Circle

Founded Year

2013Stage

Corporate Minority | AliveTotal Raised

$1.199BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-54 points in the past 30 days

About Circle

Circle provides a financial technology solution for users to send and receive funds globally. It offers crypto treasury management solutions for businesses to manage digital assets. The company serves asset managers, financial technology companies, and financial institutions. It was founded in 2013 and is based in Boston, Massachusetts.

Loading...

ESPs containing Circle

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

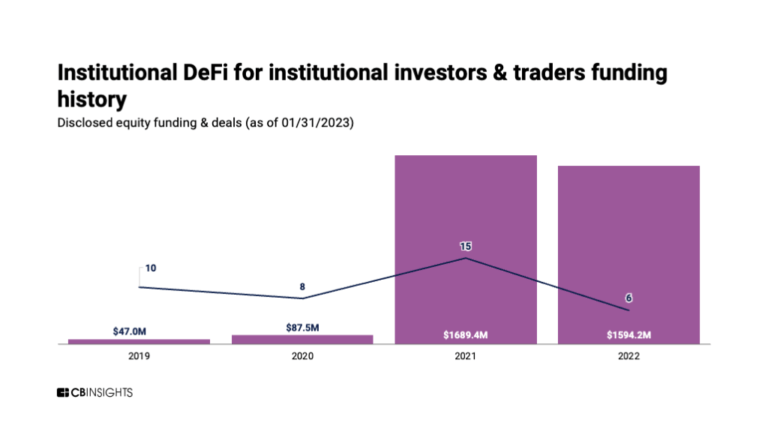

The institutional decentralized finance (DeFi) market refers to the use of decentralized finance protocols and platforms by institutional investors, such as hedge funds, asset managers, and corporations, to access DeFi services and generate returns. Technology vendors in this market offer end-to-end software solutions. These solutions provide secure access to top distributed networks, offering sec…

Circle named as Leader among 15 other companies, including BitGo, Consensys, and Fireblocks.

Circle's Products & Differentiators

Circle Account

The Circle Account is a full stack solution that replaces a fractured system for business banking. Securely custody funds, send and receive payments globally and streamline treasury operations all connected through USD Coin (USDC) and integrated with a suite of APIs.

Loading...

Research containing Circle

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Circle in 14 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

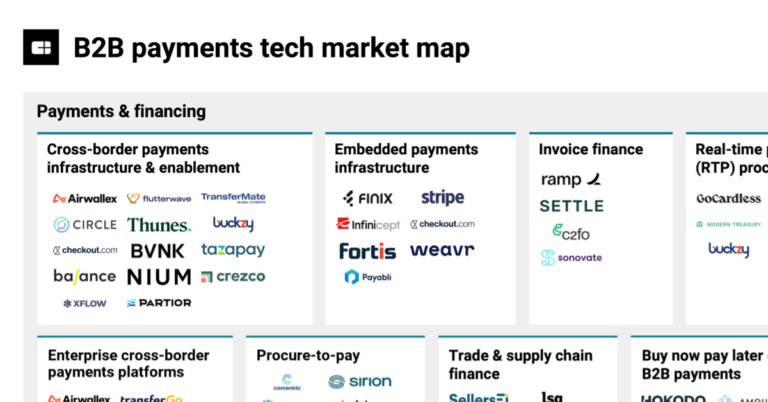

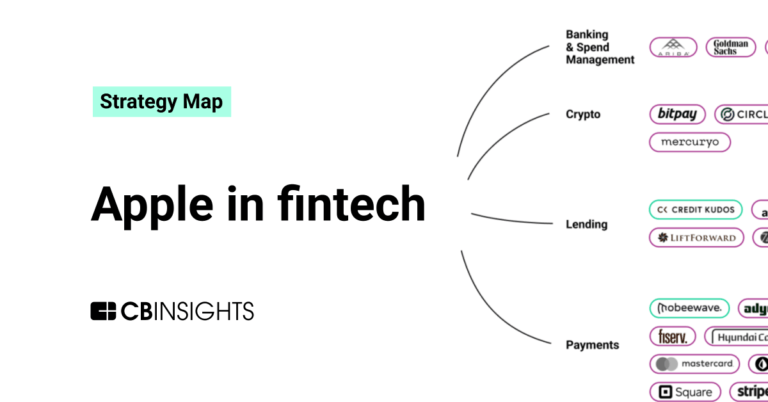

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Expert Collections containing Circle

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Circle is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Blockchain

13,017 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

286 items

Fintech

9,260 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Circle Patents

Circle has filed 48 patents.

