Hebbia

Founded Year

2020Stage

Series B | AliveTotal Raised

$161.1MValuation

$0000Last Raised

$130M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+20 points in the past 30 days

About Hebbia

Hebbia is a company focused on AI technology that enhances knowledge work across various sectors such as finance, law, government, and pharmaceuticals. Its main product, Matrix, is an AI co-pilot that assists users in extracting, structuring, and analyzing large volumes of documents, facilitating full workflow automations with language learning models (LLMs). Hebbia's AI tools are designed to be transparent and verifiable, ensuring trust and collaboration between users and AI systems. It was founded in 2020 and is based in New York, New York.

Loading...

Hebbia's Product Videos

_thumbnail.png?w=3840)

_thumbnail.png?w=3840)

ESPs containing Hebbia

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The generative AI — investment research market focuses on developing generative AI models specifically tailored for investment research and analysis. Generative AI models in this market are designed to generate investment insights, predict market movements, and automate research reports.

Hebbia named as Highflier among 11 other companies, including Boosted.ai, Portrait, and BlueFlame.

Hebbia's Products & Differentiators

Neural search

Hebbia empowers knowledge workers with neural search – eliminating work intensive information retrieval and unlocking diligence & analysis. Via one-click integration with major cloud storage providers, the platform syncs files to an end-to-end encrypted index. Users can query terabytes of unstructured information and surface passage-level results across every file type. Hebbia’s proprietary index & parse engines wrangle the most difficult data, and search scales independent of repository size.

Loading...

Research containing Hebbia

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hebbia in 3 CB Insights research briefs, most recently on Aug 23, 2024.

Expert Collections containing Hebbia

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hebbia is included in 3 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

15,089 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

Generative AI

863 items

Companies working on generative AI applications and infrastructure.

