Curacel

Founded Year

2019Stage

Incubator/Accelerator - VI | AliveTotal Raised

$5.01MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-53 points in the past 30 days

About Curacel

Curacel specializes in artificial intelligence (AI) powered insurance software and products for various sectors, focusing on streamlining insurance operations. The company offers solutions for managing and distributing insurance, processing claims, detecting fraud, and automating payment operations, all by artificial intelligence. Curacel primarily serves industries such as logistics, fintech, e-commerce, healthcare, and automotive. It was founded in 2019 and is based in Lagos, Nigeria.

Loading...

Curacel's Product Videos

ESPs containing Curacel

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

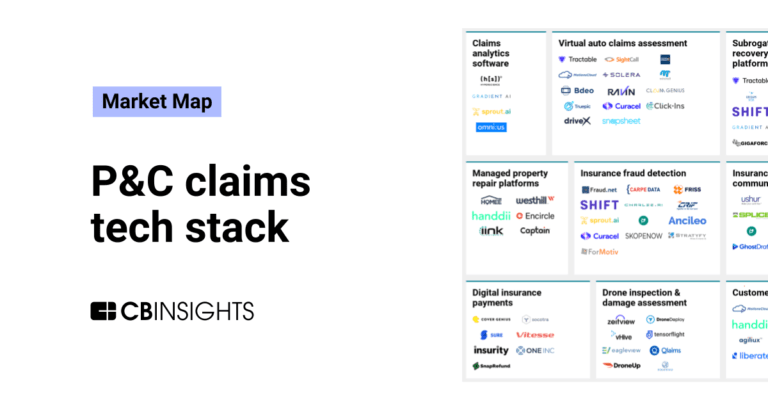

The virtual auto claims assessment market automates the analysis and assessment of auto insurance claims. These vendors typically use augmented reality and computer vision to analyze property claims data submitted by policyholders or adjusters. Additionally, some of these platforms have the ability to capture real-time data, from sources like telematics sensors, at scale. Insurance companies can b…

Curacel named as Challenger among 13 other companies, including Verisk, CCC Intelligent Solutions, and Snapsheet.

Curacel's Products & Differentiators

Curacel Claims

An AI-powered infrastructure that allows for real-time submission and processing of claims, significantly reducing the claims cycle and increasing the number of claims that can be processed.

Loading...

Research containing Curacel

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Curacel in 3 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

The P&C claims tech stack market mapExpert Collections containing Curacel

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Curacel is included in 2 Expert Collections, including Insurtech.

Insurtech

3,184 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,398 items

Excludes US-based companies

Latest Curacel News

Sep 18, 2024

[Column] Bryan Hamman: Maximizing the insurance experience through AI and the cloud Insurance clients today are more likely to consider a provider if it consistently offers seamless quotes, efficient claims processing, ongoing customer support and targeted communications. To meet these demands, insurance companies must safely make use of data and new technologies, or risk being left behind by their competitors. Personalisation and optimisation are critical elements in maximising customer experience, both in retaining existing clients as well as attracting new ones. In this context, how are insurance companies using new technologies to better meet and service their customers' expectations? Part of the answer lies in cloud adoption and the use of artificial intelligence (AI), and it's here that the use of 'InsurTech' – technology innovations to bring in savings and efficiency to the insurance industry model – is playing a critical role. InsurTech includes the use of AI, big data analytics and machine learning (ML), to improve and automate the insurance sector. Data, AI and the cloud: partners in personalisation The insurance arena is enabled by advanced data analytics and customer-centric underwriting in personalising the customer experience. The strategic use of data can provide a deeper understanding of individual customer behaviours, preferences and risks, and thereby improve the insurance experience. Insurers are therefore tapping into a variety of sources, including social media interactions, IoT device data and mobile information, to offer personalised services. However, insurance companies must put the correct foundations in place regarding their IT functionality and build systems to extract the required data that supports hyper-personalisation. For example, with regards to marketing and distribution, large language models, which are cloud-enabled, can personalise insurance messaging for specific customer personas, enhancing engagement and conversion rates. In addition, smart chatbots provide 24/7 support, while their feedback helps insurers to identify, calculate and price risks more accurately. Moving essential business applications to the cloud can help the insurance sector to gain access to the maximising benefits of AI, which is increasingly being used to improve customer experience and internal processes. According to a recent survey by global management consulting firm McKinsey & Company, which analysed data from more than 50 major African businesses, the participants reported having, on average, around 45 percent of their workloads in the public cloud. While based on a relatively small sample size, this is encouragingly on par with, or ahead of, the rates of adoption in North America and China. According to the McKinsey report, early indications also showed that African organisations are moving quickly into the cloud, with no signs of slowing down. This promising cloud adoption trend will benefit insurance organisations across the continent. AI and the fight against insurance fraud According to insurance infrastructure provider Curacel, which operates in a number of countries across Africa, the insurance industry across the continent is currently losing more than $700m to fraud annually. Against this background, Curacel notes that AI and ML technologies are developments that many insurers are using to help solve this problem. As an example, Curacel reports that in the health insurance space, an ML application named Anomaly Detection is used, which works by analysing genuine claims and then creating a model of a typical claim. This model is then applied to large data sets to detect further anomalies and pinpoint potentially fraudulent claims that may arise. In South Africa specifically, the Association for Savings and Investment South Africa (ASISA) noted that, while local insurers lost R77 million to fraud in 2022, it also prevented losses worth R1.1 billion – due, in part, to preventative measures like big data, ML, AI and enhanced authentication. With insurance fraud representing a long-standing blot on the industry, it is heartening to note that AI is helping to improve operational efficiencies and effectiveness in this ongoing war against insurance organisations and their honest clients. Happily, on the other side of the scenario, AI-powered claims-processing tools are also streamlining the claims process for genuine claims. The importance of network visibility in digital insurance Network visibility is a major component for insurance companies seeking to offer a transparent and secure customer experience. By monitoring traffic and data at the packet level in real time, insurers can detect and quickly respond to network performance issues, as well as anticipating and mitigating potential security risks. For example, good network visibility can prevent service interruptions by detecting behavioural anomalies that could indicate potential network failures, latency, slowdowns, bottlenecks, or even malicious activities. Additionally, the data obtained through network traffic analysis is indispensable for ensuring smooth operations and improving real-time decision-making. This is particularly important in scenarios where network performance can directly affect critical processes, such as claims processing or real-time risk assessment. Ultimately, success in the insurance sector increasingly relies on the harmonious and strategic integration of digital solutions that enhance internal management while enriching the customer experience. AI has an important role to play in unlocking the true potential of the insurance sector in Africa. Bryan Hamman is the Regional Director for Africa at NETSCOUT Are you interested in having your interview published on our website, click here .

