BNP Paribas

Founded Year

2000Stage

IPO | IPODate of IPO

10/25/2023Market Cap

73.64BStock Price

64.78Revenue

$0000About BNP Paribas

BNP Paribas operates as an international bank. It provides a wide range of financial services, such as mergers and acquisitions, primary equity market transactions, mortgages, and privatizations. It also offers various investment products, including mutual funds, life insurance, real estate credit, and securities to its clients. It caters to financial intermediaries and institutional investors. The company was founded in 2000 and is based in Paris, France.

Loading...

Loading...

Research containing BNP Paribas

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BNP Paribas in 2 CB Insights research briefs, most recently on Apr 28, 2023.

Nov 3, 2021

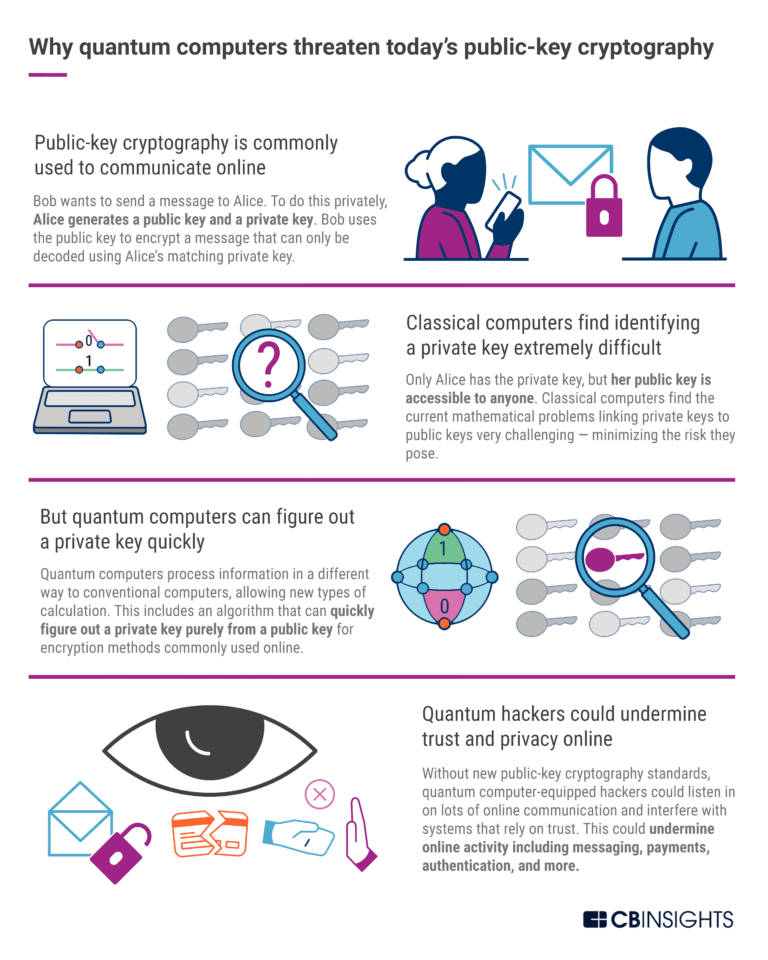

Is Quantum Computing The Next Banking Arms Race?BNP Paribas Patents

BNP Paribas has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/6/2010 | 2/25/2014 | Glass architecture, Marine edible bivalves, Architectural elements, Commercial molluscs, Solar architecture | Grant |

Application Date | 5/6/2010 |

|---|---|

Grant Date | 2/25/2014 |

Title | |

Related Topics | Glass architecture, Marine edible bivalves, Architectural elements, Commercial molluscs, Solar architecture |