Latest Hebbia News

Sep 9, 2024

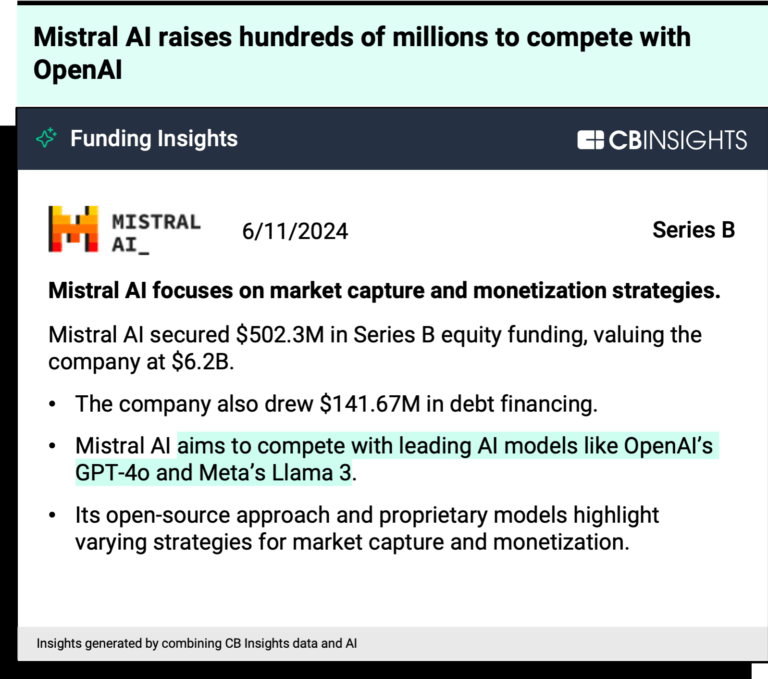

Voted on by top investors and powered by PitchBook data and AI/ML algorithms, these are the top private companies building and enabling intelligent and generative applications today. Today, Madrona is excited to announce the 2024 Intelligent Applications 40, highlighting this year’s most compelling private companies leveraging artificial intelligence and machine learning. We received over 380 nominations from more than 70 venture investors across 54 top-tier venture and corporate investment firms and continued our partnership with Pitchbook to incorporate its data-driven scoring into the voting process to further enhance the rigor and research behind our decision-making. The intelligent applications landscape has continued to evolve rapidly since our initial list in 2021 and last year’s 2023 cohort . Models have improved speed, accuracy, and multimodal capabilities, with releases such as GPT-4o and GPT-4o mini, Claude 3.5 Sonnet, and Gemini 1.5. At the 2023 IA Summit, we observed several key themes that continue to persist, including the mainstream adoption of AI and the high proliferation of AI applications. Since the 2023 Summit, we have continued to explore the rapidly evolving landscape of GenAI and began following the rise of AI agent infrastructure , which has generated new opportunities across application and platform layers. We will celebrate the 2024 Intelligent Applications 40 winners and debate where applied AI is headed at the third annual Intelligent Applications Summit on October 1 and 2 in Seattle, hosted in partnership with AWS, Microsoft, Delta, NYSE, Morgan Stanley, and McKinsey & Company. You can find out more on our event site to request an invite. To highlight how dynamic the field of applied AI/ML continues to be, the 2024 IA40 features 22 first-time winners. This is slightly lower than we observed in 2023 , as we see a higher number of late-stage application companies and large enablers selected as repeat winners (while still remaining private companies). Model companies continue to deliver higher quality models at a lower cost, driving a fundamental shift in development for all AI companies. This has benefitted scaled app-layer companies, as they have been able to capitalize on model efficiency, customer focus, and differentiated data and workflows to grow even more rapidly than in earlier years. At the model layer, two key players, OpenAI and Anthropic, made the list again this year, raising a staggering $20B combined to date. Databricks and Hugging Face also continue to top the list, reflecting the value and moat these enabler companies are establishing in the market. However, new enablers are still landing on the list, such as Braintrust and Unstructured, bringing differentiated value in transforming how businesses build AI products and increasing access to processing unstructured data. Overall, it remains too early to crown winners in the AI race. Only four companies have been selected as Intelligent Applications 40 winners all four years, and four others have won three times. We see winners continue to succeed with new applications of AI, as reflected in the evolving industry categories on the list each year. The 2024 IA40 winners have raised a total of $45.3B from inception to August 15, 2024 — the cut-off for tabulation. Nearly half, or $22B, was raised in the last 12 months alone, which includes a whopping $7.2B and $8.6B from Anthropic and CoreWeave, respectively. Even excluding these two large rounds, 2024 IA40 winners still raised an impressive $6.2B in the past year. Fundraising remains strong for prior Intelligent Applications 40 cohorts as well — the 2023 IA40 winners raised $11.3B over the last 12 months. The AI acquisition landscape also reflects the intensity of investment and competition among scaled technology players. While there is the traditional path of startup exits via acquisition, there is a growing prevalence of “ pseudo-acquisitions ” or “reverse acquihires” in the AI space. Of the 2023 IA40 winners, there was one traditional acquisition ( Mimecast acquired Elevate Security ) and two “acquisitions” — Amazon and Adept and Google and Character.AI . In these deals, the acquiring company brought in key startup talent and established new licensing agreements for the startups’ technology. The IA40 companies are split across four categories Funding data categorized as of 8/15/2024 Early — Up to $30M total capital raised Mid — $30M – $200M total capital raised Late — $200M+ total capital raised Enablers — Stage Agnostic. (We define enablers as the companies building the tools and infrastructure that enable intelligent applications.) This year, we continued to feature five Rising Star Enabler Winners. These five companies represent enablers that have raised less than $50M of capital and were top runners-up for the list. Key Takeaways From the 2024 Intelligent Applications 40 Generative-native AI companies continue to see high growth, particularly in enterprise productivity Gen-native applications (i.e., those launched in the AI space and built on top of foundation models) that can help solve for knowledge search and management, workflow acceleration, or