Earnix

Founded Year

2001Stage

Secondary Market | AliveTotal Raised

$98.5MLast Raised

$120M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+24 points in the past 30 days

About Earnix

Earnix provides predictive analytics solutions for the financial services industry. It focuses on strategies, processes, and an evolving ecosystem of technologies to help insurers and banks operate. It helps in business operations, pricing and rating, customer engagement, product personalization, and more. It serves the telematics, health, and insurance industries. The company was founded in 2001 and is based in Ramat Gan, Israel.

Loading...

Earnix's Product Videos

ESPs containing Earnix

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

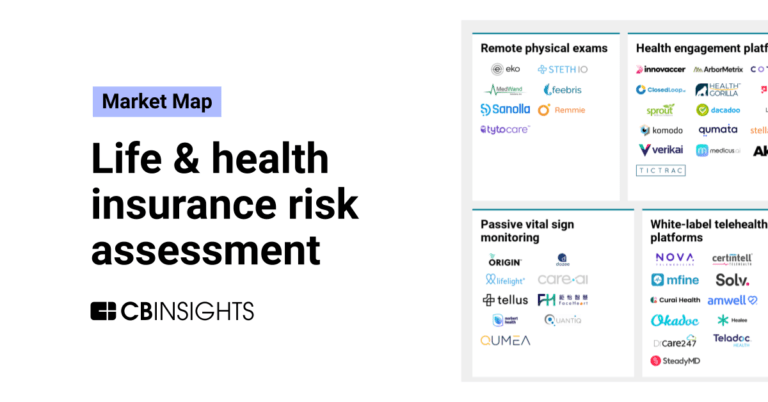

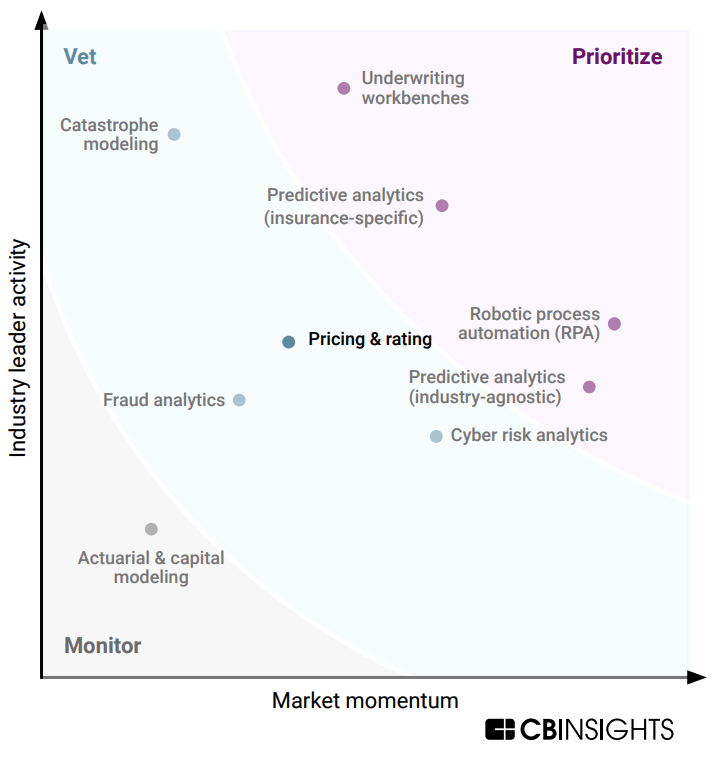

The insurance pricing software market offers solutions that help insurance companies determine the appropriate premium rates for their policies. These solutions use advanced algorithms and data analytics techniques to analyze various factors such as risk, claims history, demographics, and other relevant information. The goal is to provide accurate pricing recommendations that balance profitability…

Earnix named as Leader among 9 other companies, including Akur8, Federato, and Hyperexponential.

