Hex Trust

Founded Year

2018Stage

Series B | AliveTotal Raised

$77MValuation

$0000Last Raised

$61M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-61 points in the past 30 days

About Hex Trust

Hex Trust is a fully licensed and insured provider of bank-grade custody for digital assets. The company offers Hex Safe, a bank-grade platform for securing and managing digital assets. It was founded in 2018 and is based in Hong Kong.

Loading...

Hex Trust's Product Videos

ESPs containing Hex Trust

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The institutional staking market provides platforms to institutional investors, crypto platforms, and investment funds looking to earn yield on their digital assets through staking. Staking involves holding and locking up cryptocurrencies to support the network and validate transactions, earning rewards in return. The market offers solutions for managing and securing digital assets, as well as pro…

Hex Trust named as Challenger among 15 other companies, including BitGo, Fireblocks, and Gemini.

Hex Trust's Products & Differentiators

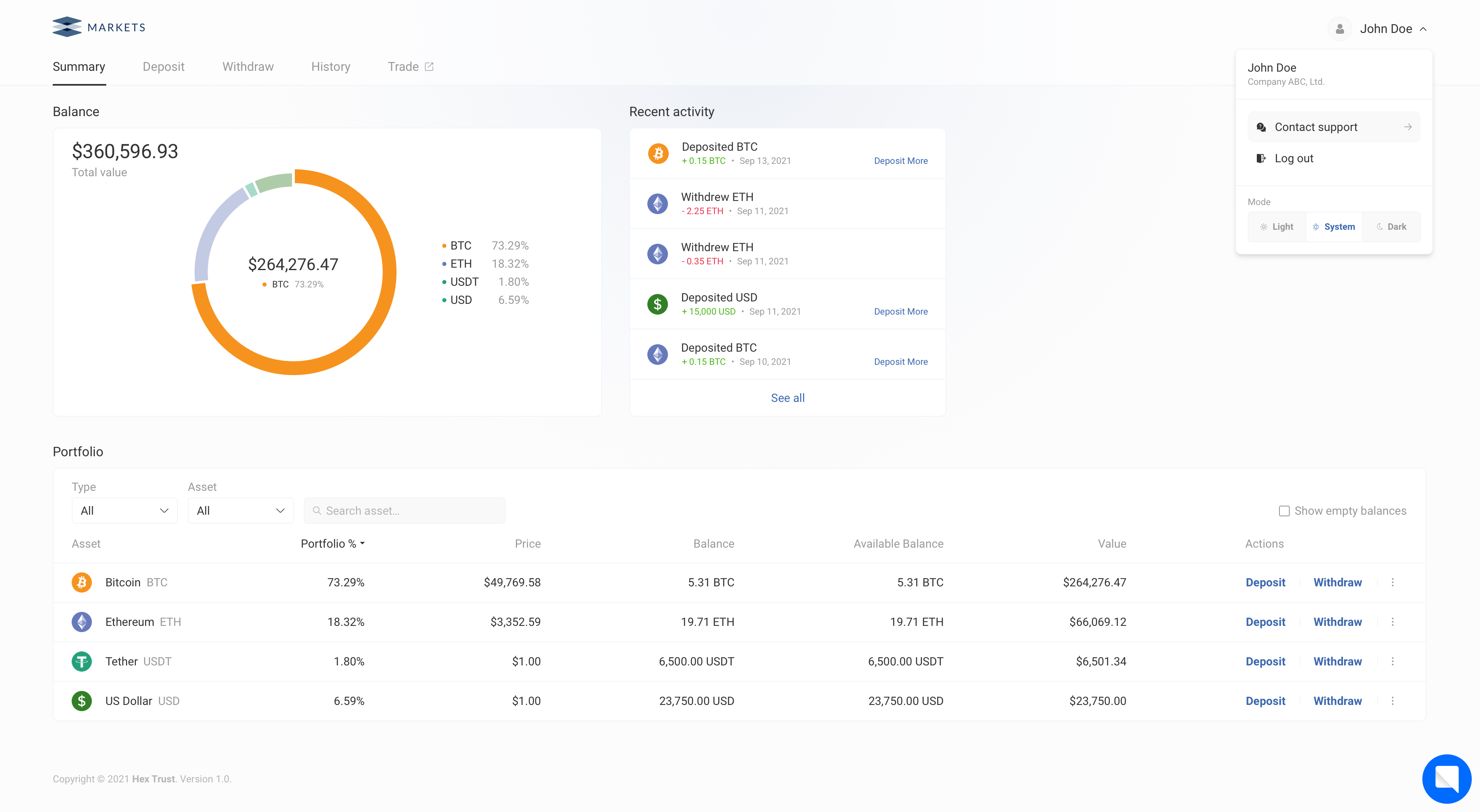

Hex Safe

Hex Trust provides institutional-grade custody, compliance frameworks, and state-of-the-art security solutions for the safekeeping of digital assets. Through Hex Safe, you have access to custody services purpose-built for banks, delivered in partnership with IBM.

Loading...

