HighRadius

Founded Year

2006Stage

Series C | AliveTotal Raised

$475MValuation

$0000Last Raised

$300M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About HighRadius

HighRadius specializes in artificial intelligence (AI) enabled autonomous finance solutions for the office. The company provides a suite of products designed to automate and optimize order-to-cash, treasury, and record-to-report processes for businesses. Its solutions aim to reduce days sales outstanding (DSO), enhance working capital management, accelerate financial close, and improve overall productivity without the need for extensive technical knowledge. It was founded in 2006 and is based in Houston, Texas.

Loading...

HighRadius's Product Videos

ESPs containing HighRadius

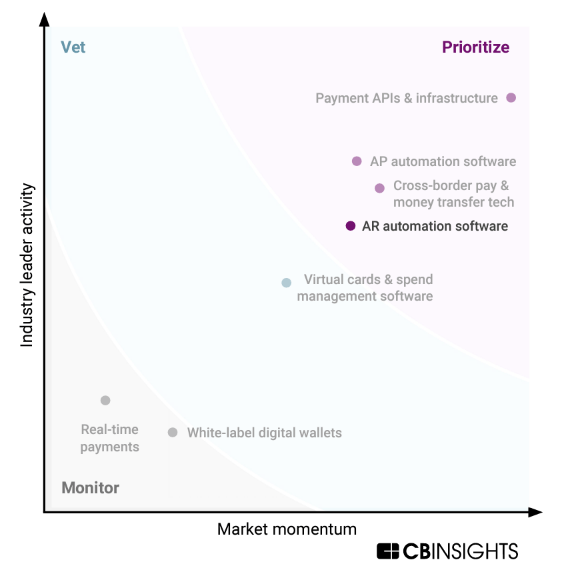

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The accounts receivable (AR) automation market streamlines invoicing and payment collection processes. Vendors provide APIs and software development kits that allow companies to embed accounts receivable functionalities into their enterprise resource planning software, customer relationship management systems, and other digital platforms. The tools allow automated invoicing, payment reminders and…

HighRadius named as Challenger among 15 other companies, including FIS, Sage, and Blackline.

HighRadius's Products & Differentiators

Credit

HighRadius Autonomous Receivable platform has 5 solutions. Customers can subscribe to them individually or any combination. Each Solution has 4 editions with base capabilities to suit varying customer sizes and demands. 1. Credit onboards prospective customers and proactively manages credit risk of existing customers through real-time monitoring of external data. AI models predict upcoming blocked orders and provide recommendations to the collections team.

Loading...

Research containing HighRadius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned HighRadius in 2 CB Insights research briefs, most recently on Oct 26, 2023.

Oct 26, 2023

The CFO tech stack market mapExpert Collections containing HighRadius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

HighRadius is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,244 items

Payments

3,034 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Artificial Intelligence

14,769 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

SMB Fintech

355 items

Fintech

9,295 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

HighRadius Patents

HighRadius has filed 19 patents.

The 3 most popular patent topics include:

- payment systems

- parallel computing

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/5/2022 | 1/16/2024 | Instruction set architectures, Payment systems, Optical character recognition, Data management, Diagrams | Grant |

Application Date | 8/5/2022 |

|---|---|

Grant Date | 1/16/2024 |

Title | |

Related Topics | Instruction set architectures, Payment systems, Optical character recognition, Data management, Diagrams |

