Enterprises are seeing opportunities to deploy more cost-effective small models for tasks across industries like healthcare and finance. We dig into how adoption is picking up and the rising players in the space.

Enterprise spend on large language models (LLMs) can run in the millions.

As enterprises focus on the ROI of their AI spend, small language models (SLMs) — which have fewer parameters than LLMs, making them cheaper to train and easier to run — are becoming an attractive option.

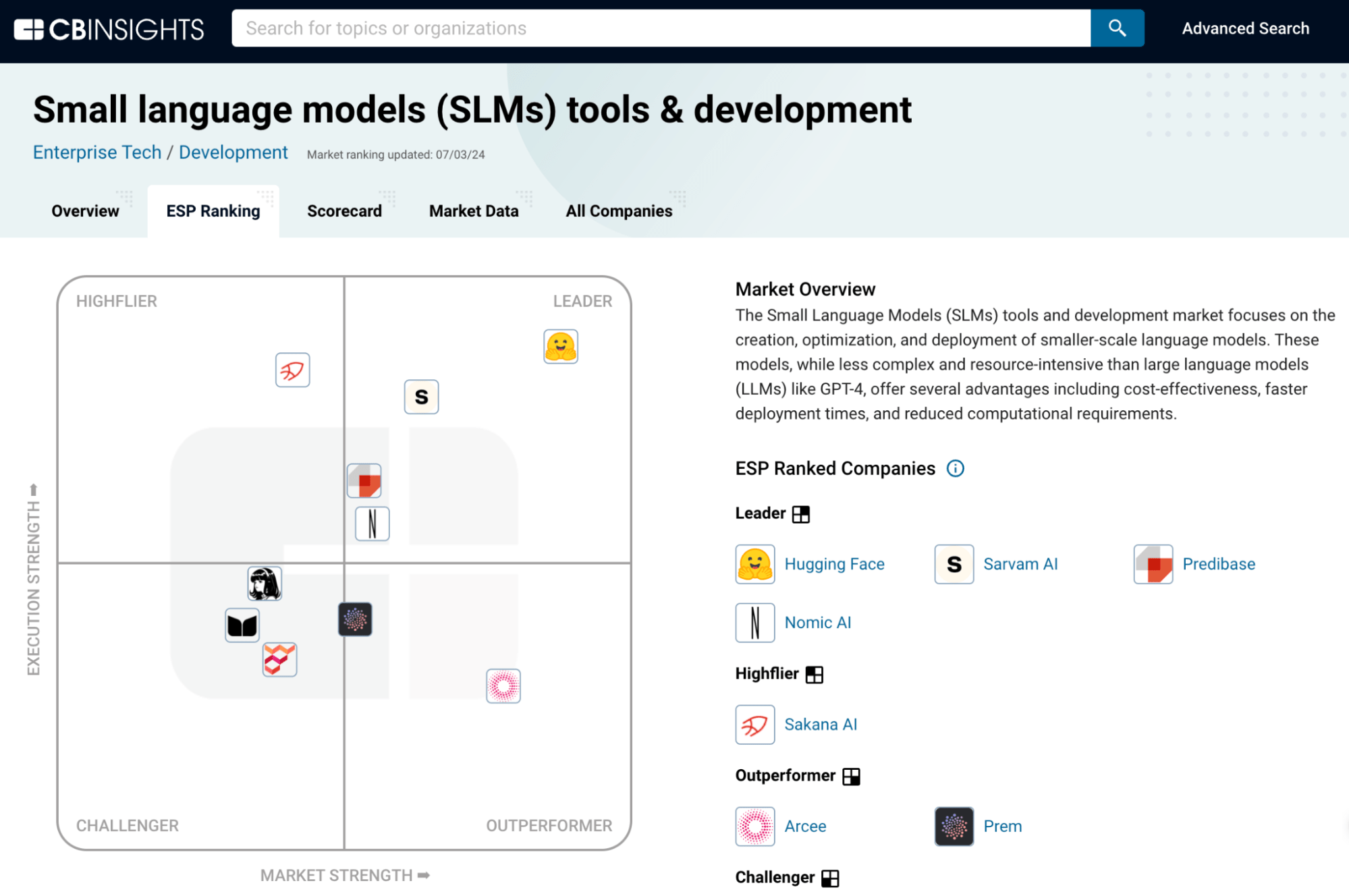

In the last year, a rising number of players — from big tech to startups — have emerged with SLM offerings.

Track data on the small language model market here.

By training on narrow datasets, small models, also called lightweight models, can be honed for targeted applications — with comparable, or even higher, accuracy and performance to larger models.

Below, we zero in on how enterprises are adopting small language models and rising competitors in the field using CB Insights data, including buyer interviews, partnerships, Commercial Maturity scores, and more.

Key takeaways

- More than 10 SLM development platforms have gained traction in the last year, with over half already developing their products commercially and raising fresh funding.

- Sectors with sensitive data like healthcare and financial services are well-suited for small models as they can be securely fine-tuned to perform narrow tasks.

- Big tech is developing in-house lightweight models, posing a threat to emerging startups in the space. Pay particular attention to Google, Meta, and Microsoft.

Want to see more research? Join a demo of the CB Insights platform.

If you’re already a customer, log in here.