Curacel Frequently Asked Questions (FAQ)

When was Curacel founded?

Curacel was founded in 2019.

Where is Curacel's headquarters?

Curacel's headquarters is located at 19B Adeyemi Lawson, Lagos.

What is Curacel's latest funding round?

Curacel's latest funding round is Incubator/Accelerator - VI.

How much did Curacel raise?

Curacel raised a total of $5.01M.

Who are the investors of Curacel?

Investors of Curacel include Visa Africa Accelerator, Y Combinator, Pioneer Fund, Olive Tree Capital, Blue Point Capital Partners and 22 more.

Who are Curacel's competitors?

Competitors of Curacel include Cover Genius, Inclusivity Solutions, Root, Tractable, Octamile and 7 more.

What products does Curacel offer?

Curacel's products include Curacel Claims.

Who are Curacel's customers?

Customers of Curacel include AXA , Jubilee, Old Mutual, Bupa Arabia. and Sanlam.

Loading...

Compare Curacel to Competitors

Lami operates as a technology in insurance solutions. It offers a platform that enables businesses, insurers, and other platforms to integrate and manage insurance coverage, tailoring risk to their priorities and budgets. The company primarily serves the insurance industry, providing solutions for underwriters, businesses, and various platforms. It was founded in 2018 and is based in Nairobi, Kenya.

Boost is a company that focuses on providing digital insurance solutions in the insurance technology sector. It offers a digital insurance platform that provides compliance, capital, and technology infrastructure for insurance technology companies, MGAs, and embedded insurance. it primarily sells to the insurance technology industry, as well as to MGAs, brokers, agents, and embedded insurance platforms. The company was founded in 2017 and is based in New York, New York.

Bolttech is an international insurtech company focused on creating a technology-enabled ecosystem for protection and insurance within the financial sector. The company's main offerings include a global insurance exchange platform that connects insurers, distributors, and customers, facilitating the purchase and sale of insurance and protection products. Bolttech primarily serves businesses across various sectors looking to integrate insurance solutions into their customer journeys, such as telecommunications, retail, e-commerce, real estate, and financial services. Bolttech was formerly known as EdirectInsure Group. It was founded in 2015 and is based in Singapore.

TrakPay is a software company focused on the insurance industry. It provides a platform for processing pay-as-you-go Workers Compensation reporting and billing, connecting policyholders with insurance brokers/agents, payroll services, and insurance carriers. The company primarily serves the insurance industry, payroll service providers, and insurance agents. It was founded in 2011 and is based in Punta Gorda, Florida.

Assurely is a company that specializes in the creation and distribution of insurance products for various business sectors. They offer market-driven insurance solutions that are rapidly developed and digitally delivered, catering to evolving companies and innovative platforms. Assurely primarily serves industries that are undergoing change and innovation, such as FinTech, PropTech, collectibles, and blockchain. It was founded in 2016 and is based in Short Hills, New Jersey.

Maskokotas is a company that focuses on the pet care industry. The company offers a wide range of products for pets including food, toys, and accessories for dogs, cats, birds, rodents, fish, and reptiles. It primarily serves the pet care industry. It is based in Barcelona, Spain.

Loading...