Status | Grant |

Latest HighRadius News

Aug 16, 2024

News Provided By Share This Article Accounts Receivable Automation Market According to HTF Market Intelligence, the Accounts Receivable Automation Market is expected to register a CAGR of 14.2% during the forecast period. Stay up-to-date with Global Accounts Receivable Automation Market Research offered by HTF MI. Check how key trends and emerging drivers are shaping this industry growth.” — Nidhi Bhawsar PUNE, MAHARASHTRA, INDIA, August 16, 2024 / EINPresswire.com / -- HTF Market Intelligence recently released a survey document on Accounts Receivable Automation Market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the Accounts Receivable Automation market. Some of the companies listed in the study from the complete survey list are SAP SE (Germany), Oracle Corporation (United States), QuickBooks (United States), Bill.com (United States), Coupa Software Incorporated (United States), Kyriba Corporation (United States), HighRadius Corporation (United States), Zoho Corporation (India), Xero Limited (New Zealand), Tipalti Inc. (United States). Definition: Accounts Receivable (AR) Automation refers to the use of technology and software to streamline and manage the processes involved in collecting and processing payments from customers. This automation is designed to improve efficiency, reduce errors, and accelerate the cash flow cycle. Market Drivers: Growing focus on improving cash flow and reducing overdue accounts Market Opportunities: Development of integrated accounts receivable systems with AI and machine learning capabilities Market Challenges: Regulatory and compliance issues related to data privacy and financial reporting standards Get Complete Scope of Work @ https://www.htfmarketintelligence.com/report/global-accounts-receivable-automation-market The titled segments and sub-section of the market are illuminated below: In-depth analysis of Accounts Receivable Automation market segments by Types: On-premise, Cloud Detailed analysis of Accounts Receivable Automation market segments by Applications: Major Key Players of the Market: SAP SE (Germany), Oracle Corporation (United States), QuickBooks (United States), Bill.com (United States), Coupa Software Incorporated (United States), Kyriba Corporation (United States), HighRadius Corporation (United States), Zoho Corporation (India), Xero Limited (New Zealand), Tipalti Inc. (United States) Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions: • The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.) • North America (United States, Mexico & Canada) • South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.) • Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.) • Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia). Objectives of the Report: • -To carefully analyse and forecast the size of the Accounts Receivable Automation market by value and volume. • -To estimate the market shares of major segments of the Accounts Receivable Automation market. • -To showcase the development of the Accounts Receivable Automation market in different parts of the world. • -To analyse and study micro-markets in terms of their contributions to the Accounts Receivable Automation market, their prospects, and individual growth trends. • -To offer precise and useful details about factors affecting the growth of the Accounts Receivable Automation market. • -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Accounts Receivable Automation market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches. The Accounts Receivable Automation Market is segmented by Component (Solutions, Services) by Deployment Mode (On-premise, Cloud) by Organization Size (Small and Medium Enterprises, Large Enterprises) by End-User Industry (BFSI, IT and Telecom, Manufacturing, Healthcare, Transportation and Logistics) and by Geography (North America, LATAM, West Europe, Central & Eastern Europe, Northern Europe, Southern Europe, East Asia, Southeast Asia, South Asia, Central Asia, Oceania, MEA). – Detailed consideration of Accounts Receivable Automation market-particular drivers, Trends, constraints, Restraints, Opportunities, and major micro markets. – Comprehensive valuation of all prospects and threats in the – In-depth study of industry strategies for growth of the Accounts Receivable Automation market-leading players. – Accounts Receivable Automation market latest innovations and major procedures. – Favourable dip inside Vigorous high-tech and market latest trends remarkable the Market. – Conclusive study about the growth conspiracy of Accounts Receivable Automation market for forthcoming years. Major highlights from Table of Contents: Accounts Receivable Automation Market Study Coverage: • It includes major manufacturers, emerging player’s growth story, and major business segments of Accounts Receivable Automation market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology. • Accounts Receivable Automation Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators. • Accounts Receivable Automation Market Production by Region Accounts Receivable Automation Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors. Key Points Covered in Accounts Receivable Automation Market Report: • Accounts Receivable Automation Overview, Definition and Classification Market drivers and barriers • Accounts Receivable Automation Market Competition by Manufacturers • Accounts Receivable Automation Capacity, Production, Revenue (Value) by Region (2023-2029) • Accounts Receivable Automation Supply (Production), Consumption, Export, Import by Region (2023-2029) • Accounts Receivable Automation Production, Revenue (Value), Price Trend by Type {On-premise, Cloud} • Accounts Receivable Automation Market Analysis by Application {BFSI, IT and Telecom, Manufacturing, Healthcare, Transportation and Logistics} • Accounts Receivable Automation Manufacturers Profiles/Analysis Accounts Receivable Automation Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing • Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis. Major questions answered: • What are influencing factors driving the demand for Accounts Receivable Automation near future? • What is the impact analysis of various factors in the Global Accounts Receivable Automation market growth? • What are the recent trends in the regional market and how successful they are? • How feasible is Accounts Receivable Automation market for long-term investment? Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, MINT, BRICS, G7, Western / Eastern Europe, or Southeast Asia. Also, we can serve you with customized research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains. Nidhi Bhawsar

HighRadius Frequently Asked Questions (FAQ)

When was HighRadius founded?