assist with GenAI content creation across teams continue to see success with enterprise customers. AI application companies such as Glean, Writer, and Hebbia have worked to integrate themselves with enterprise systems as powerful AI partners. These companies showcase a wide range of dynamic capabilities to remain accessible yet relevant for different end users. Newer gen-native AI companies such as Yurts are also exploring the market for enterprise efficiency while addressing adjacent markets such as government agencies that could benefit from similar solutions. We have also continued to see new growth with vertically focused productivity solutions that address specific customer problems in spaces such as healthcare (e.g., Tennr), software development (e.g., Codium), and sales (e.g., Clay). We expect winners in the enterprise productivity AI space to emerge more clearly in the next couple of years. Gen-enhanced applications persist in their ability to deliver value-add AI capabilities for their customers In 2023, we noted that gen-enhanced companies (i.e., companies that did not begin as AI companies but have enhanced their core products with GenAI) have advantages in engaging their existing customers and leveraging their brand. Incumbents such as Canva and Figma continue to execute well in enhancing their existing workflows and offerings to help their customers extract more value. They have proven their ability to adapt quickly to compete with offerings from gen-native applications and their strength in pursuing partnerships to accelerate their AI solutions. This is “as we predicted” last year, but we believe that gen-enhanced companies can emerge as truly disruptive category definers/winners in the medium term. Companies are exploring new autonomous capabilities of AI to take on tasks Improvements in models and platform infrastructure (e.g., frameworks like LangChain) have made it possible for companies to more actively pursue the development of autonomous AI agents. These companies are building agents to tackle a wide range of different functionalities. MultiOn is working to create AI agents that can perform a wide range of online tasks, while Factory aims to transform the software engineering space by automating tasks such as writing tests and documentation to streamline the development lifecycle. Dropzone is also pursuing unique use cases for its AI agent to autonomously investigate security alerts and generate comprehensive reports. The AI agent space is still emerging, and we expect a wide range of continued innovation across the stack to support new autonomous developments. AI companies continue to secure funding and high valuations at a rapid clip All of the 2024 Intelligent Applications 40 have successfully raised some level of outside capital. Over the past 12 months, 27 of them secured a total of $22.0B in new funding. Enthusiasm in the AI/ML space continues to run hot in recent weeks, with Runway in talks with General Atlantic eyeing a $450M round at a $4B valuation and Harvey reportedly raising $100M at a $1.5B valuation . It is interesting to note these valuations in the context of the broader 2024 IA40 cohort, as these are high but not outside the norm for this year’s late-stage winners. In terms of the median last known valuation, early-stage winners raised at a $77M median valuation, mid-stage at $500M, late-stage at $4.6B, and enablers at $6.5B. Valuations for enablers are generally higher and climbing rapidly at the extremes, with Databricks, OpenAI, Anthropic, and CoreWeave all at around $20B or higher valuations. Most notably, OpenAI is reportedly raising at a valuation of over $100B. Thematic Insights: AI Applications Intelligent applications have an increased focus on driving ROI Intelligent applications are becoming more productivity-oriented across both structured and less structured workflows and data. There is a growing shift in companies helping employees be more productive in how they conduct their work. Several companies on this year’s list aim to solve general productivity for “knowledge workers” throughout an organization by automating daily processes such as meetings (e.g., Read AI, Fireflies.ai). These general productivity applications boast capabilities such as conversation intelligence and workflow automation. They have intuitive UIs that make their tools easy for the average end customer to help boost their productivity from Day 1. Other startup solutions seek to drive productivity within specific functions by empowering teams such as sales (e.g., 11x, Clay, Unify, Rilla). These companies are taking a new approach to an antiquated or complex stack to empower sales teams to do more with less, with tailored integrations or GenAI assistance that enable higher volumes of personalized outreach, enhanced understanding of customer sentiment, and improved deal outcomes. Beyond sales, AI productivity applications are also prevalent for functions such as engineering teams to improve efficiency (e.g., Codium for coding use cases). The relationship between AI and when or how humans are “in the loop” is shifting, particularly in historically services-oriented workflows An increasing number of IA40 companies such as Hebbia, Harvey, and