HeartFlow

Founded Year

2007Stage

Series F - II | AliveTotal Raised

$757.41MLast Raised

$215M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+29 points in the past 30 days

About HeartFlow

HeartFlow provides a digital health service platform for heart disease diagnosis and treatments. It offers a non-invasive personalized cardiac test that provides unprecedented visualization of each patient’s coronary arteries, enabling physicians to create treatment plans for their patients. The company was formerly known as Cardiovascular Simulation. It was founded in 2007 and is based in Mountain View, California.

Loading...

HeartFlow's Product Videos

ESPs containing HeartFlow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The radiology AI — cardiac CT analytics market is focused on improving the diagnosis and management of heart disease through the use of artificial intelligence and advanced imaging technologies. Companies in this market use AI to accurately detect and analyze features such as coronary artery stenosis, ventricular hypertrophy, and other anomalies that can be indicative of cardiac-related diseases. …

HeartFlow named as Leader among 10 other companies, including Cleerly, Medipixel, and Arterys.

HeartFlow's Products & Differentiators

HeartFlow FFRct Analysis

The HeartFlow Analysis is a personalized cardiac test that leverages algorithms trained using deep learning and highly trained analysts to create a digital, personalized 3D model of the heart. The HeartFlow Analysis then uses powerful computer algorithms to solve millions of complex equations to simulate blood flow and provides FFRCT values along the coronary arteries. This information is used by physicians in evaluating the impact a blockage may be having on blood flow and determine the optimal course of treatment for each patient.

Loading...

Research containing HeartFlow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

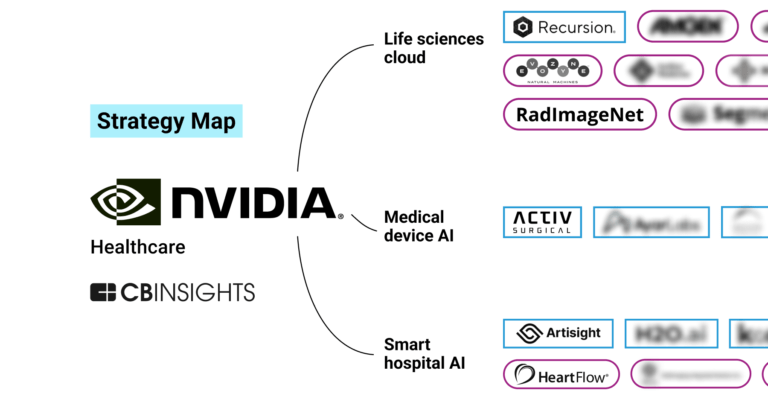

CB Insights Intelligence Analysts have mentioned HeartFlow in 3 CB Insights research briefs, most recently on Jan 5, 2024.

Aug 1, 2023

The state of healthcare AI in 5 charts

Jul 26, 2023 report

State of Digital Health Q2’23 ReportExpert Collections containing HeartFlow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HeartFlow is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Tech IPO Pipeline

568 items

Artificial Intelligence

14,767 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Health 50

150 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,072 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

HeartFlow Patents

HeartFlow has filed 376 patents.

The 3 most popular patent topics include:

- cardiology

- heart diseases

- cardiac arrhythmia

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/7/2022 | 9/3/2024 | Medical imaging, Magnetic resonance imaging, Neuroimaging, Medical physics, Image processing | Grant |

Application Date | 10/7/2022 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Medical imaging, Magnetic resonance imaging, Neuroimaging, Medical physics, Image processing |

