Carbonplace

Founded Year

2021Stage

Seed | AliveTotal Raised

$45MLast Raised

$45M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+29 points in the past 30 days

About Carbonplace

Carbonplace is a global carbon credit transaction network operating within the environmental finance sector. The company provides a platform for the secure and transparent transfer, management, and retirement of certified carbon credits, utilizing blockchain-enabled distributed ledger technology. Carbonplace primarily serves banks, corporate buyers and sellers of carbon credits, and finance partners in the voluntary carbon market. It was founded in 2021 and is based in London, England.

Loading...

ESPs containing Carbonplace

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

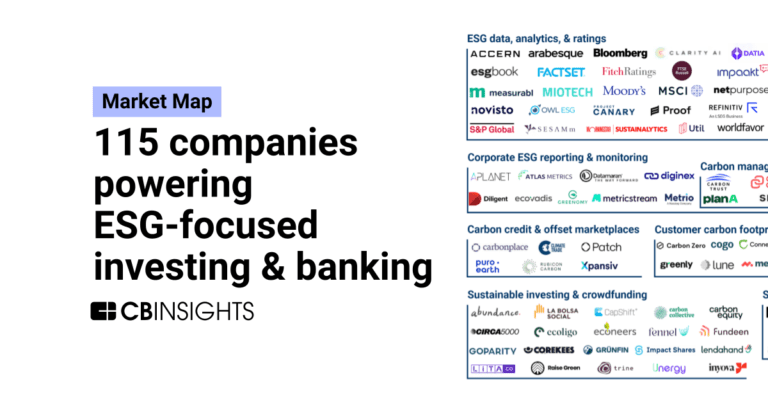

The blockchain-enabled carbon credits market offers a transparent and secure way to trade carbon credits. This market utilizes blockchain technology to ensure the authenticity of carbon credits, thereby reducing the risk of fraud and double-counting. Moreover, the use of blockchain allows for faster and more efficient transactions, reducing transaction costs and increasing liquidity. By participat…

Carbonplace named as Highflier among 14 other companies, including ACX, Flowcarbon, and ClimateTrade.

Loading...

Research containing Carbonplace

Get data-driven expert analysis from the CB Insights Intelligence Unit.

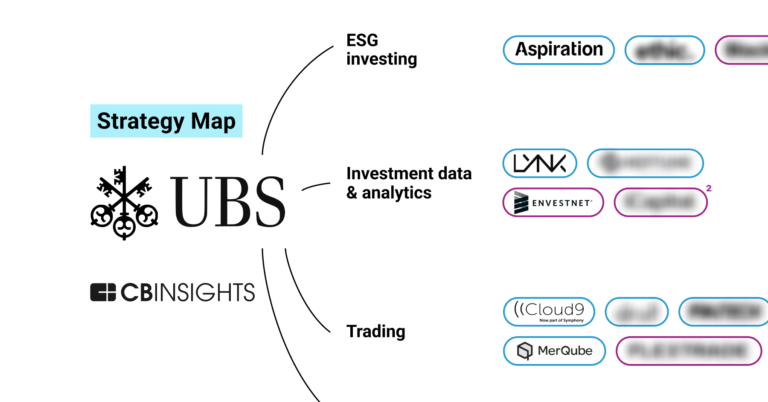

CB Insights Intelligence Analysts have mentioned Carbonplace in 5 CB Insights research briefs, most recently on Sep 12, 2023.

Expert Collections containing Carbonplace

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Carbonplace is included in 3 Expert Collections, including Decarbonization Tech.

Decarbonization Tech

2,372 items

Companies in the Decarbonization & ESG space, including those working on enterprise and cross-industry decarbonization and emissions monitoring solutions, as well as ESG monitoring and carbon accounting.

