Hyperexponential

Founded Year

2017Stage

Series B | AliveTotal Raised

$91MLast Raised

$73M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+147 points in the past 30 days

About Hyperexponential

Hyperexponential focuses on decision intelligence in the insurance industry. The company offers a pricing system that transforms insurance pricing engines by creating a feedback loop between data, insights, and decisions. Hyperexponential primarily serves the insurance industry, including specialty insurance, reinsurance, and small business insurance. It was founded in 2017 and is based in London, United Kingdom.

Loading...

ESPs containing Hyperexponential

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance pricing software market offers solutions that help insurance companies determine the appropriate premium rates for their policies. These solutions use advanced algorithms and data analytics techniques to analyze various factors such as risk, claims history, demographics, and other relevant information. The goal is to provide accurate pricing recommendations that balance profitability…

Hyperexponential named as Challenger among 9 other companies, including Akur8, Earnix, and Federato.

Hyperexponential's Products & Differentiators

Renew

Renew is a specialty pricing platform used by specialty insurers to build, iterate and deploy their insurance pricing models. As a self-serve platform this would typically entail actuaries logging in to our custom built IDE and building their models leveraging open-source programming languages primarily python. We then automate the deployment of these models for use by underwriters on a web browser.

Loading...

Research containing Hyperexponential

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hyperexponential in 3 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

May 9, 2024 report

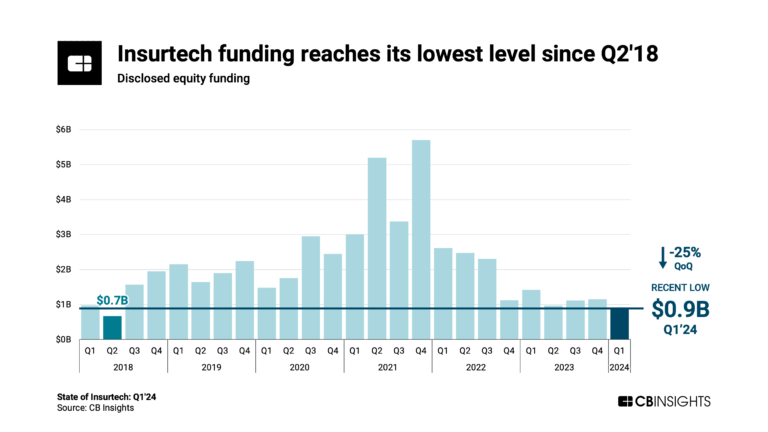

State of Insurtech Q1’24 ReportExpert Collections containing Hyperexponential

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hyperexponential is included in 5 Expert Collections, including Insurtech.

Insurtech

4,354 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,396 items

Excludes US-based companies

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

ITC Vegas 2024 - Exhibitors and Sponsors

627 items

As of 9/9/24. Company list source: ITC Vegas. Check ITC Vegas' website for any updates: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest Hyperexponential News

