Fairmatic

Founded Year

2019Stage

Series B | AliveTotal Raised

$88MLast Raised

$46M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+51 points in the past 30 days

About Fairmatic

Fairmatic provides a business vehicle insurance platform. The company offers a unique insurance service that uses data and artificial intelligence (AI) to measure and analyze fleet driving behavior, providing insights for safer driving. The platform calculates a safety score based on the driver's risky actions, including driving excessively, rapid acceleration, and hard braking. It was founded in 2019 and is based in San Francisco, California.

Loading...

ESPs containing Fairmatic

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech managing general agents — commercial lines property & casualty market comprises insurtech managing general agents (MGAs) that provide commercial lines property & casualty (P&C) insurance. These companies primarily focus on niche coverage areas such as (but not limited to) commercial flood, drone coverage, fleet insurance, professional liability, and more. Also included in this market…

Fairmatic named as Challenger among 15 other companies, including Coterie Insurance, SageSure, and Vouch.

Fairmatic's Products & Differentiators

Fairmatic

Through the power of AI, Fairmatic intelligently blends a combination of a UBI program, pay-per-mile insurance, and driving habit analysis to unlock savings for our customers. We adjust pricing based on how well insureds are driving, along with total commercial miles driven - so safer driving unlocks better insurance rates and vehicles who do not drive do not incur any costs. This provides much needed flexibility and control for fleets who would otherwise be burdened by their mounting insurance costs. Numerous providers in the industry require customers to wait a year, then on renewal, can get rated for the following year. Our platform enables fleets to realize savings much sooner (throughout insured’s entire policy & pre-renewal).

Loading...

Research containing Fairmatic

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fairmatic in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

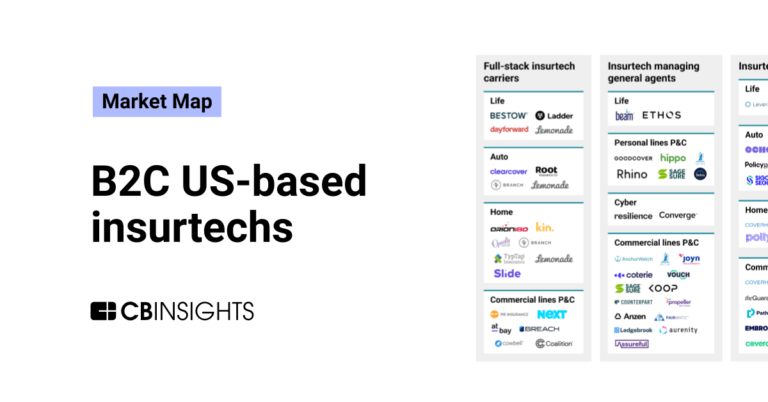

The B2C US insurtech market map

May 9, 2023 report

State of Insurtech Q1’23 ReportExpert Collections containing Fairmatic

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fairmatic is included in 5 Expert Collections, including Insurtech.

Insurtech

4,359 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

14,769 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Fintech 100

100 items

Latest Fairmatic News

Sep 6, 2024

Onfleet, Fairmatic Partner on Safety Dashboard for Last-Mile Delivery Fleets Views: 1 Last-mile delivery software company Onfleet is partnering with insurance company Fairmatic to offer a driver safety analytics dashboard designed to help reduce insurance rates. The platform gives fleet managers a snapshot of driver performance and miles driven, and uses that data to give personalized safety recommendations and identify areas where companies can get discounts on insurance. Fairmatic also estimates that its customers save at least 20% on their insurance premiums a year, while reporting 49% fewer collisions. “Fairmatic’s partnership with Onfleet empowers fleet managers with critical insights to manage their drivers more effectively while controlling insurance costs,” Fairmatic CEO Jonathan Matus said. “Our unique usage-based, telematics-enabled insurance model, combined with real-time performance analytics, offers a comprehensive solution to improve fleet safety and financial efficiency.” Onfleet director of enterprise sales Chris Garrison added that the integration “provides a unique opportunity” for fleet managers to evaluate and save on their safety practices with “real-world driving data.”

Fairmatic Frequently Asked Questions (FAQ)

When was Fairmatic founded?

Fairmatic was founded in 2019.

Where is Fairmatic's headquarters?

Fairmatic's headquarters is located at 201 Spear Street, San Francisco.

What is Fairmatic's latest funding round?

Fairmatic's latest funding round is Series B.

How much did Fairmatic raise?

Fairmatic raised a total of $88M.

Who are the investors of Fairmatic?

Investors of Fairmatic include Bridge Bank, Battery Ventures, Foundation Capital, Bill Tai, MS&AD Ventures and 8 more.

Who are Fairmatic's competitors?

Competitors of Fairmatic include Nirvana and 6 more.

What products does Fairmatic offer?

Fairmatic's products include Fairmatic.

Loading...

Compare Fairmatic to Competitors

Xtract360 is a company that focuses on advanced auto claim processing in the insurance and fleet management sectors. The company offers a modern approach to auto accident reconstruction, providing real-time incident data, telematics-based reconstruction, and front-end claim management to improve reporting efficiency, centralize claims communication, and lower claim payout. Xtract360 primarily serves the insurance industry and fleet managers. It is based in London, England.

Foresight Analytics helps professional drivers operate safer while saving them on their insurance through a mobile driving measurement tool. The company's platform measures driver performance using AI and cameras in order to segment and price risk more effectively, make commercial auto more profitable, and provide better insurance. The company serves auto insurers. Foresight Analytics was founded in 2020 and is based in Toronto, Ontario.

Accuscore (fka Acculitx) is working with many of the major insurance companies to redefine usage-based insurance (UBI) to create a more relevant identification of driver behavior and risk called RBI - Risk Based Insurance. The key differentiator of accuscore is in using continuous vehicle motion data to generate a relevant predictor for driver risk with very strong correlation to actuary data. Because accuscoreSM is not 'event' based, it results in being the most comprehensive and accurate identifier of driver risk and behavior assessment.

DriveSmart is a company that operates in the insurance industry, with a specific focus on car insurance. The company offers car insurance services, with a unique approach that involves analyzing aspects of a customer's driving behavior to potentially offer discounts on policy renewals. This service is primarily targeted towards drivers, including private individuals, professional drivers, and companies with vehicle fleets. It was founded in 2012 and is based in Madrid, Spain.

HDVI specializes in modern insurance solutions for the commercial trucking industry. The company offers dynamically-priced insurance policies, integrated telematics, and fleet safety tools designed to help trucking fleets manage risk and potentially earn discounts on monthly premiums. HDVI primarily serves commercial truck fleets and insurance agents. It was founded in 2018 and is based in Chicago, Illinois.

Allegory is an insurance technology company that focuses on the mobility and insurance sectors. The company offers a driving app that promotes safety on the road and provides rewards for good driving habits. It also provides a digital wallet for insurance and a solution for tracking business mileage. It was founded in 2019 and is based in Toronto, Ontario.

Loading...