EBANX

Founded Year

2012Stage

Series C | AliveTotal Raised

$460MLast Raised

$430M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-9 points in the past 30 days

About EBANX

EBANX is a company focused on providing cross-border payment solutions and services for global companies looking to succeed in emerging markets. The company offers a comprehensive payment platform that supports over 100 payment methods, enabling businesses to reach customers in 29 countries across Latin America, Africa, and India. EBANX's platform is designed to simplify operations for its clients, offering features such as instant market access, advanced fraud and risk management, and a commitment to innovation with a suite of payment services tailored for various digital-driven industries. It was founded in 2012 and is based in Curitiba, Brazil.

Loading...

ESPs containing EBANX

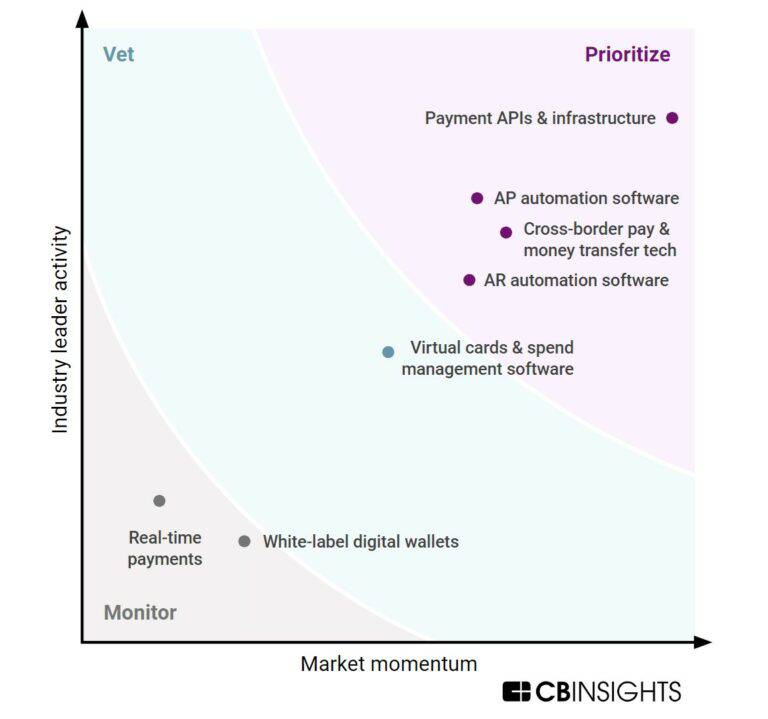

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

EBANX named as Challenger among 15 other companies, including FIS, Adyen, and NIUM.

Loading...

Research containing EBANX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EBANX in 11 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

Top cross-border payments companies — and why customers chose them

Nov 28, 2022

The Transcript from Yardstiq: Feel the churn

Sep 21, 2022 report

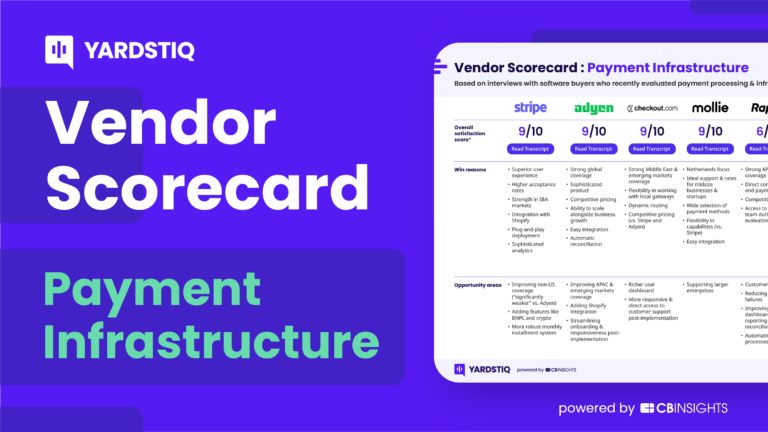

Top payment infrastructure companies — and why customers chose themExpert Collections containing EBANX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EBANX is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,250 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest EBANX News

