Branch

Founded Year

2017Stage

Series D | AliveTotal Raised

$221.47MAbout Branch

Branch specializes in providing home and auto insurance services within the insurance industry. The company offers a process for customers to obtain insurance quotes and purchase policies online, with options for personalizing coverage and bundling insurance products for potential savings. It was founded in 2017 and is based in Columbus, Ohio.

Loading...

Branch's Product Videos

ESPs containing Branch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The full-stack insurtech carriers — auto market comprises insurtech carriers that underwrite automotive insurance. As with established carriers, insurtech carriers will typically also be licensed by respective authorities and undergo review by rating agencies. The use of alternative data (such as from telematics sensors) is often central to proactive risk management and underwriting practices empl…

Branch named as Leader among 12 other companies, including Digit Insurance, Lemonade, and Root Insurance.

Branch's Products & Differentiators

Auto Insuramce

instant, bundled car insurance available with just name and address.

Loading...

Research containing Branch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Branch in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market map

Jun 15, 2022 report

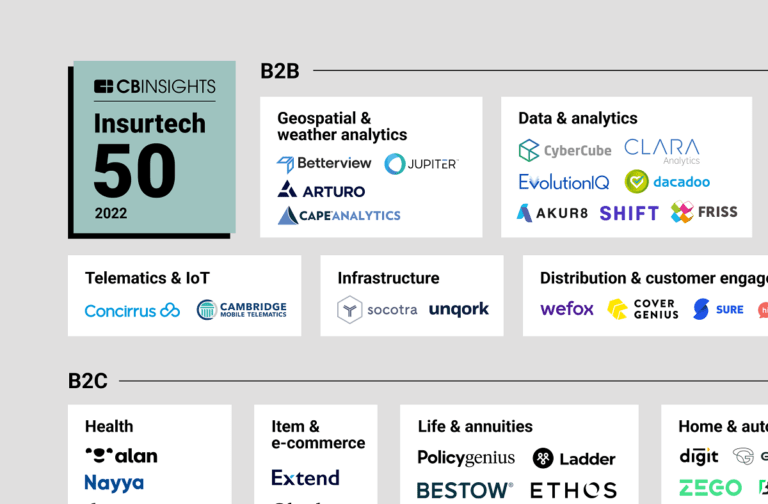

Insurtech 50: The most promising insurtech startups of 2022Expert Collections containing Branch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Branch is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,486 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,244 items

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,228 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Branch News

Feb 6, 2024

To print this article, all you need is to be registered or login on Mondaq.com. In coordinated actions, the New York State Department ofFinancial Services (NYDFS) and the Federal Reserve Board (FRB)fined the Industrial and Commercial Bank of China, Ltd. (ICBC) andits New York branch (Branch, a New York-based subsidiary) $30million and approximately $2.4 million, respectively. The Branch,which operates under the jurisdiction of both examiningauthorities, was found to have improperly disclosed confidentialsupervisory information (CSI), backdated certain books and records,and failed to self-report the impropriety of its books and recordswhen the issue came to light. These coordinated enforcement actionssignal the regulators' interest and seriousness in protectingCSI and emphasize NYDFS' focus on self-reportingmisconduct. Key Takeaways: NYDFS coordinates with federal prudential regulators forenforcement related to banking institutions. Maintaining confidentiality of CSI is a significant interest ofregulators and disclosure can only be made with approval of therelevant regulatory authority. Financial institutions are expected to have policies andprocedures in place to properly manage recordkeeping and disclosureof CSI. Regulators, particularly NYDFS, have strong expectations forfinancial institutions to self-report certain conduct. Governanceand Self-Reporting Expectations Governance and Self-Reporting Expectations NYDFS has heightened expectations for self-reporting misconduct,which is codified in its regulations. For example, § 300.1(a)of Title 3 of the New York Codes, Rules and Regulations requiresimmediate reporting (upon discovery) of misconduct relating to"embezzlement, misapplication, larceny, forgery, fraud,dishonesty, making of false entries and omission of true entries,or other misconduct, whether or not a criminal offense, in whichany director, trustee, partner, officer, employee (excludingtellers), or agent of such organization is involved." In thisICBC Consent Order , NYDFS found thatthe Branch had violated § 300.1(a) because a bank employeebackdated signatures on certain client certifications in connectionwith its Know Your Customer program. Despite the Branchand ICBC representing that the certifications did not become partof the bank client's files, NYDFS found the action a violationof New York Banking Law § 200-c for failing to maintainappropriate books and records. Furthermore, NYDFS faulted the bankfor failing to immediately report this incident upon discovery,when originally flagged to ICBC by one of its employees in 2017.The issue was internally investigated by ICBC and the investigationconcluded in April 2017 that the records were in fact backdated.The backdating of the records constitutes a false entry, whichNYDFS declared should have been immediately reported. However, ICBCdid not report the incident until January 2018. Despite ICBC takingthe needed action to investigate the issue, NYDFS, in its ConsentOrder, emphasizes its expectations regarding immediateself-reporting. Confidential Supervisory Information CSI can be broadly defined and varies in its scope acrossdifferent state and federal regulators. For example, NYDFS definesCSI as any "reports of examinations and investigations [ofNYDFS-supervised institution and affiliates], correspondence andmemoranda concerning or arising out of such examination andinvestigations, including duly authenticated copy or copiesthereof," as well as any confidential materials shared byNYDFS with any governmental agency or unit. 3 NYCCR § 7.1(1);New York Banking Law § 36.10. Meanwhile, FRB defines CSI as"information that is or was created or obtained in furtheranceof the [Federal Reserve's] supervisory, investigatory orenforcement activities," including reports of examination,inspection and visitation, confidential operating and conditionreports, supervisory assessments, investigative requests fordocuments or other information, and supervisory correspondence orother supervisory communications. 12 C.F.R. §§ 261.Regardless of the definition, regulators are the ultimate owners ofCSI, meaning a financial institution cannot disclose CSI, even toother government agencies, without the written approval of thegoverning regulator. At issue in these consent orders are examination-relateddocuments that generated CSI pursuant to New York Banking Law§ 36.10. These CSI materials were not permitted to bedisclosed without NYDFS and FRB's approval. 3 NYCCR §7.2. ; 12 C.F.R. §§ 261.4, 261.20. However, ICBC failed tocomply with these requirements when transferring a Branch employeeto an overseas affiliate in December 2021. During the transfer, theNew York Branch provided CSI to an overseas affiliate, whodisclosed the CSI to a foreign regulator while the Branch'srequest for authorization to release the CSI was pending or underreview with NYDFS, FRB, and the Federal Reserve Bank of New York.The Branch learned of the CSI breach in December 2021, and did notreport the breach to NYDFS and FRB until two weeks later. In theresulting Consent Order, FRB emphasized the Branch's lack ofadequate controls related to the use and dissemination of CSI. TheNYDFS Consent Order, and similarly the FRB Consent Order , signal the regulators'seriousness in managing CSI and the applicable expectations forimmediate self-reporting of unauthorized disclosures. In addition to the assessed total fines of $32.4 million, bothconsent orders require additional remediation efforts. For example,NYDFS and FRB have each imposed additional non-monetary penaltiesincluding providing periodic progress reports relating to AML/BSAand CSI compliance programs and establishing and reporting oncontrols and governance relating to both. The FRB is also requiringthe designation of a CSI officer who must be a voting member of theBranch's risk management committee. The Bottom Line Financial institutions are expected to have policies andprocedures, internal controls, and adequate governance surroundingthe handling of and protection of CSI, even when dealing withaffiliates. Additionally, in its consent order, NYDFS has made itvery clear how seriously it takes self-reporting and that, in thisinstance, waiting two weeks post-discovery of a reportable incidentdid not meet its "immediate" reporting expectation. The content of this article is intended to provide a generalguide to the subject matter. Specialist advice should be soughtabout your specific circumstances.