PermitFlow are shrinking the gap between human-centric service businesses and SaaS businesses by pursuing AI along two paths: streamlining existing workflows and aspiring to fully automate tasks traditionally performed by human workers — or both. Service businesses such as legal, finance, healthcare, sales, and customer service are ripe for this kind of disruption. Within the legal tech space, Harvey and EvenUp have gained significant traction where AI has become a critical partner in stages of the process that require vast amounts of data processing (e.g., legal document analysis) or content generation (e.g., creating summaries and demand letters). We are also beginning to see signs of the “Jevons Paradox” playing out in applied AI, where improvements in AI efficiency may increase corresponding demand. As features such as AI content generation become increasingly efficient, we could see a proliferation in content production and personalization across outlets with greater demands for humans to review the work. The role of where and how individuals spend their time in relation to these new AI tools will continue to evolve. Thematic Insights: Enablers Enablers are transforming the data landscape by changing how companies process and leverage unstructured and structured data As companies strive to harness the full potential of data, they increasingly leverage both unstructured and structured data to unlock deeper insights and drive innovation. Unstructured data, such as images, videos, and text, is often more complex to process but holds immense value when combined with structured data, such as databases and spreadsheets. Databricks has been a leader in this shift with its push toward lakehouse architecture, which takes the best elements from data lakes and data warehouses. This architecture enables organizations to process structured and unstructured data for analytics and machine learning. With its acquisition of Tabular, Databricks continues to enhance its capabilities in this space to advance compatibility across data types. Beyond Databricks, companies like Coactive and Unstructured are making unstructured data more accessible for AI models to consume and for businesses to unlock deeper insights from the full potential of their data. As we continue to evolve from classical machine learning to LLMs, companies have had to find new ways of testing data accuracy and evaluating data. Companies like Braintrust are tackling key questions around how to evaluate, monitor, and deploy applications pre- and post-production and how data impacts model performance. At the application level, companies also continue to experiment with unstructured data and different modalities, including repeat winners such as Runway and ElevenLabs and new winners such as Read AI and Fireflies.ai. Leaps by open-source models and infrastructure companies are driving both value and speed We noted last year that open-source models were playing a growing role in enabling developers to more quickly build and deploy intelligent applications, with companies such as Hugging Face and LangChain playing crucial roles. The success of Mistral, one of the 2024 winners, reflects the importance of an open, collaborative environment in driving continual improvement in model performance. The cost of AI also continues to drop in 2024, with the release of GPT-4o mini, which is smarter, just as fast, and more than 60% cheaper than GPT-3.5 Turbo, disrupting the traditional tradeoff between cost and performance. New 2024 enabler rising stars such as Arcee.ai and CentML are approaching efficiency in the AI ecosystem from two different but critical angles. Arcee.ai makes it easier for organizations to build and deploy small language models (SLMs), while CentML reduces LLM costs through automated compute optimizations. Coreweave is tackling the problem of compute-intensive AI workloads by being a powerful partner in increasing access to powerful GPU clusters at scale. These enablers are key to driving a more sustainable AI ecosystem and more affordable development of next-gen AI applications. Looking Ahead While we expected some IA40 winners to have gone public by now, this has yet to materialize. However, winners such as Databricks and Hugging Face continue to be active in M&A (e.g., Hugging Face’s strategic acquisition of Xethub ). We also anticipate there will continue to be “pseudo-acquisitions” of startups in the AL/ML space as scaled players race to license technology and compete on skilled talent. The Intelligent Applications 40 list highlights some of the most innovative companies leveraging AI and ML, but other high-profile companies such as Sierra, Poolside, and Cognition have raised substantial rounds at eye-popping valuations in 2024 and could be intriguing candidates for making the IA40 next year. At Madrona, we have spent over a decade partnering with and investing in intelligent application companies, observing their influence and impact across various verticals. These applications are poised to shape the future of software and the next wave of computing. We believe they deserve to be recognized and celebrated for their achievements! You can read more about the process and methodology here . Related Insights