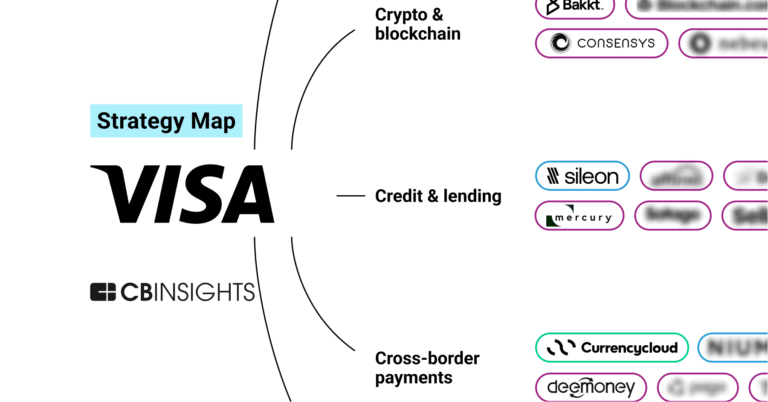

Blockchain

8,276 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,396 items

Excludes US-based companies

Latest Carbonplace News

Aug 29, 2024

| Key Players Carbonplace, Carbonex News Provided By Share This Article Carbon Credit Trading Platform Market size WILMINGTON, DE , UNITED STATES, August 29, 2024 / EINPresswire.com / -- The carbon credit trading platform market was valued at $112.4 million in 2022, and is estimated to reach $556.8 million by 2032, growing at a CAGR of 17.4% from 2023 to 2032. The carbon credit trading platform industry refers to the dynamic ecosystem that allows the buying and selling of carbon credits, an indispensable factor of carbon emissions reduction strategies. Carbon credits symbolize the right to emit a specific amount of greenhouse gases, and they are traded to offset emissions and combat climate change. The platform plays a pivotal function in enabling corporations and industries to comply with environmental regulations and undertake sustainable practices. 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 : https://www.alliedmarketresearch.com/request-sample/A145082 The carbon credit trading platform market serves as a crucial ecosystem for facilitating the exchange of carbon credits, pivotal in reducing greenhouse gas emissions. These credits signify emission allowances, traded to counteract environmental impact. The platform's significance lies in enabling corporations to adhere to environmental regulations and adopt sustainable practices. Several factors make contributions to the carbon credit trading platform market growth. Governments worldwide have intensified their efforts to fight climate change by imposing carbon pricing mechanisms and emission reduction targets. These initiatives have accelerated the demand for carbon credit as corporations search to offset their carbon footprint and obtain carbon neutrality. Technological advancements have played an imperative role in driving the expansion of the carbon credit trading platform market size. Carbon credit trading platforms leverage contemporary technologies such as blockchain to make sure that there is transparency, security, and traceability in carbon savings transactions. These innovations have extended the effectiveness and accessibility of the market, attracting a broader range of participants, from multinational companies to smaller enterprises. Despite the market's growth, some challenges exist. One such venture is the complexity and standardization of carbon deposit methodologies. Different industries and regions regularly have varying standards and protocols for measuring and verifying carbon emissions reductions. This lack of uniformity creates limitations for market contributors and expands transaction costs. 𝐁𝐮𝐲 𝐍𝐨𝐰 & 𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐎𝐧 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.alliedmarketresearch.com/checkout-final/2267e39b2c8fff3e06d8705d8a803274 Moreover, the market faces the task of precisely quantifying the environmental impact of carbon credits. Robust methodologies and data-driven calculations are fundamental to make sure the legitimacy and effectiveness of carbon offset projects.However, amidst these challenges, numerous possibilities present themselves in the carbon credit trading platform market. The rise in international cognizance of local weather exchange and the need for sustainable practices have resulted in an elevated interest in carbon offsetting by groups and individuals. This surge in demand opens the door for innovative projects and initiatives that generate carbon credits, such as reforestation efforts, renewable energy projects, and energy efficiency initiatives. Regulatory help plays an imperative role in the promotion of the carbon credit score buying and selling platform market. Governments and global companies have recognized the significance of carbon markets as a skill to reap climate goals. Supportive policies and frameworks supply balance and motivate market participation, leading to improved investments in carbon offset projects. The abovementioned factors will provide carbon credit trading platform market opportunities for growth. The carbon credit trading platform market is segmented on the basis of type, system type, end use, and region. On the basis of type, it is bifurcated into voluntary and compliance. On the basis of system type, it is categorized into cap and trade, and baseline and credit. On the basis of end use, it is segregated into industrial, utilities, energy, petrochemical, aviation, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. 𝐈𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚𝐧𝐲 𝐪𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬, 𝐏𝐥𝐞𝐚𝐬𝐞 𝐟𝐞𝐞𝐥 𝐟𝐫𝐞𝐞 𝐭𝐨 𝐜𝐨𝐧𝐭𝐚𝐜𝐭 𝐨𝐮𝐫 𝐚𝐧𝐚𝐥𝐲𝐬𝐭 𝐚𝐭: https://www.alliedmarketresearch.com/connect-to-analyst/A145082 𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐊𝐞𝐲 𝐅𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐒𝐭𝐮𝐝𝐲: On the basis of type, the voluntary segment emerged as the global leader by acquiring nearly three-fourths of the carbon credit trading platform market share in 2022 and is anticipated to continue this trend during the carbon credit trading platform market forecast period. On the basis of system type, the cap-and-trade segment emerged as the largest market share in 2022, which accounts for nearly three-fifths of the carbon credit trading platform market share. On the basis of the end-use, the utilities segment emerged as the largest market share in 2022 which accounts for one-third of the carbon credit trading platform market share, due to carbon credit trading platform market trends. On the basis of region, Europe is the major consumer of carbon credit trading platforms among other regions. It accounted for more than two-fifths of the global market share in 2022. David Correa

Carbonplace Frequently Asked Questions (FAQ)

When was Carbonplace founded?

Carbonplace was founded in 2021.

Where is Carbonplace's headquarters?

Carbonplace's headquarters is located at One Silk Street, London.

What is Carbonplace's latest funding round?

Carbonplace's latest funding round is Seed.

How much did Carbonplace raise?

Carbonplace raised a total of $45M.

Who are the investors of Carbonplace?

Investors of Carbonplace include Itau Unibanco, NAB Ventures, Banco Bilbao Vizcaya Argentaria, BNP Paribas, Standard Chartered and 6 more.

Loading...

Loading...