Biren Technology

Founded Year

2019Stage

Series B - II | AliveTotal Raised

$296.22MValuation

$0000Last Raised

$8M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-98 points in the past 30 days

About Biren Technology

Biren Technology is a company focused on the development of original general computing systems, operating in the intelligent computing industry. The company offers a range of products designed for artificial intelligence (AI) training, inference, and scientific computing, primarily deployed in large data centers, providing high-efficiency, high-universality accelerated computing power. It was founded in 2019 and is based in Minhang, Shanghai.

Loading...

ESPs containing Biren Technology

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

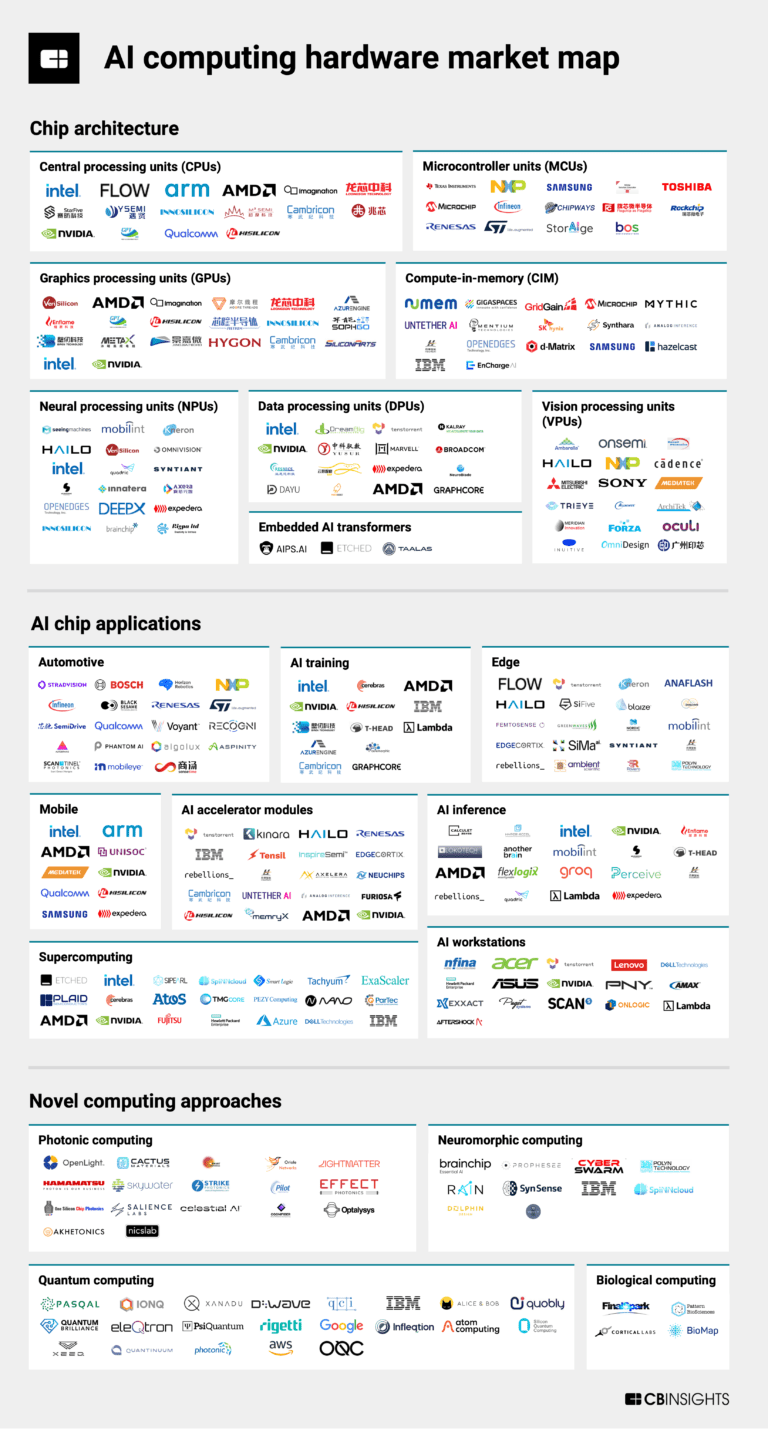

The graphics processing unts (GPUs) market focuses on specialized processors capable of efficiently handling parallel processing tasks. Initially pioneered by Nvidia for rendering graphics in applications like gaming, animations, and virtual reality, GPUs have expanded to serve a wide range of computational tasks, including scientific simulations, cryptocurrency mining, AI, and high-performance co…

Biren Technology named as Challenger among 14 other companies, including NVIDIA, Advanced Micro Devices, and Intel.

Loading...

Research containing Biren Technology

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Biren Technology in 1 CB Insights research brief, most recently on Sep 13, 2024.

