FintechOS

Founded Year

2016Stage

Incubator/Accelerator - II | AliveTotal Raised

$145.92MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+40 points in the past 30 days

About FintechOS

FintechOS specializes in financial technology and insurance, focusing on streamlining the creation and management of banking and insurance products. It offers a platform that enables businesses to design, launch, and service financial and insurance products. It serves the banking and insurance sectors, offering solutions that cater to retail banking, small business banking, general insurance, and embedded finance, among others. It was founded in 2016 and is based in London, United Kingdom.

Loading...

FintechOS's Product Videos

FintechOS's Products & Differentiators

FintechOS

The FintechOS platform works with your existing systems, enabling you to innovate faster with no-code/low-code and pre-built capabilities for product and journey definition, servicing, policy administration, billing and collections, claims, and partnership management.

Loading...

Research containing FintechOS

Get data-driven expert analysis from the CB Insights Intelligence Unit.

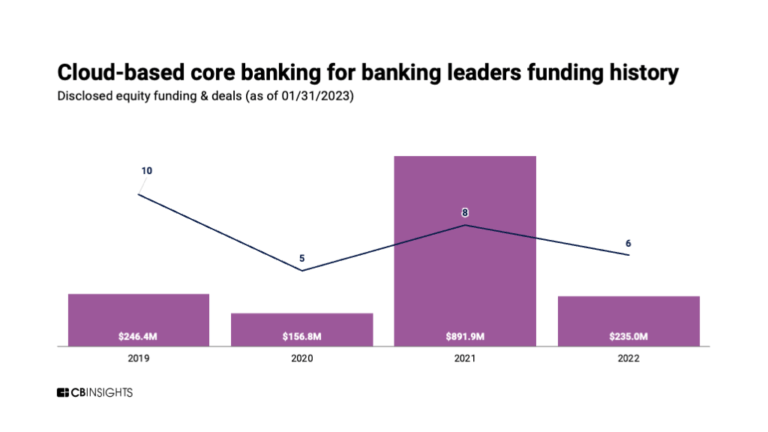

CB Insights Intelligence Analysts have mentioned FintechOS in 1 CB Insights research brief, most recently on Mar 10, 2023.

Expert Collections containing FintechOS

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FintechOS is included in 3 Expert Collections, including Insurtech.

Insurtech

4,352 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,396 items

Excludes US-based companies

Digital Banking

917 items

Latest FintechOS News

Aug 16, 2024

FintechOS Bridges Traditional Financial Institutions with Innovation and Brings in USD 60M in Series B+ Romanian platform for financial product development FIntech OS secures USD 60M of Series B+ investment The platform facilitates innovation for traditional financial institutions by providing a seamless environment for developing tailored financial products The company will use the new investment to reinforce product development, particularly AI-related, and hire more talent specializing in banking and insurance This May, FintechOS – the celebrated Romanian-founded low-code platform for custom innovative solutions for financial institutions – attracted USD 60M of funding in Series B+ round of investment. The round is co-led by Molten Ventures , Cipio Partners , and Blackrock , with the participation of FintechOS’ loyal supporters OTB Ventures , GapMinder VC ( invested in Synaptiq , among others ), and Earlybird ( invested in Anari AI , among others ). Seasoned Entrepreneurs to Facilitate Innovation in Finance Teodor Blidarus, Co-Founder and CEO at FintechOS FintechOS’ two founders – Sergiu Negut and Teodor Blidarus – can boast about profound experience in tech, finance, and entrepreneurship. Mr Blidarus spent over 25 years in the financial tech industry, working on big changes in banking, insurance, and embedded finance internationally. Mr Negut, meanwhile, is an entrepreneur and angel investor with a strong background in growing businesses across various sectors like healthcare, IT&C, financial services, and consulting. Their vast experience in their sectors allowed them to realize how complicated and rigid core systems were in the financial services industry and inspired them to start FintechOS in 2017. ‘At that moment, we noticed a big gap in the market for a platform that could make financial product management and innovation easier and faster. We wanted to create a solution that would allow financial institutions to modernize their core systems without expensive and risky migrations, making financial innovation accessible to companies everywhere,’ Mr Blidarus recalls. Problems of Innovation in Traditional Financial Institutions According to FintechOS’ founders, Financial institutions often struggle with outdated and inflexible core systems that hinder rapid innovation as up to 95% of market leaders identify such systems as a major barrier to product innovation. Relying solely on internal efforts is challenging due to limited resources, expertise, and high development costs. Octavian Patrascu, Founder and CEO at CAPEX.com ‘Large financial institutions have established structures and processes that may not be conducive to rapid innovation. Their IT departments are often focused on maintaining existing systems, making it challenging for them to pivot towards developing new, cutting-edge solutions. Innovation may not be at the core of these institutions’ operations,’ CAPEX.com ‘s founder and CEO Octavian Pătrașcu comments . What FintechOS offers is a low-code / no-code platform where financial institutions can create their own financial products and tailor them to any specific requirements. The end-to-end financial product management platform integrates seamlessly with existing systems, allowing institutions to modernize traditional banking and insurance products, create value-added bundles, and launch embedded propositions quickly across any line of business. This minimizes risk, reduces costs, and enables financial institutions to focus on delivering excellent customer experience without needing to replace their core systems. ‘FintechOS is a financial product management platform that helps banks, insurers, and other financial institutions modernize their core systems. It enables these institutions to quickly create, distribute, and manage financial products without replacing their core systems or undertaking costly and lengthy IT projects. With flexible and innovative technology, FintechOS empowers financial institutions to deliver better services, stay competitive, and adapt to changing market demands,’ Mr Blidarus explains. Rapidly Developing Platform Cem Sertoglu, Co-Founder and Managing Partner of the Digital East Fund at Earlybird Venture Capital Since the 2017 launch, FintechOS has hit quite a number of key milestones. The recent ones include: 2021: A successful Series B funding round to fuel significant growth. 2024: Recognition by leading industry analysts Gartner and Celent as a representative vendor in core banking, lending, and insurance technology. 2024: Significant operational improvements, including a 40% year-over-year growth and a 170% increase in operating margins. Roland Dennert, Managing Partner at Cipio Partners ‘We have been early investors and big believers of Teo Blidarus’s vision at FintechOS. No industry has come under as much attack as Financial Services over the last decade, with the tidal wave of Fintech offerings. The industry’s software capabilities have been stretched and stressed out, and FintechOS’s suite of solutions give the incumbents critical tools to respond to the changing expectations of their customers. The company has enjoyed healthy growth through their partnerships with banks and insurers and we are proud to continue to back them in their quest to help transform these industries,’ Cem Sertoglu , co-founder and managing partner of the Digital East Fund at Earlybird, tells ITKeyMedia. For Cipio Partners, FintechOS’s growth trajectory is a clear indicator of their potential. “We are delighted to be part of this journey and look forward to seeing the transformative impact they will make in the financial services sector.” the fund’s managing partner Roland Dennert states. ‘FintechOS’ track record with major banks and insurers demonstrates a rare ability to drive significant change within these organizations. They are at the forefront of transforming financial services through innovative technology,’ Molten Ventures’ partner Vinoth Jayakumar . Plans: Product development and Staff Expansion Vinoth Jayakumar, Partner at Molten Ventures The funding round strengthens FintechOS’s position as a market leader and validates its approach to core modernization through next-generation financial product management. USD 60M of new funding will primarily support our efforts to expand globally, particularly in the US, UK, and Continental Europe, while enabling banks and insurers to modernize core systems. To achieve this, according to Mr Blidarus, FintechOS will focus internally on three main areas: product development, including significant advancements in AI integration customer support and operations, where the company plans to recruit experienced professionals in banking and insurance continuous development of strategic partnerships Jointly, these initiatives will help the platform to improve client satisfaction further and broaden its reach in the financial services industry. ‘Looking ahead, we remain dedicated to helping financial institutions modernize their core systems and deliver superior customer experiences. We will put all our efforts into further developing our platform, and helping our customers and partners achieve their goals. Additionally, we are committed to fostering a company culture that supports innovation, encourages new ideas, and empowers initiatives,’ Mr Blidarus concludes.

