Flipkart

Founded Year

2007Stage

Corporate Minority - V | AliveTotal Raised

$10.136BValuation

$0000Last Raised

$350M | 4 mos agoRevenue

$0000About Flipkart

Flipkart is a company that focuses on technology and commerce. It offers a wide range of products across various categories, providing a platform for customers to shop online. The company primarily serves the ecommerce industry. It was founded in 2007 and is based in Bengaluru, India. Flipkart operates as a subsidiary of Walmart.

Loading...

Loading...

Research containing Flipkart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

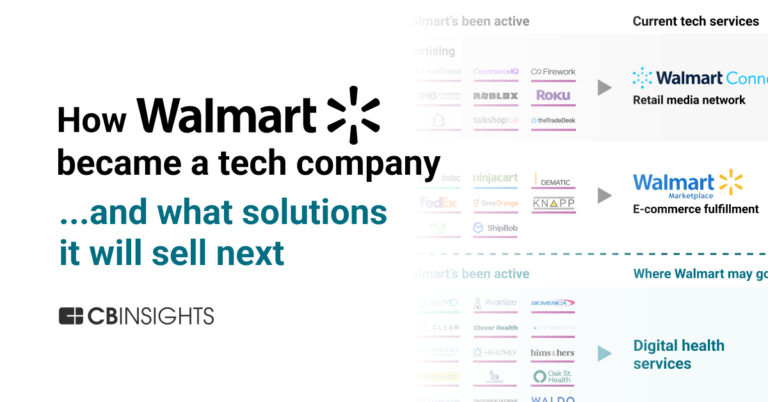

CB Insights Intelligence Analysts have mentioned Flipkart in 6 CB Insights research briefs, most recently on Feb 17, 2023.

Dec 21, 2022 report

The top 50 individual angel investors

Expert Collections containing Flipkart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Flipkart is included in 3 Expert Collections, including E-Commerce.

E-Commerce

10,930 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Fintech

13,307 items

Excludes US-based companies

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Flipkart Patents

Flipkart has filed 55 patents.

The 3 most popular patent topics include:

- crowdsourcing

- network protocols

- information retrieval techniques

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/19/2022 | 2/20/2024 | Fishing equipment, Network protocols, Fishing techniques and methods, Parallel computing, Fraud | Grant |

Application Date | 7/19/2022 |

|---|---|

Grant Date | 2/20/2024 |

Title | |

Related Topics | Fishing equipment, Network protocols, Fishing techniques and methods, Parallel computing, Fraud |

Status | Grant |

Latest Flipkart News

Sep 17, 2024

Want this newsletter delivered to your inbox? SUBSCRIBE Thank you for subscribing to Morning Dispatch We'll soon meet in your inbox. The government is attempting to understand the ownership structures of foreign-funded quick commerce firms and their dark stores. This and more in today’s ETtech Morning Dispatch. Also in the letter: Govt to quick commerce players: throw more light on dark store ownership structures The government has shot off queries to senior ecommerce executives to understand the ownership structures of quick commerce firms and their dark stores, sources told us. Let’s get into it: Driving the news: As per India’s foreign direct investment (FDI) rules, foreign-funded online marketplaces are not allowed to own inventory or control sellers on their platforms. Because of these restrictions, dark stores, mini-warehouses that enable quick deliveries by these platforms, are not owned by the quick-commerce companies themselves but by separate entities. The government wants to fill the gaps and understand some grey areas in their structures amid a rapid expansion of these companies, which in turn has started majorly affecting the business of neighbourhood stores and modern retailers. What next? The chief executive of one of the top three quick commerce firms told us that he recently briefed commerce and industry minister Piyush Goyal and his team on the nature of investors in the firm and its long-term plans. However, senior executives and investors in the quick commerce segment said that government policy may not result in any major disruption. Aggressive investment: Meanwhile, investment in quick commerce continues to be on the rise. Zepto raised $1 billion in the past two months . Zomato continues to invest aggressively in Blinkit’s expansion, and so does Swiggy in Instamart. Quick catch-up: ET reported on September 16 that the government may soon tap into purchases made through quick commerce platforms such as Zepto, Blinkit, Instamart, and BigBasket to understand changes in consumption patterns and pace of economic activity. ET Startup Awards 2024: Union minister Piyush Goyal to grace tenth edition of awards Union minister of commerce and industry Piyush Goyal will be the guest of honour at a star-studded ceremony to celebrate the winners of The Economic Times Startup Awards 2024 on October 5. The event in Bengaluru will host a galaxy of business leaders and policymakers, as ETSA 2024 marks a decade of celebrating India's brightest entrepreneurs and startups. Goyal's first interaction with startup industry leaders at the ceremony post removal of the so-called 'Angel Tax' is expected to provide insights into the government's push to further support the new-age economy which has seen several companies go public this year. The minister will update the who’s who of the startup world on the what tops the government’s agenda for the coming months. Winners: The winners of ET Startup Awards 2024 were chosen at a meeting of the elite jury on September 11, led by Infosys cofounder and chairman Nandan Nilekani in eight categories from a shortlist of 41 nominees. Omnichannel eyewear retailer Lenskart bagged the coveted Startup of the Year award. Mukul Arora, co-managing partner at Elevation Capital, was chosen winner of the coveted Midas Touch award for best investor because of his astute sense of timing on making exits from early bets. Ayyappan R, former CEO of Cleartrip Ayyappan R, the former chief executive of Flipkart-owned Cleartrip, is set to launch a new quick commerce retail venture , which is in talks with venture capital firm Accel and RTP Global for a sizable seed funding, according to people aware of the discussions. The premium play: The new venture—for which the final brand is yet to be zeroed in on—is likely to raise a larger-than-usual seed round, focusing on delivering a select range of premium products within 20-30 minutes while also having an offline retail presence, sources added. More details: It plans to offer a diverse range of products, including unbranded goods like dry fruits and healthy and localised products like freshly ground atta (flour). Premium items like blueberries and avocados as well as direct-to-consumer (D2C) commodities like organic Supima cotton t-shirts and healthy gummies are also likely to be included. Buzzing sector: This comes at a time when Walmart-owned Flipkart has entered the quick commerce race with its service called Minutes while the demand for quick delivery is at an all-time high from leading platforms like Zepto, Blinkit, and Instamart. Qure.ai chief executive Prashant Warier Deal details: Sources said the VC fund will invest around $20-25 million in the AI company and is looking to buy some secondary shares as well. “Overall the round may end up being $50-60 million in size depending on the final secondary component,” they added. The deal is to be closed this month. This would be the third major deal by Lightspeed from its growth fund. It has invested in quick commerce Zepto and edtech PhysicsWallah; the latter is yet to be formally announced. About Qure.ai: Launched in 2016, Qure provides an AI-based decision support tool for diagnostic images. It works with healthcare institutions and physicians directly, with chest X-ray reporting, TB care, lung nodule management, and heart failure being among its key focus areas. It reported revenue of Rs 91.3 crore in FY23 along with a loss of close to Rs 78 crore compared to Rs 39.3 crore and Rs 24 crore a year ago, respectively. Other Top Stories By Our Reporters E2E Networks cofounder and chief executive Tarun Dua E2E Networks is the talk of the town as AI frenzy takes hold: E2E Networks, an artificial intelligence cloud service provider, is getting a lot of attention that the National Stock Exchange-listed company has probably not seen in the 15 years since its inception. Lending firms use Account Aggregator framework for Rs 42,300 crore in loans: Sahamati | Lending firms using the Account Aggregator (AA) framework facilitated loans worth Rs 42,300 crore from September 2021 to March 2024, according to a report by Sahamati, a market-led industry alliance for the AA ecosystem. Flipkart's Big Billion Days, Amazon's annual festive sale to kick off from September 27: Flipkart's flagship sale, The Big Billion Days, is a key event , contributing a substantial portion of the company's annual sales, much like it does for its competitors and other businesses in general. Global Picks We Are Reading ■ This brain implant lets people control Amazon Alexa with their minds ( Wired ) ■ Google, Apple and the antitrust tipping point ( FT ) ■ How InstaDeep became Africa’s biggest AI startup success ( Rest of World )

