Investments

1518Portfolio Exits

159Funds

13Partners & Customers

10About Bpifrance

Bpifrance is an investment bank that provides businesses with financial solutions. It specializes in leasing, credits, medium and long-term loans, investment funds, equity participation, stock exchange, and other areas. Bpifrance offers a supplier platform, a regional service portal, and other networking solutions. The company was founded in 2012 and is based in Maisons-Alfort, France.

Expert Collections containing Bpifrance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Bpifrance in 2 Expert Collections, including Sovereign Wealth Funds.

Sovereign Wealth Funds

22 items

The world's most active sovereign wealth funds investing in private tech companies.

Beauty & Personal Care

65 items

Startups in the beauty & personal care space, including cosmetics brands, shaving startups, on-demand beauty services, salon management platforms, and more.

Research containing Bpifrance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bpifrance in 1 CB Insights research brief, most recently on Aug 5, 2021.

Aug 5, 2021

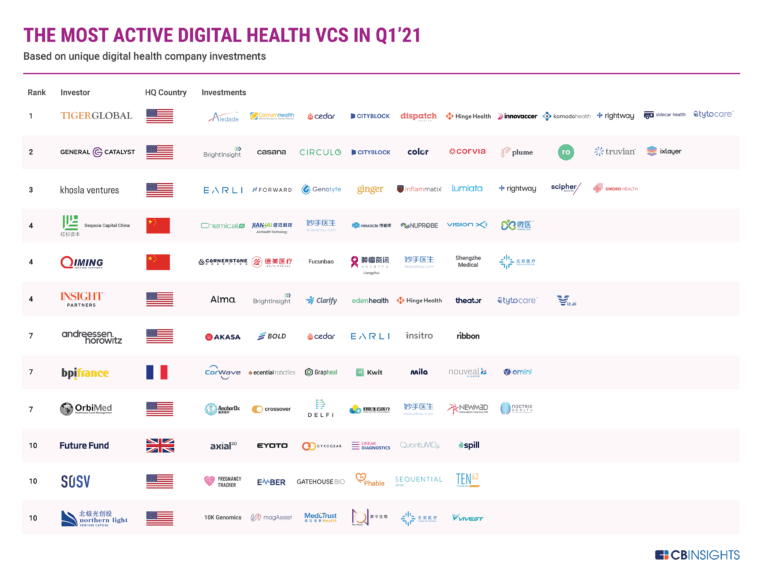

Here Are The Most Active Healthcare InvestorsLatest Bpifrance News

Aug 10, 2023

Translink Corporate Finance Acted As The Exclusive Advisor To The Shareholders of Groupe Lindera In Selling A Majority Stake To FCDE And Bpifrance July 1, 2023 TRANSLINK INTERNATIONAL AG We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit "Cookie Settings" to provide a controlled consent. Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience. Always Enabled Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously. Cookie 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". cookielawinfo-checkbox-functional 11 months The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". cookielawinfo-checkbox-necessary 11 months This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". cookielawinfo-checkbox-others 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. cookielawinfo-checkbox-performance 11 months This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". viewed_cookie_policy 11 months The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. Functional Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Performance Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. Analytics Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. Others Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet. Country Information on Team Select Home Care Team Select Home Care provides solutions to address both cost and care coordination needs through an industry-leading technology and analytics platform. Established in 2008, Team Select provides solutions to local communities that innovate the home health space. Information on Court Square Capital Partners Court Square is a middle market private equity firm with over 40 years’ experience in the industry. Since 1979, Court Square has completed over 245 platform investments, helping Founders, Families, and Manager-owners to develop their companies into leaders in their respective markets. Court Square invests in companies that have compelling growth potential in the industrial, business services, healthcare, and tech and telecom sectors. Court Square has $7.4 billion of assets under management and is based in New York, N.Y. Information on Tenex Capital Management Tenex Capital Management is a private equity firm that invests in middle-market companies. Tenex uses an in-house team of hybrid investment professionals skilled in operational leadership, investing and capital markets structuring to maximise long-term value creation. Tenex’s deep operating experience allows the firm to collaborate with management teams to capitalise on business and market opportunities. Rationale for the transaction Through the partnership with Court Square, Team Select is well positioned to complete its next phase of growth as it works to address the need for critical and cost-saving home-based care. Transaction information Translink Corporate Finance acted as the financial co-advisor to Team Select Home Health Care in its receipt of a strategic capital investment from Court Square Capital Partners Operation × Translink Corporate Finance Advised Bluethread Services, A Portfolio Company Of Seaside Equity Partners, In Its Partnership With Turner Roofing Country Information on BlueThread Services BlueThread Services is building the next market-leading commercial roofing and exterior services group by partnering with top-tier brands. The BlueThread name combines two important words that drive relationships. Blue—a color attributed to trust, security, and opportunity. Thread—a guarantee of connection and working as one. Information on Seaside Equity Partners Seaside Equity Partners is a growth-oriented and operationally focused private equity firm based in San Diego, CA. Seaside is currently investing out of a $325 million investment vehicle that closed in December 2022, which focuses on partnering with founder, family, and entrepreneur-owned businesses. Information on Turner Roofing Turner Roofing has been a Tulsa-area trustworthy roofing company serving Northeastern Oklahoma for more than 50 years. In that time, they have provided commercial and residential roofing as well as sheet metal and copper services for almost 50,000 customers. Rationale for the transaction Seaside Equity Partners seeks to provide capital, resources and strategic support to leading mission critical services businesses that are headquartered in the Western United States. Transaction information Translink Corporate Finance acted as the advisor to BlueThread Services, a portfolio company of Seaside Equity Partners, in its partnership with Turner Roofing. Operation Country Information on Indoff Company Headquartered in St. Louis, Missouri, Indoff is a value-added business solutions provider and distributor serving businesses across the U.S. and parts of Canada. For the past 50 years, Indoff has provided customers with an extensive range of business solutions, including material handling/warehouse solutions, commercial interiors, and business and promotional products. Indoff goes to market through its expert national sales network of sales professionals and relationships with hundreds of manufacturers, wholesalers, and service providers. Information on Global Industrial Company Global Industrial Company (NYSE:GIC), through its operating subsidiaries, is a value-added distributor. For more than 70 years, Global Industrial has gone the extra mile for its customers and offers more than a million industrial and MRO products, including its own Global Industrial Exclusive Brands™. With extensive product knowledge and a solutions-based approach, Global Industrial helps customers solve problems and be more successful. Rationale for the transaction The acquisition of Global Industrial empowers Indoff to leverage its strengths and capabilities, ensuring an elevated level of service and support for customers while expanding its operations. Transaction information Translink Corporate Finance acted as the exclusive financial advisor to Indoff, Inc. in its sale to Global Industrial Operation × Translink Corporate Finance Advised RQM+, A Portfolio Company Of Linden Capital Partners, On Its Acquisition Of Libra Medical Country Information on RQM+ RQM+ is the leading MedTech service provider with the world’s largest global team of regulatory and quality experts. Building upon 40 years of regulatory expertise, they also provide comprehensive clinical trial, lab and reimbursement services – reducing risk throughout the entire product lifecycle for medical devices, digital therapeutics and diagnostics. With more former FDA, Medicines in Healthcare products Regulatory Agency (MHRA) and notified body regulators than any other firm, the RQM+ team has deep expertise in all clinical specialties. In addition to early- and mid-stage MedTech companies, they currently work with 19 of the top 20 medical device manufacturers and seven of the top 10 IVD companies. Information on Linden Capital Partners Linden Capital Partners is a Chicago-based private equity firm focused exclusively on healthcare. Founded in 2004, they have grown to become one of the country’s largest dedicated healthcare private equity firms by working with company management towards their goal of creating exceptional value for companies, business owners and investors. The Linden Capital Partners model of partnership with management and actively engaged operating partners has defined the firm and become a model for others. Information on Libra Medical