Hokodo

Founded Year

2018Stage

Line of Credit - II | AliveTotal Raised

$165.19MLast Raised

$108.28M | 6 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-105 points in the past 30 days

About Hokodo

Hokodo specializes in B2B (business-to-business) payment solutions, offering a digital platform for trade credit and financing services within various industries. The company provides credit terms to businesses, enabling a frictionless checkout experience and real-time credit decision-making. Hokodo's solutions cater to sectors such as B2B marketplaces, food and beverages, agriculture, industrial supplies, construction and building materials, freight and logistics, freelance and workplace management, and corporate travel. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Hokodo's Product Videos

ESPs containing Hokodo

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

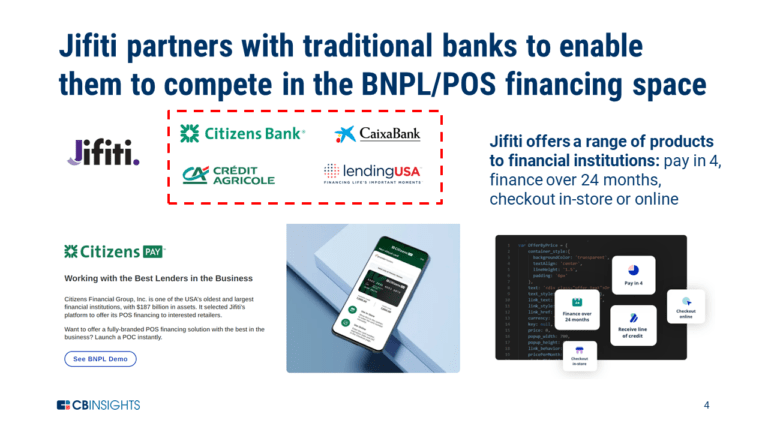

The buy now pay later (BNPL) — B2B payments market offers flexible financing options for businesses to enhance their purchasing power and manage their working capital and cash flow by acquiring goods or services immediately and paying for them in installments over time. BNPL solutions in the B2B market provide streamlined application processes, quick approvals, and transparent terms for businesses…

Hokodo named as Leader among 15 other companies, including PayPal, Slope, and Amount.

Hokodo's Products & Differentiators

Payment terms

Enables buyers to defer payment by an agreed period (usually 14, 30, 60 or 90 days, but can be up to 120)

Loading...

Research containing Hokodo

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hokodo in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market mapExpert Collections containing Hokodo

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hokodo is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,033 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Payments

3,033 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,396 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Latest Hokodo News

Sep 20, 2024

Friday 20 September 2024 10:09 CET | News The majority of finance leaders have revealed to struggle in the process of keeping pace with the speed of ecommerce, according to a report published by Hokodo . B2B ecommerce is currently going through a fast-paced evolution, with the market being set to a total of USD 2.641 trillion in 2024. Hokodo’s report has revealed that many finance functions and enterprises are not future-proofed. In fact, its pan-industry survey of CFOs and finance leaders revealed that nearly of fifth (17%) of them feel that their finance teams are not prepared for the future. The report was published by the provider of flexible payment terms for European merchants and marketplaces, in collaboration with the B2B Ecommerce Association. More insights on the Hokodo report The barriers to finance functions being future-proof come down to an overall lack of balance between development and control. Almost half (46%) of those surveyed are currently struggling to strike a balance between financial controls (as the policies used to manage financial resources and ensure accuracy at the same time), and strategic growth strategies. When asked whether ecommerce has made managing financial controls more difficult, the majority (39%) of those surveyed agreed, while only 5% disagreed. In addition, financial leaders are facing challenges around cash flows and payment terms as well. The report revealed that the top challenges for finance leaders are working capital management and cash flow unpredictability (66%), cutting costs (49%), and managing payments or payment terms (44%). These difficulties are stopping finance leaders from being able to optimise and ensure that their function is future-proof. According to the survey, other key barriers to innovation are budget constraints (66%), resistance to change (54%), and lack of capacity (37%). The report, titled ‘Hokodo Investigation: Are Finance Leaders ready for the digital transformation of B2B commerce?’, features actionable advice for finance leaders. Its main aim is to ensure all finance leaders are ready to face the future of B2B commerce, providing timely insights and valuable strategies for anyone who navigates this complex landscape. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

Hokodo Frequently Asked Questions (FAQ)

When was Hokodo founded?

