Investments

909Portfolio Exits

154Funds

15Partners & Customers

1About Founders Fund

Founders Fund is a venture capital firm. It invests in science and technology companies. The firm invests at all stages across a wide variety of sectors, including aerospace, artificial intelligence, advanced computing, energy, health, and consumer Internet. It was founded in 2005 and is based in San Francisco, California.

Expert Collections containing Founders Fund

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Founders Fund in 10 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Food & Beverage

123 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Research containing Founders Fund

Get data-driven expert analysis from the CB Insights Intelligence Unit.

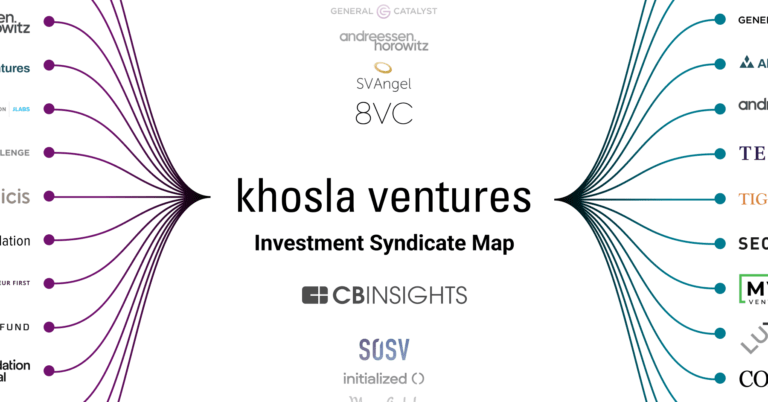

CB Insights Intelligence Analysts have mentioned Founders Fund in 8 CB Insights research briefs, most recently on May 29, 2024.