Sep 17, 2024

September 17, 2024 by David Gambrill Artificial intelligence (AI) is touted as a way for actuaries and underwriters to be more efficient in their jobs and escape manual data entry — but most don’t believe it. And even if they did, many say they aren’t receiving the proper tech training to take full advantage of AI’s benefits. Almost seven out of 10 underwriters and actuaries surveyed in the United States and the United Kingdom reported some level of worry they would be replaced by AI sometime during the next five years. With 91% of insurance companies reporting they are already investing in AI technology or planning to in the next five years, 18% of underwriters and 6% of actuaries say the issue of being replaced by AI is “an urgent issue today.” Twenty-one per cent of actuaries and underwriters believe it will become urgent over the next two years. The survey for Hyperexponential , a pricing platform for global (re)insurers, polled the opinions of 245 underwriters and 105 pricing actuaries across the UK and U.S. The respondents work in specialty and commercial insurance on behalf of Hyperexponential. The report, Mind the Gap: 2024 State of Pricing, cites Jamie Wilson, head of pricing and innovation at Hyperexponential, discussing how AI is being used to help actuaries, not replace them. “Actuaries who can leverage AI — which has never been easier to get started with — will find themselves coding faster, summarizing complex analyses faster, communicating more effectively, and building new tools that would have been impossible five years ago,” says Wilson. “Far from being replaced, this means actuaries can add significantly more value to the business.” Similar arguments are commonly heard at Canadian property and casualty insurance industry conferences. But even if this is true, underwriters and actuaries in the survey worry they aren’t receiving the tech training they need to harness the potential benefits of AI. “In order to successfully implement AI and machine learning, actuaries and some underwriters are likely to need modern coding skills,” the report states. “That’s why it’s such a concern that eight out of 10 actuaries report feeling worried that they don’t have the right tech skills for the future, like the application of machine learning.” Seventy-four percent of underwriters similarly worry they don’t have the right tech skills for the future, with 16% considering the issue urgent today. “Without focused upskilling and an emphasis on recruiting for technical talent, insurers may find themselves with the infrastructure for AI and machine learning, but without the current or incoming talent to get the most out of it,” the report states. The survey asked how long insurance underwriters are take to complete their daily tasks. About 50% of underwriters in the survey said they spend more than three hours a day doing manual data entry. Just over 40% said they spend more than three hours a day re-keying data. And about 30% reported spending more than three hours a day ingesting third-party data. What about meeting brokers? How much time do underwriters spend on that each day? Most (roughly 40%) say they spend one to two hours a day meeting clients and brokers.

Hyperexponential Frequently Asked Questions (FAQ)

When was Hyperexponential founded?

Hyperexponential was founded in 2017.

Where is Hyperexponential's headquarters?

Hyperexponential's headquarters is located at The Ministry, 79-81 Borough Road, London.

What is Hyperexponential's latest funding round?

Hyperexponential's latest funding round is Series B.

How much did Hyperexponential raise?

Hyperexponential raised a total of $91M.

Who are the investors of Hyperexponential?

Investors of Hyperexponential include Highland Europe, Andreessen Horowitz, Battery Ventures and Lloyd's Lab.

Who are Hyperexponential's competitors?

Competitors of Hyperexponential include Federato and 5 more.

What products does Hyperexponential offer?

Hyperexponential's products include Renew.

Who are Hyperexponential's customers?

Customers of Hyperexponential include Aegis.

Loading...

Compare Hyperexponential to Competitors

Starr Insurance Companies specializes in providing commercial property and casualty insurance, as well as travel and accident coverage, across a wide range of industries. The company offers a diverse portfolio of insurance products designed to meet the complex needs of businesses globally. Starr Insurance serves various sectors including aviation and aerospace, marine, energy, construction, and government contractors, among others. It was founded in 1919 and is based in New York, New York.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. Its main service is an artificial intelligence (AI)-powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Convr specializes in AI-driven underwriting analysis for the commercial property and casualty (P&C) insurance sector. The company offers a modular end-to-end underwriting management platform that processes commercial insurance data, automates risk assessment, and supports underwriting decisions with a patented AI decisioning engine. Convr's platform is designed to enhance underwriting productivity, improve risk classification accuracy, and streamline the submission intake process. It was founded in 2015 and is based in Schaumburg, Illinois.

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence(AI) powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Send Technology is a software company that specializes in the insurance technology sector. The company offers a flexible commercial insurance software platform that provides solutions for insurers and managing general agents (MGAs). The platform includes features for managing submissions, underwriting, agency management, asset data management, document management, and task management, among others. It primarily serves the insurance industry. It was founded in 2017 and is based in London, England.

Two Sigma IQ is a technology-focused company operating in the insurance industry. The company provides commercial property and casualty underwriting software, utilizing technology, data science, and intelligent automation to better understand risk and strengthen business offerings. Its primary market is the insurance industry, particularly in the commercial property and casualty sectors. It is based in New York, New York.

Loading...