Fetch

Founded Year

2013Stage

Debt - III | AliveTotal Raised

$631.51MValuation

$0000Last Raised

$50M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-65 points in the past 30 days

About Fetch

Fetch operates in the loyalty and rewards industry. The company provides a mobile application that allows users to earn points by scanning shopping receipts, which can then be redeemed for gift cards and other rewards. Fetch also offers insights to brand partners on consumer shopping habits and engagement. It was founded in 2013 and is based in Madison, Wisconsin.

Loading...

ESPs containing Fetch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cash-back & gift card rewards market is made up of platforms that offer consumers the opportunity to earn cash back and gift cards on purchases made from various brands and retail partners. It provides an efficient way for brands to drive incremental sales of their products in a cost-effective way while only paying per sale. The market also helps retailers reduce the need for paper coupons, wh…

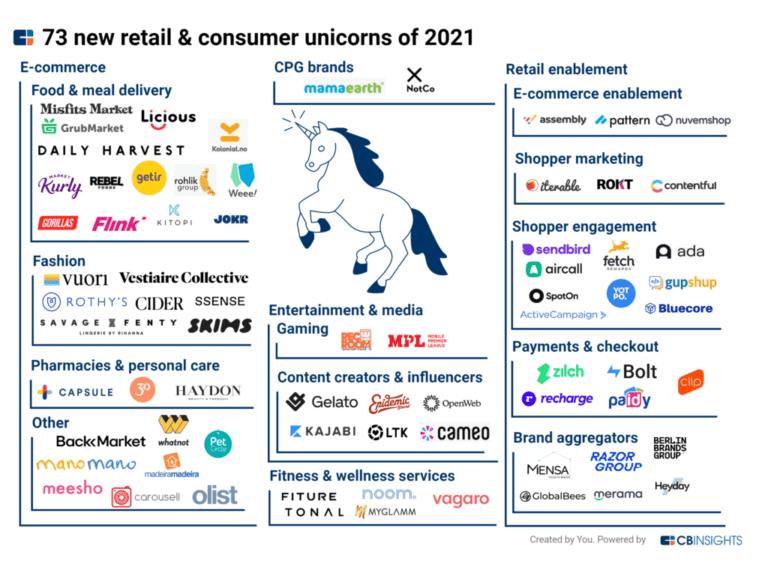

Fetch named as Leader among 15 other companies, including Upside, Ibotta, and ShopBack.

Loading...

Research containing Fetch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fetch in 3 CB Insights research briefs, most recently on May 2, 2022.

Expert Collections containing Fetch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fetch is included in 5 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,677 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,244 items

Grocery Retail Tech

831 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

Loyalty & Rewards Tech

617 items

Startups allowing global brands and local shops alike to offer tech-enabled loyalty and rewards programs including loyalty software, AI-powered loyalty, blockchain-powered loyalty, and more.

Conference Exhibitors

5,302 items

Fetch Patents

Fetch has filed 2 patents.

The 3 most popular patent topics include:

- credit

- credit cards

- customer loyalty programs

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/10/2014 | Payment systems, Promotion and marketing communications, Banking technology, Bonds (finance), Retailing | Application |

Application Date | 6/10/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Promotion and marketing communications, Banking technology, Bonds (finance), Retailing |

Status | Application |

Latest Fetch News

Mar 23, 2024

Rewards app company Fetch announced it has raised $50 million in debt financing from Morgan Stanley Private Credit. This funding will enable Fetch to pursue another year of aggressive growth as a now-profitable company. Fetch will utilize this funding to expand its business on four axes: 1.) Product innovation to enhance the user experience and partner success 2.) Further development in the platform’s proprietary A.I. and machine learning technologies 3.) Investment in growing the app’s user base 4.) Hiring top talent to shepherd this next phase of hypergrowth. Fetch is continuing to attract top talent from major tech companies – most recently hiring Sean Han (Chief Accounting Officer), Win Sakdinan (General Manager, Partner Marketing), Marc Bearman (General Manager, Fetch Play), Raj Prazad (SVP, Data Engineering), Aitan Weinberg (SVP, Ads/Media Products), and Daniel Block (VP, Corporate Business Development). With even greater talent investments this year, Fetch aims to cultivate a diverse and skilled workforce capable of driving innovation at the forefront of the technology industry. Executive Director Griffin Coakley led Morgan Stanley Private Credit’s investment in Fetch. And Armentum Partners served as Fetch’s advisor in the transaction. KEY QUOTES: “Fetch is transforming the way brands and consumers connect and solving the biggest problems in advertising. This financing will allow us to innovate faster and supercharge our ability to bring our platform to more brands and more households.” – Wes Schroll, CEO & Founder of Fetch “We’re thrilled to be working with Morgan Stanley Private Credit as Fetch moves into our next phase of maturity. Through diversifying our capital structure, we can maximize the value we are creating for our users and brand partners.” – Gideon Oppenheimer, Fetch CFO “We are pleased to be Fetch’s financing partner and support the company in its next phase of growth. This senior debt investment is an example of our ability to provide a flexible capital solution tailored to meet Fetch’s needs in the current operating environment.” – Ashwin Krishnan, co-head of North America Private Credit, Morgan Stanley Investment Management Pulse 2.0 focuses on business news, profiles, and deal flow coverage.

Fetch Frequently Asked Questions (FAQ)

When was Fetch founded?

Fetch was founded in 2013.

Where is Fetch's headquarters?

Fetch's headquarters is located at 1050 East Washington Avenue, Madison.

What is Fetch's latest funding round?

Fetch's latest funding round is Debt - III.

How much did Fetch raise?

Fetch raised a total of $631.51M.

Who are the investors of Fetch?

Investors of Fetch include Morgan Stanley Private Credit, Greycroft, DST Global, SoftBank, ICONIQ Growth and 17 more.

Who are Fetch's competitors?

Competitors of Fetch include Ibotta, Benjamin, Drop, Upside, Kard and 7 more.

Loading...

Compare Fetch to Competitors

Upside operates as a retail technology company. The company's main service is a mobile application that offers cash-back rewards to consumers for their everyday purchases such as gas, groceries, and food. It primarily serves the retail industry. Upside was formerly known as GetUpside. It was founded in 2016 and is based in Washington, DC.

Benjamin operates a financial technology company that offers a service that helps users get cash back and rewards from everyday spending. It primarily serves the consumer finance industry. The company was founded in 2022 and is based in New York, New York.

Drop operates at the nexus of e-commerce and financial technology, offering a rewards program to incentivize shopping. The company provides a platform where users can earn points for purchases made online and offline, which can then be redeemed for gift cards and other rewards. Drop primarily serves the e-commerce industry, engaging Millennials and consumers by offering a tailored shopping experience and rewards for survey participation. It was founded in 2015 and is based in Toronto, Canada.

Top Cashback is a company that operates in the online retail and financial services sector. It provides a platform where consumers can earn cashback rewards from thousands of brands when they shop online. The company primarily serves the ecommerce industry. It is based in Stafford, England.

Karma is an AI-powered shopping assistant that operates in the ecommerce industry. The company offers a browser extension and mobile app that help users save money by tracking prices, finding coupons, and managing shopping lists. Karma primarily serves individual consumers looking to optimize their online shopping experience. It was founded in 2014 and is based in Tel Aviv, Israel.

Bright Bucks is a company focused on financial services and community support. The company offers a platform where members can earn extra cash and cashback rewards through various activities such as taking surveys, shopping, and referrals. These earnings can be used for personal expenses or donated to various non-profit organizations. It was founded in 2019 and is based in San Antonio, Texas.

Loading...