Sep 10, 2024

News provided by Share this article Share toX Expected to reach 44% of online purchases by 2025, Brazil's instant payment system and its growth will be key topics at EBANX's Payments Summit, starting on September 18 in four countries CURITIBA, Brazil, Sept. 10, 2024 /PRNewswire/ -- Brazil's instant payment system Pix is set to surpass credit cards as the most widely used payment method in Brazilian digital commerce by next year, according to Payments and Commerce Market Intelligence (PCMI) data analyzed by EBANX , a global technology company specializing in payment services for emerging markets. The projection for 2025 estimates that Pix will account for 44% of all value transacted in online purchases in Brazil, an increase of four percentage points, while cards will have a 41% share. The even more intense acceleration of Pix over the past year has brought this scenario forward, as previous forecasts indicated it would surpass credit cards only after 2026. This data is part of a study produced for the 7th EBANX Payments Summit , an annual event that brings together industry leaders from around the world to discuss trends and innovations in digital economy and payments, such as Pix, which in less than four years has more more than 168 million users and accounts for 14% of all instant payments worldwide, according to ACI Worldwide report . By 2025, Pix will account for 44% of all value transacted in online purchases in Brazil, an increase of four percentage points, while cards will have a 41% share. The growth of Pix in the past year has been driven primarily by retail and travel, the two largest digital verticals in the country, and also the two that will accelerate the most: 31% and 20% per year, respectively, over the next three years, with Pix currently holding one third of the total value transacted in each. "These sectors saw Pix as a way to reach more customers. Many merchants encourage payments with Pix by offering discounts to those who choose it," explains Sebastian Fantini, Product Director at EBANX. Gaming and delivery apps have also contributed significantly to Pix's acceleration. In both cases, the volume of Pix transactions is already approaching the percentage of credit cards. xVerticals like SaaS and streaming services are still dominated by credit cards, with over 60% share, but this scenario is expected to change in the near future, as the Central Bank of Brazil has been developing new features for Pix that have the potential to make it even more popular, such as Auto Pix, for recurring payments, and Pix Garantido, which will enable people to pay with Pix in installments, which is a common habit among Brazilian consumers. "Pix still has significant room for growth, even though it is already a part of the lives of 4 out of 5 Brazilian adults," says Fantini. Not surprisingly, Pix alone will respond for 24% of the total value transacted online across Latin America in 2025. With the success of Pix, Brazil has become a beacon for the payments market across the region: ten Latin American countries are pursuing or launching instant payment methods led by Pix, as stated by Capgemini. Pix is a catalyst for digital commerce, as credit cards remain strong According to the Central Bank of Brazil , Pix included 71.5 million users in the financial system in just the first two years of operation. These people were virtually excluded from digital commerce. EBANX internal data shows that 95% of people who made their first purchase at one of its partner's online stores paid with Pix. "Indeed, Pix has been serving as a gateway to digital commerce. It has positively impacted not only the financial and digital inclusion of Brazilians but also the businesses of merchants who offer this payment method to their customers," says Fantini. Companies accepting Pix with EBANX in digital commerce experience a 16% increase in their revenue and a 25% growth in the number of clients. "Pix is moving the needle on their financial results," he emphasizes. EBANX's internal data considers more than 2 million daily transactions, including payments for 20% of all Pix users and nearly 70% of Brazil's credit cardholders. Despite Pix's rapid rise, credit cards still hold significant importance in building customer loyalty in Brazil, where card issuance has increased by a staggering 130% in four years . The PCMI data analyzed by EBANX indicates a 21% annual growth in the value transacted on digital commerce by credit cards over the next three years. "Credit cards and instant payment methods like Pix are allies, not competitors," Fantini explains. "This is why we say at EBANX that merchants should not focus on one method or the other, but rather have a combination of methods, tailored to their vertical and the country they are focusing." Payments Summit 2024 The tremendous success of instant payments, such as Pix in Brazil, will be one of the topics discussed at the upcoming 7th edition of EBANX Payments Summit, which will explore the forefront of payments innovation across rising economies. It will take place in four locations across the globe: Barcelona, Spain (Sep 18-20); Napa Valley, in California, US (Sep 30-Oct 2); Bangkok, Thailand (Oct 24-26); and São Paulo, Brazil (Nov 5). The lineup of speakers includes João Del Valle, CEO of EBANX; Maria Francis, Head of Business Development for Americas at National Payments Corporation of India (NPCI); Rene Salazar, Head of Financial Partnerships for Latin America at Stripe; Anderson Teixeira, Head of Global Cards at Santander Brasil; Wolfgang Fengler, CEO of World Data Lab; Andrew Kaing, Senior Product Manager at Canva; Constanza López Vela, Deputy General Manager of Acquiring Business at Banorte Mexico; and several others. ABOUT EBANX EBANX is the leading payment platform connecting global companies with customers from the fastest-growing digital markets in the world. The company was founded in 2012 in Brazil with the mission of giving people access to buy in international digital commerce. With powerful proprietary technology and infrastructure, combined with in-depth knowledge of the markets where it operates, EBANX enables global businesses to connect with hundreds of payment methods in different countries in Latin America, Africa, and Asia. EBANX goes beyond payments, increasing sales, and fostering seamless purchase experiences for businesses and clients. For further information, please visit:

EBANX Frequently Asked Questions (FAQ)

When was EBANX founded?

EBANX was founded in 2012.

Where is EBANX's headquarters?

EBANX's headquarters is located at Marechal Deodoro, 630, Curitiba.

What is EBANX's latest funding round?

EBANX's latest funding round is Series C.

How much did EBANX raise?

EBANX raised a total of $460M.

Who are the investors of EBANX?

Investors of EBANX include Advent International, FTV Capital and Endeavor.

Who are EBANX's competitors?

Competitors of EBANX include CloudWalk, Pismo, HedgeWiz, Checkout.com, Melio and 7 more.

Loading...

Compare EBANX to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Rapyd is a fintech company specializing in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, England.

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Planet Payment specializes in tax-free shopping services and (Value Added Tax) VAT refund solutions within the retail and hospitality sectors. The company offers a VAT refund service for international shoppers and provides businesses with end-to-end payment solutions and tax-free refund processes. Planet Payment was formerly known as Fintrax. It was founded in 1985 and is based in Galway, Ireland.

NIUM specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. NIUM primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. NIUM was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

Float operates as a financial technology company specializing in global payment solutions. The company offers a platform for businesses to make domestic and international payments using various methods such as card, automated clearing house (ACH), wire, society for worldwide interbank financial telecommunication (SWIFT), and local payments, as well as features for managing invoices, collections, and vendor relationships. It primarily serves the financial service sector. Float was formerly known as Swipe Technologies. It was founded in 2020 and is based in San Francisco, California.

Loading...