Human Interest

Founded Year

2015Stage

Debt | AliveTotal Raised

$730.72MValuation

$0000Last Raised

$25M | 2 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-7 points in the past 30 days

About Human Interest

Human Interest focuses on providing retirement savings solutions. It offers full-service 401(k) and 403(b) plans, making it easier for small and medium-sized businesses to help their employees save for retirement. Its services primarily cater to the small and medium business sectors. It was formerly known as Captain401. The company was founded in 2015 and is based in San Francisco, California.

Loading...

Human Interest's Product Videos

_Retirement_Plans_for_Nonprofits_thumbnail.png?w=3840)

ESPs containing Human Interest

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The benefits administration market is focused on providing solutions to employers to help them manage their employee benefits programs. This includes retirement plans, health insurance, wellness programs, and more. The market is driven by the need for employers to attract and retain top talent, comply with government regulations, and provide a competitive benefits package. The market is highly com…

Human Interest named as Challenger among 15 other companies, including Automatic Data Processing, Oscar, and Castlight Health.

Human Interest's Products & Differentiators

401(k) Plans

A customized, full-service retirement plan with transparent pricing. -In-house recordkeeping with automated plan administration that tracks participation, contributions, and distributions. -Robust reporting for a 360-degree view of your plan -Regulatory support by prepping select government filings -Plan compliance and IRS testing preparation.

Loading...

Research containing Human Interest

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Human Interest in 5 CB Insights research briefs, most recently on Mar 22, 2023.

Expert Collections containing Human Interest

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Human Interest is included in 7 Expert Collections, including HR Tech.

