Investments

1443Portfolio Exits

210Funds

36Partners & Customers

10Service Providers

2About General Catalyst

General Catalyst works as a venture capital firm focused on early-stage and transformational investments within the technology and market leading business sectors. The firm supports exceptional entrepreneurs building innovative technology companies, offering funding and strategic guidance to help them grow. General Catalyst primarily sells to sectors such as fintech, health assurance, consumer, and enterprise industries. It was founded in 2000 and is based in San Francisco, California.

Expert Collections containing General Catalyst

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find General Catalyst in 13 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Grocery Retail Tech

16 items

Startups providing tools to grocery businesses to improve in-store operations. Includes IoT tools, customer analytics platforms, in-store robots, predictive inventory management systems,and more. (Does not include on-demand grocery delivery startups or online-only grocery stores)

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

Research containing General Catalyst

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned General Catalyst in 12 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

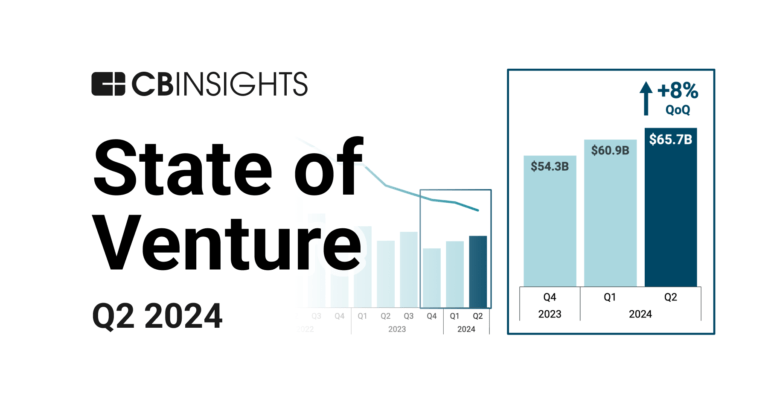

Jul 3, 2024 report

State of Venture Q2’24 Report

Mar 5, 2024 report

The top 20 venture investors in North America

Oct 25, 2023 report

State of Digital Health Q3’23 Report

Aug 1, 2023

The state of healthcare AI in 5 chartsLatest General Catalyst News

Sep 20, 2024

From the Washington Business Journal. General Catalyst, one of the largest U.S. venture capital firms, has launched a D.C.-based think tank to influence public policy on AI and technology. The San Francisco-based firm has tapped former Amazon Web Services executive Teresa Carlson to serve as president of the General Catalyst Institute. A spokesperson said the firm has taken space in D.C. but would not disclose where or say whether the office is open yet. The institute will also open offices in…

General Catalyst Investments

1,443 Investments

General Catalyst has made 1,443 investments. Their latest investment was in AtoB as part of their Series C on September 19, 2024.

General Catalyst Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/19/2024 | Series C | AtoB | No | Bloomberg Beta, Mastercard, and Undisclosed Investors | 1 | |

9/17/2024 | Seed VC - II | Martian | $9M | No | 5 | |

9/16/2024 | Series B | TeamBridge | $28M | No | 6 | |

9/16/2024 | Seed VC | |||||

9/11/2024 | Seed VC |

Date | 9/19/2024 | 9/17/2024 | 9/16/2024 | 9/16/2024 | 9/11/2024 |

|---|---|---|---|---|---|

Round | Series C | Seed VC - II | Series B | Seed VC | Seed VC |

Company | AtoB | Martian | TeamBridge | ||

Amount | $9M | $28M | |||

New? | No | No | No | ||

Co-Investors | Bloomberg Beta, Mastercard, and Undisclosed Investors | ||||

Sources | 1 | 5 | 6 |

General Catalyst Portfolio Exits

210 Portfolio Exits

General Catalyst has 210 portfolio exits. Their latest portfolio exit was Heyday on September 05, 2024.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/5/2024 | Acquired | 4 | |||

8/19/2024 | Acquired | 2 | |||

6/10/2024 | Acquired | 2 | |||

General Catalyst Acquisitions

10 Acquisitions

General Catalyst acquired 10 companies. Their latest acquisition was HarmonyCares on July 08, 2024.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

7/8/2024 | Acq - Fin - II | 3 | ||||

6/19/2024 | Merger | 4 | ||||

10/16/2023 | Merger | 2 | ||||

3/1/2023 | Debt | |||||

4/15/2019 | Seed / Angel |

Date | 7/8/2024 | 6/19/2024 | 10/16/2023 | 3/1/2023 | 4/15/2019 |

|---|---|---|---|---|---|

Investment Stage | Debt | Seed / Angel | |||

Companies | |||||

Valuation | |||||

Total Funding | |||||

Note | Acq - Fin - II | Merger | Merger | ||

Sources | 3 | 4 | 2 |

General Catalyst Fund History

36 Fund Histories

General Catalyst has 36 funds, including General Catalyst Health Assurance Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/20/2022 | General Catalyst Health Assurance Fund II | $670M | 1 | ||

