Curebase

Founded Year

2017Stage

Series B | AliveTotal Raised

$58.13MLast Raised

$40M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-160 points in the past 30 days

About Curebase

Curebase provides a range of software tools designed for clinical trial recruitment, consent, and data collection processes. Curebase primarily serves the clinical research industry, including CROs, research sites, and study participants. The company was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Curebase

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The decentralized clinical trials platforms market specifically encompasses software and technology solutions designed to facilitate and manage remote clinical trials. These platforms integrate various components such as telemedicine, mobile health applications, and wearable device data collection to enable trial activities without frequent site visits. By streamlining remote participation, these …

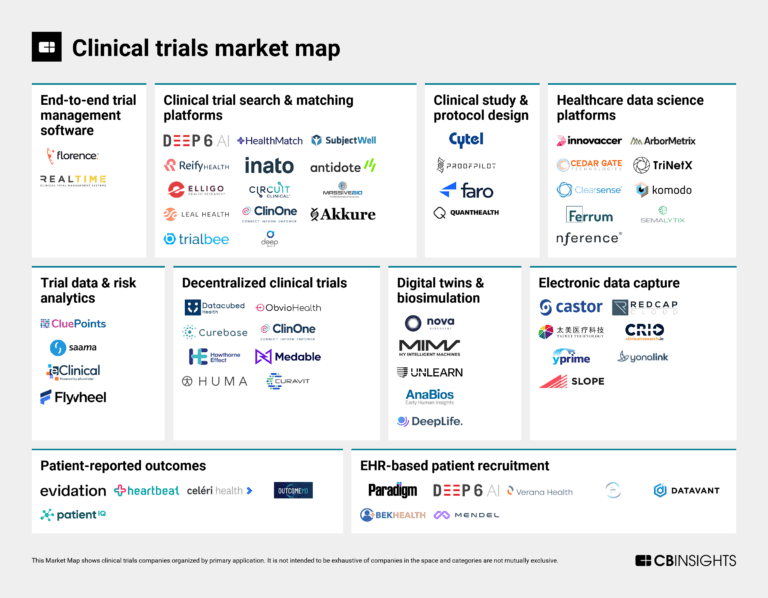

Curebase named as Leader among 15 other companies, including ObvioHealth, Huma, and Medable.

Curebase's Products & Differentiators

Virtual Site

Any study, ongoing or just starting, can benefit from a virtual site. Traditional physical sites only reach a limited portion of potential patients, while a Curebase virtual site can reach patients anywhere. Add a virtual Curebase site to your study just like you would with a traditional site. We use local, mobile, and teleheath providers to administer care. Your typical site resources are all mapped to the Curebase cloud and overseen by our virtual research coordinators. Curebase is staffed with experienced virtual research coordinators that guide patients through the study process and make themselves available to help when patients need it. Our virtual site staff coupled with our software acts in the same manner as a traditional physical site but with greater reach. https://www.curebase.com/site/virtual-sites

Loading...

Research containing Curebase

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Curebase in 8 CB Insights research briefs, most recently on Aug 21, 2024.

Aug 21, 2024

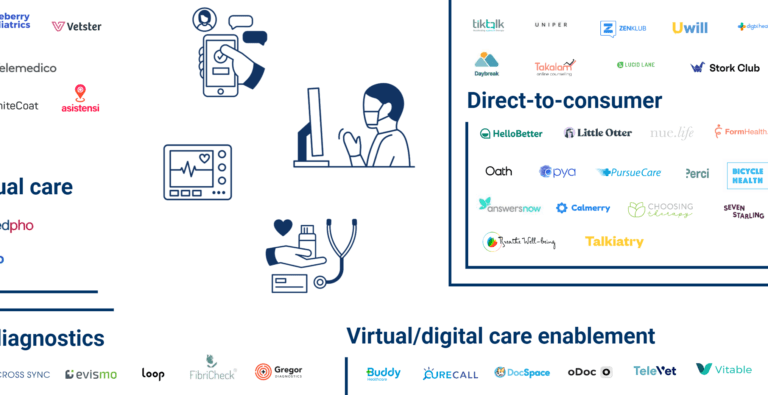

The clinical trials tech market map

Aug 1, 2023

The clinical trials market mapExpert Collections containing Curebase

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Curebase is included in 3 Expert Collections, including Digital Health.

Digital Health

11,060 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

2,916 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Digital Health 50

150 items

The winners of the third annual CB Insights Digital Health 150.