May 29, 2024

483 startup failure post-mortems

Latest Founders Fund News

Sep 14, 2024

The 11 Largest US Funding Rounds of August 2024 Views: 1 Armed with some data from our friends at CrunchBase, I broke down the largest US startup funding rounds from August 2024. I have included some additional information such as industry, company description, round type, founders, and total equity funding raised to further the analysis. The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series A Description: Palo Alto-based DevRev offers a cloud-based solution for both customer support and software development. Founded by Dheeraj Pandey and Manoj Agarwal in 2020, DevRev has now raised a total of $150.8M in total equity funding and is backed by Khosla Ventures, Alumni Ventures, Mayfield Fund, Firebolt Ventures, and Ballistic Ventures. Investors in the round: Khosla Ventures, Mayfield Fund, Param Hansa Values Industry: Artificial Intelligence (AI), CRM, Customer Service, Developer APIs, Developer Platform, Software Founders: Dheeraj Pandey, Manoj Agarwal Founding year: 2020 Total equity funding raised: $150.8M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series D Description: Plymouth-based HistoSonics specializes in developing non-invasive medical devices, interventional radiology, and surgical robotics. Founded by Brian Fowlkes, M. Christine Gibbons, and Thomas Davison in 2009, HistoSonics has now raised a total of $223.8M in total equity funding and is backed by Johnson & Johnson Innovation ‚Äì JJDC, Alpha Wave Ventures, Signature Bank, HealthQuest Capital, and Varian. Investors in the round: Alpha Wave Ventures, Amzak Health Investors, Hatteras Venture Partners, HealthQuest Capital, Johnson & Johnson Innovation ‚Äì JJDC, Lumira Ventures, State of Wisconsin Investment Board, Venture Investors, Yonjin Venture Industry: Health Care, Medical, Medical Device Founders: Brian Fowlkes, M. Christine Gibbons, Thomas Davison Founding year: 2009 Total equity funding raised: $223.8M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series E Description: Waltham-based Devoted Health is a healthcare company serving seniors and giving them a health care plan with personal guides and world-class technology. Founded by Edward Park and Todd Park in 2017, Devoted Health has now raised a total of $2.3B in total equity funding and is backed by Andreessen Horowitz, General Catalyst, PremjiInvest, Cox Enterprises, and F-Prime Capital. Investors in the round: Cox Enterprises, The Space Between, White Road Investments Industry: Elder Care, Elderly, Health Care, Health Insurance Founders: Edward Park, Todd Park Founding year: 2017 Total equity funding raised: $2.3B The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Venture Description: Framingham-based Re:Build is an industrial manufacturing company that integrates advanced technologies with traditional manufacturing processes‚Äã. Founded by Anthony Manzo, Jeff Wilke, Michael Foley, and Miles Arnone in 2020, Re:Build has now raised a total of $231.0M in total equity funding and is backed by General Catalyst and US Department of Energy. Investors in the round: General Catalyst Industry: Industrial, Industrial Automation, Industrial Manufacturing, Machinery Manufacturing, Manufacturing Founders: Anthony Manzo, Jeff Wilke, Michael Foley, Miles Arnone Founding year: 2020 Total equity funding raised: $231.0M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series C Description: Mountain View-based Codeium provides an AI-powered coding platform that maximizes developer productivity. Founded by Douglas Chen and Varun Mohan in 2021, Codeium has now raised a total of $243.0M in total equity funding and is backed by General Catalyst, Kleiner Perkins, Founders Fund, Howie Liu, and Nitesh Banta. Investors in the round: General Catalyst, Greenoaks, Kleiner Perkins Industry: Artificial Intelligence (AI), Enterprise Applications, Machine Learning, Software Founders: Douglas Chen, Varun Mohan Founding year: 2021 Total equity funding raised: $243.0M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Venture Description: New York-based Bilt Rewards offers a rewards program that allows renters to earn points on rent and create a path towards homeownership. Founded by Ankur Jain in 2021, Bilt Rewards has now raised a total of $563.3M in total equity funding and is backed by Blend, General Catalyst, AvalonBay Communities, Greystar, and Mastercard. Investors in the round: Teachers‚Äô Venture Growth, University of Illinois Foundation, Vanderbilt University Industry: FinTech, Loyalty Programs, Real Estate, Rental Property Founders: Ankur Jain Total equity funding raised: $563.3M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series E Description: San Francisco-based Cribl enables open observability and defies data gravity, giving customers radical levels of choice and control over their data. Founded by