Groww

Founded Year

2016Stage

Series E - II | AliveTotal Raised

$399.89MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-82 points in the past 30 days

About Groww

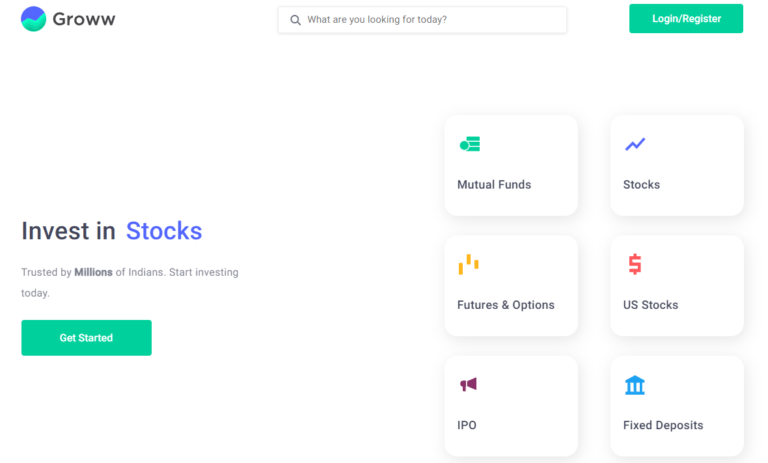

Groww is a financial services company specializing in investment and trading platforms. The company offers a range of services including equity trading, direct mutual funds, and investment in US stocks, all through a user-friendly online platform. Groww provides tools for both systematic investment plans (SIPs) and lumpsum investments, as well as educational resources to empower investors. It was founded in 2016 and is based in Bengaluru, India.

Loading...

Loading...

Research containing Groww

Get data-driven expert analysis from the CB Insights Intelligence Unit.

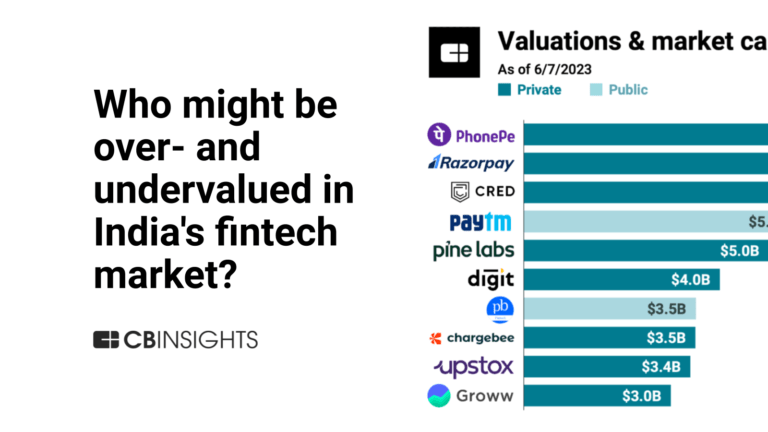

CB Insights Intelligence Analysts have mentioned Groww in 5 CB Insights research briefs, most recently on Jun 14, 2023.

Expert Collections containing Groww

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Groww is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

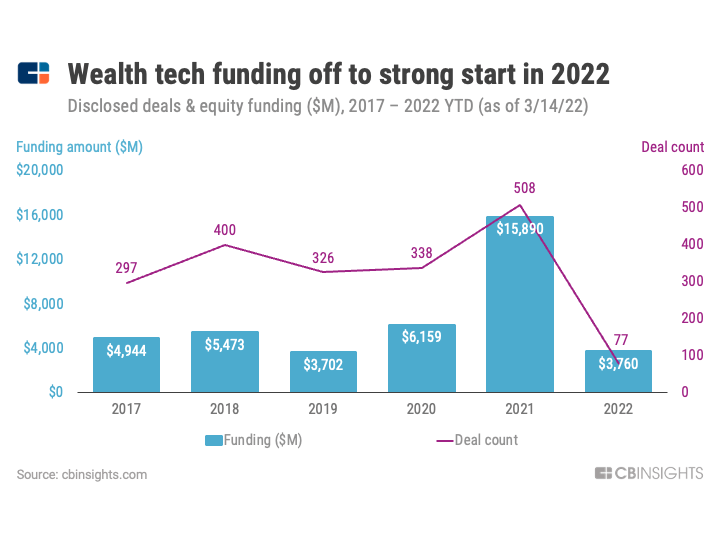

Wealth Tech

2,294 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,396 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Latest Groww News