Earnix's Products & Differentiators

Earnix Price-it

Earnix is the only end to end solution from pricing through rating, enabling speed to market, governance and full automation with open integration and management of any and all machine learning and always-on dynamic monitoring of business performance.

Loading...

Research containing Earnix

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Earnix in 5 CB Insights research briefs, most recently on Aug 9, 2023.

May 10, 2022

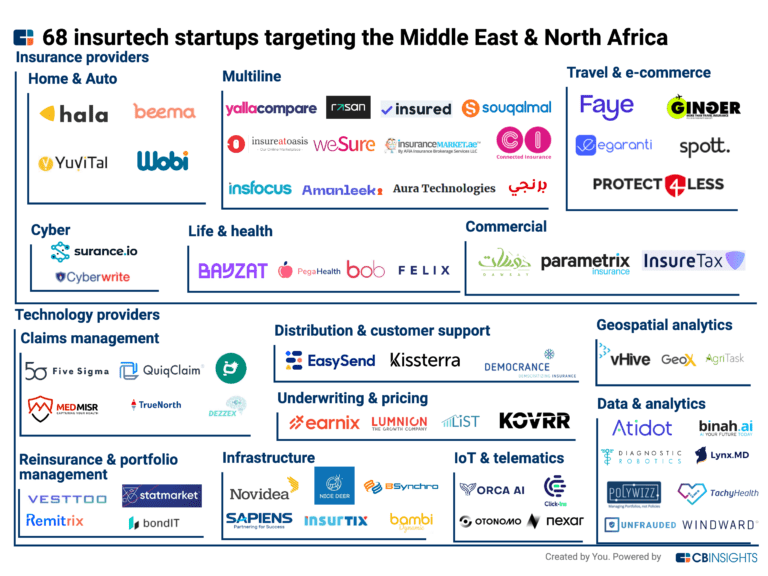

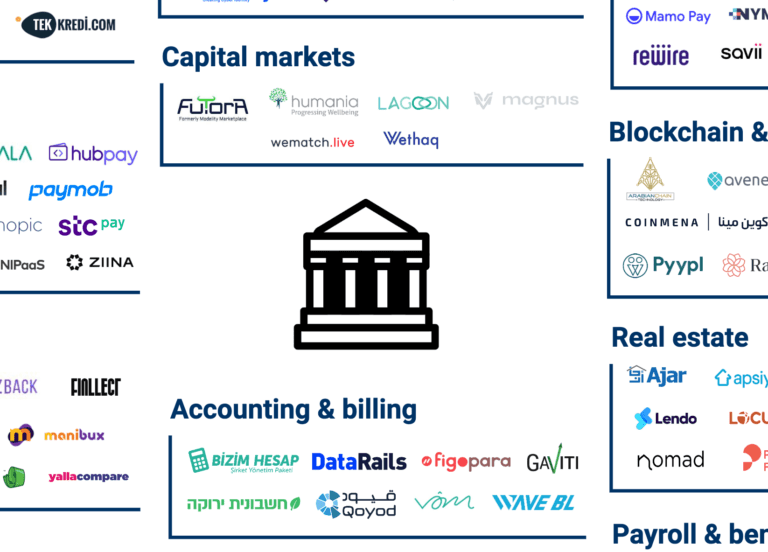

130+ startups driving the Middle East’s fintech boomExpert Collections containing Earnix

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Earnix is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,653 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Digital Banking

