CloudMargin

Founded Year

2014Stage

Series B | AliveTotal Raised

$25MLast Raised

$15M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-10 points in the past 30 days

About CloudMargin

CloudMargin is a cloud-based collateral management workflow tool. The firm's Software-as-a-Service model helps financial institutions – including exchanges, brokerage firms, banks, asset management firms and insurance companies – meet regulatory deadlines and reduce costs associated with collateral requirements that are growing. CloudMargin enables clients to experience rapid implementation and access to robust and secure collateral management workflow software.

Loading...

ESPs containing CloudMargin

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

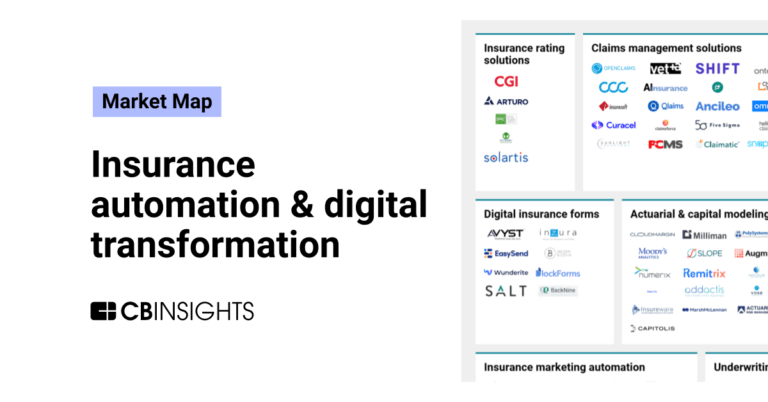

The actuarial & capital modeling market helps insurers fulfill capital and actuarial obligations, such as holding necessary and optimal reserve amounts based on their in-force portfolio. This market has undergone significant change since the 2008 financial crisis and is marked by heavy regulation, increased operational challenges, and a need to control costs. Clean, accessible, and real-time colla…

CloudMargin named as Leader among 4 other companies, including Capitolis, Montoux, and Quantee.

CloudMargin's Products & Differentiators

CloudMargin

CloudMargin is the world’s first cloud-based collateral management workflow tool covering all asset and instrument classes, from calculation through to real-world settlement and reporting. CloudMargin facilitates exception-based processing by centralizing data, connecting to industry utilities, automating workflow and optimizing collateral firm-wide.

Loading...

Research containing CloudMargin

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CloudMargin in 1 CB Insights research brief, most recently on Aug 7, 2023.

Expert Collections containing CloudMargin

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CloudMargin is included in 5 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Capital Markets Tech