Latest Curebase News

Sep 13, 2024

Posted on Browse 434 market data Tables and 54 Figures spread through 432 Pages and in-depth TOC on “Electronic Clinical Outcome Assessment (eCOA) Solution Market by Modality (Wearable, Mobile, BYOD), Type (PRO, CLINRO, OBSRO, PERFO), Application ((Clinical trial (Onco, Rare, Mental Health)), RWE, Registery), End User – Global Forecast to 2029 Electronic Clinical Outcome Assessment (eCOA) Solution Market Worth $3.9 Billion | MarketsandMarkets™ Electronic Clinical Outcome Assessment (eCOA) Solution Market in terms of revenue was estimated to be worth $1.8 billion in 2024 and is poised to reach $3.9 billion by 2029, growing at a CAGR of 16.6% from 2024 to 2029 according to a new report by MarketsandMarkets™. The growth in the Electronic Clinical Outcome Assessment (eCOA) Solutions market is driven by rise in patient centricity, increase in incidences of chronic disorders, and growing acceptance of eCOA solutions by several pharmaceutical and biotechnology companies for data collection and its analysis. As eCOA helps enhance patient engagement by facilitating patient-reported outcomes. Moreover, the increase in demand for real-world evidence across may boost the market during the forecast period. But the increase in concerns about data breaches and privacy may pose a challenge to the Electronic Clinical Outcome Assessment (eCOA) Solutions market during the forecast period. Hybrid model is the fastest growing in the Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023. Based on component, the Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into software, services, and wearable, mobile & other devices. The wearable, mobile & other devices segment is further categorized into bring your own device model (BYOD), Provisioned device model, and hybrid model. The hybrid model is the fastest growing in Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023 attributing to its ability to offer a balanced and flexible approach to data collection in clinical trials. The hybrid model combines elements of both Bring Your Own Device (BYOD) and Provisioned Device models, providing a versatile solution that accommodates varying preferences and trial requirements. Hybrid model gives flexibility to the participants by offering option to use their own devices or devices provided by the study, depending on their comfort and accessibility. This flexibility reduces barriers to participation, as participants can choose the mode that aligns with their technological preferences. By application, observational studies and real-world evidence generation is the fastest growing in the Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023. Based on application, the Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into clinical trials, observational studies and real-world evidence (RWE) generation, patient management and registries, and other applications. Among these the observational studies and real-world evidence generation is the fastest growing in the Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023 attributing to an increasing emphasis on real-world data’s significance in healthcare decision-making. Moreover, the segment’s growth is due to the growing acceptance of real-world evidence (RWE) by regulatory bodies, healthcare providers, and pharmaceutical companies drives. RWE is crucial for understanding a treatment’s effectiveness, safety, and overall impact on patients in everyday clinical practice. Pharmaceuticals and biotechnology companies are the largest end users of the Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023. Based on end users, the Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs), medtech companies, government organizations, research centers & academic institutes, hospitals & healthcare providers, and consulting service companies. The pharmaceutical and biotechnology companies dominated the eCOA solutions market in 2023 attributing to growth in adoption of eCOA solution across by companies. As the Electronic Clinical Outcome Assessment (eCOA) slutions helps in advancing clinical trials by streamlining and enhancing the accuracy of data collection. Moreover, eCOA also helps to ensure the integrity of clinical data, facilitating regulatory compliance and improving overall study quality. For pharmaceutical and biotechnology firms, the adoption of eCOA translates into accelerated decision-making, reduced trial timelines, and enhanced patient engagement, thus these end users are dominating the market. North America dominates the global Electronic Clinical Outcome Assessment (eCOA) Solutions market in 2023. The Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into five major regional segments, namely, North America, Europe, Asia Pacific, Latin America and Middle East and Africa. In 2023, North America accounted for the largest share of the Electronic Clinical Outcome Assessment (eCOA) Solutions market. As this region is home to a significant number of pharmaceutical and biotechnology companies which are using eCOA solutions. These companies conduct extensive clinical trials, seeking efficient and accurate methods of data collection to meet rigorous regulatory standards. Moreover, the well-established healthcare infrastructure in North America, coupled with a high level of digital literacy among healthcare professionals, facilitates the seamless integration of eCOA technologies. Furthermore, the region’s leadership in research and development, coupled with substantial investments in healthcare technology, reinforces its position at the forefront of the eCOA market. Electronic Clinical Outcome Assessment (eCOA) Solution Market Dynamics: Drivers: Restraints: Opportunities: Challenge: Key Market Players of Electronic Clinical Outcome Assessment (eCOA) Solution Industry: Prominent players in the Electronic Clinical Outcome Assessment (eCOA) Solutions market include include Signant Health (US), IQVIA HOLDINGS INC, (US), Oracle Corporation (US), Kayentis (France), TransPerfect (US), Obvio Health USA, Inc. (US), WCG Clinical (US), clincapture (US), Merative (US), Clario (US), Medable Inc. (US), Medidata (US), healthentia (Belgium), Veeva Systems Inc. (US), assiTek (US), Curebase Inc (US), Castor (US), EvidentIQ (Germany), Y-Prime, LLC. (US), Clinical ink (US), and ICON PUBLIC LIMITED COMPANY(Ireland). Breakdown of the supply-side, demand side, primary interviews by company type, designation, and region: By Supply Side: Tier 1 (31%), Tier 2 (28%), and Tier 3 (41%) By Demand Side: Hospital Directors/VPs/Managers/Department Heads (40%), Pharma & Biopharma Company’s Product managers, Purchase Heads, etc. (35%), and Others (25%). By Designation: C-level Executives (31%), Director-level (25%), and Managers (44%) By Region: North America (45%), Europe (20%), Asia Pacific (28%), and RoW (4%) Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=87857774 Electronic Clinical Outcome Assessment (eCOA) Solution Market – Key Benefits of Buying the Report: The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the below-mentioned five strategies. This report provides insights into the following pointers: Analysis of key drivers (increasing R&D expenditure for product development by medtech, and pharma-biotech companies, rising operational costs and regulatory requirements associated with clinical research studies, favorable government support and funding for clinical trials, growing prevalence of chronic diseases & subsequent increase in clinical trials, effective monitoring of clinical data, reduction in overall costs and timelines of clinical trials), restraints (lack of skilled professionals to develop and operate eCOA solutions, high implementation and maintenance cost, lack of awareness about eCOA solutions among end users), opportunities (surging eCOA adoption owing to increasing number of clinical trials in emerging economies, growing outsourcing of clinical trial processes to CROs, gradual shift from manual data interpretation to real-time data analysis, growing penetration of mobile technology in healthcare industry), and challenges (evolving regulatory landscape and compliance requirements, interoperability & integration, data security & privacy issues, resistance from traditional healthcare professionals and concerns regarding software reliability) influencing the growth of electronic clinical outcome assessment (eCOA) solutions market. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the electronic clinical outcome assessment (eCOA) solutions market. Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of electronic clinical outcome assessment (eCOA) solutions solutions across regions. Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the electronic clinical outcome assessment (eCOA) solutions market. Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the electronic clinical outcome assessment (eCOA) solutions market. Media Contact