Status | Grant |

Latest BNP Paribas News

Sep 21, 2024

Most Read from Bloomberg Some money supervisors declare {the marketplace} can also be obsequious regarding causes for fear at present. “You have the US election coming up, and expectations around economic growth in Germany are some of the weakest it’s been since pre-Covid times,” claimed Simon Matthews, an aged profile supervisor atNeuberger Berman “Consumers are feeling the pinch and growth in China is slowing. When you pull that all together, it’s not telling you that credit spreads should be close to the tights,” he included, preserving in thoughts that dropping loaning costs will definitely assist in lowering a couple of of the headwinds. Investors have truly been alloting the possible downsides and diving deeper proper into the riskiest edges of debt within the quest for larger returns. The lowest-rated bonds are at present outshining the broader scrap bond market whereas want for Additional Tier 1 bonds, which might compel losses on capitalists to assist a monetary establishment endure chaos, is anticipated to spice up. Buyers are wagering that decreased loaning costs will definitely enable debt-laden companies to re-finance and press out their maturations, proscribing defaults and sustaining value determinations. And as short-term costs go down, capitalists are anticipated to maneuver their allowances proper into tool- and longer-term firm monetary debt from money markets which might set off infect tighten up additionally higher. Still, rising price of residing can start ticking up as soon as extra if clients start investing far more as charge of curiosity are decreased, in response to Hunter Hayes, main monetary funding police officer at Intrepid Capital Management Inc. Story proceeds “Who knows, maybe the Fed funds rate has to come right back up like it has in previous inflationary cycles and then, all of a sudden, high-yield bonds are a lot less attractive again,” he claimed. With United States monetary plan almost certainly to proceed to be limiting, market people are moreover on the lookout for indicators of degeneration in rules, particularly amongst customers revealed to floating-rate monetary debt, BlackRockInc scientists Amanda Lynam and Dominique Bly created in a word. In enhancement, corporations ranked CCC proceed to be compelled in accumulation, whatever the present outperformance of their monetary debt, they created. They identified decreased levels of earnings the companies have truly in accumulation in comparison with their ardour expenditure. Borrowing costs for CCC ranked corporations are nonetheless round 10%– debilitating for some little companies when they should re-finance adhering to completion of the gravy prepare interval– and leaving them in jeopardy of default additionally as costs drop. Any weak level within the labor market would definitely moreover “be a headwind for spreads as it will increase recession fears and lower yields,” JPMorgan Chase & &Co specialists consisting of Eric Beinstein and Nathaniel Rosenbaum created in a research word this earlier week. To make sure, evaluation points proceed to be average and capitalists are primarily overweight firm monetary debt. The begin of the rate-cutting cycle should moreover maintain want for non-cyclicals over cyclicals within the investment-grade market, specialists at BNP Paribas SA created in a word. In sure, minimal issuance by healthcare corporations and energies give space for unfold compression, they included. “It’s a prime opportunity for non-cyclicals to outperform,” Meghan Robson, the monetary establishment’s head folks debt method, claimed in a gathering. “Cyclicals we think are overvalued.” Week in Review Traders are stacking proper into financial institution on extra relieving by the United States reserve financial institution after it decreased charge of curiosity on Wednesday by a fifty % % issue– its very first lower in 4 years. The historic step completed weeks of conjecture regarding whether or not the Federal Reserve would definitely begin its relieving cycle with a quarter- or half-point minimize. The minimize is useful of debt spreads on the entire, but it is going to definitely urge firm bond issuance– particularly from high-yield corporations. The minimize will seemingly want these acquiring on the front- as an alternative of back-end of the return contour, in response to market people checked by Bloomberg Credit acquired spreads dipped Wednesday adhering to the step, to round their narrowest as a result of the pandemic However, Fed Governor Michelle Bowman cautions that the 50 foundation issue lower “could be interpreted as a premature declaration of victory” over rising price of residing In numerous different reserve financial institution data, the Bank of England maintained costs the identical and cautioned capitalists it won’t hurry to alleviate monetary plan Wall Street monetary establishments shed 2 years again after backing big firm acquistions and winding up with 10s of billions of dollars of “hung debt” are at present again for much more, making ready your self to finance much more European LBOs. Companies profiting from decreased funding costs to win a lot better phrases on present monetary debt or to press out maturations have truly obtained one of the vital from the United States leveraged automotive mortgage market in 7 years. Liquidators of China Evergrande Group, the globe’s most indebted constructing contractor, are going again to a Hong Kong court docket as they attempt to find yourself a subsidiary with essential properties. UBS Group AG is main a $1.15 billion funding bundle to help Vista Equity Partners’ buy of software program program enterprise Jaggaer, vanquishing straight mortgage suppliers that had been moreover finishing for the cut price. Apollo Global Management Inc secured $5 billion in contemporary firepower from BNP Paribas SA because it seeks to broaden an important borrowing group, muscling a lot deeper proper into garden when managed by monetary establishments. A a lot greater share of supervisors within the $1 trillion United States collateralized automotive mortgage accountability market have the flexibility to deal fundings far more simply than when been afraid, after a refinancing and resetting rise pressed again the clock on reinvesting limitations. In the globe of unique debt, KKR & & Co.’s assets markets arm led a funding for USIC Holdings to assist pay again extensively syndicated monetary debt, whereas Oak Hill Advisors supplied $775 million to maintain Carlyle Group Inc.’s acquisition of Worldpac, and Alegeus Technologies is in search of to rack up regarding $75 million in ardour price financial savings with re-financing the unique automotive mortgage that Vista Equity Partners made use of to take the enterprise unique in 2018. Tupperware utilized for insolvency after a years-long struggle with gross sales decreases and increasing opponents. Bankrupt truckerYellow Corp and its hedge fund proprietors shed an important court docket judgment over $6.5 billion within the crimson that pension plan funds assert the out of date enterprise owes them, almost certainly eliminating most therapeutic for buyers. Bausch Health Cos is coping with Jefferies Financial Group to take a look at re-financing a couple of of its monetary debt to help a long-planned offshoot of its danger within the eye-care enterprise Bausch + Lomb. On the Move BlackRockInc is upgrading its unique debt group. The firm is establishing a brand-new division, Global Direct Lending, assigning Stephan Caron, head of the European middle-market unique monetary debt group, to steer it. Jim Keenan, worldwide head of BlackRock’s unique monetary debt group, will definitely go away the corporate following yr, as will definitely Raj Vig, co-head folks unique assets. Silver Point Capital has truly labored with Joseph McElwee from Investcorp as head of collateralized automotive mortgage accountability assets markets and structuring. Jefferies Financial Group Inc has truly labored with previousCitigroup Inc lender Simon Francis in a freshly produced operate main its monetary debt funding group in Europe, the Middle East and Africa. Fidelity Investments has truly employed Lendell Thompson, a earlier supervisor at Vista Credit Partners, because it proceeds growing proper into the unique debt market. He will definitely be a dealing with supervisor within the firm’s straight borrowing group. –With help from Dan Wilchins and James Crombie. Most Read from Bloomberg Businessweek © 2024 Bloomberg L.P.

