Hepster

Founded Year

2016Stage

Series B | AliveTotal Raised

$32.2MLast Raised

$11.24M | 1 yr agoAbout Hepster

Hepster is a company specializing in providing online insurance services across various sectors. Their main offerings include insurance for bicycles, electronic devices, pets, sports equipment, travel, and personal liability, all managed digitally for ease of use. Hepster primarily caters to individual consumers seeking situational lifestyle insurance and businesses looking for corporate insurance solutions. It was founded in 2016 and is based in Rostock, Germany.

Loading...

Hepster's Products & Differentiators

API

The insurance product can be seamlessly integrated into existing B2B customer journeys. The API endpoints are flexible and modular.

Loading...

Research containing Hepster

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hepster in 1 CB Insights research brief, most recently on Sep 7, 2022.

Expert Collections containing Hepster

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

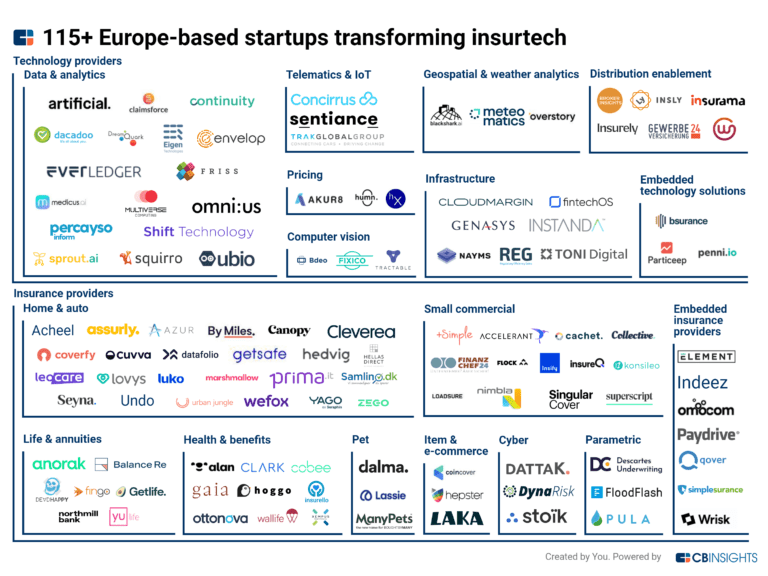

Hepster is included in 2 Expert Collections, including Insurtech.

Insurtech

4,341 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,307 items

Excludes US-based companies

Latest Hepster News

May 7, 2024

BAUR, one of the largest online retailers in Germany, is partnering with embedded insurance startup Hepster. As part of the partnership, BAUR will introduce a variety of coverages to its shoppers at the point of sale including smartphone insurance, sports equipment insurance, bicycle insurance and e-bike insurance. Founded in 2016, Hepster raised ~$34 million in funding and it claims to have worked with over 2,500 partners. “We are very pleased about the collaboration with BAUR. This partnership reflects the commitment of both sides to continually expand their service in order to be able to respond to customers’ needs. The potential of insurance as a value-added service is also made clear by the even more attractive shopping experience.” – Hanna Bachmann, CRO and co-founder of Hepster. “For us at BAUR, customer satisfaction is our focus at all times. We therefore see the recommendation of hepster insurance within the entire purchasing experience as a valuable addition to our service offering.” – Nicole Mielich-Lange, Manager Assortment & Sales – Retail Media, BAUR. Share this

Hepster Frequently Asked Questions (FAQ)

When was Hepster founded?

Hepster was founded in 2016.

Where is Hepster's headquarters?

Hepster's headquarters is located at Am Kreuzgraben 1a, Rostock.

What is Hepster's latest funding round?

Hepster's latest funding round is Series B.

How much did Hepster raise?

Hepster raised a total of $32.2M.

Who are the investors of Hepster?

Investors of Hepster include Element Ventures, Seventure Partners, Claret Capital Partners, Mittelständische Beteiligungsgesellschaft Mecklenburg-Vorpommern, InsurTech NY and 6 more.

Who are Hepster's competitors?

Competitors of Hepster include Wefox and 5 more.

What products does Hepster offer?

Hepster's products include API and 4 more.

Loading...

Compare Hepster to Competitors

Embea operates in the insurance industry and offers digital life and insurance plans. It provides coverage against severe life risks such as critical illnesses, accidents, and death. It primarily sells to companies of all sizes, embedding their insurance products into their apps and services. It was founded in 2022 and is based in Berlin, Germany.

ELEMENT specializes in white-label insurance products and technology solutions for the insurance sector. The company offers a platform for insurance solutions, including policy and claims administration. ELEMENT primarily serves intermediaries, insurers, and enterprises across the B2B2X value chain. It was founded in 2017 and is based in Berlin, Germany.

INZMO is a company that operates in the insurance industry, providing a fully-digital insurance platform. The company offers insurance services for various items such as e-scooters, mobile phones, bicycles, and laptops/tablets, all managed through a digital application. The primary customer base of INZMO is individuals seeking insurance for their personal belongings. It was founded in 2015 and is based in Tallinn, Estonia.

Bolttech is an international insurtech company focused on creating a technology-enabled ecosystem for protection and insurance within the financial sector. The company's main offerings include a global insurance exchange platform that connects insurers, distributors, and customers, facilitating the purchase and sale of insurance and protection products. Bolttech primarily serves businesses across various sectors looking to integrate insurance solutions into their customer journeys, such as telecommunications, retail, e-commerce, real estate, and financial services. Bolttech was formerly known as EdirectInsure Group. It was founded in 2015 and is based in Singapore.

TONI Digital is a company that focuses on innovating in the insurance industry. The company offers a white-label solution that allows insurers, brokers, and distribution partners to create and offer tailored insurance products to their customers. These products cover a range of areas including car, building, travel, life, and household insurance. It was founded in 2017 and is based in Zurich, Switzerland.

Penni is a company specializing in embedded insurance within the insurance industry. Its main service is a digital distribution solution that facilitates online sales of insurance products through partnerships with brands. The company primarily serves the insurance sector, enabling insurers and brokers to leverage digital channels for their offerings. It was founded in 2017 and is based in Copenhagen, Denmark.

Loading...