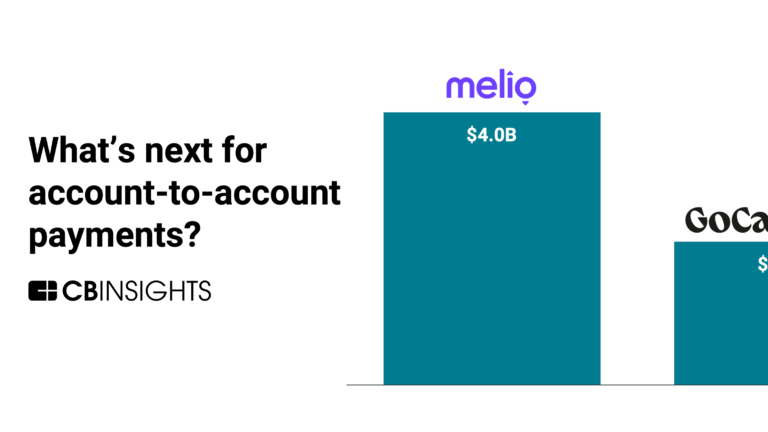

GoCardless

Founded Year

2011Stage

Series G | AliveTotal Raised

$529.32MValuation

$0000Last Raised

$312M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-6 points in the past 30 days

About GoCardless

GoCardless specializes in online payment processing solutions. The company offers services to facilitate direct bank payments, including instant one-off payments, automated recurring payments, and access to bank account data for businesses. GoCardless primarily serves businesses looking to streamline their payment collection and reconciliation processes. It was founded in 2011 and is based in London, United Kingdom.

Loading...

GoCardless's Product Videos

ESPs containing GoCardless

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real-time payments (RTP) processing market provides infrastructure and technologies to facilitate instant and seamless electronic payments. This market offers solutions that enable the immediate transfer of funds between financial institutions or individuals, allowing for real-time settlement of transactions. Businesses can benefit from enhanced speed, efficiency, and convenience in their paym…

GoCardless named as Challenger among 15 other companies, including Mastercard, Visa, and Temenos.

GoCardless's Products & Differentiators

GoCardless Payments

GoCardless is the world’s largest direct bank pay network, processing over $30bn in payments every year. We enable businesses to collect payments directly from their customers bank accounts without the need for card network intermediaries. Operate globally, but feel local with bank debit payment options in over 30 countries, including the UK (Bacs Direct Debit), Eurozone countries (SEPA), the USA (ACH), Canada (PAD), Australia (BECS) and New Zealand (PaymentsNZ). Manage your payments from a single platform, customizable to match your needs - whether you’re a small business or global enterprise. It’s time to say goodbye to cards for good.

Loading...

Research containing GoCardless

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned GoCardless in 9 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing GoCardless

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

GoCardless is included in 9 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Unicorns- Billion Dollar Startups