Clint Sharp, Dritan Bitincka, and Ledion Bitincka in 2018, Cribl has now raised a total of $602.2M in total equity funding and is backed by CrowdStrike, Sequoia Capital, Google Ventures, Tiger Global Management, and Citi Ventures. Investors in the round: CapitalG, CRV, GIC, Google Ventures, IVP Industry: Big Data, Information Technology, Real Time, Software Founders: Clint Sharp, Dritan Bitincka, Ledion Bitincka Founding year: 2018 Total equity funding raised: $602.2M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series D Description: Santa Monica-based FLYR is a technology company that uses AI to help airlines and hospitality businesses. Founded by Alexander Mans, Cyril Guiraud, and Jean Tripier in 2013, FLYR has now raised a total of $411.8M in total equity funding and is backed by BlackRock, Founders Fund, WestCap, Abu Dhabi Investment Authority, and Marbruck. Investors in the round: Abu Dhabi Investment Authority, Avianca, BlackRock, Streamlined Ventures, WestCap Industry: Air Transportation, Analytics, Artificial Intelligence (AI), Machine Learning, Predictive Analytics Founders: Alexander Mans, Cyril Guiraud, Jean Tripier Founding year: 2013 Total equity funding raised: $411.8M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series D Description: San Francisco-based Abnormal Security is an email security company that protects enterprises and organizations from targeted email attacks. Founded by Evan Reiser and Sanjay Jeyakumar in 2018, Abnormal Security has now raised a total of $534.0M in total equity funding and is backed by Menlo Ventures, Wellington Management, Insight Partners, Greylock, and Ballistic Ventures. Investors in the round: CrowdStrike Falcon Fund, Greylock, Insight Partners, Menlo Ventures, Wellington Management Industry: Artificial Intelligence (AI), Cyber Security, Email, Information Technology, Network Security Founders: Evan Reiser, Sanjay Jeyakumar Founding year: 2018 Total equity funding raised: $534.0M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series C Description: San Francisco-based Magic is an AI coding startup that enables developers to work with AI to find code for building apps. Founded by Eric Steinberger and Sebastian De Ro in 2022, Magic has now raised a total of $465.1M in total equity funding and is backed by Sequoia Capital, CapitalG, Nat Friedman, Sahin Boydas, and Daniel Gross. Investors in the round: Atlassian Ventures, CapitalG, Daniel Gross, Elad Gil, Eric Schmidt, Jane Street Capital, Nat Friedman, Sequoia Capital Industry: Artificial Intelligence (AI), Information Technology, Machine Learning Founders: Eric Steinberger, Sebastian De Ro Founding year: 2022 Total equity funding raised: $465.1M The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series D Description: Mountain View-based Groq radically simplifies compute to accelerate workloads in artificial intelligence, machine learning, and high-performance computing. Founded by Jonathan Ross in 2016, Groq has now raised a total of $1.0B in total equity funding and is backed by BlackRock, Neuberger Berman, Alumni Ventures, Tiger Global Management, and Daniel Gross. Investors in the round: BlackRock, Cisco Investments, E1 Ventures, Firestreak Ventures, Global Brain Corporation, Neuberger Berman, Samsung Catalyst Fund, Type One Ventures, Verdure Capital Management Industry: Artificial Intelligence (AI), Electronics, Machine Learning, Semiconductor Founders: Jonathan Ross Total equity funding raised: $1.0B The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here . Round: Series F Description: Costa Mesa-based Anduril Industries is a defense product company that builds technology for military agencies and border surveillance. Founded by Brian Schimpf, Joseph Chen, Matt Grimm, Palmer Luckey, and Trae Stephens in 2017, Anduril Industries has now raised a total of $3.7B in total equity funding and is backed by Fidelity, BlackRock, Thrive Capital, Andreessen Horowitz, and General Catalyst. Investors in the round: Altimeter Capital, Baillie Gifford, BlackRock, Counterpoint Global, Fidelity, Founders Fund, Franklin Venture Partners, Sands Capital Ventures Industry: Aerospace, Government, Military, National Security Founders: Brian Schimpf, Joseph Chen, Matt Grimm, Palmer Luckey, Trae Stephens Founding year: 2017 Total equity funding raised: $3.7B The TechWatch Media Group audience is driving progress and innovation on a global scale. With its regional media properties ( NYC Tech , LA Tech , London Tech )TechWatch Media Group is the highway for technology and entrepreneurship. There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including developing prominent brand placement, driving demand generation, and building thought leadership among the vast majority of key influencers in the global business community and beyond. Find out how to partner with us to drive a return on your marketing investment here .