Hebbia Frequently Asked Questions (FAQ)

When was Hebbia founded?

Hebbia was founded in 2020.

Where is Hebbia's headquarters?

Hebbia's headquarters is located at 110 Greene Street, New York.

What is Hebbia's latest funding round?

Hebbia's latest funding round is Series B.

How much did Hebbia raise?

Hebbia raised a total of $161.1M.

Who are the investors of Hebbia?

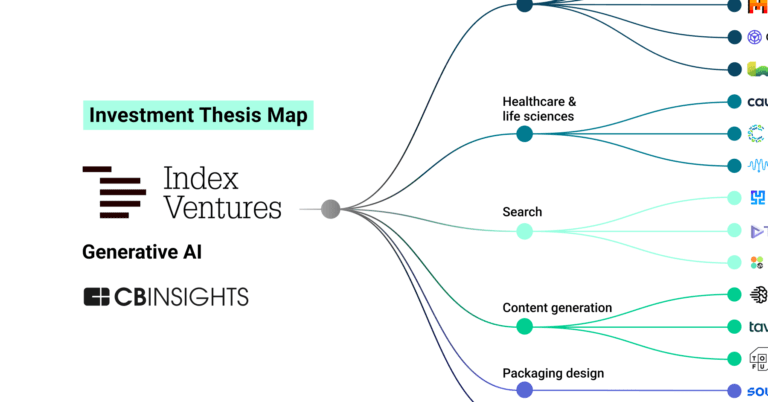

Investors of Hebbia include Peter Thiel, Index Ventures, Andreessen Horowitz, Google Ventures, Raquel Urtasun and 10 more.

Who are Hebbia's competitors?

Competitors of Hebbia include Glean, Vectara, AlphaSense, Clue Software, Aleph Alpha and 7 more.

What products does Hebbia offer?

Hebbia's products include Neural search and 4 more.

Loading...

Compare Hebbia to Competitors

Glean specializes in enterprise artificial intelligence search and knowledge discovery within the technology domain. The company offers a suite of tools that enable businesses to search and analyze their internal data, using generative ai to provide personalized and relevant information. Its solutions cater to various teams including engineering, sales, and support, helping in workplace productivity across the board. The company was founded in 2019 and is based in Palo Alto, California.

Multiply is a company focused on enhancing creative workflows through personalized assistance and AI integration within various business sectors. The company offers a platform that streamlines the creative process by providing customizable templates, workflow automation, and tools for consistent content creation without repetitive tasks. Multiply primarily serves sectors that require collaborative content creation, such as marketing agencies, branding agencies, and digital content teams. Multiply was formerly known as Fluent. It was founded in 2019 and is based in Stockholm, Sweden.

Maya AI is a personalized AI solution designed to enhance team performance and improve customer experience within various business sectors. The company offers services such as real-time data insights, predictive strategic planning, and AI-driven adaptive training to facilitate better decision-making and operational efficiency. Maya AI primarily serves sectors such as retail, finance, healthcare, pharmacy, and technology. Maya AI was formerly known as XiByte. It was founded in 2017 and is based in Tampa, Florida.

Dashworks is an AI knowledge assistant focused on enhancing team productivity across various business sectors by centralizing and integrating scattered knowledge bases. The company offers an enterprise search platform that provides AI-powered answers by connecting to a multitude of work applications, enabling quick and secure access to information. Dashworks primarily serves sectors that require efficient knowledge management and rapid information retrieval, such as sales, customer support, engineering, and marketing. It was founded in 2020 and is based in San Francisco, California.

Mem operates as an artificial intelligence (AI) knowledge assistant. The company offers services that use artificial intelligence to organize the team's work, including meeting notes, projects, and knowledge bases, making them searchable and discoverable. It was formerly known as Supernote. It was founded in 2019 and is based in Los Altos, California.

theGist develops generative artificial intelligence (AI) technology to manage workplace productivity. The company offers a unified AI workspace that simplifies information creation and consumption, providing services such as a smart unified inbox, AI insights, and personalized summaries of work discussions. Its primary customer base includes various sectors that require efficient data management and communication. It was founded in 2022 and is based in Tel Aviv, Israel.

Loading...