Elliptic

Founded Year

2013Stage

Series C | AliveTotal Raised

$99.13MLast Raised

$60M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Elliptic

Elliptic is a company specializing in blockchain analytics and crypto compliance solutions within the financial technology sector. The company offers products and services designed to prevent financial crime in cryptoassets, including real-time wallet screening, automated transaction monitoring, and cross-chain investigations. Elliptic primarily serves financial institutions, crypto businesses, regulators, and law enforcement agencies. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, England.

Loading...

ESPs containing Elliptic

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

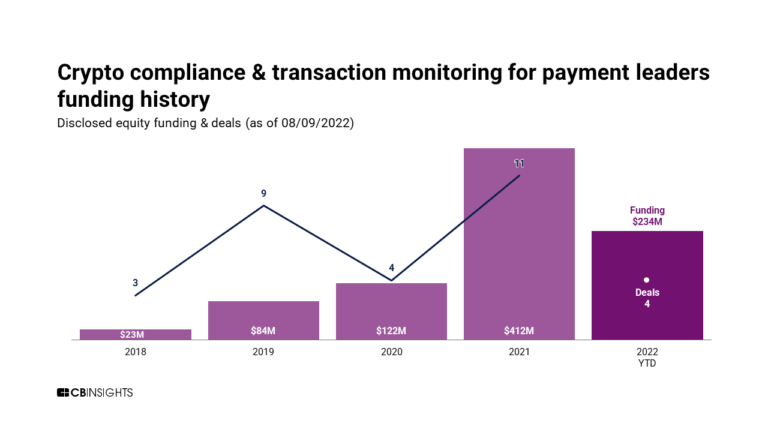

The crypto compliance & transaction monitoring market helps organizations comply with regulatory requirements in the cryptocurrency industry, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These solutions leverage blockchain technology and proprietary risk algorithms to monitor transactions for potential illicit activity, such as money laundering, terrorism …

Elliptic named as Leader among 15 other companies, including Chainalysis, CertiK, and Coinfirm.

Elliptic's Products & Differentiators

Elliptic Navigator

Screen your cryptoasset transactions in real-time to uncover links to money laundering, terrorist financing, and sanctioned entities in order to detect and act on high risk transactions and customers, trace source and destination of funds, and to provide audit trails that can speed up SARs submissions.

Loading...

Research containing Elliptic

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Elliptic in 7 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Expert Collections containing Elliptic

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Elliptic is included in 8 Expert Collections, including Regtech.

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,396 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Game Changers 2018

70 items

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Cybersecurity

9,329 items

These companies protect organizations from digital threats.

Fintech

13,396 items

Excludes US-based companies

Elliptic Patents

Elliptic has filed 60 patents.

The 3 most popular patent topics include:

- audio engineering

- acoustics

- spectroscopy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/29/2019 | 7/23/2024 | Home appliance brands, Internet of things, Smartwatches, Audio engineering, GPS navigation devices | Grant |

Application Date | 8/29/2019 |

|---|---|

Grant Date | 7/23/2024 |

Title | |

Related Topics | Home appliance brands, Internet of things, Smartwatches, Audio engineering, GPS navigation devices |

Status | Grant |

Latest Elliptic News

Aug 19, 2024

RegTech Analyst Moody’s and Elliptic enhance VASP screening with integrated data solutions August 19, 2024 Moody’s and Elliptic have announced a strategic partnership aimed at revolutionising virtual asset service provider (VASP) screening. This collaboration seeks to enhance the integration of on-chain blockchain data with traditional off-chain data sources. The partnership addresses the significant challenges financial institutions, crypto businesses, and governments face in anti-money laundering (AML) efforts amid the complexities of fiat currencies and digital assets such as Bitcoin and Ethereum. These challenges include navigating evolving regulatory landscapes, balancing various risks, and performing due diligence to prevent illicit activities. Moody’s and Elliptic have developed a joint approach to utilise on- and off-chain data programmatically at scale. On-chain data involves information recorded on blockchain networks, such as transaction histories, while off-chain data includes traditional sources like financial records and regulatory databases. This integration facilitates a unified compliance framework bridging traditional financial services and digital asset compliance. This solution leverages Elliptic’s real-time on-chain data, categorizing digital asset transactions’ exposure to illicit activities, combined with Moody’s extensive off-chain data within an integrated risk engine. It provides a comprehensive view of a VASP, aiding institutions in understanding their business partners and associated risks. Elliptic’s proprietary Holistic technology underpins the solution, assessing the risk of a VASP across various blockchains. This technology ensures up-to-date profiles for over 1,000 major VASPs, enabling a consolidated, risk-based compliance screening approach. The collaboration between Moody’s and Elliptic equips risk and compliance teams with necessary tools to address exposures to digital asset risks from sanctioned actors, terrorist groups, or money launderers, supporting an efficient compliance workflow accessible to those without blockchain expertise. “By joining forces with Moody’s as part of this strategic alliance, we are enabling financial institutions and crypto businesses to engage with VASPs safely and confidently. Combining Elliptic’s best-in-class on-chain risk analytics with Moody’s market-leading off-chain analytics provides our clients with a comprehensive set of tools to manage VASP risk more efficiently and effectively, allowing them to expand their business securely,” James Smith, co-founder of Elliptic, said. “Moody’s and Elliptic are coming together to address a burgeoning area of risk — enhancing risk analytics and insights by integrating on-chain and off-chain data. Our collaboration sets a new, global benchmark for managing AML compliance between fiat and cryptocurrency and helps address the complexities of an evolving digital economy,” Danielle Ferry, managing director of product strategy, Moody’s compliance and third-party risk management, said. Copyright © 2024 RegTech Analyst

