Snapsheet

Founded Year

2011Stage

Series E - III | AliveTotal Raised

$125.6MLast Raised

$5M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-50 points in the past 30 days

About Snapsheet

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment, by generating communication between consumers, shops, and carriers. The company offers a range of services including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

Loading...

ESPs containing Snapsheet

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

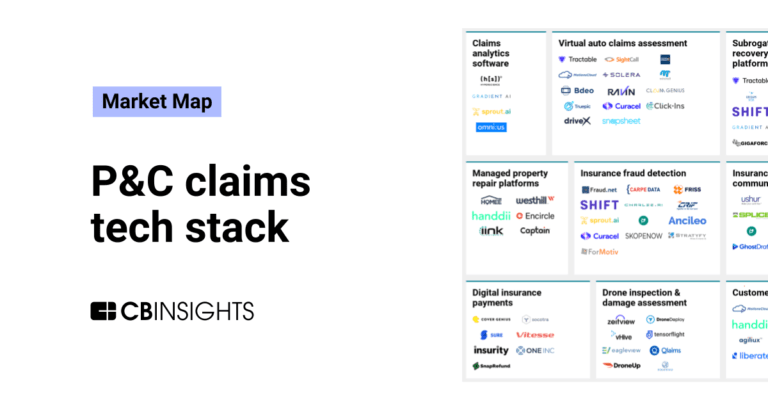

The virtual auto claims assessment market automates the analysis and assessment of auto insurance claims. These vendors typically use augmented reality and computer vision to analyze property claims data submitted by policyholders or adjusters. Additionally, some of these platforms have the ability to capture real-time data, from sources like telematics sensors, at scale. Insurance companies can b…

Snapsheet named as Leader among 13 other companies, including Verisk, CCC Intelligent Solutions, and Tractable.

Snapsheet's Products & Differentiators

Claims

Snapsheet Claims is a modern, cloud-based claims management platform designed to streamline and enhance the entire claims process for insurance companies. Machine Learning and AI Integration Learning from Data: Machine learning models are trained on large datasets, including historical claims data, to identify patterns and make predictions. This enables the platform to continually improve its accuracy and efficiency over time. Adaptability: As the platform interacts with users and processes more claims, it learns and adapts to new types of data, emerging fraud patterns, and changes in user behavior. Enhanced Decision Making: AI supports adjusters by providing predictive analytics, detecting anomalies, and highlighting potential issues, thus enhancing the overall decision-making process.

Loading...

Research containing Snapsheet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Snapsheet in 4 CB Insights research briefs, most recently on Jun 7, 2024.

Dec 18, 2023

The P&C claims tech stack market mapExpert Collections containing Snapsheet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Snapsheet is included in 6 Expert Collections, including Fintech 100.

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

9,297 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

ITC Vegas 2024 - Exhibitors and Sponsors

627 items

As of 9/9/24. Company list source: ITC Vegas. Check ITC Vegas' website for any updates: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest Snapsheet News