FintechOS Frequently Asked Questions (FAQ)

When was FintechOS founded?

FintechOS was founded in 2016.

Where is FintechOS's headquarters?

FintechOS's headquarters is located at 15-19 Cavendish Place, London.

What is FintechOS's latest funding round?

FintechOS's latest funding round is Incubator/Accelerator - II.

How much did FintechOS raise?

FintechOS raised a total of $145.92M.

Who are the investors of FintechOS?

Investors of FintechOS include Endeavor Romania, Gap Minder, OTB Ventures, Earlybird Venture Capital, Molten Ventures and 9 more.

Who are FintechOS's competitors?

Competitors of FintechOS include NayaOne, Dimply, Finastra, Instanda, BackBase and 7 more.

What products does FintechOS offer?

FintechOS's products include FintechOS.

Who are FintechOS's customers?

Customers of FintechOS include Admiral Insurance, Howden Insurance, Vibrant Credit Union and Societe Generale.

Loading...

Compare FintechOS to Competitors

Mambu is a software-as-a-service (SaaS) company focused on providing a cloud banking platform within the financial services industry. The company offers a composable banking infrastructure that enables clients to create and manage lending and deposit services, as well as integrate with various application programming interfaces (APIs) for a customizable financial experience. Mambu primarily serves sectors such as banks, credit unions, and retailers looking to offer digital financial products. It was founded in 2011 and is based in Amsterdam, Netherlands.

BrightFi is a financial technology company that provides digital banking services that help financial institutions and non-banks of all sizes who want to launch banking products, configure, test and deploy new products or digital brands at a fraction of the time and cost.

Business Alliance Financial Services (BAFS) specializes in providing commercial lending software and services to financial institutions. Their main offerings include a cloud-based lending platform known as BLAST, along with a suite of services that support client onboarding, credit administration, and regulatory compliance. They also offer financial statement analysis, credit risk rating systems, and data analytics solutions to enhance the commercial lending process. It was founded in 2009 and is based in Monroe, Louisiana.

Architecht is a technology company with a focus on financial technologies, operating in the finance and technology sectors. The company offers a wide range of services including core banking, open banking, supplier and consumer financing, multifactor authentication and security solutions, API management platforms, alternative channel solutions, software development, support, and consultancy services. These services are primarily offered to banks, fintechs, telecommunication companies, technology companies, and private pension companies. Architecht has many customers from various sectors both local and international. It was founded in 2015 and is based in Istanbul, Turkey.

10x Banking focuses on providing a cloud-native core banking platform, operating within the financial technology sector. The company offers a digital banking solution that enables banks to modernize their core banking systems, launch digital banks, and reduce operating costs. It was founded in 2016 and is based in London, United Kingdom.

LendingFront is a technology company specializing in lending solutions for financial institutions. Their platform offers end-to-end capabilities for business and consumer lending, including origination, underwriting, and servicing processes. The company primarily serves banks, credit unions, CDFIs, payment processors, and alternative lenders with its lending technology. It was founded in 2014 and is based in New York, New York.

Loading...