reduce healthcare costs, with a focus on clinically enabled, patient-centric solutions. Health Recovery Solutions primarily serves healthcare providers, including hospitals, health systems, home health agencies, community health centers, hospice and palliative care, physician practices, and payers. It was founded in 2012 and is based in Hoboken, New Jersey.

Byteflies is a healthcare technology company focused on streamlining care through remote patient monitoring and data insights. The company offers end-to-end solutions, known as 'flows', that capture real-world patient data and transform it into actionable insights for healthcare providers, without the operational and administrative hurdles. Byteflies primarily serves the healthcare sector, offering technologies that integrate with existing medical record systems and provide near real-time reports to clinicians. It was founded in 2015 and is based in Antwerp, Belgium.

Doctomatic is a remote management platform for chronic patients. It transmits the data provided by non-invasive medical devices via a mobile application to a medical platform where medical professionals analyze and evaluate the information of their patients. The company serves clients in the healthcare sector. It was founded in 2021 and is based in Barcelona, Spain.

Medioh focuses on digital health and telehealth solutions within the healthcare industry. The company offers services such as logistics, asset management, and operational support for remote patient monitoring programs, as well as providing technology and support for patients to self-test for medical data. Medioh primarily sells to the healthcare industry. It was founded in 2012 and is based in Montreal, Canada.

Loading...