Libra Medical, Inc. was founded in January 2007 as a full Contract Research Organisation (CRO) providing innovative solutions to the Regulatory Affairs, Clinical Research, and Quality Assurance functions within life science companies. Their client base focuses on emerging medical device companies both in the US and around the world, but also includes well-established global medical device companies. Libra Medical has extensive experience working with start-up companies to obtain approvals in the US, Europe, Canada, and other international markets. They also provide services to companies in the Biotech and Pharmaceutical areas. Rationale for the transaction This strategic acquisition further strengthens RQM+ clinical trial business as Libra’s deep expertise with first-in-human (FIH) studies for complex devices and diagnostics is an excellent complement to the process. Transaction information Translink Corporate Finance acted as the advisor to RQM+, a portfolio company of Linden Capital Partners, on its acquisition of Libra Medical Operation Information on Pelican Energy Partners Pelican Energy Partners is a Houston-based private equity firm specializing in strategic investments in small to middle-market, high-growth potential energy service and equipment companies. The firm has raised $609 million of managed capital since inception and makes investments in energy equipment and service companies in the oil and gas and nuclear sectors. Information on Blue Wave AI Labs Founded in 2016, and already trusted by over half the boiling water reactors in the U.S. domestic fleet, Blue Wave is an AI-centric, industry-focused innovation company serving the nuclear energy and defense industries. Blue Wave combines the insight of exceptional scientific technical talent with the latest advancements in AI and Machine Learning to transform data into solutions for the world’s most difficult problems. Rationale for the transaction By forming a partnership with Pelican Energy Partners, Blue Wave is poised to meet the increasing customer demand and expand its customer base, geographical reach, and range of products. Transaction information Translink Corporate Finance acted as the advisor to Pelican Energy Partners in its partnership with Blue Wave AI Labs Operation Information on Saudi Napesco Saudi Napesco is a well-established API Licensed Saudi Arabian company, which is specialised in the supply of oilfield services and downhole equipment to the oil and gas industry. They provide “solutions” combining technology, experience and expertise in services such as Fishing & Remedial, Whipstock systems, Downhole Drilling Tools, which includes drilling jars, shock subs, reamers, and motors (PDMs). To compliment this, they have the capability to provide a third-party service for make/break services for most downhole tools. Information on Oreco Oreco is a Denmark-based world leader in Automated Systems for Crude Oil Tank Cleaning, Oil Recovery from Slop-oils, and generation of Nitrogen/Oxygen gases for industrial applications. Rationale for the transaction Transaction information Operation Information on Evonik Industries Evonik is one of the world leaders in specialty chemicals. The company is active in more than 100 countries around the world and generated sales of €18.5 billion and an operating profit (adjusted EBITDA) of €2.49 billion in 2022. Evonik goes far beyond chemistry to create innovative, profitable, and sustainable solutions for customers. About 34,000 employees work together for a common purpose: We want to improve life today and tomorrow. Information on Novachem Novachem, established in 2007 and employer of 20, develops biotechnological, natural, and sustainable active ingredients for skin and hair care applications. Rationale for the transaction By leveraging Novachem’s innovation strategy, accessibility to biodiversity and strong skin and hair care portfolio, Evonik will boost its Systems Solutions portfolio and take a further step in the transformation of the Care Solutions business towards becoming a leading actives provider. Transaction information Translink Corporate Finance acted as the exclusive advisor to shareholders of Novachem on the sale to Evonik Industries Operation Information on Oxbo Oxbo’s journey began with several key companies that shared a commitment to serving specialty crop customers. Today, as a unified global organization, Oxbo is the leading choice for specialty harvesting and controlled application technology, with over 60 years of experience. Headquartered in the Netherlands, they have manufacturing facilities worldwide, supported by a global team dedicated to customer service and equipment uptime. Through direct service, sales, parts support, and dealer networks, Oxbo ensures exceptional customer service and remains at the forefront of optimizing farming practices. Information on H&S Manufacturing H&S Manufacturing founded in 1967 by Mr. Lauri Heikenen and two partners, initially focused on manufacturing and selling self-unloading forage boxes for farm equipment dealers. Over the years, H&S has expanded its facilities, products, and markets, growing from a 5,000 square foot manufacturing plant to a total of 220,000 square feet across locations in Marshfield and Clintonville, WI, and Ripley, NY. While the dairy farm industry has always been their primary market, H&S has diversified its offerings to include manure spreaders and hay rakes, becoming a dominant player in these markets as well. They have also ventured into emerging agricultural technologies such as wrapping high moisture baleage and crop merging. H&S takes pride in being a sponsor of the National Farm Medicine Center since 1998. Rationale for the transaction Oxbo is strategically expanding its presence and product offerings in the hay and forage industry by acquiring H&S Manufacturing, with a focus on customer service, product innovation, and global market strength. Transaction information Translink Corporate Finance acted as the exclusive advisor to H&S Manufacturing in its sale to Oxbo Operation Information on Groupe CEME A national reference company in electrical, HVAC engineering, and maintenance, Groupe CEME operates in projects and services related to energy efficiency and thermal comfort for the tertiary sector, industrial clients, local authorities, and individuals. Information on VÊPRES Founded in 1962 near Grenoble, France, VÊPRES has specialized in cleanrooms and cleanrooms for over 60 years, serving a wide range of customers in research, healthcare, medical devices, agri-food, microelectronics, biotech, nanotechnologies, aerospace, plastics processing and more. With a workforce of 75, the company operates in 3 business lines: design and construction, general contracting and maintenance. Rationale for the transaction With the integration of this company, Groupe CEME completes its electrical and HVAC engineering business by adding the design and construction of cleanrooms, a high-potential activity. Transaction information Translink Corporate Finance acted as the advisor to Groupe CEME in acquiring a majority stake in VÊPRES Operation Information on Groupe Lindera Groupe Lindera is a specialised group that focuses on the production and installation of shop fittings and interior design. With over 30 years of experience, they excel in the design, layout, and remodeling of various premises, catering to both domestic and international clients in France and beyond. Information on FCDE FCDE is a private equity firm based in France, specialising in supporting the growth and transformation of SMEs with significant potential for expansion. With a responsible investment approach, FCDE offers both human and financial resources to assist management teams in achieving sustainable operational improvements and creating long-term strategic value. Over the years, FCDE has successfully guided over 30 entrepreneurial journeys by implementing transformative strategies and driving meaningful changes to propel their development. Rationale for the transaction The main objectives are to accelerate growth in various sectors such as retail, luxury, tertiary, and hospitality/leisure. Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Groupe Lindera in selling a majority stake to FCDE and Bpifrance. Operation Information on ITsjefen AS ITsjefen AS, located in Trondheim, Norway delivers Datacenter services, Infrastructure services, IT Security and other IT services. ITsjefen is successful within Datacenter services to Enterprise customers from 3 own data centers located in Trondheim. ITsjefen AS has a revenue of 54.1 MNOK for the fiscal year ending 31.12.2022, according to local generally accepted accounting principles. Applying IFRS accounting standards, revenue for the fiscal year ending 31.12.2022 is reduced to 50.2 MNOK since software license revenue with certain characteristics is recognized on a net income basis. Information on ECIT Founded in 2013, ECIT supports a large customer base with accounting, payroll, and IT services. ECIT has a proven model for acquisitions, combining proximity to customers, local entrepreneurship and the strength of a larger international group. ECIT has a full-year proforma revenue of 3.1 billion NOK per Q1 2023 and more than 2,300 employees across ten countries. M&A has been key to drive the Company’s growth as ECIT has completed more than 130 acquisitions since 2013. Rationale for the transaction Transaction information Operation Information on Integrated Power Services IPS is the leading North American solution provider for power management, electromechanical, and rotating equipment processes. The company serves over 13,000 customer locations across a wide range of end uses, including power generation, utilities, water and wastewater, petrochemicals, air separation, oil and gas, metals, mining, paper, aggregates, cement, hospitals, universities, commercial buildings, and data centers. Headquartered in Greenville, South Carolina, IPS has the industry’s largest network of locations, with service centers, distribution centers, and field service offices across North America, combining industry-specific experience with comprehensive engineering resources to revolutionize reliability for customers. Information on Surplec Surplec is a trusted provider of centralized services for medium and high-voltage transformers and equipment. With over 30 years of experience, they offer a comprehensive range of new and refurbished products that undergo rigorous testing according to ISO 17025 standards. Their rental service ensures prompt supply in case of breakdowns or short-term installations, backed by the largest inventory of refurbished items in Canada. With four specialized facilities, Surplec excels in efficient repairs and modernization during critical situations. Rationale for the transaction In addition to expanding their service capabilities across Canada, this development brings a full range of transformer service capabilities to their Canadian and US customers. Transaction information Operation Information on Groupe Valmen Groupe Valmen is an IT consulting company that focuses on the creation, implementation, and deployment of solutions tailored to personal insurance and social protection. In addition to their business acumen, the company actively participates in operational transformation, provides assistance with project management and organization, and offers expertise in digital transformation and strategy. Information on Vivei Vivei is a consulting company that focuses on providing services to insurance and social protection organizations. The firm specializes in three core areas of expertise: actuarial services, information systems project management assistance, and organization and process optimization. Rationale for the transaction Groupe Valmen aims to leverage the knowledge and skills of its consulting business, broaden its customer reach, explore new areas of expertise, and solidify its prominent position as a consultant in the fields of life and health insurance. Transaction information Operation Information on saas.group Saas.group is a software as a service portfolio company focusing on acquiring promising SaaS companies and providing them with a founder-friendly process to elevate their products and people. Information on AddSearch AddSearch, a Finnish SaaS company, is a leading provider of hosted website search solutions. The Company specializes in offering a comprehensive solution to improve website conversion rates, customer experience, and customer support. Rationale for the transaction The acquisition strengthens saas.group’s portfolio and offers customers the opportunity to enhance user experiences, increase conversions, reduce operational costs, and maximize customer lifetime value. Transaction information Translink Corporate Finance acted as the financial advisor to the owners of AddSearch Oy, in the share sale conducted by saas.group. Operation Information on U.S. Legal Support U.S. Legal Support was founded in 1996 with a single goal: to be the first nationwide, all-inclusive litigation support company. Over the last thirty years, their mission has remained the same: to build lasting relationships with their legal industry partners by delivering exceptional litigation support services. With a full suite of court reporting solutions, record retrieval, interpreting & translations, trial services and transcription services, they serve the legal industry better. To law firms, enterprise legal teams, and insurance carriers across the country, U.S. Legal Support offers on-demand access to 12,000+ offices in more than 2,700 cities with in-person, remote and hybrid service capabilities. Information on Summit Court Reporting Summit Court Reporting is a global legal service company specialising in out-of-town litigation. They offer many conference room suites with video conferencing capabilities and catered affairs upon request. The video team is certified along with real time reporters. Their Court Reporters have travelled the globe and use state-of-the-art equipment. Summit Court Reporting offers a superb product, and their customer service is valued. Summit Court Reporting travels beyond one’s basic needs for deposition services. Rationale for the transaction This strategic acquisition is a testament to U.S. Legal Support’s unwavering commitment to supporting legal professionals across the nation and delivering exceptional, precise, and prompt service. Transaction information Translink Corporate Finance acted as the advisor to U.S. Legal Support, Inc. in its acquisition of Summit Court Reporting, Inc. Operation Information on Groupe Brangeon Established in 1919, the Groupe Brangeon stands as a self-reliant, family-owned enterprise that spans across western France. With a core focus on two distinct sectors, namely transportation and logistics, as well as waste collection, recycling, and recovery, the company has solidified its expertise over the years. Information on Groupe UNIFER Groupe UNIFER, a company headquartered in Le Havre, was established in 1955 with a primary specialisation in industrial waste recycling within the Normandy region. Rationale for the transaction By incorporating this company, Groupe Brangeon enhances its transportation operations and expands its services to include waste recycling in Normandy, a region known for its considerable potential. Transaction information Translink Corporate Finance acted as the exclusive advisor to Groupe UNIFER on its sale to Groupe Brangeon. Operation Information on Education Partners GmbH Education Partners GmbH team has been the professional in further education for almost 25 years. They have a lean organisational structure and extensive know-how in the creation, planning and implementation of qualified and certified seminars, courses and learning content. Education Partners is a certified partner in continuing education. It stands out for its quality and service. Information on FernAkademie Touristik FernAkademie Touristik is a reputable institution specialising in distance learning courses for tourism education and professional development. Rationale for the transaction This strategic acquisition further strengthens Education Partners’ position in the education sector, expanding its portfolio and enhancing its offerings in the field of tourism education. Transaction information Translink Corporate Finance acted as the advisor to Education Partners GmbH, a portfolio company of Odewald KMU, on the acquisition of FernAkademie Touristik. Operation ARCXIS Headquartered in Houston, TX, ARCXIS (formerly known as DPIS Builder Services), is the leading, national provider of outsourced engineering, inspection, energy efficiency, and quality assurance services to single-family and multi-family homebuilders, and energy inspections and permitting services to existing homes. Saw Mill Capital Partners Based in Briarcliff Manor, NY, Saw Mill Capital Partners is a private equity firm that acquires facility and industrial service, specialty distribution and manufacturing businesses with enterprise values of $25 million to $200 million. Information on the seller Jacksonville Building Science LLC is a provider of design, inspection, and testing services to residential homebuilders in Florida. Rationale for the transaction The acquisition expands ARCXIS’ footprint and further establishes ARCXIS as the national partner to residential homebuilders across the US. Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor to ARCXIS, a portfolio company of Saw Mill Capital Partners, on the acquisition of Jacksonville Building Science LLC. Operation About Frontier Frontier Dental Lab (FDL) Group is a full service, multi-site laboratory group that provides high-end dental prosthetics for cosmetic dentistry (full arch, single and multi-unit anterior crowns and bridges, and veneers), general dentistry (single and multi-unit posterior crowns and bridges), implants (single unit, bridge, and full mouth) and removable dental products (dentures, custom trays, and nightguards). With approximately 575 employees across seven laboratories, FDL Group serves over 6,000 customers throughout North America. About O2 Investment Partners O2 Investment Partners is a Midwestern-based private equity firm that seeks to acquire majority interests in lower-middle market Family/Founder-owned businesses in B2B services, technology, and select niche industrial companies. The firm invests in businesses with earnings growth potential and a clear path to the creation of shareholder value. Information on the seller Friendship Dental Laboratories, LLC is a full-service dental laboratory providing a complementary offering of general dentistry and cosmetic dentistry products. Friendship also offers a full suite of value-added services including in-office assistance, in-house continuing education courses, and chair-side conversions. Friendship has approximately 90 employees across its headquarters in Rosedale, MD (fixed lab), and Baltimore, MD (removable lab). Rationale for the transaction The transaction will enable Frontier Dental Laboratories to provide Friendship Dental Laboratories with additional resources to support growth as they continue to invest in their employees and technology, which will allow them to best serve their customers. Transaction information Translink Corporate Finance acted as the advisor to Frontier Dental Laboratories, a portfolio company of O2 Investment Partners, on its partnership with Friendship Dental Laboratories. Operation Information on the buyer Renta is a Northern European full-service equipment rental company founded in 2015. The company has operations in Finland, Sweden, Norway, Denmark, Poland, and the Baltics, with 135 depots and approximately 1,500 employees. Offering a wide range of construction machines and equipment along with related services, Renta is also a significant supplier of scaffolding and weather-protection services. Information on the sellers Rationale for the transaction IK Partners-owned Renta Group strengthens its position in Finland by acquiring the share capital of Espoon Rakennuskonevuokraamo Oy. Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Espoon Rakennuskonevuokraamo Oy on the sale to Renta Group, a portfolio company of IK Partners. Operation Information on the buyer Charterhouse is one of the longest established private equity firms operating in Europe. Charterhouse invests with a growth-focused approach to mid-market European companies across the services, healthcare, industrials, and consumer sectors. They follow a selective, conviction-led style, sourcing attractive investment opportunities often ahead of any process with the long-term ambition of driving transformational change. Information on the seller France Valley is an asset management company offering two main investment solutions – investment funds in Natural Assets (forestry and vineyards) and investment funds in real estate usufruct of SCPIs – to a diversified investor base composed of both institutional and private investors. Rationale for the transaction France Valley is a leader in its niche market in France. Having Charterhouse onboard as a minority shareholder will boost the image of the group in the market. The ambition of the founders, together with Charterhouse, is to become the European leader in its niche markets. Transaction information Translink Corporate Finance acted as the advisor to the shareholders of France Valley on the minority stake sale of Charterhouse Capital Partners. Operation Information on the buyer Industrial Service Solutions (ISS) manufactures, supplies, installs, integrates, and services critical-to-process equipment for a broad range of industries. Their regional shops are fully equipped to repair and overhaul all process and rotating equipment types, brands, and applications. They also provide nationwide field services through our in-house engineering support. Information on the seller Servo South is your single source for repair and service of servo motors, electronic boards and drives, hydraulic motors, and AC/DC electrical motors. Their company was founded by Barry Beaver with two strong principles in mind: to offer exceptional customer service and deliver a quality product on time. Rationale for the transaction The acquisition expands ISS’ position in the rapid-growth industrial automation sector, facilitating extension of servo motor and electronics repair services at key ISS facilities across the United States. Transaction information Translink Corporate Finance in the US, Dinan & Company LLC, acted as the advisor to Industrial Service Solutions in the acquisition to Servo South. Operation Information on the buyer B.group is an entrepreneurial investment company, founded in 2000 in Bologna. They invest directly in the capital of already consolidated small and medium-sized enterprises and in highly innovative scale-up projects. Information on the seller IFP Europe is a company specializing in the production of vacuum cycle metal washing machines using modified alcohols and HFE hydrocarbons. Rationale for the transaction The transaction represents a further milestone in IFP’s growth strategy in foreign markets, with a particular focus on Europe and North America. Transaction information Translink acted as the exclusive advisor to IFP Europe on the majority stake sale to a pool of industrial investors led by B.group. Operation Information on the buyer CECOP Group is the first global community leader in the sector. It is an expert in providing strategic solutions in operational management, development, training and transformation of opticians. It currently has more than 7,500 members distributed around the 11 countries where it is present: Europe (Spain, Germany, Portugal, Italy, England, Ireland and France), Latin America (Brazil, Colombia and Mexico) and the USA. Information on the seller Optic Society works with over 40 renowned national and international optics suppliers. This ensures you clear purchasing advantages at first-class conditions and the choice to only offer your customers the best. Rationale for the transaction Transaction information Operation Information on the buyer Cpl is a global provider of recruitment and talent solutions to startup companies, multinationals and SMEs in every sector from Technology to Accounting. The group currently has 12 companies with a total of 21 offices spread across 14 Irish offices and 7 other European countries. Cpl Resources plc became part of OUTSOURCING Inc., a listed company based in Tokyo, in 2020. Information on the seller neusta consulting has been on the market since 2008 and was formed out of the team neusta group through an MBO. The company is active in the recruitment and placement of IT professionals and the acquisition of IT projects. The core business of neusta consulting is the placement of external, freelance IT specialists with corporate clients throughout the DACH region. Rationale for the transaction Transaction information Operation Information on the buyer The PlanetHome Group is one of the leading real estate service providers in Germany and Austria with the core areas of brokerage and financing of residential real estate. With consolidated sales of EUR 115 million and over 700 employees at more than 100 locations, the company is a sought-after partner in Germany and Austria. Information on the seller Hamburg-based RENEWA GmbH is a holistic provider of energy consulting. The one-stop-shop concept includes renovation consulting, subsidy consulting and CO2 neutral real estate optimisation. RENEWA’s philosophy is to contribute to the German energy transition and to make it sustainable. Rationale for the transaction Transaction information Operation BlueThread Services BlueThread Services is building the next market-leading roofing and exterior services group by partnering with top-tier companies. Seaside Equity Partners Seaside Equity Partners are a San Diego-based private equity firm focused on making control investments in leading providers of mission critical services in the Western U.S. Information on the seller Founded in Albuquerque in 2008, RoofCARE is a full-service commercial roofing contractor that focuses on cost-efficient, sustainable solutions that avoid premature roof replacement. Rationale for the transaction The partnership will further develop BlueThread Services Southwestern U.S footprint, augmenting the platform’s service, repair and maintenance focus. Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor to BlueThread Services, a portfolio company of Seaside Equity Partners on their partnership with RoofCARE. Operation Information on the buyer Trumpet Behavioral Health is a leading provider of behavioural health services. They specialise in the treatment of children and adults with autism spectrum disorders and developmental disabilities, using the principles of Applied Behaviour Analysis (ABA). Information on the seller Therapeutic Pathways provides intensive language and behaviour therapy to children on the autism spectrum. They also provide social skills training in small groups. In addition, summer social skills training camps are available. Rationale for the transaction The partnership with Therapeutic Pathways will increase access to care for Trumpet Behavioral Health clients in the Sacramento area and the Central Valley of California. Transaction information Translink Corporate Finance acted as the exclusive advisor to Therapeutic Pathways, Inc. on its partnership with Trumpet Behavioral Health, a portfolio company of WindRose Health Investors. Transaction information Information on the buyer Trivest Partners, with offices in Miami, Charlotte, Chicago, Los Angeles, Philadelphia, and Toronto, is a private investment firm that focuses exclusively on the support and growth of founder-led and family-owned businesses in the U.S. and Canada, in both control and non-control transactions. Information on the seller Perricone Juices is the leading producer of premium, craft juices in the country. Headquartered in Newport Beach, CA, the company operates manufacturing facilities in Beaumont, CA and Vero Beach, FL. Rationale on the transaction With Trivest Partners’ support, Perricone Juices will continue their track record of organic growth while they significantly invest in their operations and their team to better serve their customers. Transaction information Operation Information on the buyer Renta is a Northern European full-service equipment rental company founded in 2015. The company has operations in Finland, Sweden, Norway, Denmark, Poland, and the Baltics, with 135 depots and approximately 1,500 employees. Offering a wide range of construction machines and equipment along with related services, Renta is also a significant supplier of scaffolding and weather-protection services. Information on the sellers Espoon Nosturikeskus Oy Pohjanväre is a Finnish company specializing in the rental and maintenance of aerial work platforms and construction equipment, founded in 1964. Rationale for the transaction IK Partners-owned Renta Group strengthens its position in Finland by acquiring the share capital of Espoon Nosturikeskus Oy Pohjanväre. Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Espoon Nosturikeskus Oy Pohjanväre on the sale to Renta Group, a portfolio company of IK Partners. Operation Information on the buyer Renta is a Northern European full-service equipment rental company founded in 2015. The company has operations in Finland, Sweden, Norway, Denmark, Poland, and the Baltics, with 135 depots and approximately 1,500 employees. Offering a wide range of construction machines and equipment along with related services, Renta is also a significant supplier of scaffolding and weather-protection services. Information on the sellers Rationale for the transaction IK Partners-owned Renta Group strengthens its position in Finland by acquiring the business operations of Lohjan Nosturipalvelu Oy. Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Lohjan Nosturipalvelu Oy on the sale of business operations to Renta Group, a portfolio company of IK Partners. Operation Information on the buyer Renta is a Northern European full-service equipment rental company founded in 2015. The company has operations in Finland, Sweden, Norway, Denmark, Poland, and the Baltics, with 135 depots and approximately 1,500 employees. Offering a wide range of construction machines and equipment along with related services, Renta is also a significant supplier of scaffolding and weather-protection services. Information on the sellers Hyrpoolen is a leading rental company of construction machines, scaffolding and similar equipment in the Greater Stockholm area. The operations expanded in 2017 to include rental of sheds and trailers, which has contributed to continued profitable growth. Hyrpoolen has two depots in Stockholm, one in Nacka and one in Haninge, with more than 30 employees and annual turnover of approximately 70 SEKm. Rationale for the transaction Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Hyrpoolen on the sale to Renta, a portfolio company of IK Partners. Operation Information on the buyer Turenne Groupe, one of the leaders in capital investment in France, has been supporting entrepreneurs with their innovative projects, from the development of the transfer of their companies, for over 20 years. As an independent player, the group manages over 1.2 billion euros. Information on the seller Mycophyto proposes revitalising cultivable soils with exclusively indigenous micro-organisms. Mycophyto does not replace chemical products with organic products. Instead, the Mycophyto innovation is based on the natural synergies between plants and microscopic fungi (AMF) in soils capable of interacting with plant roots. Rationale of the transaction Transaction information Translink Corporate Finance acted as the advisor to Mycophyto on the raising of equity from several financial investors. Operation Information on the buyer For over 20 years, Mytee has been providing professionals in the Automotive, Carpet Cleaning, and Facility Maintenance industries with the best quality products and the best customer service, at the lowest price possible. Information on the seller Square Scrub floor cleaning and prep machines were developed to maximise productivity in every application. With 100+ different surface cleaning and preparation tools, their industrial floor machines handle cleaning, scrubbing, floor striping, and mopping while making the most efficient use of every pad, paper, or screen, saving both time and money. Rationale for the transaction The combined businesses will be able to provide a broad product line of extractors and floor machines for industrial cleaning applications across many industries. Transaction information Translink Corporate Finance acted as the advisor Mytee Product, Inc, a portfolio company of Dry Fly Capital on the acquisition of Square Scrub. Operation Information on the buyer Over 30 years ago, NorthStar was founded to provide environmental abatement services to the northeast United States. Today, NorthStar has a nationwide branch network that generates more than $500 million in average annual sales and completes over 7,500 projects each year. Information on the seller Trans Ash is a leading provider of coal ash or coal combustion residuals (“CCR”) services to utilities customers across North America. Rationale for the transaction With the acquisition of Trans Ash, NorthStar has assembled market leading capabilities across their three primary service offerings: Commercial and Industrial Deconstruction, Nuclear Decommissioning and Waste Management, and Coal Ash Remediation and Reuse. Transaction information Translink Corporate Finance acted as the exclusive advisor to Trans Ash Inc, on the sale to NorthStar Group, a portfolio company of J.H. Lehman & Company. Operation Information on the buyer Tamtron Group Oyj is an international weighing technology company that provides reliable, accurate, and intelligent weighing solutions for several industrial needs to over 60 countries globally, with 50 years of weighing industry experience. Information on the seller Lahti Precision is a weighing technology company with over 100 hundred years of expertise in improving industrial competitiveness. The company’s product and service offerings cover a wide range of industrial weighing solutions and a SaaS-based material flow management system. The company is