Status | Grant |

Latest HeartFlow News

Sep 16, 2024

September 16, 2024 By Tim Fonte and Cara Santillo, HeartFlow HeartFlow’s Fractional Flow Reserve – Computed Tomography (FFRCT) Analysis is a noninvasive procedure that provides a 3D model of a patient’s coronary arteries to identify potential blockages. [Image courtesy of HeartFlow] Artificial intelligence (AI) has been increasingly adopted in healthcare. Many of these improvements are related to medical transcription, digital communications and diagnostics. Despite innovation, few AI enhancements and offerings receive additional reimbursements from federal or private insurance payors. Some AI improvements add incremental value or efficiency to existing medical products or services. That’s a useful benefit for the facility and staff, but does not correlate to higher reimbursement like a distinctly new product or service would. For example, an algorithm that helps a physician more efficiently perform an existing service like interpreting an x-ray can be valuable, but would most likely require payment from a hospital budget and not be eligible for independent reimbursement. If AI-enabled medical technologies that offer new products and services are to be widely adopted, they need to achieve broad coverage and reimbursement. Product designers and developers should consider reimbursement at each stage of the development process. Design plays a pivotal role in reimbursement from the start Bringing new AI-enabled medical technology to market is not a matter of launching a new product and expecting immediate commercial viability, even for compelling products. Pursuing the reimbursement process and ensuring broad access and payment for patients is a multi-year journey that requires patience and grit. Don’t wait for a new technology to be cleared by the FDA before addressing how it fits existing reimbursement codes or if new codes need to be developed. How the clinical value of a new technology is studied and how the indication is submitted to the FDA have implications for achieving reimbursement. Here are tips to help guide new AI-enabled medical technology through development while positioning it well to achieve reimbursement. 1. Determine what problem the new technology solves In order to be reimbursed, the new technology must offer independent clinical value, such as informing diagnosis or treatment decisions for patients in a way not possible with existing methods. Creating a distinctly new product or service that generates useful information can change how physicians or staff care for patients. Ideally, the new technology should offer operational or financial value as well. During the development process, it’s important to ask what unmet need the technology addresses, and is the impact compelling enough that it could be demonstrated? 2. Bring in reimbursement advisors early on Once there is proof-of-concept for the new technology, ask for the help of reimbursement or market access advisors. These experts can help assess how the new technology could be used and how it could be classified and paid for under the existing reimbursement system — or if new reimbursement codes need to be developed. Later on, these experts can help payers understand the technology and how it benefits patients. 3. Commit to getting clinical data to show the technology provides a benefit HeartFlow Plaque Analysis quantifies and characterizes plaque type and volume for coronary artery disease risk assessment and treatment optimization. [Image courtesy of HeartFlow] All too often, AI-enabled medical technologies do not have the clinical data to back up their claims, or the data only answers some of the key clinical questions. For example, demonstrating the accuracy of a diagnostic test is important, but you need a plan for evidence to also show how it impacts decision-making and patient care. Defining these needs early is important because it could affect the design of the product or regulatory claims, and many studies take significant time to enroll and complete, sometimes as long or longer than the development process itself. Consider clinical evidence jointly with your overall technology development plans. For example, HeartFlow’s Fractional Flow Reserve – Computed Tomography (FFRCT) Analysis is a noninvasive procedure that provides a 3D model of a patient’s coronary arteries to identify potential blockages. We wanted to show from the outset that it creates novel information and addresses a need. To do this, we obtained clinical data throughout the development process to build, validate and prove the new technology. This clinical evidence showed that the product was accurate, helped physicians make decisions, improved patient outcomes, and was of economic benefit to the healthcare providers. All of these elements are essential for reimbursement. We are continuing to leverage this expertise and proven success to create new AI reimbursement categories in the development of additional products like HeartFlow Plaque Analysis, a product that quantifies and characterizes plaque type and volume enabling physicians to accurately assess a patient’s risk and optimize treatment for coronary artery disease. 4. Prove the new technology’s value with physician advocates It is important to show from the start that the new technology addresses an unmet need. It is also important to identify physician advocates for the new innovation. This is key as new technologies rarely achieve reimbursement without physicians standing behind them. Designers and marketing teams should work together to summarize what the new technology will do in a simple, compelling way for physicians. Once physicians use the new technology, develop the experience and data to show it creates value for them and that they need it for patient care. Keep in mind that the new technology should not require physicians to perform additional work for which they are not paid. First, design the new technology to be as accessible, interpretable and as efficient as possible. Second, ensure physicians get reimbursed for additional time spent using the new information. 5. Establish pricing A particular challenge for AI-enabled technology is that, unlike most healthcare products, it doesn’t often fit existing codes. Medicare has not often valued or priced AI technologies, and there are varying perceptions about what AI does. While some AI simply runs one algorithm alone, other products like HeartFlow use multiple algorithms on large datasets incorporated in a service that includes human quality review and verification on every patient’s analysis. It is important to look at healthcare economics and consider the overall net savings to the healthcare system, including savings for patients, providers and insurers. Additionally, benchmarking your technology against other technologies can help you to better understand the market. HeartFlow Chief Technology Officer Tim Fonte [Photo courtesy of HeartFlow] Product and technology design can play a pivotal role in achieving reimbursement for AI-enabled medical technology. By keeping reimbursement in mind as an end goal from the start, designers and developers can ensure adoption of breakthrough technologies that help physicians care for their patients. Tim Fonte is chief technology officer at HeartFlow Inc., a leader in noninvasive integrated AI heart care solutions. Fonte has 18 years of experience leading the development and market introduction of innovative healthcare technologies. HeartFlow SVP of Market Access and Reimbursement Cara Santillo [Photo courtesy of HeartFlow] Cara Santillo, HeartFlow SVP of market access and reimbursement, is responsible for reimbursement strategy across the device developer’s product portfolio and pipeline. Most recently, Santillo helped establish a reimbursement pathway for the HeartFlow Fractional Flow Reserve – Computed Tomography (FFRCT) Analysis.