The 3 most popular patent topics include:

- alternative currencies

- cryptocurrencies

- bitcoin

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/23/2020 | 9/17/2024 | Optical devices, Panorama photography, Photographic techniques, Optoelectronics, Optical components | Grant |

Application Date | 6/23/2020 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Optical devices, Panorama photography, Photographic techniques, Optoelectronics, Optical components |

Status | Grant |

Latest Circle News

Sep 17, 2024

Stablecoin issuer Circle is expanding its native issuance of USD Coin ( USDC ) and deploying its Cross-Chain Transfer Protocol on the layer-1 blockchain Sui . In a Sept. 17 X post, Evan Cheng, co-founder and CEO of Mysten Labs, revealed that his firm’s blockchain—Sui—has partnered with Circle to bring USDC to the network. Cheng did not provide additional information on the partnership. However, market observers noted that the move would boost liquidity in Sui’s fast-rising ecosystem and further attract more users to the network. Launched in 2023, Sui has quickly gained attention within the crypto space for its simplicity and recent high-flying moves, which include a partnership with automaker DeLorean to bring innovation to the automotive industry and usher the brand into the digital era. Furthermore, crypto asset management firm Grayscale recently opened its Sui Trust for qualified investors. USDC’s growing influence USDC is currently the second-largest stablecoin , with a circulating supply exceeding $35 billion. According to Circle, USDC is supported on 15 blockchain networks, including Ethereum , Algorand, Arbitrum, Avalanche , Polkadot , Base, and Polygon . Circle promotes USDC as a compliant digital asset offering robust user protections. The company recently announced plans to relocate its headquarters to New York City’s World Trade Center. Despite its success, Circle has faced criticism. Blockchain investigator ZachXBT recently called out the company for delays in blacklisting a wallet tied to North Korea’s Lazarus Group . In a Sept. 17 post on X, ZachXBT highlighted instances where Circle failed to safeguard the crypto ecosystem. He criticized the firm’s slow response in preventing malicious actors and its reluctance to assist users who accidentally transferred USDC to contract addresses due to poor user interface design. “A large number of users have accidentally transferred USDC to the contract address on various chains due to bad UX in the ecosystem. While yes, it is the user’s fault, Circle does have the ability in the contract to transfer the funds back to the rightful owner, yet unlike their competitors, it will not help you.” Mentioned in this article

Circle Frequently Asked Questions (FAQ)

When was Circle founded?

Circle was founded in 2013.

Where is Circle's headquarters?

Circle's headquarters is located at 99 High Street, Boston.

What is Circle's latest funding round?

Circle's latest funding round is Corporate Minority.

How much did Circle raise?

Circle raised a total of $1.199B.

Who are the investors of Circle?

Investors of Circle include Coinbase, Marshall Wace Asset Management, Fidelity Investments, BlackRock, Fin Capital and 34 more.

Who are Circle's competitors?

Competitors of Circle include BitGo, Bitstamp, Kraken, bitFlyer, BlockFi and 7 more.

What products does Circle offer?

Circle's products include Circle Account and 3 more.

Who are Circle's customers?

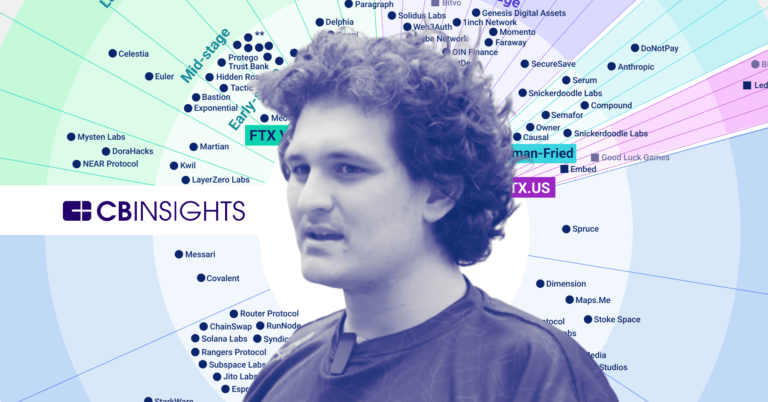

Customers of Circle include FTX and CMS.

Loading...

Compare Circle to Competitors

BurjX facilitates cryptocurrency trading exchange and broker-dealer solutions. The company develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in Abu Dhabi, United Arab Emirates.

CoinDCX is a cryptocurrency investment platform operating in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin, offering a secure and efficient service for its users. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

CoinZoom is a company that focuses on providing cryptocurrency services in the financial technology sector. The company offers a platform for buying, selling, and trading top cryptocurrencies, as well as a Visa card that allows customers to spend their cryptocurrencies like cash. CoinZoom primarily serves the financial technology industry. It was founded in 2018 and is based in Salt Lake City, Utah.

Crypto.com operates as a platform in the cryptocurrency industry. The company offers services that allow users to buy, sell, and trade a wide range of cryptocurrencies including Bitcoin and Ethereum. It primarily serves the financial technology sector. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Abra offers a mobile application platform for buying, selling, trading, storing, and borrowing cryptocurrency. Its platform enables users to store digital cash on smartphones and send it to other users. The company was founded in 2014 and is based in Mountain View, California.

Loading...