HighRadius was founded in 2006.

Where is HighRadius's headquarters?

HighRadius's headquarters is located at 2107 CityWest Boulevard, Houston.

What is HighRadius's latest funding round?

HighRadius's latest funding round is Series C.

How much did HighRadius raise?

HighRadius raised a total of $475M.

Who are the investors of HighRadius?

Investors of HighRadius include Susquehanna Growth Equity, ICONIQ Growth, Michael Scarpelli, Tiger Global Management, Frank Slootman and 8 more.

Who are HighRadius's competitors?

Competitors of HighRadius include Cforia Software, Tipalti, Coupa, Billtrust, Basware and 7 more.

What products does HighRadius offer?

HighRadius's products include Credit and 4 more.

Who are HighRadius's customers?

Customers of HighRadius include Land O’Lakes, Inc. is a member-owned agricultural cooperative based in the Minneapolis-St. Paul suburb of Arden Hills, Minnesota, focusing on the dairy industry., Mattel is a toy manufacturing and entertainment company.It is headquartered at El Segundo, California., Duracell Inc. is an American manufacturing company that produces batteries and smart power systems., J. J. Keller & Associates, Inc. is a publisher and service organization, providing a wide spectrum of regulatory and information products and services ,complementary forms and supply products to customers regulated by the Department of Transportation, Occupational Safety and Health Administration, and more than 300 state agencies. and 3 more.

Loading...

Compare HighRadius to Competitors

Global PayEx focuses on B2B payments modernization and working capital optimization within the financial technology sector. The company offers a suite of services including automation of accounts receivable and payable, electronic invoice presentment, and payment reconciliation, all powered by artificial intelligence to enhance financial operations for businesses. It was founded in 2011 and is based in Rockville, Maryland.

Billtrust focuses on automating accounts receivable and order-to-cash processes for businesses. Its main offerings include artificial intelligence (AI)-powered invoicing, payment processing, cash application, and collections, designed to streamline financial operations and enhance cash flow. Billtrust's solutions cater to a variety of industries, providing tailored automation to meet specific sector needs. It was founded in 2001 and is based in Hamilton, New Jersey.

Fintainium focuses on financial technology, specifically in the business payables and receivables sector. The company offers a platform that provides solutions for cash flow management, embedded payments, mass disbursements, and lending, aiming to simplify problems in business payables and receivables. It primarily serves sectors such as small-to-medium-sized businesses, financial institutions, financial technology companies, software companies, and accounting firms. It was formerly known as ePayRails. It was founded in 2018 and is based in Jacksonville, Florida.

CHERRY is a B2B payment processing solution that specializes in integrating accounting software with bank payment platforms. The company offers a plugin that automates payments, streamlines approvals, and facilitates reconciliation, thereby reducing manual processes for businesses. CHERRY primarily serves businesses looking to enhance their accounting and financial workflows through automation. It was founded in 2018 and is based in Brooklyn, New York.

Routable is a financial technology company specializing in accounts payable automation for businesses. The company offers a platform that streamlines invoice processing, vendor payments, and compliance management, while also providing tools for customizable approval workflows, payment reconciliation, and vendor onboarding. Routable's solutions cater to various sectors, including marketplaces, gig economy, insurance, real estate, logistics, manufacturing, and nonprofit organizations. It was founded in 2017 and is based in San Francisco, California.

Kyriba is a company that focuses on enterprise liquidity management in the financial services sector. The company offers a range of services including treasury management, risk management, payments processing, and working capital management, all aimed at enabling real-time, intelligent enterprise liquidity decisions. Kyriba primarily serves sectors such as retail, financial services, higher education, healthcare, and manufacturing. It was founded in 2000 and is based in San Diego, California.

Loading...