Dibbs

Founded Year

2020Stage

Series A - II | AliveTotal Raised

$15.8MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-82 points in the past 30 days

About Dibbs

Dibbs is a company specializing in the tokenization of physical collectibles, operating within the blockchain and NFT sectors. They provide a platform for brands and intellectual property holders to create and manage asset-backed NFTs, offering services such as regulated custody, proprietary 3D imaging, and minting of digital tokens. Dibbs primarily serves sectors that deal with consumer products in sports, music, entertainment, toys, and luxury goods. It was founded in 2020 and is based in El Segundo, California.

Loading...

Dibbs's Product Videos

.png)

_thumbnail.png?w=3840)

_(2023-04-28)_thumbnail.png?w=3840)

Dibbs's Products & Differentiators

TaaS

Tokenization As A Service

Loading...

Research containing Dibbs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dibbs in 2 CB Insights research briefs, most recently on Jan 30, 2023.

Expert Collections containing Dibbs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dibbs is included in 1 Expert Collection, including Blockchain.

Blockchain

12,836 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Latest Dibbs News

Jul 8, 2024

Transport for NSW offers them $1.062 million in 2021 The Dibbs launch legal proceedings seeking $5.5 million The Land and Environment Court awards them $1.417 million The NSW Court of Appeal reduces this to $1.359 million and orders the Dibbs to pay costs He said most landowners settled “with a gun to their head” for a lower valuation rather than go to court to fight for a better deal, and an independent body should conduct compulsory acquisitions, not the government. The couple first visited Coffs Harbour in 1976, and by the 1980s they could see the city was on the precipice of expansion, prompting them to buy on the outskirts. They planned to subdivide their block into 26 lots once the land was rezoned as residential, live on one block and drip-feed two or three others on to the market each year. Advertisement They were going to finance the development using a line of credit from their eldest son, who founded a gold mining company with operations in Africa, Dibb told the Land and Environment Court during a 10-day hearing last year. By 1996 it looked like their investment was going to pay off, with Coffs Harbour City Council earmarking Korora for possible residential development, saying the area once covered in banana plantations was ideal for “rural living”. The location of the Gibbs’ land on Bruxner Park Rd But just as the council was about to rezone the Dibb land in 2001, the government unveiled its plans for the highway bypass and urged the council to refrain from doing so until the route was determined. Dibb told this masthead that curtailed his ability to do anything with the land for the next 20 years and depleted all the land values in the area, to the benefit of Transport for NSW. The $2.2 billion highway is now being built over the top of the block, which will be the site of a major intersection when the bypass opens to traffic in late 2026. In the Land and Environment Court, Justice Nicola Pain found the council would have rezoned the land as low-density residential if not for the highway plans. But she said the Dibbs had not accounted for the cost of developing the land, nor the risk to the project arising from a watercourse that ran over the block. ‘The number of people I’ve spoken to … [whose land was affected by the bypass], you would break down and cry if you heard their stories.’ Raymond Dibb She increased their compensation to $1.42 million after finding the land could have produced seven residential lots with less risk and cost, and that the couple were also entitled to money to cover fees and stamp duty on a replacement block for their land bank, which the couple said they would have to buy to delay paying capital gains tax. The Dibbs appealed to the NSW Court of Appeal, where they appeared without legal representation and sought greater compensation. Transport for NSW argued, however, that the couple should not have received any money for stamp duty and Justices Kristina Stern, Anthony Payne and Jeremy Kirk agreed, stripping that from the award and refusing to revalue the block of land. They also ordered the couple pay the government’s costs of the two-day appeal. Loading Dibb said he was considering seeking leave to appeal the decision to the High Court, and the couple’s retirement plans had been ruined by the actions of Transport for NSW, which had originally offered them just $470,000 for their block in 2019. “I can’t let this go because we’re talking millions of dollars,” he said. “We could have resolved this much earlier if it was only about the self-interest aspect, but the number of people I’ve spoken to over the years [whose land was affected by the bypass], you would break down and cry if you heard their stories.” The government is reviewing the laws that govern compulsory acquisitions after a 2022 parliamentary inquiry raised concerns about the process. The state government has been approached for comment. Start the day with a summary of the day’s most important and interesting stories, analysis and insights. Sign up for our Morning Edition newsletter . Save

Dibbs Frequently Asked Questions (FAQ)

When was Dibbs founded?