763 items

Latest Earnix News

Sep 5, 2024

Reinsurance News Hexaware, an IT services and solutions provider, looks to accelerate insurance pricing transformation with its recent Earnix partnership, a global provider of AI-based SaaS pricing and rating solutions for financial services. The partnership aims to improve underwriting, efficiency, reduce losses, better comply with the regulations, and ensure competitive advantage through effective pricing strategies. Hexaware supports pricing transformation across lines of business and pricing models for insurers, brokers, and MGAs. The firm believes that intelligent pricing is crucial in enabling more accurate risk assessment and premium setting. With emerging AI and ML technologies transforming insurance pricing, insurers can benefit from Earnix’s advanced data analytics and AI-driven models as it allows them to evaluate individual risk factors precisely, creating more accurate and dynamic pricing models. These tailored premiums improve underwriting accuracy and customer satisfaction, adapting to real-time data and reflecting changes in risk profiles promptly. Sandesh Shetti, Global Leader of Insurance, Hexaware, said: “Hexaware’s expertise in AI and ML, combined with Earnix’s pricing and underwriting solutions will help our clients refine pricing strategies, improve customer satisfaction, and maintain a competitive edge.” Ruth Fisk, Head of Business Development, Earnix, commented: “Earnix is excited to join forces with Hexaware to drive significant advancements in the insurance industry. “By combining our expertise, we can offer a comprehensive suite of solutions that helps insurers optimise their pricing and risk management strategies, improve customer experience, and ultimately drive growth and profitability.” Share this:

Earnix Frequently Asked Questions (FAQ)

When was Earnix founded?

Earnix was founded in 2001.

Where is Earnix's headquarters?

Earnix's headquarters is located at 2 Ze’ev Jabotinsky Street, Ramat Gan.

What is Earnix's latest funding round?

Earnix's latest funding round is Secondary Market.

How much did Earnix raise?

Earnix raised a total of $98.5M.

Who are the investors of Earnix?

Investors of Earnix include Jerusalem Venture Partners, Vintage Investment Partners, Israel Growth Partners, Insight Partners, PropertyCasualty360 Insurance Luminaries and 4 more.

Who are Earnix's competitors?

Competitors of Earnix include Akur8, Lumnion, Swallow, Federato, Atidot and 7 more.

What products does Earnix offer?

Earnix's products include Earnix Price-it and 3 more.

Who are Earnix's customers?

Customers of Earnix include Gore Mutual and Suncorp.

Loading...

Compare Earnix to Competitors

Akur8 leverages machine learning and predictive analytics to improve insurance pricing processes in the insurance industry. It offers a solution that automates the generation of insurance pricing models, enabling insurers to make more accurate predictions and pricing decisions faster and more efficiently. The company was founded in 2018 and is based in Paris, France.

Quantee specializes in dynamic insurance pricing software within the insurance industry. The company offers a platform that enhances the precision and granularity of insurance pricing models, facilitates targeted outcomes, and supports instant deployment and real-time monitoring. Quantee's solutions cater to insurers, MGAs, and InsurTechs seeking to optimize their pricing strategies and operational efficiency. It was founded in 2018 and is based in Warsaw, Poland.

Atidot specializes in integrating artificial intelligence into life insurance. The company offers a cloud-based platform that uses predictive analytics to generate insights, helping insurers identify untapped opportunities and grow their customer's lifetime value. It primarily serves the life insurance industry. It was founded in 2016 and is based in Palo Alto, California.

Zesty AI specializes in leveraging artificial intelligence for property and climate risk assessment within the insurance and real estate sectors. The company provides a suite of products that deliver detailed insights into property value and risk exposure to natural disasters, utilizing advanced technologies such as computer vision. Zesty AI primarily serves the insurance industry, including personal and commercial lines, as well as the real estate sector. Zesty AI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

Binah.ai is a technology company focused on the healthcare and wellness sectors. The company offers an AI-powered health data platform that transforms camera-equipped devices into biomarker monitoring solutions, enabling users to measure a range of health parameters such as blood pressure, heart rate, and oxygen saturation. Binah.ai primarily serves the healthcare, wellness, and insurance industries. It was founded in 2016 and is based in Ramat Gan, Israel.

Lapetus Solutions is a company specializing in artificial intelligence with a focus on health intelligence within the insurance and financial sectors. The company offers AI-powered solutions that provide insights into health and life expectancy using facial analytics and biometric analysis. Lapetus Solutions primarily serves industries such as insurance, reinsurance, life settlements, and financial planning. It was founded in 2015 and is based in Wilmington, North Carolina.

Loading...