Corvus Insurance

Founded Year

2017Stage

Acquired | AcquiredTotal Raised

$161MValuation

$0000About Corvus Insurance

Corvus Insurance is a company that specializes in the insurance industry, with a particular focus on cyber insurance solutions. The company offers insurance products that help manage cyber risks, including data-driven risk prevention tools and consultations with their Risk Advisory team. Their primary market is businesses seeking to mitigate their cyber risk exposure. It was founded in 2017 and is based in Boston, Massachusetts. In November 2023, Corvus Insurance was acquired by The Travelers Companies.

Loading...

Corvus Insurance's Product Videos

ESPs containing Corvus Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital cyber insurance providers market consists of companies that provide businesses and individuals with insurance that covers cyber risks. These companies include insurtech producers (e.g., agents and brokers), insurtech managing general agents (MGAs), and full-stack insurtech carriers. Digital cyber insurance providers may also offer cybersecurity services, primarily for proactive risk ma…

Corvus Insurance named as Leader among 15 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Corvus Insurance's Products & Differentiators

Smart Cyber Insurance

Data-informed coverage built for evolving threats. We combine our underwriting expertise with technology for personalized quotes, optimal pricing, and broad coverage.

Loading...

Research containing Corvus Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Corvus Insurance in 5 CB Insights research briefs, most recently on Feb 29, 2024.

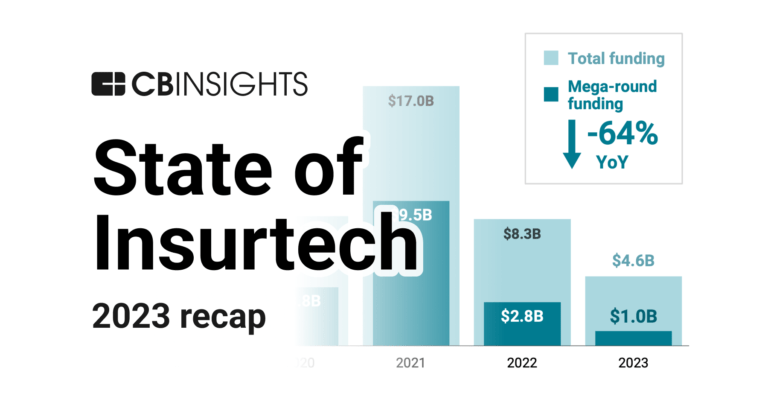

Feb 9, 2024 report

State of Insurtech 2023 Report

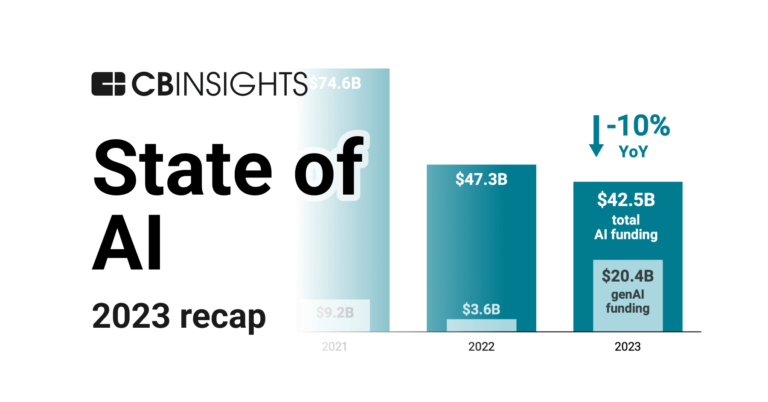

Feb 1, 2024 report

State of AI 2023 Report

Jan 18, 2024 report

State of Fintech 2023 ReportExpert Collections containing Corvus Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Corvus Insurance is included in 7 Expert Collections, including Insurtech.

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,653 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Cybersecurity

9,329 items

These companies protect organizations from digital threats.