Sep 13, 2024

The AI computing hardware market mapExpert Collections containing Biren Technology

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Biren Technology is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Artificial Intelligence

14,769 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Semiconductors, Chips, and Advanced Electronics

7,161 items

Companies in the semiconductors & HPC space, including integrated device manufacturers (IDMs), fabless firms, semiconductor production equipment manufacturers, electronic design automation (EDA), advanced semiconductor material companies, and more

Latest Biren Technology News

Sep 19, 2024

The overarching view is that they are lagging behind Nvidia at this point. "These companies have made notable progress in developing AI chips tailored to specific applications (ASICs)," Wei Sun, a senior analyst at Counterpoint Research, told CNBC. "However, competing with Nvidia still presents substantial challenges in technological gaps, especially in general-purpose GPU. Matching Nvidia in short-term is unlikely." China's key challenges Chinese firms have a "lack of technology expertise", according to Sun, highlighting one of the challenges. However, it's the U.S. sanctions and their knock-on effects that pose the biggest roadblocks to China's ambitions. Some of China's leading Nvidia challengers have been placed on the U.S. Entity List, a blacklist which restricts their access to American technology. Meanwhile, a number of U.S. curbs have restricted key AI-related semiconductors and machinery from being exported to China. China's GPU players all design chips and rely on a manufacturing company to produce their chips. For a while, this would have been Taiwan Semiconductor Manufacturing Co. , or TSMC. But U.S. restrictions mean many of these firms cannot access the chips made by TSMC. They therefore have to turn to SMIC Meanwhile, Huawei has been pushing development of more advanced chips for its smartphones and AI chips, which is taking up capacity at SMIC, according to Paul Triolo, a partner at consulting firm Albright Stonebridge. "The key bottleneck will be domestic foundry leader SMIC, which will have a complex problem of dividing limited resources for its advanced node production between Huawei, which is taking up the lion's share currently, the GPU startups, and many other Chinese design firms which have been or may be cutoff from using global foundry leader TSMC to manufacture their advanced designs," Triolo told CNBC. Nvidia is more than just GPUs Nvidia has found success due to its advanced semiconductors, but also with its CUDA software platform that allows developers to create applications to run on the U.S. chipmaker's hardware. This has led to the development of a so-called ecosystem around Nvidia's products that others might find hard to replicate. "This is the key, it is not just about the hardware, but about the overall ecosystem, tools for developers, and the ability to continue to evolve this ecosystem going forward as the technology advances," Triolo said. Huawei leading the pack Triolo identified Huawei as one of the leaders in China with its Ascend series of data center processors. The firm's current generation of chip is called the Ascend 910B, and the company is gearing up to launch the Ascend 910C, which could be on par with Nvidia's H100 product, according to a Wall Street Journal report in August. In its annual report earlier this year, Nvidia explicitly identified Huawei, among other companies, as a competitor in areas such as chips, software for AI and networking products. watch now In the area of software and building a developer community, Huawei "holds lots of advantages," Triolo said. But it faces similar challenges to the rest of the industry in trying to compete with Nvidia. "The GPU software support ecosystem is much more entrenched around Nvidia and to a lesser degree AMD, and Huawei faces major challenges, both in producing sufficient quantities of advanced GPUs such as part of the Ascend 910C, and continuing to innovate and improve the performance of the hardware, given U.S. export controls that are limiting the ability of SMIC to produce advanced semiconductors," Triolo said. Chip IPOs ahead? The challenges facing China's Nvidia competitors have been evident over the past two years. In 2022, Biren Technology carried out a round of layoffs, followed by Moore Threads the year after, with both companies blaming U.S. sanctions. But startups are still holding out hope, looking to raise money to fund their goals. Bloomberg reported last week that Enflame and Biren are both looking to go public to raise money. "Biren and the other GPU startups are staffed with experienced industry personnel from Nvidia, AMD, and other leading western semiconductor companies, but they have the additional challenge of lacking the financial depth that Huawei has," Triolo said. "Hence both Biren and Enflame are seeking IPOs in Hong Kong, to raise funding for additional hiring and expansion."

Biren Technology Frequently Asked Questions (FAQ)

When was Biren Technology founded?

Biren Technology was founded in 2019.

Where is Biren Technology's headquarters?

Biren Technology's headquarters is located at No. 2388, Chenhang Highway, Minhang.

What is Biren Technology's latest funding round?

Biren Technology's latest funding round is Series B - II.

How much did Biren Technology raise?

Biren Technology raised a total of $296.22M.

Who are the investors of Biren Technology?

Investors of Biren Technology include V FUND, Zhuhai Da Heng Qin Company, Guosheng Group, C Ventures, Bertelsmann Asia Investments and 28 more.

Who are Biren Technology's competitors?

Competitors of Biren Technology include Enflame and 2 more.

Loading...

Compare Biren Technology to Competitors

Enflame specializes in artificial intelligence cloud computing products. Its offerings include the development and delivery of software solutions and systems. It engages in the development of deep learning high-end chips for cloud data centers. The company was founded in 2018 and is based in Shanghai, China.

Huada Semiconductor, a subsidiary of China Electronics Corporation, specializes in integrated circuits. The company's products include MCU, FPGA, power and driver chips, SmartCard and security chips, power management chips, new display chips, among others.

Tsinghua Unigroup is a tech company that specializes in integrated circuits and provides mobile phone chips. Tsinghua Unigroup is an operating subsidiary of Tsinghua Holdings Co., a solely state-owned limited liability corporation funded by Tsinghua University in China. The company was founded in 1988 and is based in Beijing, Beijing.

Hexaflake operates a high-technology start-up company. It provides research and development of artificial intelligence (AI) high-performance processor chips, software, and hardware full-stack system solutions. The company was founded in 2019 and is based in Shanghai, China.

NEUCHIPS is a company focused on developing artificial intelligence solutions for data centers. The company offers hardware Artificial Intelligence Engine (AIE) solutions that serve as deep learning inference accelerators, providing energy-efficient and cost-efficient services especially for deep learning recommendation systems. NEUCHIPS primarily caters to the data center industry. It was founded in 2021 and is based in Hsinchu, Taiwan.

Cerebrus is an ML-powered analytics cloud platform for small and medium enterprises. It allows business owners to understand how the business performs now, how it will perform in the nearest future, and how the business owner needs to act to achieve the data-driven sustainable growth of the business.

Loading...