Generate Capital

Founded Year

2014Stage

Unattributed - IV | AliveTotal Raised

$6.384BLast Raised

$1.5B | 8 mos agoAbout Generate Capital

Generate Capital provides financing, building, and operational services for infrastructure projects, offering funding and support to technology and project developers. The company primarily serves companies, communities, school districts, and universities. It was founded in 2014 and is based in San Francisco, California.

Loading...

Loading...

Research containing Generate Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Generate Capital in 1 CB Insights research brief, most recently on Apr 4, 2024.

Apr 4, 2024 report

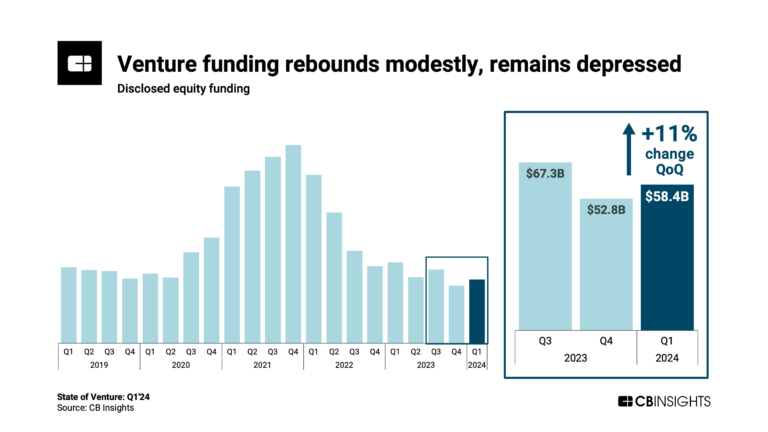

State of Venture Q1’24 ReportLatest Generate Capital News

Sep 11, 2024

Director, Loan Programs Office , U.S. Department of Energy Jigar Shah was most recently co-founder and President at Generate Capital, where he focused on helping entrepreneurs accelerate decarbonization solutions through the use of low-cost... Member since 2017 2 views LPO's latest Monthly Application Activity Report (MAAR) is out and shows that as of August 31, 2024, LPO's pipeline of pre-conditional commitment applications has reached a record amount of nearly $300 billion in cumulative requested financing for proposed clean energy, energy infrastructure reinvestment, advanced transportation, tribal energy, and CO2 transportation infrastructure projects across the country. (See: https://lnkd.in/gusNHMSk ) This monthly report breaks down LPO's active applications across 14 broad technology sectors and their proposed project sites across eight geographic regions. See LPO's MAAR page for these breakdowns, examples of what types of technologies are included within each of the tech sector categories used for the reporting, and the current estimated remaining loan authority for each LPO financing program: Energy.gov/LPO/MAAR DOE Loan Programs Office Monthly Application Activity Report - August 2024 The report breaks down the cumulative loan amount requested of current applications into general technology sectors that are potentially eligible under the Title 17 Clean Energy Financing Program (Title 17, Sections 1703 and 1706), Advanced Technology Vehicles Manufacturing (ATVM) Loan Program, Tribal Energy Financing Program, or Carbon Dioxide Transportation Infrastructure Finance and Innovation (CIFIA) Program

Generate Capital Frequently Asked Questions (FAQ)

When was Generate Capital founded?

Generate Capital was founded in 2014.

Where is Generate Capital's headquarters?

Generate Capital's headquarters is located at 560 Davis Street, San Francisco.

What is Generate Capital's latest funding round?

Generate Capital's latest funding round is Unattributed - IV.

How much did Generate Capital raise?

Generate Capital raised a total of $6.384B.

Who are the investors of Generate Capital?

Investors of Generate Capital include Queensland Investment Corporation, AustralianSuper, HESTA, California State Teachers Retirement System, FirstMark Capital and 11 more.

Who are Generate Capital's competitors?

Competitors of Generate Capital include LevelTen Energy and 5 more.

Loading...

Compare Generate Capital to Competitors

Ygrene Energy Fund specializes in providing clean energy financing solutions within the residential and commercial sectors. The company offers accessible and affordable financing for energy efficiency, renewable energy projects, water conservation, storm protection, and seismic upgrades through its Property Assessed Clean Energy (PACE) program. Ygrene's financing options are designed to support public policy initiatives and contribute to local economies without utilizing public tax dollars or credits. It was founded in 2010 and is based in Petaluma, California.

CapeZero focuses on creating a clean energy finance ecosystem, operating within the renewable energy and finance sectors. The company offers a software solution that standardizes tax equity structuring models, simplifying collaboration and increasing access for all stakeholders involved in renewable energy project financing. The company's customers are project developers, advisors, consultants, and investors in the renewable energy industry. It was founded in 2023 and is based in New York, New York.

GoodLeap is a marketplace for sustainable home solutions, operating in the financial technology sector. The company offers a point-of-sale platform that facilitates flexible payment options for home upgrades, focusing on sustainability and energy efficiency. GoodLeap primarily serves the sustainable home improvement industry, partnering with contractors and homeowners to finance products like solar panels, smart home devices, and energy-efficient windows. It was founded in 2003 and is based in Roseville, California.

Pexapark specializes in software and advisory services for post-subsidy renewable energy sales and risk management. The company offers a range of services including renewable energy pricing data, pre-deal analysis software, and risk and revenue management, all aimed at optimizing renewable energy transactions and managing associated risks. Pexapark primarily serves the renewable energy industry. It was founded in 2017 and is based in Zurich, Switzerland.

Lacuna Sustainable Investments is an investment firm focused on the renewable energy sector. The company primarily invests in early-stage renewable energy projects, providing capital and strategic expertise to de-risk these opportunities and facilitate their transition to long-term investors or owners. Lacuna primarily serves the renewable energy industry. It is based in New York, United States.

Enfin focused on solar financing, operating within the renewable energy and financial services sectors. The company provides affordable financing solutions for homeowners looking to control their energy costs through residential solar installations. Enfin primarily serves the renewable energy industry, specifically targeting residential solar installers. It is based in Irvine, California.

Loading...