Clearco

Founded Year

2015Stage

Series D | AliveTotal Raised

$1.158BLast Raised

$60M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-18 points in the past 30 days

About Clearco

Clearco e-commerce investor providing equity-free capital solutions to e-commerce businesses. It provides growth capital to web-enabled firms using business data instead of a personal credit score. It was formerly known as Clearbanc. The company was founded in 2015 and is based in Toronto, Canada.

Loading...

ESPs containing Clearco

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The revenue-based financing platforms market offers an innovative approach to funding for businesses seeking capital without traditional equity or debt financing and instead exchange a percentage of their future revenues. This arrangement enables entrepreneurs to access growth capital without diluting ownership or incurring fixed interest payments. These platforms use advanced algorithms and data …

Clearco named as Leader among 15 other companies, including Capchase, Pipe, and Liberis.

Clearco's Products & Differentiators

Invoice Funding

Invoice Funding is a non-dilutive financial solution designed to provide ecommerce businesses with working capital by advancing funds against their outstanding invoices. This allows businesses to maintain cash flow and continue operations without waiting for customers to pay their invoices.

Loading...

Research containing Clearco

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clearco in 7 CB Insights research briefs, most recently on May 31, 2022.

Expert Collections containing Clearco

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clearco is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

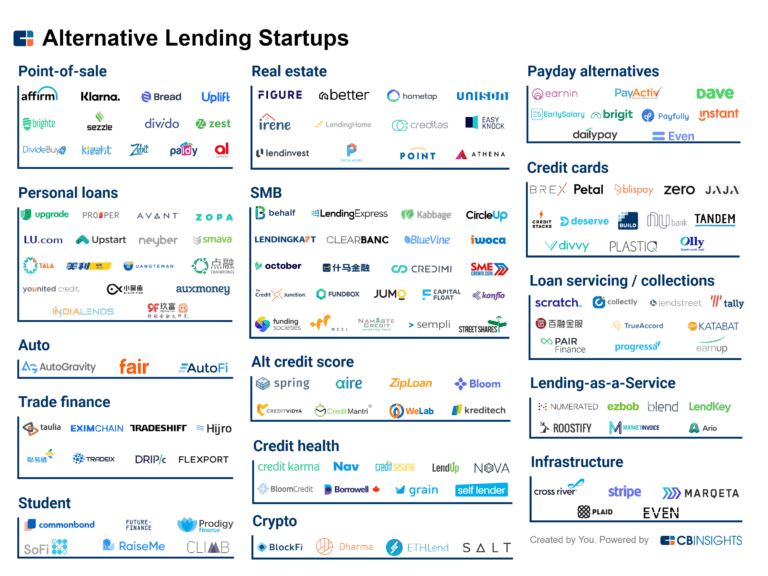

Digital Lending

2,271 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,586 items

Fintech

13,396 items

Excludes US-based companies

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Canadian fintech

345 items

Latest Clearco News

Sep 10, 2024

After celebrating its one year anniversary, Canuck Eats continues to garner business for locally-owned restaurants News provided by Share this article Share toX TORONTO, Oct. 12, 2021 /PRNewswire-PRWeb/ -- Clearco , the world's largest e-commerce investor revolutionizing the way founders grow their businesses, today announced that its industry-leading ClearAngel program is funding Canada-based, Canuck Eats , a locally-owned food delivery franchise serving the Edmonton, Oshawa, Merritt & Lower Nicola communities. ClearAngel gives early-stage companies access to revenue share capital, data-driven advice, and an extensive network of apps, agencies, and investors powered by Clearco. Founded in 2020, Canuck Eats is the first delivery service of its kind to offer a variety of restaurant delivery options to rural, less populated towns. Founded during the pandemic, Canuck Eats' competitive model helped users to diversify their meal options and helped local businesses to weather the lockdown measures when indoor dining was not permitted. As a serial entrepreneur with projects in many industries, Founder, William Tsui, is poised to continue to scale this business to the next level. The company has grown to three markets in Canada but with ClearAngel's investment, will be able to continue to build franchises across British Columbia and Canada, enabling Canuck Eats to reach a new customer pool and increase revenue. “We’re proud to provide the tools Canuck Eats needs to scale to the next level,” said Andrew D’Souza, CEO and co-founder, Clearco. “Canuck Eats acts as a catalyst for economic growth in local Canadian communities and with more capital, will be able to bring their model to other markets.” ClearAngel is among just a few equity-free, flexible capital options for early-stage founders who lack the network to raise an angel round or join exclusive accelerators. Since its February 2021 launch, the program has already funded over 350 companies. "Clearco's investment will have an incredible impact for our company," said William Tsui, Founder, Canuck Eats. "The support will help to open up the possibilities of expanding our strategic marketing initiatives and recruitment efforts in order to continue encouraging local economic growth." In addition to $13,000 CAD of flexible capital, Canuck Eats will also get access to a network of more than 500 investors, growth