Investments

26About CVS Health Ventures

CVS Health Ventures is a dedicated corporate venture capital fund that invests in and partners with high-potential, early-stage companies that strive to make health care more accessible, affordable, and better.

Research containing CVS Health Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CVS Health Ventures in 4 CB Insights research briefs, most recently on Sep 13, 2024.

Jan 25, 2024 report

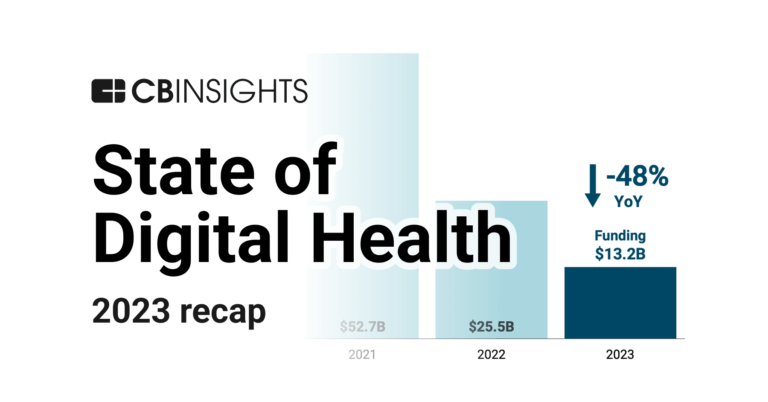

State of Digital Health 2023 ReportLatest CVS Health Ventures News

Sep 24, 2024

CVS Health Co. (NYSE:CVS) Shares Sold by Kayne Anderson Rudnick Investment Management LLC Posted by MarketBeat News on Sep 24th, 2024 Kayne Anderson Rudnick Investment Management LLC reduced its stake in shares of CVS Health Co. ( NYSE:CVS – Free Report ) by 74.6% in the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 20,609 shares of the pharmacy operator’s stock after selling 60,481 shares during the period. Kayne Anderson Rudnick Investment Management LLC’s holdings in CVS Health were worth $1,217,000 at the end of the most recent quarter. Several other large investors have also added to or reduced their stakes in the company. Ables Iannone Moore & Associates Inc. purchased a new stake in shares of CVS Health in the 4th quarter valued at $32,000. First Community Trust NA grew its position in CVS Health by 116.2% during the 2nd quarter. First Community Trust NA now owns 562 shares of the pharmacy operator’s stock worth $33,000 after purchasing an additional 302 shares during the period. Creekmur Asset Management LLC purchased a new position in shares of CVS Health during the 4th quarter valued at about $34,000. Steph & Co. boosted its stake in shares of CVS Health by 192.0% in the first quarter. Steph & Co. now owns 438 shares of the pharmacy operator’s stock worth $35,000 after buying an additional 288 shares during the last quarter. Finally, ORG Partners LLC grew its holdings in CVS Health by 11,840.0% during the second quarter. ORG Partners LLC now owns 597 shares of the pharmacy operator’s stock worth $35,000 after acquiring an additional 592 shares during the period. Hedge funds and other institutional investors own 80.66% of the company’s stock. Get CVS Health alerts: CVS Health Stock Performance NYSE CVS opened at $57.57 on Tuesday. CVS Health Co. has a fifty-two week low of $52.77 and a fifty-two week high of $83.25. The firm has a market capitalization of $72.27 billion, a P/E ratio of 10.12, a price-to-earnings-growth ratio of 0.79 and a beta of 0.53. The stock’s fifty day moving average is $58.28 and its two-hundred day moving average is $62.32. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.66 and a current ratio of 0.86. Want More Great Investing Ideas? CVS Health ( NYSE:CVS – Get Free Report ) last announced its quarterly earnings data on Wednesday, August 7th. The pharmacy operator reported $1.83 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $1.73 by $0.10. CVS Health had a net margin of 1.98% and a return on equity of 12.72%. The firm had revenue of $91.23 billion during the quarter, compared to analyst estimates of $91.41 billion. During the same quarter in the prior year, the firm posted $2.21 earnings per share. CVS Health’s quarterly revenue was up 2.6% on a year-over-year basis. On average, research analysts anticipate that CVS Health Co. will post 6.51 earnings per share for the current year. CVS Health Announces Dividend The firm also recently disclosed a quarterly dividend, which will be paid on Friday, November 1st. Investors of record on Monday, October 21st will be issued a $0.665 dividend. This represents a $2.66 dividend on an annualized basis and a yield of 4.62%. The ex-dividend date is Monday, October 21st. CVS Health’s dividend payout ratio is presently 46.75%. Analyst Ratings Changes Several research firms have commented on CVS. Wells Fargo & Company upped their price objective on CVS Health from $60.00 to $61.00 and gave the stock an “equal weight” rating in a research report on Monday, August 12th. Deutsche Bank Aktiengesellschaft cut their price objective on shares of CVS Health from $64.00 to $63.00 and set a “hold” rating for the company in a report on Friday, August 9th. Royal Bank of Canada restated an “outperform” rating and set a $68.00 target price on shares of CVS Health in a research report on Wednesday, September 4th. Cantor Fitzgerald reaffirmed a “neutral” rating and issued a $62.00 price target on shares of CVS Health in a report on Monday, September 16th. Finally, Evercore ISI cut their price objective on CVS Health from $65.00 to $62.00 and set an “outperform” rating for the company in a research report on Thursday, August 8th. Eleven investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of “Moderate Buy” and an average target price of $72.10.