1,244 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,648 items

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,398 items

Excludes US-based companies

Latest GoCardless News

Sep 20, 2024

UK government plans crack down on late payments in major support package for small businesses New package of measures aimed at tackling scourge of late payments Share Late payments cost small businesses £22,000 a year on average and lead to 50,000 business closures a year image credit shutterstock The UK government has unveiled new measures to support small businesses and the self-employed by tackling the scourge of late payments. It says that late payments cost small businesses £22,000 a year on average and lead to 50,000 business closures a year. The government will consult on tough new laws which are designed to hold larger firms to account. Go deeper with GlobalData In addition, new legislation will require all large businesses to include payment reporting in their annual reports. The intention is to put the onus on them to provide clarity in their annual reports about how they treat small firms. This will mean company boards and international investors will be able to see how firms are operating. Enforcement will also be stepped up on the existing late payment performance reporting regulations. These require large companies to report their payment performance twice yearly on GOV.UK. Under current laws, responsible directors at non-compliant companies who don’t report their payment practices could face criminal prosecutions including potentially unlimited fines and criminal records. The consultation will also consider a range of further policy measures that could help address poor payment practices. How well do you really know your competitors? Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge. Not ready to buy yet? Download a free sample We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form By GlobalData Submit Tick here to opt out of curated industry news, reports, and event updates from Retail Banker International. Submit and download Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address. Issue impacts 2.6 million small businesses Every quarter, 52% of small firms in the UK suffer from late payments. This means that around 2.6 million small firms face this issue. The Federation of Small Businesses describes it as one of the biggest problems facing SMEs. UK prime minister Keir Starmer said: “We’re determined to back small businesses by unlocking their barriers to growth. Stamping out late payments is at the heart of this. We know how important it is for business owners to have the peace of mind and certainty around their cashflow to keep their businesses alive. Late payments cost businesses tens of thousands of pounds and is one of the biggest reasons businesses collapse. After years of delay, we’re bringing forward measures that small businesses have long been calling for to tackle late payments once and for all.” GoCardless acknowledges role of the Federation of Small Businesses Paul Stoddart, President at GoCardless, added: “Small businesses are the backbone of the British economy, but it’s not an easy environment. The government’s decision to recognise this and tackle late payments directly is a welcome one. It is in large part thanks to the Federation of Small Businesses’ (FSB) continued effort to put this issue in the limelight. “It’s important for decisive action to be taken because if a small business doesn’t get paid on time, it’s not going to survive. Stamping down on late payments through the measures laid out by the government will lead to economic growth. This will encourage an environment that allows small businesses to thrive, invest in new employees, boost wages and do business overseas, rather than spending time and resources chasing down late payments. “We are a longstanding champion of helping businesses to get paid on time, and the need to allow small businesses to focus on growth. We are proud to be the headline sponsor of the FSB’s Late Payments Campaign, which reflects our commitment to bringing practical solutions to business owners and providing the tools needed to get paid on time. We look forward to seeing how the government’s plans unfold, and contributing to the future growth of small businesses and the communities they serve.” Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

GoCardless Frequently Asked Questions (FAQ)

When was GoCardless founded?

GoCardless was founded in 2011.

Where is GoCardless's headquarters?

GoCardless's headquarters is located at 65 Goswell Road, London.

What is GoCardless's latest funding round?

GoCardless's latest funding round is Series G.

How much did GoCardless raise?

GoCardless raised a total of $529.32M.

Who are the investors of GoCardless?

Investors of GoCardless include BlackRock, Permira, Accel, Balderton Capital, Notion Capital and 14 more.

Who are GoCardless's competitors?

Competitors of GoCardless include Clip, Stripe, PayNearMe, Druo, SlimPay and 7 more.

What products does GoCardless offer?

GoCardless's products include GoCardless Payments and 4 more.

Who are GoCardless's customers?

Customers of GoCardless include Docusign and Gravity Active Entertainment.

Loading...

Compare GoCardless to Competitors

Stripe operates as a technology company that specializes in online payment processing and financial infrastructure for Internet businesses. The company provides a suite of products that enable businesses to accept payments, manage billing and subscriptions, handle in-person transactions, and integrate various financial services into their operations. Its platform is designed to support startups, enterprises, and everything in between with scalable, API-driven solutions. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The company offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

TouchBistro is a company that focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services including front of house, back of house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. These services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Ontario.

Klarna specializes in providing payment solutions and services within the e-commerce sector. The company offers a platform for online shopping that includes price comparisons, deals, and various payment options to facilitate purchases for consumers. Klarna primarily serves the e-commerce industry by enabling a seamless shopping experience through its payment and financing services. It was founded in 2005 and is based in Stockholm, Sweden.

ToneTag is a company specializing in soundwave-based communication and payment technologies within the financial and retail sectors. The company offers a range of products that facilitate contactless payments, voice-assisted transactions, and sound-based data communication for businesses and customers, ensuring secure and convenient interactions. ToneTag's solutions cater to various business types, including grocery, food and beverage, and banking services, providing them with tools for in-store and online operations. It was founded in 2013 and is based in Bengaluru, India.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

Loading...