997 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,396 items

Excludes US-based companies

Latest CloudMargin News

May 20, 2024

News provided by Share this article Share toX Company Marks 10-Year Anniversary with Above-Target Performance, Strongest Pipeline to Date as Automation in Collateral Management Takes on Increased Importance LONDON, May 20, 2024 /PRNewswire/ -- CloudMargin, a leading global collateral management technology company, announced today that it achieved 35% revenue growth for the fiscal year ended March 31, 2024, ahead of its annual target. The company saw a rise in the value of new annual contracts signed, along with increased business from existing clients, as automation in collateral management assumed a role of increasing importance in firms' risk mitigation strategies. The strong performance comes as CloudMargin celebrates its 10th anniversary as the world's first collateral and margin management solution created specifically for the cloud. The Software-as-a-Service (SaaS) company signed its first client – a UK bank – in 2014. Today, clients range from asset managers and pension funds to banks, brokerages, insurance firms, fund administrators, outsourcers and major industry service providers across the globe. They use the CloudMargin platform to manage their collateral for cleared and uncleared over-the-counter (OTC) products, exchange-traded derivatives, repo and Stock Borrowing and Lending (SBL) products. CloudMargin CEO Stuart Connolly said: "We're extraordinarily pleased with the growth of our franchise over the past year and the significant opportunities we intend to leverage in this new fiscal year as we celebrate our 10th anniversary milestone. We have the strongest pipeline in our history, and while we continue to see demand from the buy-side, regional banks are now especially keen to ensure their collateral and margin management program is robust and state-of-the-art. Using the CloudMargin platform, firms can realize substantial cost efficiencies and market-leading automation, with customized reporting, dynamic dashboards to access real-time data and seamless workflow across the entire trade lifecycle." Connolly said numerous macroeconomic episodes over the past few years have highlighted that in times of market stress, even some of the largest firms and financial institutions have been challenged by inadequate liquidity and preparedness for increased margin calls. These events have captured the attention of regulators and board members intent on preventing future disasters. He said automation of collateral processing is now a necessity, as evidenced by proposed measures announced last month by the Financial Stability Board (FSB) to enhance the liquidity preparedness of non-bank market participants for margin and collateral calls during market-wide stress. Over the course of the past year, CloudMargin's platform – accessed in 52 countries by more than 210 organizations – processed over twice the amount of margin calls exchanged in 2022. The continuously enhanced platform released more than 1,130 updates and introduced 30 new and improved features, automatically benefiting users of the SaaS service. About CloudMargin Headquartered in London, CloudMargin transforms financial services firms' workflows with cutting-edge, SaaS collateral management technology. Over 210 buy-side and sell-side institutions across the globe rely on CloudMargin to streamline their operations through automated, end-to-end collateral management processes. Celebrating its 10th anniversary in 2024, CloudMargin has always been at the forefront of innovation, creating the world's first cloud-based collateral management workflow tool. Combining market-leading process automation with flexible, real-time analytics, CloudMargin delivers unparalleled efficiencies and risk reduction through smart, simplified workflows and straight-through processing (STP). A high-growth technology company, CloudMargin is committed to solving client and industry challenges with its pioneering solutions, helping firms navigate all market conditions. For more information, visit cloudmargin.com . SOURCE CloudMargin

CloudMargin Frequently Asked Questions (FAQ)

When was CloudMargin founded?

CloudMargin was founded in 2014.

Where is CloudMargin's headquarters?

CloudMargin's headquarters is located at 4-8 Whites Grounds, London.

What is CloudMargin's latest funding round?

CloudMargin's latest funding round is Series B.

How much did CloudMargin raise?

CloudMargin raised a total of $25M.

Who are the investors of CloudMargin?

Investors of CloudMargin include Deutsche Bank, Citi Ventures, DB1 Ventures, Illuminate Financial Management, IHS Markit and 3 more.

Who are CloudMargin's competitors?

Competitors of CloudMargin include Q4, Treasury4, Axoni, Kantox, New York Shipping Exchange and 7 more.

What products does CloudMargin offer?

CloudMargin's products include CloudMargin.

Loading...

Compare CloudMargin to Competitors

Axoni is a capital markets technology firm. It provides an analysis platform, a communication network, and real-time market information, and it integrates traditional financial technologies with blockchain currencies and transactions. It was founded in 2017 and is based in New York, New York.

sFOX is a full-service crypto prime dealer that operates in the financial services industry, focusing on institutional investors. The company offers a suite of services including trading, liquidity solutions, secure custody, staking, prime services, and API integration to facilitate digital asset transactions. sFOX caters primarily to institutions, asset managers, financial institutions, advisors, hedge funds, crypto exchanges, family offices, and sophisticated individual traders. sFOX was formerly known as Ox Labs Inc.. It was founded in 2014 and is based in El Segundo, California.

Capitolis operates as a financial technology company. It offers capital marketplace solutions providing access to capital and portfolio optimization solutions. It allows market participants to reduce meaningful positions with banks and counterparties in their trading portfolios. It was founded in 2016 and is based in New York, New York.

Trumid operates as a financial technology company. It provides an electronic trading platform and provides corporate bond market professionals with direct access to anonymous and counterparty-disclosed liquidity. It primarily serves the financial technology sector. The company was founded in 2014 and is based in New York, New York.

Elefant is a data science Fintech focused on building smarter marketplaces through advanced analytics and abundant capital. Elefant has two operating companies: Elefant Sciences (data science) and Elefant Markets (FINRA regulated broker-dealer). Elefant Markets utilizes proprietary technology to provide liquidity, as principal, to asset managers in the corporate bond market.

TradeIX offers an open platform for trade finance. The company offers tools to transform and rewire the global trade infrastructure. It was founded in 2016 and is based in Dublin, Ireland.

Loading...