based in Lahti, Finland. Rationale for the transaction The acquisition will enable Tamtron to provide its customers with an even wider global range of weighing and dispensing technologies, advanced SaaS solutions and lifecycle services to ensure customer success. Transaction information Operation Information on the buyer The CECOP Group is the only global purchasing group for opticians. Founded in 1996 by Jorge Rubio in Madrid, CECOP Group stands out above all for its commitment to the development and modernization of the sector and has more than 8,000 members in eleven countries. Information on the seller EGS Optik GmbH is one of the top five purchasing associations in Germany with clear added value in all areas to support standalone, owner-operated specialist optical stores. Furthermore, EGS is an established, reliable, and indispensable partner for the optical industry with long-standing business relationships. Rationale for the transaction Transaction information Operation Information on the buyer Eagle Eye Solutions Group plc (AIM: EYE), is a leading SaaS technology company that develops digital connections enabling personalised, real-time marketing through coupons, loyalty, apps, subscriptions, and gift services. Information on the seller Untie Nots is a leading business based in France providing large retailers with AI powered promotion and gamification SaaS software solutions. Rationale for the transaction The transaction will provide Eagle Eye with additional product and technology capabilities and an enlarged talent base, including the Untie Nots co-founders and its current 30 tech-oriented employees. Untie Nots strong reach in France and growing footprint in Europe and the US will expand Eagle Eye’s geographic reach and bring additional blue-chip customers into the Group, offering global cross-selling opportunities across complementary customer bases. Transaction information Translink Corporate Finance acted as the exclusive advisor to French Untie Nots on the sale* to English Eagle Eye Solutions Group. Operation Information on the buyer Siblu owns and operates 23 large family holiday parks in France and the Netherlands. Siblu’s holiday parks are located across Normandy, the Brittany coastline, the west of France, the Loire Valley, the Mediterranean coast, Zeeland and the Wadden Sea. Information on the seller Campings Grand Sud is a selection of high-quality campsites and holiday parks in the south of France. In Les Landes, Gironde and Hérault, all our campsites are located at the water’s edge, either by the sea or by a lake. Rationale for the transaction The acquisition allows the European leader in open-air accommodation and the French leader in the sale of mobile homes to owner-occupiers to increase its total capacity by 3,500 pitches, i.e., an increase of 25%. Transaction information Translink Corporate Finance acted as the advisor to Siblu in acquiring 100% of Holding New Aire – Campings Grand Sud. Operation Information on the buyer PLD automobile is a vehicle distributor and repairer in the Aix-Marseille-Provence region. Its Volkswagen, Seat, Skoda, Audi, Toyota, Lexus, and Suzuki dealerships sell 9,000 new vehicles and 7,000 used vehicles each year, for a turnover of €350 million in 2021. Beyond the figures, customer satisfaction is the main objective. Information on the sellers BHL is a franchisee Europcar with 7 agencies in the south-east of France. Europcar is the European leader in car and light vehicle rental operating in over 140 countries. Rationale for the transaction Transaction information Translink Corporate Finance acted as the exclusive financial advisor to PLD Auto on the acquisition of a Europcar franchisee with 7 agencies in the south-east of France. Operation Information on the buyer ID Logistics is a global contract logistics group that generated €2.5 billion in revenue in 2022. The company is managed by Eric Hémar and operates 365 sites in 17 countries across Europe, America, Asia, and Africa. With over 8 million square meters of warehousing facilities and a team of 30,000 employees, ID Logistics provides end-to-end logistics solutions to businesses worldwide. Information on the seller Spedimex is a privately-owned contract logistics company based in Poland. It is managed by Marcin Bąk and specializes in providing end-to-end solutions for supply chain management. The company offers comprehensive services for storing and distributing goods, making it a one-stop-shop for businesses seeking efficient logistics solutions. Rationale for the transaction Transaction information Translink Corporate Finance acted as the exclusive advisor to the shareholders of Spedimex Sp. z o.o. on the 100% sale to ID Logistics Group S.A. Operation Information on the buyer Sterimed Group is a global leader in the field of medical packaging, servicing both medical device manufacturers and patient care facilities. Information on the seller Granton Medical is a manufacturer of sterilisation pouches and a provider of packing services for the medical device industry in the UK. Rationale for the transaction The acquisition of Granton Medical allows Sterimed Group to make a first step into contract packing and associated services to medical device companies. This is a major strategic axis for the years to come, as a continuation of the expansion of Sterimed’s portfolio of products and services to this industry. Transaction information Translink Corporate Finance acted as the exclusive advisor to Granton Medical on the sale to Sterimed Group. Operation Information on the buyer CEME is a national company of reference for electrical engineering, HVAC, and maintenance. They are involved in projects and services related to energy efficiency and thermal comfort for the tertiary sector, manufacturers, communities, and individuals. Information on the seller SEQUOR is part of Groupe SNEF, a multinational created in 1905 in France. They currently have 70 branches in France and 30 more around the world. They operate in the age of hyperintelligence for industrial development and transform data into experiences. Rationale for the transaction The acquisition allows CEME to extend their range of skills, particularly in the nuclear industry, and strengthens their geographical presence in the Mediterranean region. Transaction information Operation Information on the buyer Alvic is a Spanish company with a global presence and a leader in the manufacturing and distribution of high-quality panels and furniture components for the furniture and decoration industry. They are present in over one hundred countries across five continents. Information on the seller Since 1987, Stratagem has offered a wide range of “decorative laminate” products. From classic colours to the latest design trends, Stratagem endeavors to present you with as complete a panel as possible, both in terms of decorations and finishes. Rationale for the transaction Stratagem will enable the Alvic Group to strengthen its offer of high-quality bespoke worktops in France and Spain in the first instance, before expanding the service to other markets. Transaction information Translink Corporate Finance advised Alvic, a portfolio company of KKR and Artá Capital, on the acquisition of Stratagem. Operation Information on the buyer Groupe Ficade is a leading media group in the B2B field in Finance / Assets, Law / Audit / Accountancy, IT / Cybersecurity, Real estate / Town planning, and Architecture. Information on the seller Leaders League is a business services company and the rating agency with the largest presence on the ground around the world, with a team based in Paris, Lima, Rio de Janeiro, São Paulo, Milan, and Madrid. We deliver C-level events, comprehensive rankings and in-depth analysis designed to bring the world’s markets together. Rationale for the transaction Groupe Ficade bought Leaders League to create the first French B2B player in media and communication market. Transaction information Operation Information on the buyer Southern HVAC provides Air Conditioning, Heating, Electrical, and Plumbing repair and maintenance services throughout Florida, Georgia, South Carolina, North Carolina, Texas, Kansas, and Missouri. Information on the seller Pro Plumbing offers high-quality plumbing, electrical, heating, and air conditioning services to homeowners throughout the Greensboro, Winston-Salem, High Point and Lexington and NC markets. Rationale for the transaction The acquisition of Pro Plumbing by Southern HVAC builds on their already established plumbing & air service company brand servicing the greater Piedmont Triad area. Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor Southern HVAC on the acquisition of Pro Plumbing Air & Electric. Operation Information on the buyer Centre Technologies is a full-service IT consulting and managed services provider headquartered in Texas, focusing on mid-sized businesses. As a trusted IT partner for well over a decade, the business is recognized for its local experience and enterprise-grade cloud and cybersecurity solutions. Centre Technologies is committed to helping organizations harness the power of technology to maximize their operational efficiency and exceed their business goals. Information on the seller Since 2005, Commercial IT Solutions has served small and medium-sized businesses with managed services, cloud solutions, help desk support, and network support. Their goal has been to provide enterprises with cutting-edge IT practices and solutions to help businesses succeed. They have built and developed the perfect Cloud workspace, CIT Cloud Office, which offers small businesses a complete cloud solution at an affordable cost. Rationale for the transaction The acquisition marks the expansion of Centre Technologies coverage in the South-Central Texas area, providing San Antonio businesses with access to industry-leading managed IT services and cybersecurity. Transaction information Translink Corporate Finance in the US, Dinan & Company LLC, acted as the advisor to Centre Technologies, a portfolio company of Main Street Capital Corporation, on the acquisition of Commercial IT Solutions. Operation Information on the buyer Gausepohl Fleisch GmbH is an owner-managed family business with a long tradition in the meat industry. They specialise in the slaughtering and cutting of pork, as well as trading in all types of meat for the national and international market. Information on the buyer Carne Fleischhandel GmbH was founded in 2005 and is an established player in the growing emerging market of pork head meat led by a strong management team with a value-based company culture. Rationale for the acquisition The sale to Gausepohl Fleisch GmbH will allow Carne Fleischhandel GmbH to continue organic growth and build-up additional services and implement cross-selling strategies with investor’s operations. Transaction information Translink acted as the exclusive advisor to Carne Fleischhandel GmbH on the sale to Gausepohl Food GmbH. Operation Information on the buyer CECOP is the first global community leader in the sector. It is an expert in providing strategic solutions in operational management, development, training, and transformation of opticians. It currently has more than 7,000 members distributed around the 10 countries where it is present: Europe (Spain, Portugal, Italy, England, Ireland and France), Latin America (Brazil, Colombia and Mexico) and the USA. Information on the seller Vision Unlimited is a family-owned company that consistently provides its customers with high quality vision care. The company is committed to improve the vision of all its patients and provide them with leading vision correction technology and a high level of customer service, focusing on fulfilling each patients’ individual needs. Rationale for the transaction Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor CECOP on the acquisition of Vision Unlimited. Operation Information on the buyer DOC Brands Inc. is a well-established and emerging OTC supplier of consumer dental products, particularly with its leading brand Dentemp®, in the temporary tooth repair, denture and dental guard segments. Information on the seller OrVance LLC is a developer of proprietary oral health products and is based in Grand Rapids, Michigan. It is over 90% owned by orthodontists, dentists and its managing partners. Rationale for the transaction The partnership with OrVance strengthens DOC Brands’ oral care product line and their ability to continue to bring retailers and consumers meaningful advancements in consumer oral health. Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor to Doc Brands Inc. on its partnership with OrVance. Operation Information on the buyer Fortress Brand is a global digital marketplace accelerator that represents acclaimed brands across a multitude of industries, including beauty and personal care, health and wellness, and consumer product goods. Founded in 2012 and headquartered in New York, Fortress, along with its family of companies, School House, Finc3 Marketing Group, and Taylor & Pond, offers its clients an integrated platform to accelerate digital growth at any stage in a brand’s lifecycle including full-service marketplace management, brand strategy and creative services, 360-degree performance marketing, data analytics, and international strategy all under one roof. Fortress has been recognized as one of Inc.’s 5,000 Fastest-Growing Companies in 2020 and 2021 and is also trusted by Amazon as a verified agency partner. Information on the seller Taylor & Pond was founded in 1995 as one of the first digital agencies in the world to revolutionize the traditional print advertising and PR industry. We specialize in every aspect of digital marketing strategy, social media marketing, content creation, influencer marketing, paid digital media, creative development, email marketing and website development for the beauty & wellness industry. Rationale for the transaction The acquisition allows Fortress Brand to expand their capabilities and further deepen their beauty, health, and wellness expertise. Transaction information Translink Corporate Finance in the US, Dinan & Company LLC, acted as the advisor to Fortress Brand, a portfolio company of Trivest, in the acquisition of Taylor & Pond. Operation Information on the buyer Presto Group, the Nordic market leader in fire safety, makes 60,000+ customer visits per year to provide fire safety inspections, risk management and education, and other related services. Presto has operations in Sweden, Norway, and Finland. Information on the seller Safedo specialises in workplace safety. Their products and services include first aid products, first aid training and layperson defibrillators (AEDs). The Company is based in Kuopio, Finland. Rationale for the transaction The acquisition of Safedo also enables Presto Group to expand to the first aid consumables segment in its other markets. Transaction information Translink acted as the exclusive advisor to the shareholders of Safedo on the 100% sale to Presto Group. Operation Information on the buyer M3-operated M3 Global Research provides healthcare market research fieldwork, powered by the world’s largest proprietary provider panel of verified healthcare professionals, covering 27 countries. Offering a comprehensive portfolio of qualitative and quantitative methodologies, our ISO 20252 and ISO 27001 certifications underpin our focus on compliance and high-quality data. Information on the seller Founded in 2003 by the Baus family, and headquartered in Hilden, Germany, pharma-insight continues under the stewardship of co-founder Gabi Baus and the team, with Guido Baus supporting the integration of pharma-insight into the M3 family as a consultant. Their extensive healthcare research experience has fostered a culture of excellence in delivery, underpinned by strong social commitments and philanthropy, with their support of Wünsch Dir Was e.V., a non-profit organization supporting chronically and seriously ill children and young adults nationwide. Rationale for the transaction The acquisition further strengthens M3’s European presence, with pharma-insight’s dedicated German call centre, and coverage in Germany, UK, France, Denmark, Netherlands, Norway, Austria, Italy, Poland, Switzerland, Spain, and Czech Republic, alongside M3’s capabilities in US, Canada, Brazil, China, Japan, and South Korea. Transaction information Operation Information on the buyer DOC Brands Inc. is a well-established and emerging OTC supplier of consumer dental products, particularly with its leading brand Dentemp®, in the temporary tooth repair, denture and dental guard segments. Information on the seller OrVance LLC is a developer of proprietary oral health products and is based in Grand Rapids, Michigan. It is over 90% owned by orthodontists, dentists and its managing partners. Rationale for the transaction The partnership with OrVance strengthens DOC Brands’ oral care product line and their ability to continue to bring retailers and consumers meaningful advancements in consumer oral health. Transaction information Translink Corporate Finance in the US, Dinan and Company LLC, acted as the advisor to Doc Brands Inc. on its partnership with OrVance. Operation

