Boomi

Founded Year

2000Stage

Loan | AliveTotal Raised

$979.25MLast Raised

$975M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-161 points in the past 30 days

About Boomi

Boomi focuses on providing intelligent connectivity and automation solutions within the integration platform as a service (iPaaS) industry. The company offers a suite of services including application and data integration, API management, and master data synchronization to facilitate digital transformation for businesses. Boomi primarily serves sectors such as healthcare, life sciences, manufacturing, financial services, retail, public sector, and higher education. It was founded in 2000 and is based in Conshohocken, Pennsylvania.

Loading...

Boomi's Product Videos

ESPs containing Boomi

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

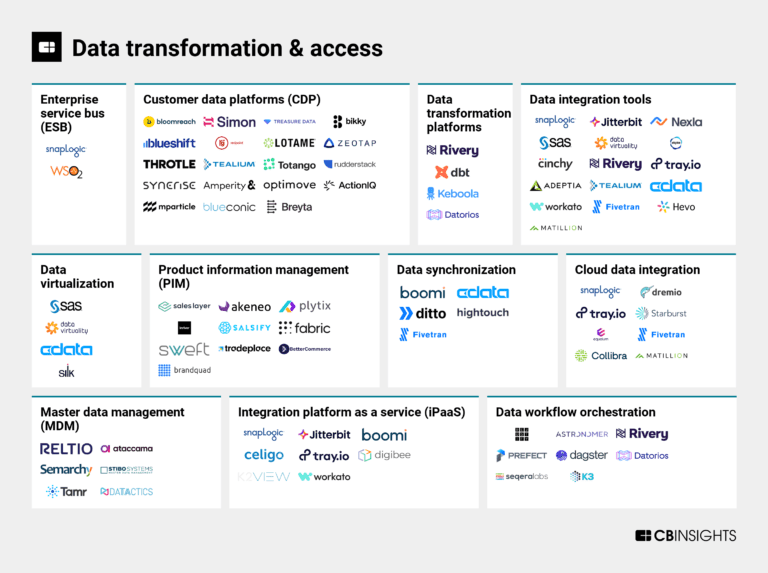

The integration platform as a service (iPaaS) market is focused on providing solutions to connect disparate systems, whether on-premises or in the cloud, to enable efficient data management. These solutions address the challenge of accessing trusted data and delivering it to relevant users when needed. iPaaS vendors allow organizations to automate key processes as well as create and manage APIs.

Boomi named as Leader among 13 other companies, including IBM, ServiceNow, and Informatica.

Boomi's Products & Differentiators

Integration

- Accelerate building application and B2B integrations with an intuitive, drag-and-drop UI, a robust library of connectors, pre-built integration processes, reusable components, and trading partner framework - Support all key integration and communication patterns, including application-to-application, pub-sub, real-time and event-driven web services, streaming, batch, and ETL integrations, and more - Support EDI standards X12, EDIFACT, HL7, RosettaNet, and Tradacoms, as well as trading partner communication requirements, including AS2, disk, FTP, SFTP, HTTP, and HTTPS - Quickly and easily onboard trading partners, and scale to support any transaction volume

Loading...

Research containing Boomi

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Boomi in 3 CB Insights research briefs, most recently on Aug 4, 2023.

Aug 4, 2023

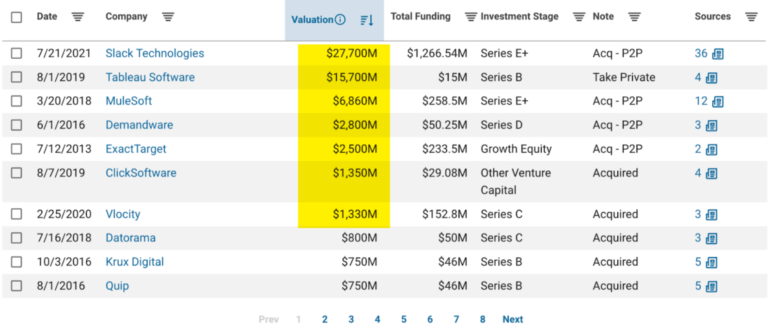

The data transformation & access market mapExpert Collections containing Boomi

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Boomi is included in 1 Expert Collection, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Boomi Patents

Boomi has filed 37 patents.

The 3 most popular patent topics include:

- data management

- transaction processing

- computer memory

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/15/2022 | 6/25/2024 | Data management, Computer memory, Transaction processing, Diagrams, Information technology management | Grant |

Application Date | 8/15/2022 |

|---|---|

Grant Date | 6/25/2024 |

Title | |

Related Topics | Data management, Computer memory, Transaction processing, Diagrams, Information technology management |