HR Tech

4,169 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,244 items

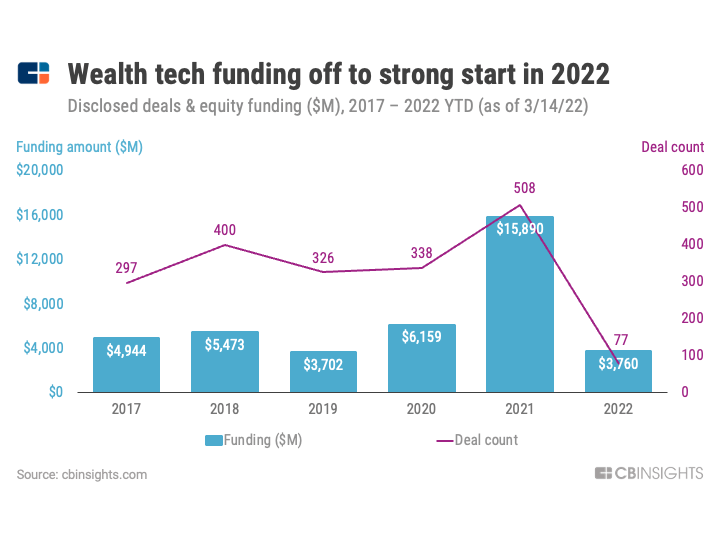

Wealth Tech

2,528 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

SMB Fintech

2,003 items

Fintech 100

750 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest Human Interest News

Jul 20, 2024

The Week’s 10 Biggest Funding Rounds: Cardurion Pharmaceuticals And Human Interest Nab Largest Raises Views: 0 Want to keep track of the largest startup funding deals in 2024 with our curated list of $100 million-plus venture deals to U.S.-based companies? This is a weekly feature that runs down the week’s top 10 announced funding rounds in the U.S. Check out last week’s biggest funding rounds here . Eight startups raised $100 million or more this week as a biotech and financial services company led the way. In fact, the big rounds came from everywhere, including automotive, fintech and IT software. Notice anything missing? Yep, no huge AI raise. 1. Cardurion Pharmaceuticals , $260M, biotech: Cardurion Pharmaceuticals led the way for biotech startups raising big money this week, as the Burlington, Massachusetts-based biotech firm raised a $260 million Series B financing led by Ascenta Capital . The startup is focused on developing therapeutics for the treatment of cardiovascular diseases. Founded in 2017, the company has raised more than $600 million, per Crunchbase . 2. Human Interest , $242M, financial services: Retirement planning is big business and it also can apparently produce big valuations. San Francisco-based Human Interest offers small businesses the ability to more easily offer 401(k) plans to their employees. The company locked up a $267 million round led by investment firms Baillie Gifford and Marshall Wace that values the company at $1.3 billion. The round included $25 million of debt. The company said it recently surpassed $100 million in annual recurring revenue. Founded in 2015, Human Interest says it has raised more than $700 million in total primary and secondary financings. 3. Tekion , $200M, automotive: Providing a software platform to the retail automotive industry may not be the sexiest of technology plays, but it obviously can make a valuable company. Tekion, whose software connects manufacturers, retailers and others, raised a $200 million growth equity round from Dragoneer Investment Group that values the company at more than $4 billion. Bloomberg reported that the startup now has between $100 million and $200 million in revenue. Founded in 2016, the company has raised $635 million, per Crunchbase . 4. Saronic , $175M, defense: Autonomous surface vessels maker Saronic locked up a $175 million Series B at a $1 billion valuation led by Andreessen Horowitz — minting the defense tech startup as the newest unicorn in the growing sector. The Austin, Texas-based startup designs and manufactures autonomous surface vehicles — basically drones for the U.S. Navy that move along the water surface. Founded in 2022, the company has raised $245 million, per Crunchbase . Saronic’s new round comes just about a week after Germany-based Helsing , which develops artificial intelligence software for defense, raised approximately $489 million in funding led by General Catalyst that valued the company at $5.4 billion. With the new rounds, global venture dollars in defense tech this year has now passed $1 billion, per Crunchbase data . That is still behind last year’s pace, when such funding hit nearly $2 billion for all of 2023. 5. Scorpion Therapeutics , $150M, biotech: Yet another big biotech round. Scorpion Therapeutics, a clinical-stage precision oncology company, closed a $150 million Series C co-led by Frazier Life Sciences and Lightspeed Venture Partners . The Boston-based startup will use the new cash for further development of its program for the treatment of breast cancer and other solid tumors. Founded in 2020, the company has raised $420 million, per Crunchbase . 6. Aven , $142M, fintech: San Francisco-based Aven, which offers consumer credit cards backed by home equity, raised a $142 million Series D round of funding led by General Catalyst and Khosla Ventures . Founded in 2019, this is the company’s first disclosed round, per Crunchbase . 7. NGM Biopharmaceuticals , $122M, biotech: South San Francisco-based NGM Biopharmaceuticals locked up a $122 million Series A led by The Column Group . The company is developing therapeutics for, among other things, liver diseases and issues during pregnancy. Founded in 2007, the company has raised more than $542 million, per Crunchbase . 8. Kandji , $100M, information technology: San Diego-based Kandji, an Apple device management platform, raised $100 million in capital from General Catalyst valuing the startup at $850 million. Founded in 2018, the company has raised more than $288 million, per Crunchbase . 9. Halo Industries , $80M, semiconductor: Santa Clara, California-based Halo Industries, a developer of a laser manufacturing technology platform for the semiconductor industry, raised an $80 million Series B led by US Innovative Technology Fund . Founded in 2014, this is the company’s first disclosed raise, per Crunchbase . 10. DreamBig Semiconductor , $75M, semiconductor: San Jose, California-based DreamBig Semiconductor locked up a $75 million equity round co-led by the Samsung Catalyst Fund and Sehat Sutardja . DreamBig, founded in 2019, develops chiplet platforms, and its specialties include applications in large language models, generative AI and more. The company has raised nearly $93 million, per Crunchbase data . Big global deals Sydney-based renewable energy startup Symphony locked up a Series A worth approximately $201 million. Methodology We tracked the largest announced rounds in the Crunchbase database that were raised by U.S.-based companies for the seven-day period of July 13 to July 19. Although most announced rounds are represented in the database, there could be a small time lag as some rounds are reported late in the week. Crunchbase Daily. All four companies joining the board are U.S.-based and — surprisingly — not pure-play AI companies. Equity funding to startups focused on cleantech and sustainability is down this year. However, that decline is counter-balanced somewhat by ultra… Menlo Ventures launched a new $100 million fund called the Anthology Fund, in partnership with its portfolio company Anthropic. It’s just the latest… Funding to cybersecurity startups had its best quarter in more than two years, with $4.4 billion rolling to VC-backed companies. The dollar figure is… PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here. PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

Human Interest Frequently Asked Questions (FAQ)

When was Human Interest founded?

Human Interest was founded in 2015.

Where is Human Interest's headquarters?

Human Interest's headquarters is located at 655 Montgomery Street, San Francisco.

What is Human Interest's latest funding round?

Human Interest's latest funding round is Debt.

How much did Human Interest raise?

Human Interest raised a total of $730.72M.

Who are the investors of Human Interest?

Investors of Human Interest include Marshall Wace Asset Management, Baillie Gifford, U.S. Venture Partners, Operator Collective, ACT Venture Capital and 36 more.

Who are Human Interest's competitors?

Competitors of Human Interest include Folio, Vestwell, Raisin, Blooom, ForUsAll and 7 more.

What products does Human Interest offer?

Human Interest's products include 401(k) Plans and 1 more.

Who are Human Interest's customers?

Customers of Human Interest include Center for Empowering Refugees and Immigrants (CERI) , Epaulette Agency and Kevin Cradock Builders.

Loading...

Compare Human Interest to Competitors

ForUsAll offers a platform enabling employers to provide a modern 401(k) plan. The company offers 401(k) plans for startups and small businesses, with features such as payroll integration, the ability to add cryptocurrency to the plan, and automated administration. It caters to the startup sector, small to medium-sized businesses, and blockchain and web3 companies. The company was founded in 2012 and is based in San Francisco, California.

Betterment operates as a digital investment advisor focusing on automated investing and savings services within the financial technology sector. The company offers a range of products including automated portfolio management, and tax-advantaged retirement accounts that aid personal finance management for individuals. Betterment provides diversified investment portfolios, tax-loss harvesting, and financial planning tools to help clients achieve their financial goals. It was founded in 2008 and is based in New York, New York.

SigFig focuses on digital wealth management solutions within the financial services industry. The company offers a suite of products that facilitate effortless and compliant account opening, client onboarding, investment management, and financial planning for various financial institutions. SigFig's solutions cater to banks, credit unions, wealth management firms, insurance companies, and individual investors. It was founded in 2006 and is based in San Francisco, California.

Wacai operates as a fin-tech company. It develops an online personal financial management platform that provides users with wealth management services and credit solutions. The company was founded in 2009 and is based in Hangzhou, China.

Raisin provides a savings and investment marketplace. It allows users to compare savings products from banks and credit unions. The company also offers various tools to help users find savings products as per their needs. It was formerly known as SaveBetter. The company was founded in 2012 and is based in Berlin, Germany.

Wealthsimple operates in the investment management industry. The company offers a range of services including managed investing, investing, and high-interest savings accounts. These services are designed to help individuals build long-term wealth by maximizing returns and minimizing risk. Wealthsimple was formerly known as Canadian Shareowner Investments. It was founded in 2014 and is based in Toronto, Canada.

Loading...