Bpifrance Investments

1,518 Investments

Bpifrance has made 1,518 investments. Their latest investment was in Tenergie as part of their Unattributed - II on August 10, 2023.

Bpifrance Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

8/10/2023 | Unattributed - II | Tenergie | $85.6M | Yes | Bpifrance, CIC, and Groupe BPCE | 1 |

8/9/2023 | Grant | Advanced BioDesign | $3.29M | Yes | 1 | |

7/28/2023 | Series A | Mob Energy | $11.03M | Yes | 3 | |

7/27/2023 | PIPE | |||||

7/25/2023 | Loan |

Date | 8/10/2023 | 8/9/2023 | 7/28/2023 | 7/27/2023 | 7/25/2023 |

|---|---|---|---|---|---|

Round | Unattributed - II | Grant | Series A | PIPE | Loan |

Company | Tenergie | Advanced BioDesign | Mob Energy | ||

Amount | $85.6M | $3.29M | $11.03M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | Bpifrance, CIC, and Groupe BPCE | ||||

Sources | 1 | 1 | 3 |

Bpifrance Portfolio Exits

159 Portfolio Exits

Bpifrance has 159 portfolio exits. Their latest portfolio exit was EZ-Wheel on August 01, 2023.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/1/2023 | Corporate Majority | 1 | |||

7/27/2023 | Acquired | 1 | |||

7/25/2023 | Acquired | 4 | |||

Date | 8/1/2023 | 7/27/2023 | 7/25/2023 | ||

|---|---|---|---|---|---|

Exit | Corporate Majority | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 1 | 1 | 4 |

Bpifrance Acquisitions

56 Acquisitions

Bpifrance acquired 56 companies. Their latest acquisition was Lindera Group on July 05, 2023.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

7/5/2023 | Acq - Fin | 2 | ||||

5/5/2023 | Acq - Fin | 2 | ||||

3/28/2023 | Acq - Fin | 2 | ||||

3/23/2023 | Private Equity | |||||

3/9/2023 | Private Equity |

Date | 7/5/2023 | 5/5/2023 | 3/28/2023 | 3/23/2023 | 3/9/2023 |

|---|---|---|---|---|---|

Investment Stage | Private Equity | Private Equity | |||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acq - Fin | Acq - Fin | Acq - Fin | ||

Sources | 2 | 2 | 2 |

Bpifrance Fund History

13 Fund Histories

Bpifrance has 13 funds, including French Tech Souveraineté.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/29/2022 | French Tech Souveraineté | $166.62M | 2 | ||

9/4/2020 | Bpifrance Hexagone 1 FPCI | $49.24M | 1 | ||

5/25/2020 | LAC 1 | $4,677.82M | 1 | ||

12/4/2017 | Digital Health Fund | ||||

11/20/2017 | Defense Investment Vehicle |

Closing Date | 3/29/2022 | 9/4/2020 | 5/25/2020 | 12/4/2017 | 11/20/2017 |

|---|---|---|---|---|---|

Fund | French Tech Souveraineté | Bpifrance Hexagone 1 FPCI | LAC 1 | Digital Health Fund | Defense Investment Vehicle |

Fund Type | |||||

Status | |||||

Amount | $166.62M | $49.24M | $4,677.82M | ||

Sources | 2 | 1 | 1 |

Bpifrance Partners & Customers

10 Partners and customers

Bpifrance has 10 strategic partners and customers. Bpifrance recently partnered with ARISE Integrated Industrial Platforms on February 2, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/16/2023 | Partner | Mauritius | Mr. Gagan Gupta , founder and CEO of Arise IIP , added : `` This ambitious programme with our trusted partner , Bpifrance , will accelerate the development of French SMEs in Africa . | 1 | |

12/15/2022 | Vendor | United Kingdom | Bpifrance taps Thought Machine for Vault Core banking platform French public investment bank Bpifrance has tapped core banking vendor Thought Machine for its cloud-native core banking platform Vault Core , as it looks to upgrade its financial services offering to businesses . | 3 | |

6/24/2022 | Partner | South Africa | Bpifrance Strengthens Its Economic Links With Africa - Bpifrance.com Bpifrance has maintained closed relationship with Africa , either with entrepreneurs or with funds . | 1 | |

2/25/2022 | Partner | ||||

2/24/2022 | Partner |

Date | 2/16/2023 | 12/15/2022 | 6/24/2022 | 2/25/2022 | 2/24/2022 |

|---|---|---|---|---|---|

Type | Partner | Vendor | Partner | Partner | Partner |

Business Partner | |||||

Country | Mauritius | United Kingdom | South Africa | ||

News Snippet | Mr. Gagan Gupta , founder and CEO of Arise IIP , added : `` This ambitious programme with our trusted partner , Bpifrance , will accelerate the development of French SMEs in Africa . | Bpifrance taps Thought Machine for Vault Core banking platform French public investment bank Bpifrance has tapped core banking vendor Thought Machine for its cloud-native core banking platform Vault Core , as it looks to upgrade its financial services offering to businesses . | Bpifrance Strengthens Its Economic Links With Africa - Bpifrance.com Bpifrance has maintained closed relationship with Africa , either with entrepreneurs or with funds . | ||

Sources | 1 | 3 | 1 |

Loading...