Status | Grant |

Latest Boomi News

Sep 19, 2024

With the new offering, the fintech aims to capture a larger share of the B2B payments market, working with partners in addition to selling directly, Brex’s president said. Published Sept. 18, 2024 Brex Embedded Payments solution Permission granted by Brex Brex, the expense management fintech, has launched an embedded payments tool to chase the potential the company sees with partnerships, expanding its reach beyond direct sales. “This fundamentally opens up a big way of going to market through these other partners versus only selling directly. It opens up a massive time and opportunity for us to capture a much larger pie of the $1.5 trillion [business-to-business] payment solution,” Karandeep Anand, Brex’s chief product officer and president, told Banking Dive. The B2B payments space is expected to cross $1.5 trillion by 2027 — up from roughly $953 billion in 2021, according to ResearchAndMarkets data . Brex Embedded, the new application programming interface-driven tool combines providers using various integrations, including Mastercard’s virtual card platform, which allows software vendors to integrate Brex’s corporate card and payments capabilities into their platform without taking on underwriting, onboarding, and credit risk, the company announced Wednesday . Brex said the tool enables software vendors to embed Brex virtual cards with higher limits, competitive rewards, local currency payments in some 50 countries, and quick customer onboarding. The fintech launched the tool broadly Wednesday, but it’s already in use by clients like Sabre, Coupa, DoorDash, Boomi, and ScaleAI. The embedded payments solution helps save 440 hours per year on manual general ledger coding and thousands on foreign transaction fees annually, the company noted. Sherri Haymond, co-president of global partnerships at Mastercard, noted how large enterprises have transformed businesses in the digital landscape and the need to offer innovative solutions. “We're thrilled to expand our partnership with Brex to launch Brex Embedded, which puts corporations in control with a simple, safe and easy way to manage connected payments experiences,” Haymond said in a statement Wednesday. The test programs the fintech ran with Coupa and Sabre materially shaped what the embedded tool needed to look like, according to Anand. Though the current solution is based on customer feedback, there’s an opportunity for the company to build out the tool, he added. Issuing credit cards using an API is the easy part, Anand said. “The hard part about building a fintech is, how do you do risk? How do you do credit modeling?” he said. “While we own credit card offering, we own expanding software, we also want to power hundreds and thousands of other businesses which want to embed payments into their product.” Founded in 2017, Brex, the brainchild of immigrants, built the corporate credit card for startups and today, one in every three startups in the U.S. uses Brex, Anand noted. As startups like DoorDash grew, Brex created a software stack to orchestrate a growing company’s expense management, travel, accounts payable and procurement in addition to payment methods. A ‘hardened’ platform “When you're touching somebody's money, you are in a trust game,” Anand said. Having a global payments footprint has “hardened” the stack of payment solutions through the number of licenses, approvals, and checks the platform required, he noted. “We co-create and harden with early adopters,” Anand said. “So, by the time it goes on, it is compliance-hardened, regulatory-hardened, and enterprise-grade before it gets opened up.” As Brex readies to become a public company — the timing depends on market condition — investments in compliance and regulatory policies become more critical, he highlighted. Three-way win Companies that work with Brex and that used to be non-digital required weeks and months to get their workflow payments done, Anand said. A faster process improves user experience, he added. And for software partners, offering the embedded tool can attract more customers and create increased revenue through payments processing share, Anand said. Meanwhile, those vendors avoid the costs of building in-house solutions related to risk, Know Your Customer and fraud checks. Brex’s model helps to generate payments into a profitable, risk-free income stream for partners while improving overall service quality, according to the product chief. “This is a unique offering in the sense it's not even win win it's a three-way win-win-win across the customer, Brex and the partner,” Anand said.

Boomi Frequently Asked Questions (FAQ)

When was Boomi founded?

Boomi was founded in 2000.

Where is Boomi's headquarters?

Boomi's headquarters is located at 1 West Elm Street, Conshohocken.

What is Boomi's latest funding round?

Boomi's latest funding round is Loan.

How much did Boomi raise?

Boomi raised a total of $979.25M.

Who are the investors of Boomi?

Investors of Boomi include Sixth Street Partners, TPG Capital, Francisco Partners, Dell Technologies, FirstMark Capital and 3 more.

Who are Boomi's competitors?

Competitors of Boomi include CData, StreamSets, Quickwork, Digibee, Talend and 7 more.

What products does Boomi offer?

Boomi's products include Integration and 4 more.

Who are Boomi's customers?

Customers of Boomi include Avalara, Flinders University and PTC.

Loading...

Compare Boomi to Competitors

SnapLogic provides an integration platform as a service (iPaaS) solution for enterprises specializing in self-service integration. The company provides application integration, data integration, application programming interface (API) management and development, and more. It serves human resources, information technology (IT), sales, finance and accounting, marketing, and other sectors. The company was formerly known as Brown Fox Software. It was founded in 2006 and is based in San Mateo, California.

WSO2 specializes in digital transformation and management software within the technology sector. The company offers a suite of tools for API management, integration, and identity & access management, designed to help enterprises create and deliver digital experiences. Its products are available as open source solutions, enterprise-grade SaaS, and private cloud deployments, catering to a variety of customer needs in building and managing digital platforms. It was founded in 2005 and is based in Santa Clara, California.

Jitterbit is a company focused on providing data integration solutions and low-code application development within the technology sector. Its main offerings include a platform for connecting systems, automating workflows, and creating applications with a low-code approach. Jitterbit's products and services are designed to facilitate seamless integration and automation for businesses across various industries. It was founded in 2004 and is based in Alameda, California.

Youredi is a company that focuses on data integration services and connectivity solutions, primarily operating in the supply chain and logistics industry. The company offers a range of services including the provision of fully managed data integration services and solutions that streamline customer processes through B2B integrations. These services are primarily targeted towards logistics technology companies, shippers or receivers of goods, logistics service providers, and carriers. It is based in Espoo, Finland.

Celigo is a company that focuses on integration and automation, operating within the technology industry. The company offers a platform that connects applications and automates processes, enabling both IT and business teams to streamline common and custom business operations. Celigo primarily serves sectors such as IT, finance, ecommerce, SaaS/Software, and human resources. It was founded in 2005 and is based in San Mateo, California.

Workato specializes in artificial intelligence (AI) powered enterprise automation. The company offers a platform that enables businesses to automate their processes by integrating their applications, data, and experiences, all in a low-code, no-code environment, primarily serving sectors such as information technology, human resources, sales, marketing, finance, and support. It was founded in 2013 and is based in Mountain View, California.

Loading...