Hokodo was founded in 2018.

Where is Hokodo's headquarters?

Hokodo's headquarters is located at 77 Leadenhall Street, London.

What is Hokodo's latest funding round?

Hokodo's latest funding round is Line of Credit - II.

How much did Hokodo raise?

Hokodo raised a total of $165.19M.

Who are the investors of Hokodo?

Investors of Hokodo include Viola Credit, Citibank, Anthemis, Notion Capital, Mosaic Ventures and 10 more.

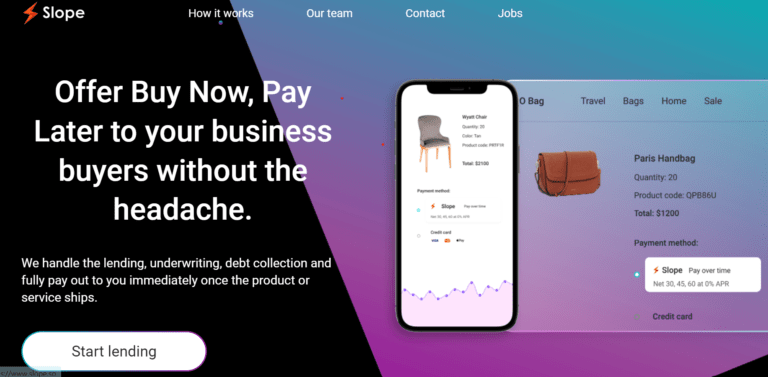

Who are Hokodo's competitors?

Competitors of Hokodo include Slope, Mondu, Defacto, Sprinque, Optty and 7 more.

What products does Hokodo offer?

Hokodo's products include Payment terms and 2 more.

Who are Hokodo's customers?

Customers of Hokodo include Ankorstore, Monin and Rawlins Paints.

Loading...

Compare Hokodo to Competitors

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms in a multi-channel setting, both online and offline. It empowers business customers to purchase and pay when they want, which translates to a higher conversion rate and average order value, and drives growth for merchants and marketplaces. Mondu was founded in 2021 and is based in Berlin, Germany.

Billie is a leading provider of Buy Now, Pay Later (BNPL) payment methods for the B2B sector, offering innovative digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Two specializes in B2B Buy Now Pay Later (BNPL) payment solutions within the e-commerce sector. The company offers services that enable merchants to provide high net term credit limits, manage credit and fraud risks, and streamline the checkout process for business customers. Two's solutions cater to various sectors including construction, wholesale, B2B marketplaces, and SaaS. Two was formerly known as Tillit. It was founded in 2020 and is based in Oslo, Norway.

PenTech is a company that focuses on digital financing and corporate financing. The company offers digital factoring, digital loans, digital leasing, and supplier financing services, providing businesses with quick and flexible financing solutions. The company primarily serves the small and medium-sized enterprise sector. It was founded in 2019 and is based in Budapest, Hungary.

Defacto is a fintech company specializing in business-to-business lending and financing solutions. The company offers instant, flexible financing options for small and medium-sized businesses to cover expenses such as stock, marketing, and business-to-business receivables, without the need for paperwork or complex setup processes. Defacto primarily serves sectors such as e-commerce, retail, and small business through its lending platform and Application Programming Interface integrations. It was founded in 2021 and is based in Paris, France.

Sprinque is a B2B crossborder payments platform that specializes in facilitating global expansion for businesses. The company offers a suite of payment solutions, including the ability for business buyers to pay by invoice with net payment terms or in installments, and provides merchants with instant payment while managing credit and fraud risks. Sprinque primarily serves businesses looking to streamline their payment processes and expand their customer base internationally. It was founded in 2021 and is based in Amsterdam, Netherlands.

Loading...