CVS Health Ventures Investments

26 Investments

CVS Health Ventures has made 26 investments. Their latest investment was in Thyme Care as part of their Series C on May 28, 2024.

CVS Health Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

5/28/2024 | Series C | Thyme Care | $55M | Yes | 6 | |

4/19/2024 | Series D - II | Wayspring | $45M | Yes | 2 | |

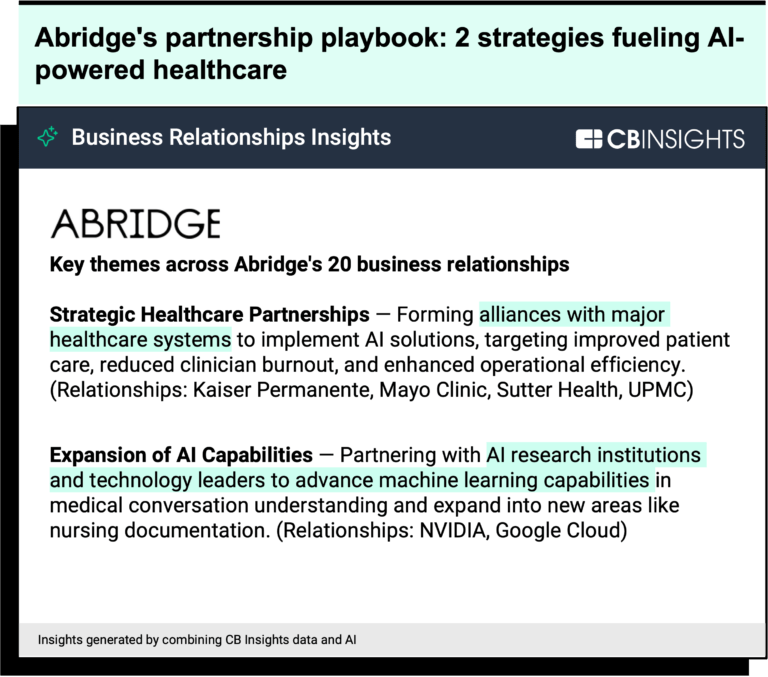

2/23/2024 | Series C | Abridge | $150M | No | 4 | |

1/7/2024 | Seed VC | |||||

10/26/2023 | Series B |

Date | 5/28/2024 | 4/19/2024 | 2/23/2024 | 1/7/2024 | 10/26/2023 |

|---|---|---|---|---|---|

Round | Series C | Series D - II | Series C | Seed VC | Series B |

Company | Thyme Care | Wayspring | Abridge | ||

Amount | $55M | $45M | $150M | ||

New? | Yes | Yes | No | ||

Co-Investors | |||||

Sources | 6 | 2 | 4 |

CVS Health Ventures Team

2 Team Members

CVS Health Ventures has 2 team members, including current Founder, Managing Partner, Vijay Jun Patel.

Name | Work History | Title | Status |

|---|---|---|---|

Vijay Jun Patel | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | Founder, Managing Partner | Current |

Name | Vijay Jun Patel | |

|---|---|---|

Work History | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | |

Title | Founder, Managing Partner | |

Status | Current |

Loading...