Branch Frequently Asked Questions (FAQ)

When was Branch founded?

Branch was founded in 2017.

Where is Branch's headquarters?

Branch's headquarters is located at 20 East Broad Street, Columbus.

What is Branch's latest funding round?

Branch's latest funding round is Series D.

How much did Branch raise?

Branch raised a total of $221.47M.

Who are the investors of Branch?

Investors of Branch include Gaingels, Greycroft, SignalFire, American Family Ventures, Acrew Capital and 14 more.

Who are Branch's competitors?

Competitors of Branch include Hippo and 4 more.

What products does Branch offer?

Branch's products include Auto Insuramce and 4 more.

Loading...

Compare Branch to Competitors

Openly provides a homeowner insurance platform. It offers home insurance coverage to consumers through independent agents. Openly was founded in 2017 and is based in Boston, Massachusetts.

Swyfft is a company that focuses on the insurance industry, specifically homeowners insurance. The company uses unique data sources and analytics to provide homeowners insurance quotes in a quick and efficient manner. Swyfft primarily serves the insurance industry. It is based in Morristown, New Jersey.

Kin is a company focused on providing affordable home insurance solutions within the insurance industry. The company offers a range of products including homeowners, mobile home, condo, flood, landlord, and hurricane insurance, all designed to protect customers' properties and interests in the event of disasters or other damages. Kin's insurance products are tailored to meet the needs of homeowners and property investors, offering customizable policies and direct purchasing options to keep costs down. Kin was formerly known as Bright Policy. It was founded in 2016 and is based in Chicago, Illinois.

Branch Media is a company that operates in the insurance industry, with a focus on home and auto insurance. The company offers simple and quick insurance coverage services, allowing customers to see their price and purchase within seconds using just their name and address. The company primarily serves the insurance industry. Branch Media was formerly known as Roundtable Media. It is based in New York, New York. Branch Media operates as a subsidiary of Meta.

Surround Insurance is a company that focuses on providing insurance services in the financial sector. The company offers a range of insurance products including auto insurance, non-owner auto insurance, renters insurance, and coverage for biking and walking. These services are designed to cater to the needs of modern consumers, particularly those in their 20s and 30s, offering fast, simple, and personalized insurance solutions. It was founded in 2018 and is based in Cambridge, Massachusetts.

Allegory is an insurance technology company that focuses on the mobility and insurance sectors. The company offers a driving app that promotes safety on the road and provides rewards for good driving habits. It also provides a digital wallet for insurance and a solution for tracking business mileage. It was founded in 2019 and is based in Toronto, Ontario.

Loading...