HeartFlow Frequently Asked Questions (FAQ)

When was HeartFlow founded?

HeartFlow was founded in 2007.

Where is HeartFlow's headquarters?

HeartFlow's headquarters is located at 331 East Evelyn Avenue, Mountain View.

What is HeartFlow's latest funding round?

HeartFlow's latest funding round is Series F - II.

How much did HeartFlow raise?

HeartFlow raised a total of $757.41M.

Who are the investors of HeartFlow?

Investors of HeartFlow include U.S. Venture Partners, HealthCor Management, Martis Capital, Capricorn Investment Group, Wellington Management and 13 more.

Who are HeartFlow's competitors?

Competitors of HeartFlow include Medipixel and 7 more.

What products does HeartFlow offer?

HeartFlow's products include HeartFlow FFRct Analysis.

Who are HeartFlow's customers?

Customers of HeartFlow include Atrium Health.

Loading...

Compare HeartFlow to Competitors

Cleerly is a digital healthcare company that focuses on the treatment of heart disease. The company's main service is an AI-based digital care platform that works with coronary computed tomography angiography imaging to help clinicians identify and define atherosclerosis earlier, enabling them to provide personalized treatment plans. The platform measures atherosclerosis, or plaque build-up in the heart's arteries, and offers simpler, faster, and more accurate heart disease evaluation and reporting. It was founded in 2017 and is based in New York, New York.

Caristo Diagnostics specializes in advanced cardiovascular diagnostic tools within the healthcare technology sector. The company enhances the accuracy of routine cardiac CT scans by identifying coronary inflammation and other hidden cardiac issues, which improves the prediction of cardiovascular risk and aids in treatment decisions. Caristo Diagnostics' technology is utilized in preventive screening, disease diagnosis, intervention planning, and clinical research. It was founded in 2018 and is based in Oxford, England.

Artrya is a healthcare technology company that focuses on the application of artificial intelligence in the medical sector, specifically in the diagnosis of coronary heart disease. The company offers AI-driven solutions that assist in the rapid assessment of chest pain patients, providing insights into the type and volume of arterial plaque detected through coronary computed tomography angiography. This facilitates the accurate stratification of patients, enabling efficient patient intake and rapid discharge. It was founded in 2019 and is based in Crawley, Western Australia.

Elucid specializes in advanced arterial analysis software within the healthcare technology sector. The company offers software that provides objective and quantitative assessment of arterial plaque, validated by histology, to aid in the diagnosis and treatment of cardiovascular diseases. Elucid's software is designed to support physicians, patients, and clinical researchers by improving the accuracy of non-invasive testing and enabling personalized care. It was founded in 2013 and is based in Boston, Massachusetts.

CorVista Health specializes in cardiac diagnostics within the healthcare sector, focusing on the development of non-invasive, machine learning-powered diagnostic systems. It offers the CorVista System, a point-of-care diagnostic tool designed to accurately detect significant coronary artery disease (CAD) and pulmonary hypertension (PH) during a single patient visit. It aims to provide early diagnosis and intervention for cardiovascular diseases, leveraging advanced algorithms to analyze cardiac data and support treatment decisions. It was formerly known as Analytics 4 Life. The company was founded in 2012 and is based in Bethesda, Maryland.

CathWorks is a medical technology company that focuses on optimizing Coronary Artery Disease (CAD) therapy decisions through its advanced computational science platform. The company's main product, the FFRangio System, provides a quick, reliable intraprocedural physiologic assessment for the entire coronary tree, aiding physicians in making objective, wire-free FFR-guided PCI decisions. CathWorks primarily serves the healthcare industry, particularly in the field of cardiology. It was founded in 2013 and is based in Kfar-Saba, Israel.

Loading...