Bunq

Founded Year

2012Stage

Series B - III | AliveTotal Raised

$368.05MLast Raised

$31.41M | 7 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-1 points in the past 30 days

About Bunq

Bunq focuses on providing financial services. The company offers a range of banking products including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

Loading...

Bunq's Product Videos

Bunq's Products & Differentiators

bunq account in 5 minutes

Bank account that's ready to use in 5 minutes

Loading...

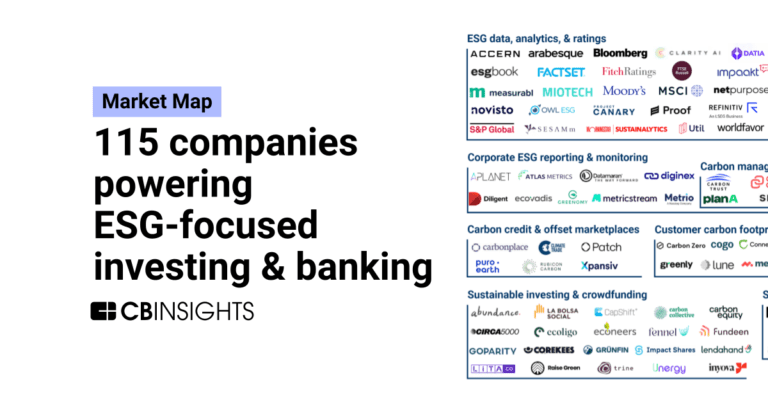

Research containing Bunq

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bunq in 1 CB Insights research brief, most recently on May 24, 2023.

Expert Collections containing Bunq

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bunq is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Fintech

13,396 items

Excludes US-based companies

Digital Banking

1,008 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

100 items

Bunq Patents

Bunq has filed 3 patents.

The 3 most popular patent topics include:

- banking

- banking technology

- international taxation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2017 | 11/6/2018 | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop | Grant |

Application Date | 5/18/2017 |

|---|---|

Grant Date | 11/6/2018 |

Title | |

Related Topics | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop |

Status | Grant |

Latest Bunq News

Sep 16, 2024

Dutch neobank Bunq aims to increase headcount by 70% before end of 2024 16th September 2024 Dutch neobank Bunq is seeking to expand its current workforce by 70% by the end of this year with an emphasis on “bolstering its commercial functions”. Bunq to expand global workforce by 70% The planned hiring spree will bring over 730 new employees to Bunq’s marketing, business development, sales and market analysis departments as the company looks to double down on its expansion efforts. A statement released by the neobank also confirms plans to hire “international expansion specialists”, with additional openings for user support, development and quality assurance roles. The majority of new hires will be supported by a “tailored digital nomad program” for remote working assurance, the company adds. Headquartered in Amsterdam, Bunq currently maintains offices in Bulgaria, Germany, France, Ireland, Spain, the UK, and the US, where it lodged a banking licence application last year. The company has also applied for an Electronic Money Institution (EMI) licence in the UK as it looks to challenge the likes of Monzo and Revolut in the country. “To keep our skyrocketing growth soaring, we’re looking for user-centric, entrepreneurial minds who crave growth and love a challenge,” comments founder and CEO Ali Niknam. Bunq notably stepped into 2024 with a net profit of €53.1 million for the previous year, marking its first full year of profitability since its inception in 2012.

Bunq Frequently Asked Questions (FAQ)

When was Bunq founded?

Bunq was founded in 2012.

Where is Bunq's headquarters?

Bunq's headquarters is located at Naritaweg 131-133, Amsterdam.

What is Bunq's latest funding round?

Bunq's latest funding round is Series B - III.

How much did Bunq raise?

Bunq raised a total of $368.05M.

Who are the investors of Bunq?

Investors of Bunq include Pollen Street Capital.

Who are Bunq's competitors?

Competitors of Bunq include Monese, Allica Bank, Finom, Qonto, Vivid Money and 7 more.

What products does Bunq offer?

Bunq's products include bunq account in 5 minutes and 4 more.

Loading...

Compare Bunq to Competitors

N26 provides a mobile banking platform. It gives customers a solution to control finances. The company allows users to open an N26 account directly from their phone or computer. It also offers insights into spending habits. The company was founded in 2013 and is based in Berlin, Germany.

Lydia is a financial technology company specializing in mobile and digital banking services. The company offers a range of products including a digital current account, multi-account management, and tools for shared expenses, catering to the needs of modern consumers seeking efficient and secure online financial management. Lydia's services are designed to facilitate everyday banking, instant money transfers, and secure online payments without fees on international transactions. It was founded in 2011 and is based in Paris, France.

Qonto is a business finance solution specializing in banking, financing, bookkeeping, and spend management for small and medium enterprises (SMEs) and freelancers. The company offers an online platform that includes business accounts with Mastercard debit cards, invoice management, and tools for expense and cash flow management. Qonto primarily serves the needs of small and medium-sized enterprises, freelancers, and various associations seeking efficient financial management solutions. It was founded in 2016 and is based in Paris, France.

Tide is a financial business platform offering digital banking services in the financial sector. The company provides FSCS-protected bank accounts in partnership with ClearBank and e-money accounts through PrePay Solutions, with a suite of business account administration tools including accounting software integration, expense management, and customizable invoicing. Tide caters to UK and Indian SMEs with a focus on saving time and money for its members. It was founded in 2015 and is based in London, United Kingdom.

Bitwala offers a transactions and blockchain investment platform. It provides an all-in-one platform combining a regular bank account, crypto wallets, and seamless bitcoin and Ethereum trading options. Its customers can buy and sell Bitcoin and Ether online or mobile with liquidity directly from their bank account. Bitwala was formerly known as Nuri. The company was founded in 2014 and is based in Berlin, Germany.

ConnectPay is a financial platform operating in the fintech industry. The company offers a range of services including banking for businesses and individuals, cross-border and multi-currency payments, and merchant services. It primarily serves online businesses, marketplaces, and fintechs. It was founded in 2017 and is based in Vilnius, Lithuania.

Loading...