teams, agencies, apps, lawyers, and buyers; and data-driven advice designed to help scale and hit new revenue milestones. "We're proud to provide the tools Canuck Eats needs to scale to the next level," said Andrew D'Souza, CEO and co-founder, Clearco. "Canuck Eats acts as a catalyst for economic growth in local Canadian communities and with more capital, will be able to bring their model to other markets." To learn more about Canuck Eats and their franchising opportunities for yourself, visit canuckeats.com/franchise . ClearAngel is currently onboarding E-commerce and product companies. The program has limited spots available for SaaS, Apps, marketplace and stealth companies. To learn more about applying, visit angel.clearbanc.com . About Clearco: Co-founded as Clearbanc in 2015 by Michele Romanow from Canada's Shark Tank (Dragons' Den), Andrew D'Souza, Ivan Gritsiniak, Charlie Feng, and Tanay Delima, Clearco offers the most founder-friendly capital solutions for e-commerce, mobile apps, and SaaS founders as well as a full suite of products and access to a powerful global network, insights and data, and recommendations. Clearco has invested over $2 Billion in over 4,500 companies to date, including Leesa Sleep, fashion-rental service Le Tote, home goods company Public Goods, shirtmaker UNTUCKit, online speech therapy practice Expressable, and digital real estate marketplace SetSchedule. For more information visit clear.co and @getClearco. Media Contact SOURCE Clearco

Clearco Frequently Asked Questions (FAQ)

When was Clearco founded?

Clearco was founded in 2015.

Where is Clearco's headquarters?

Clearco's headquarters is located at 1200-33 Yonge Street, Toronto.

What is Clearco's latest funding round?

Clearco's latest funding round is Series D.

How much did Clearco raise?

Clearco raised a total of $1.158B.

Who are the investors of Clearco?

Investors of Clearco include Inovia Capital, Founders Circle Capital, Pollen Street Capital, SVB Financial Group, Park West Asset Management and 24 more.

Who are Clearco's competitors?

Competitors of Clearco include Pipe, Braavo Capital, Capchase, Boopos, Vitt and 7 more.

What products does Clearco offer?

Clearco's products include Invoice Funding.

Loading...

Compare Clearco to Competitors

Pipe provides financial services specializing in non-dilutive capital solutions for businesses. It offers a modern capital platform that allows entrepreneurs to access funding based on their revenue, with payment terms. It primarily serves the financial needs of small to mid-size businesses and entrepreneurs seeking growth without equity dilution. It was formerly known as Third Base Pipe. The company was founded in 2019 and is based in San Francisco, California.

Wayflyer provides a revenue-based financing platform for e-commerce merchants. The company offers an analytics platform to analyze marketing performance on a daily basis and helps e-commerce businesses with insights for their decision-making. It was founded in 2019 and is based in Dublin, Ireland.

Arc Technologies operates as a digital financial services platform. It allows firms to convert their future revenue into upfront capital, deposit those funds into a digital bank account, and utilize its insights and analytics to spend that capital. It was founded in 2021 and is based in San Francisco, California.

Payability is a fintech company that operates in the eCommerce industry. The company provides flexible financing solutions to eCommerce sellers, offering accelerated daily payouts and working capital for inventory and marketing. Its primary customers are businesses operating in the eCommerce sector. It was founded in 2014 and is based in New York, New York.

Vitt focuses on investment management. The company offers services that allow customers to invest their idle cash in Money Market Funds. These funds are managed by Goldman Sachs Asset Management and are held with a Financial Conduct Authority-regulated custodian, mitigating counterparty risk. It was founded in 2021 and is based in London, United Kingdom.

Levenue is a platform focused on providing financial services in the business sector. The company offers a service that allows businesses with recurring revenue to access funding without dilution of shares. It primarily serves businesses in need of non-dilutive financing to accelerate their growth. It was founded in 2021 and is based in Breda, Netherlands.

Loading...