Flipkart Frequently Asked Questions (FAQ)

When was Flipkart founded?

Flipkart was founded in 2007.

Where is Flipkart's headquarters?

Flipkart's headquarters is located at Buildings Alyssa, Begonia & Clove Embassy Tech Village, Bengaluru.

What is Flipkart's latest funding round?

Flipkart's latest funding round is Corporate Minority - V.

How much did Flipkart raise?

Flipkart raised a total of $10.136B.

Who are the investors of Flipkart?

Investors of Flipkart include Google, Walmart, Tiger Global Management, Accel, ICONIQ Capital and 32 more.

Who are Flipkart's competitors?

Competitors of Flipkart include FirstCry, Digikala, Lazada, Pepperfry, Pai Platforms and 7 more.

Loading...

Compare Flipkart to Competitors

Snapdeal is an online shopping platform specializing in value-priced merchandise across various categories such as fashion, home, and beauty. The platform offers a wide selection of products that cater to the needs of value-conscious consumers, focusing on affordability without compromising on quality. Snapdeal primarily serves the e-commerce industry, with a significant customer base in non-metro areas. Snapdeal was formerly known as Jasper Infotech Private Limited. It was founded in 2010 and is based in Gurugram, India.

Pepperfry is an online and offline retailer specializing in furniture, home decor, and related products. The company offers a wide range of furniture for living rooms, bedrooms, dining areas, offices, and outdoor spaces, as well as home decor items like lighting, kitchenware, bedding, and spiritual items. Pepperfry caters to customers seeking to furnish and decorate their homes with a variety of styles and preferences. It was founded in 2012 and is based in Mumbai, India.

Digikala Group operates as an e-commerce organization. It focuses on multiple online industries. The company offers a wide range of services including online retail of consumer goods, fashion and apparel, digital content publishing, advertising, data analytics, financial technology, and logistics solutions. It primarily serves the e-commerce industry with its comprehensive suite of services designed to enhance the online shopping experience. It was founded in 2006 and is based in Tehran, Iran.

V2 Retail specializes in providing a range of fashion apparel and accessories for men, women, and children in the retail sector. The company offers a shopping experience through its portfolio of sustainable and durable products, ensuring value for money. V2 Retail serves a broad customer base, including the e-commerce industry, with its online shopping platform and home delivery services. V2 Retail was formerly known as Vishal Megamart. It was founded in 2001 and is based in New Delhi, India.

OrientSwiss is a digital lending platform operating in the financial technology (fintech) industry. The company offers a comprehensive ecosystem of services including financial solutions for individuals and small and medium-sized enterprises (SMEs), e-commerce, and e-logistics, with lending being the core of its operations. OrientSwiss primarily serves the financial technology, e-commerce, and logistics sectors. It was founded in 2015 and is based in Lausanne, Switzerland.

Pai Platforms is an online shopping platform operating in the ecommerce industry. The company offers a wide range of products including electronics, fashion items, groceries, home and kitchen products, automobiles, books, and stationery. It was founded in 2010 and is based in New Delhi, India.

Loading...