12/17/2020 | GC Health Assurance Holdings | $103.5M | 1 | ||

11/25/2020 | GC Venture X | $50M | 1 | ||

4/9/2020 | General Catalyst Group X - Early Venture | ||||

4/9/2020 | General Catalyst Group X - Growth Venture |

Closing Date | 7/20/2022 | 12/17/2020 | 11/25/2020 | 4/9/2020 | 4/9/2020 |

|---|---|---|---|---|---|

Fund | General Catalyst Health Assurance Fund II | GC Health Assurance Holdings | GC Venture X | General Catalyst Group X - Early Venture | General Catalyst Group X - Growth Venture |

Fund Type | |||||

Status | |||||

Amount | $670M | $103.5M | $50M | ||

Sources | 1 | 1 | 1 |

General Catalyst Partners & Customers

10 Partners and customers

General Catalyst has 10 strategic partners and customers. General Catalyst recently partnered with Sheba Medical Center on August 8, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

8/11/2023 | Partner | Israel | 1 | ||

5/29/2023 | Partner | Rapyd, and MultiChoice Group | United Kingdom, and South Africa | MultiChoice, Rapyd and General Catalyst to launch new integrated payment platform for Africa MultiChoice Group , Rapyd and General Catalyst on Monday announced a joint venture aimed at developing an integrated payment platform for Africa . | 5 |

12/20/2022 | Partner | United States | Health systems are 'all chasing the same staff' to fill roles, UHS CEO says We hear from Marc Miller , president and CEO of Universal Health Services , as he discusses the health system 's recent partnership with General Catalyst and its push to increase access to behavioral healthcare . | 1 | |

11/15/2022 | Partner | ||||

11/14/2022 | Partner |

Date | 8/11/2023 | 5/29/2023 | 12/20/2022 | 11/15/2022 | 11/14/2022 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | Rapyd, and MultiChoice Group | ||||

Country | Israel | United Kingdom, and South Africa | United States | ||

News Snippet | MultiChoice, Rapyd and General Catalyst to launch new integrated payment platform for Africa MultiChoice Group , Rapyd and General Catalyst on Monday announced a joint venture aimed at developing an integrated payment platform for Africa . | Health systems are 'all chasing the same staff' to fill roles, UHS CEO says We hear from Marc Miller , president and CEO of Universal Health Services , as he discusses the health system 's recent partnership with General Catalyst and its push to increase access to behavioral healthcare . | |||

Sources | 1 | 5 | 1 |

General Catalyst Service Providers

2 Service Providers

General Catalyst has 2 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel | ||

Service Provider | ||

|---|---|---|

Associated Rounds | ||

Provider Type | Counsel | |

Service Type | General Counsel |

Partnership data by VentureSource

General Catalyst Team

29 Team Members

General Catalyst has 29 team members, including current Founder, Managing Director, Joel E. Cutler.

Name | Work History | Title | Status |

|---|---|---|---|

Joel E. Cutler | Founder, Managing Director | Current | |

Name | Joel E. Cutler | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, Managing Director | ||||

Status | Current |

Compare General Catalyst to Competitors

Andreessen Horowitz (a16z) is a venture capital firm with $4.2 billion under management. The firm invests in entrepreneurs building companies at every stage, from seed to growth. It seeks to invest in sectors such as bio and healthcare, consumer, cryptocurrency, enterprise, fintech, and games. It was founded in 2009 and is based in Menlo Park, California.

Kleiner Perkins serves as a venture capital firm with a focus on technology and life sciences sectors. The company invests in innovative and forward-thinking startups, offering financial support and strategic partnerships to help them grow. Kleiner Perkins primarily serves sectors such as software, biotechnology, healthcare, and internet technology. It was founded in 1972 and is based in Menlo Park, California.

Sequoia Capital serves as a venture capital firm that focuses on supporting startups from inception to IPO within various sectors. It provides investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Lightspeed Venture Partners operates as an early-stage venture capital firm. It focuses on accelerating disruptive innovations and trends in the enterprise and consumer sectors. It was founded in 2000 and is based in Menlo Park, California.

Bessemer Venture Partners works as a venture capital firm with offices in New York, Silicon Valley, Boston, Mumbai, and Herzliya. Bessemer primarily invests in early-stage opportunities but also participates in late-stage financing and occasionally makes seed-stage investments as well. The firm invests in the following areas: cleantech, data security, financial services, healthcare, online retail, and SaaS. Bessemer Venture Partners typically makes investments in the range of $4M–$10M. It was founded in 1911 and is based in San Francisco, California.

Accel serves as a global venture capital firm operating in the financial sector. The company's main service is providing financial backing to exceptional teams at all stages of private company growth. Accel primarily sells to the tech industry, with investments in companies across various sectors such as social media, cloud computing, and ecommerce. It was founded in 1983 and is based in Palo Alto, California.

Loading...