Sep 20, 2024

Kyber, a Y-combinator backed AI startup announced the launch of its revolutionary new platform that automates the claims notification process for insurance teams. Designed to tackle inefficiencies head-on, this AI-powered solution enables adjusters to auto-draft, review, and send complex claim notices like Denial letters and Reservation of rights notices faster than ever before, dramatically improving workflow efficiency. Addressing Industry Pain Points Claims adjusters across the insurance industry spend a significant portion of their time preparing notices such as Reservation of Rights and Coverage Denial letters. These processes are highly manual and repetitive, often leading to delays and bottlenecks that cost insurers time and money. The traditional claims notification process has long been problematic due to several factors: 1. Manual Drafting: Adjusters frequently spend over 25% of their day drafting and reviewing claim notices. Complex claims often require hours of analyzing policy documents to extract relevant language, format and personalize. 2. Cumbersome Review Cycles: Review processes involving emails and meetings result in delays, making timely notice delivery challenging. 3. Inconsistent Documentation: Without standardized templates, notices may vary in tone and language or miss critical regulatory, increasing the risk of non-compliance. Kyber’s AI-Powered Solution Kyber’s platform brings AI-driven automation to insurance claims teams, providing a streamlined, efficient, and compliant way to manage claims notices and letters. Here’s how it works: 1. Automated Drafting: Kyber’s AI drafts claim notices in seconds, pulling in the correct policy language directly from the policy documents. Adjusters no longer need to manually review policy documents—Kyber does it for them. 2. Real-Time Collaboration: Teams can now collaborate on notices in real time, significantly speeding up review and approval workflows without relying on email or meetings. 3. Consistency and Compliance: Kyber’s pre-built templates ensure that all notices follow the same structure and tone, reducing the risk of errors or non-compliance. Key Features of the Kyber Platform 1. AI-Generated Notices: Kyber’s AI engine instantly creates notices like Reservation of Rights or Coverage Decline letters, pulling in necessary policy information with minimal manual effort. Kyber also personalizes and formats the drafts such that its ready for review and sending. 2. Customizable Review Workflows: Teams can configure review workflows to match their internal processes, ensuring compliance with company policies at every step. Kyber’s review workflow is simple, intuitive and fast helping you team stay on top of customer notifications. 3. Omni channel Delivery: Kyber automates the delivery of notices, ensuring they are sent via physical mail or digital channels, and always on time. 4. Seamless Integration: Kyber integrates easily with leading claims management systems, including Guidewire and Snapsheet, providing a smooth user experience without disrupting existing workflows. Driving Efficiency for Claims Teams By adopting Kyber’s platform, claims teams can save over 25% of their time, allowing adjusters to focus on more valuable tasks. The AI-driven automation not only speeds up the notification process but also ensures compliance and consistency, reducing operational risks. Arvind Sontha, co-founder of Kyber, emphasizes the platform’s impact: “We created Kyber to address the inefficiencies in the claims notice and letter sending process. By automating this tedious and rather thankless task, we allow adjusters to be happy, work faster and with greater accuracy, ensuring a more transparent and consistent process.” Book a Demo Kyber’s AI-powered claims notification platform is available now. To learn more about how it can transform your claims team, visit [ askkyber.com/demo ] and book a demo today. With Kyber, the future of claims notifications is faster, smarter, and fully automated. Share this

Snapsheet Frequently Asked Questions (FAQ)

When was Snapsheet founded?

Snapsheet was founded in 2011.

Where is Snapsheet's headquarters?

Snapsheet's headquarters is located at 1 North Dearborn Street, Chicago.

What is Snapsheet's latest funding round?

Snapsheet's latest funding round is Series E - III.

How much did Snapsheet raise?

Snapsheet raised a total of $125.6M.

Who are the investors of Snapsheet?

Investors of Snapsheet include Tola Capital, Lightbank, F-Prime Capital, Ping An Global Voyager Fund, State Farm Ventures and 20 more.

Who are Snapsheet's competitors?

Competitors of Snapsheet include Digit Insurance, Next Insurance, Bima Milvik, Spruce, Tractable and 7 more.

What products does Snapsheet offer?

Snapsheet's products include Claims and 2 more.

Loading...

Compare Snapsheet to Competitors

Bima Milvik provides digital health solutions in the healthcare industry. The company offers services such as telemedicine, discounts on medicines and lab tests, hospital cashback, and a health wallet with points. BIMA primarily serves underserved families across South Asia, Southeast Asia, and Africa. It was founded in 2010 and is based in Stockholm, Sweden. In October 2023, CapitalSG and LeapFrog Investments acquired a majority stake in Bima Milvik.

Alan focuses on health and wellness, operating in the insurance industry. It offers health insurance services, providing solutions tailored to the needs of different types of businesses, from startups and small businesses to large corporations, as well as independent workers. The company was founded in 2016 and is based in Paris, France.

Socotra operates as a company providing technology solutions in the insurance industry. The company offers a range of products that help insurers accelerate product development, reduce maintenance costs, and improve customer experiences. It primarily serves the insurance industry. It was founded in 2014 and is based in San Francisco, California.

Duck Creek Technologies specializes in providing low-code software as a service core system for the property and casualty (P&C) and general insurance industry. Their offerings include a suite of software solutions that enable insurers to manage policies, process claims, and engage with customers digitally. Duck Creek's products are designed to support insurers in streamlining their operations and adapting to the ever-changing insurance landscape. It was founded in 2000 and is based in Boston, Massachusetts.

Insurity offers flexible technology solutions to the property and casualty insurance industries. It includes policy, billing, and claims solutions, data analytics, predictive tools, and digital enablement. The company was founded in 1985 and is based in Hartford, Connecticut.

ControlExpert provides services to the automotive industry. It streamlines the claims management process using a combination of software, data analytics, and human expertise. The company was founded in 2002 and is based in Langenfeld, Germany.

Loading...