Elliptic Frequently Asked Questions (FAQ)

When was Elliptic founded?

Elliptic was founded in 2013.

Where is Elliptic's headquarters?

Elliptic's headquarters is located at 35-37 Ludgate Hill, London.

What is Elliptic's latest funding round?

Elliptic's latest funding round is Series C.

How much did Elliptic raise?

Elliptic raised a total of $99.13M.

Who are the investors of Elliptic?

Investors of Elliptic include Digital Currency Group, Octopus Ventures, Paladin Capital Group, SignalFire, SBI Group and 11 more.

Who are Elliptic's competitors?

Competitors of Elliptic include Coinfirm, Chainalysis, Gray Wolf, Ospree, Elementus and 7 more.

What products does Elliptic offer?

Elliptic's products include Elliptic Navigator and 4 more.

Loading...

Compare Elliptic to Competitors

Chainalysis is a blockchain data platform that operates in the cryptocurrency sector, providing insights and analytics to support various industries. The company offers solutions for crypto investigations, regulatory compliance, and market intelligence, enabling businesses, financial institutions, and government agencies to engage with digital assets securely and effectively. Chainalysis primarily serves law enforcement agencies, financial institutions, and regulatory bodies seeking to understand and leverage blockchain technology for security and compliance purposes. It was founded in 2014 and is based in New York, New York.

TRM is a blockchain intelligence company focused on detecting and investigating crypto-related financial crime and fraud. The company offers a suite of services including transaction monitoring, wallet screening, and know-your-entity solutions, as well as training programs for digital forensics and crypto compliance. TRM primarily serves financial institutions, crypto businesses, and the public sector. It was founded in 2018 and is based in San Francisco, California.

Merkle Science offers predictive transaction monitoring and forensics advanced solutions in blockchain monitoring. The company provides the infrastructure to help blockchain companies, cryptocurrency exchanges, investment funds, banks, and regulators perform due diligence on the blockchain. It was founded in 2018 and is based in Manhattan, New York.

Notabene provides pre-transaction compliance solutions in cryptocurrency. The company's main service is its SafeTransact platform, which offers a holistic view of crypto transactions, enabling customers to automate real-time decision-making, perform counterparty sanctions screening, identify self-hosted wallets, and ensure compliance with global regulations. It primarily serves financial institutions and virtual asset service providers (VASPs). It was founded in 2020 and is based in Brooklyn, New York.

Solidus Labs provides market integrity solutions in the cryptocurrency sector. The company offers services such as trade surveillance, transaction monitoring, and threat intelligence, which help in identifying irregular market activities, detecting suspicious crypto transactions, and preventing money laundering from smart contract scams. It primarily serves crypto and decentralized finance (DeFi) businesses, financial institutions, and regulators. The company was founded in 2018 and is based in New York, New York.

Scorechain specializes in blockchain analytics and compliance solutions within the cryptocurrency sector. The company offers a suite of tools for crypto wallet and transaction screening, customizable alerts, risk assessments, and detailed reporting to enhance due diligence and manage digital asset risks. Scorechain primarily serves sectors such as crypto businesses, financial institutions, law enforcement agencies, and regulators. It was founded in 2015 and is based in Esch-sur-Alzette, Luxembourg.

Loading...