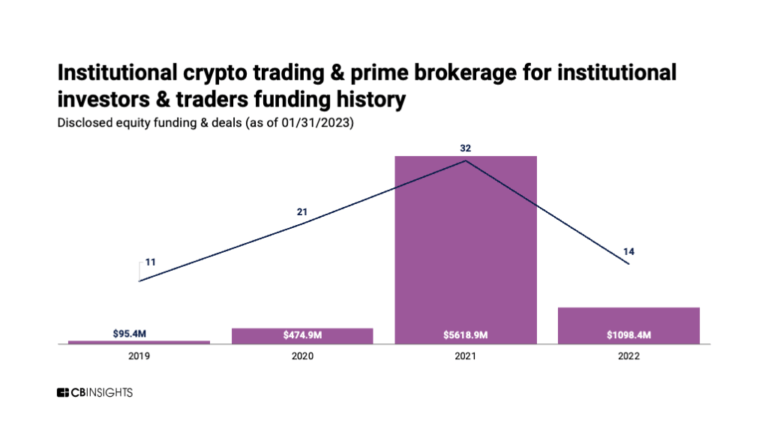

Research containing Hex Trust

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hex Trust in 2 CB Insights research briefs, most recently on Feb 23, 2023.

Expert Collections containing Hex Trust

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hex Trust is included in 2 Expert Collections, including Blockchain.

Blockchain

8,743 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

13,398 items

Excludes US-based companies

Latest Hex Trust News

Sep 13, 2024

Link copied Hong Kong is reportedly considering involving the local securities regulator in licensing over-the-counter crypto trading services. Over-the-counter crypto trading services in Hong Kong might soon come under the joint oversight of the Securities and Futures Commission and the Customs and Excise Department, as the city seeks to tighten its regulatory framework. According to a South China Morning Post report , which cites persons familiar with the matter, the SFC is exploring a new licensing regime for OTC crypto services, working alongside the C&ED to address regulatory gaps identified following the JPEX scandal, which resulted in losses of more than $200 million. Previously, OTC services were solely regulated by the C&ED, but recent discussions indicate a shift toward a combined regulatory approach. The SFC has been consulting industry players about the potential new regime and has also been evaluating regulations for cryptocurrency custodian services. These discussions are still in early stages and subject to change, the sources said. In mid-August, crypto.news reported that the SFC identified unsatisfactory practices during on-site inspections of 11 “deemed-to-be-licensed” crypto exchanges, raising doubts about their ability to meet full licensing requirements. The investigation revealed that some exchanges were overly reliant on a small number of executives to manage client asset custody, while others were not “properly guarding against cybercrime risks.” Hong Kong’s regulatory landscape has been evolving, with new licensing requirements for crypto exchanges and the introduction of crypto exchange-traded funds. However, concerns persist among local players. In March, Alessio Quaglini, co-founder and CEO of crypto custodian Hex Trust, voiced worries about proposed OTC regulations, suggesting that stringent requirements could drive businesses like Hex Trust to relocate to more crypto-friendly jurisdictions.

Hex Trust Frequently Asked Questions (FAQ)

When was Hex Trust founded?

Hex Trust was founded in 2018.

Where is Hex Trust's headquarters?

Hex Trust's headquarters is located at 9/F, H Code, High Block 45 Pottinger Street Central, Hong Kong.

What is Hex Trust's latest funding round?

Hex Trust's latest funding round is Series B.

How much did Hex Trust raise?

Hex Trust raised a total of $77M.

Who are the investors of Hex Trust?

Investors of Hex Trust include Kenetic Capital, Cell Rising, Radiant Tech Ventures, QBN Capital, Ripple and 32 more.

Who are Hex Trust's competitors?

Competitors of Hex Trust include BitGo, Fireblocks, Fordefi, Metaco, Ledger and 7 more.

What products does Hex Trust offer?

Hex Trust's products include Hex Safe and 3 more.

Who are Hex Trust's customers?

Customers of Hex Trust include Animoca, Algorand and Tezos.

Loading...

Compare Hex Trust to Competitors

Fireblocks is an enterprise-grade platform specializing in secure infrastructure for moving, storing, and issuing digital assets within the blockchain and cryptocurrency sectors. The company offers a suite of applications for digital asset operations management and a comprehensive development platform for building blockchain-based businesses. Fireblocks' solutions cater to a variety of sectors including financial institutions, exchanges, and fintech startups. It was founded in 2018 and is based in New York, New York.

Copper is a technology company focused on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

BitGo focuses on providing secure and solutions for the digital asset economy. The company offers a range of services including regulated custody, financial services, and core infrastructure. BitGo primarily serves investors and builders in the digital asset economy, including exchanges, retail platforms, crypto-native firms, and institutional investors. It was founded in 2013 and is based in Palo Alto, California.

Ledger specializes in secure hardware wallets and digital asset management solutions within the cryptocurrency sector. The company offers products that store private keys for cryptocurrencies and NFTs, enabling secure transactions and asset management. Ledger's hardware wallets are designed to work with the Ledger Live app, which facilitates the buying, selling, swapping, and staking of various cryptocurrencies. It was founded in 2014 and is based in Paris, France.

Anchorage Digital offers a cryptocurrency platform providing institutions with digital asset financial services and infrastructure solutions. It offers a digital bank as a crypto-native bank and also offers crypto strategies for institutions. The company provides security and asset accessibility, including capturing yield from staking and inflation, voting, auditing proof of existence, and fast transactions. It primarily caters to the financial sector. The company was founded in 2017 and is based in San Francisco, California.

Cobo is a provider of digital asset custody solutions within the blockchain technology sector. The company offers a range of wallet technologies, including custodial, multi-party computation (MPC), smart contract, and exchange wallets, designed to secure and manage digital assets. Cobo primarily serves institutions in the financial services, exchanges, and blockchain application development sectors. It was founded in 2017 and is based in Singapore, Singapore.

Loading...