Sep 19, 2024

SHARE SUMMARY As per rating agency ICRA, personal loans accounted for 98% of the total loan book, while consumer durable loans accounted for the rest of the amount Groww Creditserv is an NBFC of invest tech unicorn Groww. It received an NBFC licence from the RBI in late 2022 Groww Creditserv posted a loss of INR 24.1 Cr in FY24 as against a loss of INR 2.8 Cr in FY23 FOLLOW US Fintech unicorn Groww’s non-banking financial company (NBFC) Groww Creditserv Technologies’s total on-balance sheet loan book stood at INR 965.44 Cr as on June 30, 2024, growing 32% from INR 731.1 Cr as of March 31 this year. As per rating agency ICRA, personal loans accounted for 98% of the total loan book, while consumer durable loans accounted for the rest of the amount. The NBFC is a wholly-owned subsidiary of Groww’s India entity, Billionbrains Garage Ventures Private Limited. RECOMMENDED FOR yOU 19th September, 2024 While it was initially held directly by the four cofounders of Groww – Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh, Billionbrains Garage Ventures acquired a stake in Groww Creditserv in multiple tranches during April 2023 to March 2024. The ICRA report said that Groww Creditserv received a total of INR 378 Cr in total capital infusion till March 31, 2024. This entity’s net worth was INR 351 Cr around the same time. The report said that Groww Creditserv posted a loss of INR 24.1 Cr in FY24 as against a loss of INR 2.8 Cr in FY23. Founded in 2017, Groww is a wealthtech startup that enables users to invest in stocks, exchange-traded funds (ETFs), and IPOs, among other fintech services. It entered the unicorn club in 2021 by bagging $83 Mn in its Series D funding round led by Tiger Global. Billionbrains Garage Private Limited, the parent entity of Groww, posted a net profit of INR 448.7 Cr in FY23 as against a net loss of INR 239 Cr in the previous fiscal year. Its operating revenue more than tripled year-on-year to INR 1,277.8 Cr in FY23.

Groww Frequently Asked Questions (FAQ)

When was Groww founded?

Groww was founded in 2016.

Where is Groww's headquarters?

Groww's headquarters is located at Vaishnavi Tech Park, 3rd and 4th Floor, Bengaluru.

What is Groww's latest funding round?

Groww's latest funding round is Series E - II.

How much did Groww raise?

Groww raised a total of $399.89M.

Who are the investors of Groww?

Investors of Groww include Satya Nadella, Y Combinator, Peak XV Partners, Propel Venture Partners, Ribbit Capital and 14 more.

Who are Groww's competitors?

Competitors of Groww include ET Money and 8 more.

Loading...

Compare Groww to Competitors

INDmoney is a financial services platform specializing in investment management and advisory services. The company offers a comprehensive suite of products that enable users to track their investments, plan financial goals, and invest in a variety of instruments including stocks, mutual funds, and fixed deposits. It was founded in 2018 and is based in Gurgaon, India.

Zerodha is a financial services company specializing in discount broking and online stock trading. The company offers a platform for investing in stocks, derivatives, mutual funds, ETFs, and bonds with a transparent flat fee pricing model. Zerodha provides educational resources and a community for traders and investors. It was founded in 2010 and is based in Bengaluru, India.

InCred Wealth is a modern, agile wealth management company operating in the financial services industry. The company offers a range of wealth solutions, including investment products, portfolio management services, and investment banking solutions. Their primary customers are individuals and businesses seeking wealth management and investment services. It was founded in 2019 and is based in Mumbai, India.

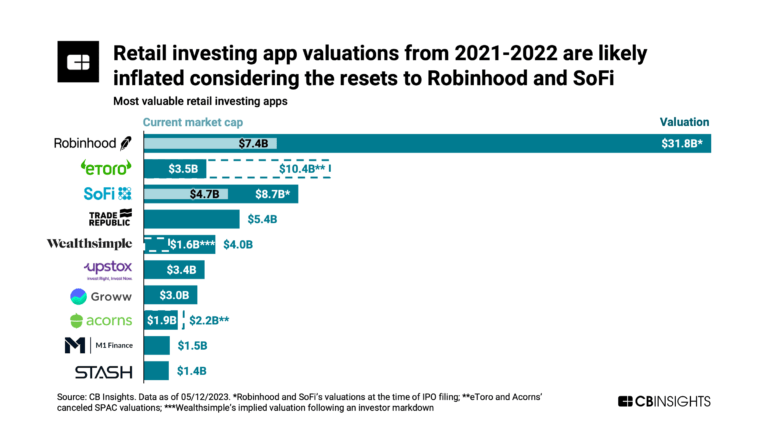

Upstox is a financial services company specializing in online trading and investment platforms. The company offers a range of services including stock trading, mutual funds, IPOs, and derivatives trading, as well as tools and calculators for financial planning and market analysis. Upstox primarily caters to individual investors and traders looking for digital solutions to manage their investment portfolios. It was founded in 2009 and is based in Mumbai, India.

Public is an investing platform that offers a diverse range of financial products across multiple asset classes. The company provides tools for trading stocks, options, and cryptocurrencies, as well as investing in bonds, ETFs, and treasuries, complemented by high-yield cash accounts and tailored investment plans. Public also integrates AI-powered data and analysis to enhance the investment experience, while fostering a community-driven environment for sharing insights and educational content. It was founded in 2019 and is based in New York, New York.

eToro is a social investment platform that operates in the financial services industry, offering a multi-asset investment experience. The company provides a platform for investing in stocks and digital assets, trading contracts for difference (CFDs), and a community feature for users to exchange investment strategies and share market insights. eToro primarily serves retail investors looking to engage in stock and cryptocurrency investments and trading. It was founded in 2007 and is based in Limassol, Cyprus.

Loading...