Curebase Frequently Asked Questions (FAQ)

When was Curebase founded?

Curebase was founded in 2017.

Where is Curebase's headquarters?

Curebase's headquarters is located at 548 Market Street, San Francisco.

What is Curebase's latest funding round?

Curebase's latest funding round is Series B.

How much did Curebase raise?

Curebase raised a total of $58.13M.

Who are the investors of Curebase?

Investors of Curebase include Pioneer Fund, BOLD Capital Partners, Xfund, Notable Capital, Gilead Sciences and 6 more.

Who are Curebase's competitors?

Competitors of Curebase include ObvioHealth, Formation Bio, Science 37, Lindus Health, Delve Health and 7 more.

What products does Curebase offer?

Curebase's products include Virtual Site and 1 more.

Who are Curebase's customers?

Customers of Curebase include Luminostics, Inbios, Adaptive Biotech, Applied VR and Cofactor Genomics.

Loading...

Compare Curebase to Competitors

Medable specializes in providing digital clinical trial software solutions within the healthcare and pharmaceutical sectors. The company offers a comprehensive platform that facilitates the management of clinical trials, including tools for remote data collection, electronic consent (eConsent), patient-reported outcomes (ePRO), and clinical outcome assessments (eCOA), all designed to streamline the trial process and enhance data quality. Medable was formerly known as Dermatrap. It was founded in 2012 and is based in Palo Alto, California.

Hawthorne Effect specializes in providing mobile, tech-driven solutions for clinical trials within the healthcare sector. The company offers a platform that facilitates mobile clinical trial visits, enhances patient access, and ensures high-quality data collection through a network of healthcare professionals. Hawthorne Effect primarily serves the biopharma, medtech, and healthcare industries by improving clinical trial efficiency, data quality, and patient diversity. It was founded in 2015 and is based in Lafayette, California.

THREAD is a company that focuses on providing a decentralized clinical trial platform in the healthcare and life sciences industry. The company offers a platform and supporting services that enable biopharma, CROs, and life science organizations to remotely capture data from participants and sites during, in-between, and in lieu of in-clinic visits. The platform includes features such as electronic consent (eConsent), electronic clinical outcome assessment (eCOA), sensors, reminders, and telehealth virtual visits. It was founded in 2005 and is based in Tustin, California.

Reify Health is a company focused on improving the clinical trial process within the healthcare industry. The company offers cloud-based software that accelerates patient enrollment in clinical trials, thereby facilitating the development of new therapies. Reify Health primarily serves the healthcare and biopharma industries. The company was formerly known as ZeroSum Health. It was founded in 2012 and is based in Boston, Massachusetts.

Castor is a medical research data platform. It provides decentralized clinical trial solutions to control clinical trial design. It analyzes, manages, and organizes medical data collected from multiple electronic records. The company was founded in 2012 and is based in New York, New York.

ObvioHealth is a company focused on providing digital health solutions, specifically in the realm of decentralized clinical trials. The company offers a suite of services including digital trial design, remote patient monitoring, virtual site services, and integration of sensors and wearable devices. It's platform, ObvioGo, and accompanying services such as electronic patient-reported outcomes (ePRO), electronic consent (eConsent), and clinical outcome assessments (eCOA) streamline the clinical trial process for sponsors and participants. It was founded in 2017 and is based in New York, New York.

Loading...