Founders Fund Investments

909 Investments

Founders Fund has made 909 investments. Their latest investment was in Hgen as part of their Seed VC - II on September 17, 2024.

Founders Fund Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/17/2024 | Seed VC - II | Hgen | $5M | No | 2 | |

8/29/2024 | Seed VC | Hangout | $8.2M | Yes | 2 | |

8/7/2024 | Series F | Anduril | $1,500M | No | 9 | |

7/24/2024 | Series A | |||||

7/23/2024 | Series A |

Date | 9/17/2024 | 8/29/2024 | 8/7/2024 | 7/24/2024 | 7/23/2024 |

|---|---|---|---|---|---|

Round | Seed VC - II | Seed VC | Series F | Series A | Series A |

Company | Hgen | Hangout | Anduril | ||

Amount | $5M | $8.2M | $1,500M | ||

New? | No | Yes | No | ||

Co-Investors | |||||

Sources | 2 | 2 | 9 |

Founders Fund Portfolio Exits

154 Portfolio Exits

Founders Fund has 154 portfolio exits. Their latest portfolio exit was PatternAg on August 28, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/28/2024 | Merger | 2 | |||

7/23/2024 | Acq - Pending | 2 | |||

7/9/2024 | Acquired | 2 | |||

Date | 8/28/2024 | 7/23/2024 | 7/9/2024 | ||

|---|---|---|---|---|---|

Exit | Merger | Acq - Pending | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 2 |

Founders Fund Fund History

15 Fund Histories

Founders Fund has 15 funds, including Founders Growth Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/3/2022 | Founders Growth Fund | $3,400M | 1 | ||

3/3/2022 | Founders Fund VIII | $1,900M | 2 | ||

3/26/2020 | Founders Fund Growth Principals Fund | $101.54M | 1 | ||

2/19/2020 | Founders Fund Growth I | ||||

11/20/2019 | Founders Fund VII |

Closing Date | 3/3/2022 | 3/3/2022 | 3/26/2020 | 2/19/2020 | 11/20/2019 |

|---|---|---|---|---|---|

Fund | Founders Growth Fund | Founders Fund VIII | Founders Fund Growth Principals Fund | Founders Fund Growth I | Founders Fund VII |

Fund Type | |||||

Status | |||||

Amount | $3,400M | $1,900M | $101.54M | ||

Sources | 1 | 2 | 1 |

Founders Fund Partners & Customers

1 Partners and customers

Founders Fund has 1 strategic partners and customers. Founders Fund recently partnered with SVB Financial Group on .

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

Vendor | United States | 1 |

Date | |

|---|---|

Type | Vendor |

Business Partner | |

Country | United States |

News Snippet | |

Sources | 1 |

Founders Fund Team

8 Team Members

Founders Fund has 8 team members, including current Chief Financial Officer, Neil Ruthven.

Name | Work History | Title | Status |

|---|---|---|---|

Neil Ruthven | VantagePoint Capital Partners, 3i Group, Merriman Capital, and EY | Chief Financial Officer | Current |

Name | Neil Ruthven | ||||

|---|---|---|---|---|---|

Work History | VantagePoint Capital Partners, 3i Group, Merriman Capital, and EY | ||||

Title | Chief Financial Officer | ||||

Status | Current |

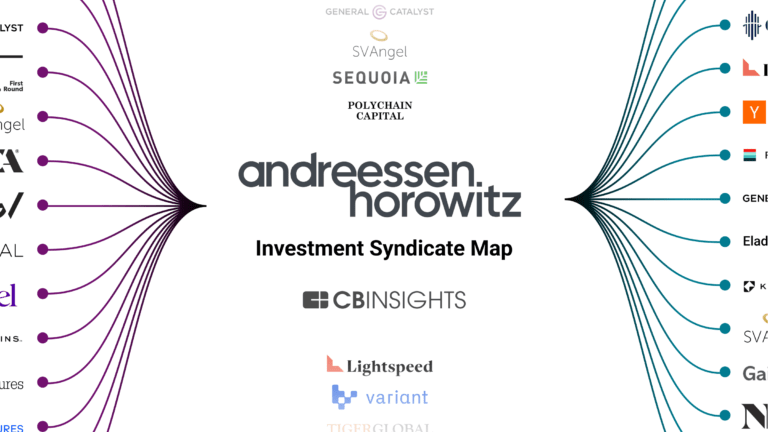

Compare Founders Fund to Competitors

Andreessen Horowitz (a16z) is a venture capital firm with $4.2 billion under management. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Insight Partners is a global venture capital and private equity firm. It seeks to invest in mobile, cybersecurity, big data, the internet of things, artificial intelligence, and construction technology sectors. Insight Partners was formerly known as Insight Venture Partners. The company was founded in 1995 and is based in New York, New York.

Accel serves as a global venture capital firm operating in the financial sector. The company's main service is providing financial backing to exceptional teams at all stages of private company growth. Accel primarily sells to the tech industry, with investments in companies across various sectors such as social media, cloud computing, and ecommerce. It was founded in 1983 and is based in Palo Alto, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Loading...