Dibbs was founded in 2020.

Where is Dibbs's headquarters?

Dibbs's headquarters is located at 129 Nevada Street, El Segundo.

What is Dibbs's latest funding round?

Dibbs's latest funding round is Series A - II.

How much did Dibbs raise?

Dibbs raised a total of $15.8M.

Who are the investors of Dibbs?

Investors of Dibbs include Amazon, Founder Collective, Channing Frye, Kevin Love, Courtside Ventures and 11 more.

Who are Dibbs's competitors?

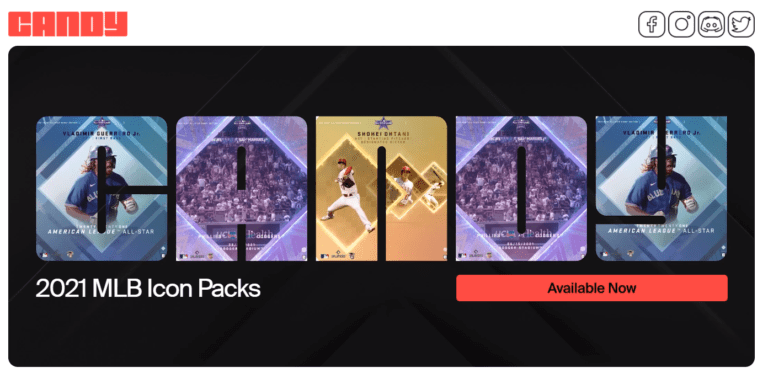

Competitors of Dibbs include Masterworks, Rally, DappRadar, Mint Songs, Candy and 7 more.

What products does Dibbs offer?

Dibbs's products include TaaS.

Loading...

Compare Dibbs to Competitors

DappRadar is a decentralized application store. The company offers a platform for managing crypto wallets, tokens, and non-fungible tokens (NFTs), as well as providing insights into the market with smart tools. DappRadar serves as a hub for dapp discovery and a distribution channel for developers to reach consumers, while also incorporating community governance through its decentralized autonomous organization (DAO). It was founded in 2018 and is based in Klaipeda, Lithuania.

Sorare is a company focused on the intersection of digital collectibles and fantasy sports within the gaming and sports industry. The company offers a platform where users can collect, play, and win with officially licensed digital cards featuring professional athletes from football, the National Basketball Association (NBA), and Major League Baseball (MLB). The platform primarily caters to sports enthusiasts and gamers. It was founded in 2018 and is based in Saint Mande, France.

Mythic Markets is a company that specializes in the fractional ownership and alternative investing within the collectibles market. They offer a platform for buying, selling, and trading fractional shares in rare pop culture collectibles, such as vintage comic books and collectible cards. The company primarily caters to the alternative investment market and fans of pop culture. It was founded in 2017 and is based in San Rafael, California.

Vincent is a company that focuses on private market investing, operating within the financial services industry. The company provides information and insights on alternative asset investing, covering a broad set of uncorrelated asset classes such as real estate, collectibles, art, and venture capital. Vincent primarily serves individuals interested in diversifying their investment portfolios. It was founded in 2019 and is based in New York, New York.

Rally offers a platform specializing in alternative asset investment, offering a marketplace for buying and selling equity shares in collectible assets. The company enables investors to participate in initial offerings and secondary market trading of shares representing ownership in curated collectible items. Rally primarily serves individual investors interested in diversifying their portfolios with alternative investments. It was founded in 2016 and is based in New York, New York.

Dapper Labs provides a blockchain-based collectibles and non-fungible token (NFT) platform. Its platform uses blockchain-enabled applications to bring its customers closer to the brands. It enables users to access new forms of digital engagement and track Its ownership securely. The company was founded in 2018 and is based in Vancouver, Canada.

Loading...