Fintech

9,228 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

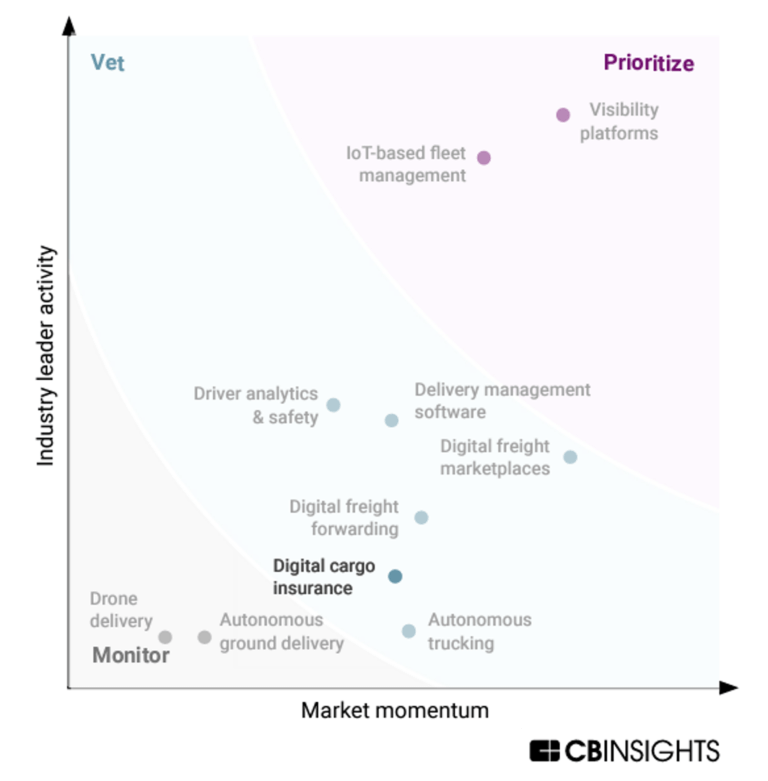

Supply Chain & Logistics Tech

343 items

Latest Corvus Insurance News

Sep 4, 2024

Help Net Security Ransomware crisis deepens as attacks and payouts rise During the second quarter, new ransomware groups, including PLAY, Medusa, RansomHub, INC Ransom, BlackSuit, and some additional lesser-known factions, led a series of attacks that eclipsed the first quarter of this year by 16% and the second quarter of 2023 by 8%, according to Corvus Insurance. These new threat actors emerged following the international law enforcement’s takedown of LockBit and BlackCat . Ransomware: Most frequently targeted industries (Source: Corvus Insurance) Ransomware demands and payouts Based on Corvus data, the Q2 report found that the average ransomware demand reached $1,571,667. That represents a quarterly increase of 102% and the highest figure Corvus has reported since the second quarter of 2022. The average ransom payment also reached a new high of $626,415. According to the research, a company’s backup strategies can impact payouts. Businesses without robust backups are more than twice as likely to surrender to ransom demands during an attack. Conversely, organizations with effective backup strategies have incurred median claim costs 72% lower than their less-prepared counterparts. Ransomware operators continue evolving tactics Recognizing that many organizations possess valuable and sensitive information, ransomware operators have evolved their tactics by engaging in double-extortion schemes where operators encrypt data, exfiltrate it, and then threaten to release it on the dark web. So far in 2024, data theft was involved in 93% of ransomware incidents observed by Corvus, up from 88% in 2023. Using double-extortion schemes, even organizations with secure backups may be forced to pay ransoms, often to prevent the exposure of stolen data. “Data theft has become the technique employed by attackers to secure maximum payouts from their victims, whether or not they have secure backups,” said Jason Rebholz , CISO at Corvus Insurance. “A robust security plan is never one layer deep. While a sound backup strategy is important, it cannot mitigate these threats alone. Businesses must utilize a multi-layered security strategy based on a resilient environment with fast detection and prevention capabilities.” Key industry trends While the study found that industries most affected by ransomware attacks remained largely similar from the first quarter, Construction moved from second to first in the second quarter. In addition, Government and Oil and Gas joined the list, and ransomware attacks targeting the Software Development and IT Services and IT Consulting sectors were up 257% and 54%, respectively. RansomHub was responsible for 16% of the reported victims within the IT Services industry, followed by PLAY and BlackSuit, which accounted for an additional 18%. More about

Corvus Insurance Frequently Asked Questions (FAQ)

When was Corvus Insurance founded?

Corvus Insurance was founded in 2017.

Where is Corvus Insurance's headquarters?

Corvus Insurance's headquarters is located at 100 Summer Street, Boston.

What is Corvus Insurance's latest funding round?

Corvus Insurance's latest funding round is Acquired.

How much did Corvus Insurance raise?

Corvus Insurance raised a total of $161M.

Who are the investors of Corvus Insurance?

Investors of Corvus Insurance include The Travelers Companies, SiriusPoint, Aquiline Capital Partners, FinTLV, .406 Ventures and 8 more.

Who are Corvus Insurance's competitors?

Competitors of Corvus Insurance include Cowbell Cyber and 7 more.

What products does Corvus Insurance offer?

Corvus Insurance's products include Smart Cyber Insurance and 2 more.

Loading...

Compare Corvus Insurance to Competitors

Counterpart is a management liability platform specializing in the insurance sector. The company offers a range of liability insurance products including coverage for directors and officers, employment practices, fiduciary responsibilities, and commercial crime, as well as professional liability insurance. Counterpart also provides business services such as risk assessment, claims management, and HR compliance tools, primarily serving small businesses and insurance brokers. It was founded in 2019 and is based in Covina, California.

Resilience specializes in cyber risk management and insurance solutions within the cybersecurity industry. The company offers cyber insurance, risk management services, and technology errors and omissions (E&O) insurance to help organizations mitigate and manage cyber threats. Resilience's solutions are designed to enhance cyber resilience by integrating risk mitigation, risk acceptance, and risk transfer strategies. It was founded in 2016 and is based in San Francisco, California.

Coalition operates in the cyber insurance and cybersecurity sectors. The company offers comprehensive insurance coverage and cybersecurity tools designed to help businesses manage and mitigate digital risks. Coalition primarily serves businesses worldwide that are seeking resilience against cyber attacks. It was founded in 2017 and is based in San Francisco, California.

Eye Security provides cybersecurity solutions for various business sectors, focusing on protecting companies from cyber threats. Its main offerings include managed extended detection and response (xDR) services, round-the-clock incident response, and cyber insurance to ensure business continuity. Eye Security caters to a wide range of industries, including logistics, manufacturing, professional services, and healthcare. It was founded in 2020 and is based in The Hague, Netherlands.

Cowbell Cyber specializes in providing cyber insurance solutions within the insurance industry. The company offers cyber coverage tailored to small and medium-sized enterprises (SMEs), utilizing artificial intelligence for continuous risk assessment and underwriting. Cowbell Cyber's products are designed to assist businesses in managing cyber risks through a closed-loop approach, including risk prevention, mitigation, and incident response services. It was founded in 2019 and is based in Pleasanton, California.

BOXX Insurance specializes in providing integrated cyber insurance and protection services across various sectors. The company offers a suite of products designed to predict, prevent, and insure against cyber threats, with a focus on small businesses and individual home protection. BOXX Insurance caters to a range of sectors including banking, insurers, retailers, e-commerce, mobile operators, and telcos, offering tailored cyber solutions and partnerships. It was founded in 2018 and is based in Toronto, Ontario.

Loading...