BNP Paribas Frequently Asked Questions (FAQ)

When was BNP Paribas founded?

BNP Paribas was founded in 2000.

Where is BNP Paribas's headquarters?

BNP Paribas's headquarters is located at 16, boulevard des Italiens, Paris.

What is BNP Paribas's latest funding round?

BNP Paribas's latest funding round is IPO.

Who are BNP Paribas's competitors?

Competitors of BNP Paribas include Credit Suisse, TD Cowen, CaixaBank, Barclays Bank, Goldman Sachs and 7 more.

Loading...

Compare BNP Paribas to Competitors

Citibank provides financial services within banking. It offers a range of banking solutions, including personal and corporate banking, as well as investment management and wealth advisory services. Citibank was formerly known as First National City Bank. It was founded in 1812 and is based in New York, New York.

Barclays is a financial services company operating in the banking industry. The company offers a range of services including online banking, personal and business accounts, wealth management, mortgages, loans, credit cards, savings and investment accounts, and various types of insurance. Barclays primarily serves individuals, businesses, and corporations. It is based in London, England.

Marathon Capital operates as an independent investment bank with a focus on the clean economy and energy transition within the financial sector. The company offers a range of services including mergers and acquisitions, equity and debt capital market strategies, tax credit, and offtake advisory. It primarily serves sectors such as renewable power, sustainable infrastructure, and low-carbon technologies. It was founded in 1999 and is based in Chicago, Illinois.

Bank of America Merrill Lynch is an American multinational investment bank division under the auspices of Bank of America. It provides services in mergers and acquisitions, equity and debt capital markets, lending, trading, risk management, research and liquidity and payment management. It was formed through the combination of the corporate and investment banking activities of Bank of America and Merrill Lynch & Co.

Pipeline Capital operates as a technology-driven investment and merger & acquisition advisory firm operating in the capital investment sector. The company specializes in facilitating mergers and acquisitions, venture capital funding, and crowd equity financing, with a focus on technology-driven businesses. Pipeline Capital also offers services such as cross-border business expansion, business ecosystem mapping, and corporate culture advisory to support companies in their growth and transformation journeys. It was founded in 2012 and is based in Sao Paulo, Brazil.

Capital Markets Partnership specializes in the issuance of green and sustainable financial instruments within the capital markets sector. The company offers underwriting standards and services for green bonds, sustainable stocks, green initial public offerings (IPOs), and more. It primarily caters to sectors that seek sustainable investment opportunities. The company is based in Washington, DC.

Loading...